What is a Good Loan-to-Value (LTV) Ratio?

If you’re making a large purchase, you’ve probably heard of a number of different financial ratios. You might have heard of the debt-to-income (DTI) ratio, but another very important ratio is the loan-to-value ratio.

The LTV ratio is generally used for mortgages or other valuable assets you buy with a loan, such as a car.

It is the ratio of the outstanding debt on the loan to the value of the asset. Lenders care about the LTV ratio because a higher LTV indicates a higher risk loan.

That makes tracking the LTV ratio of a loan you’re applying for important since it could affect whether your application is approved or not.

Learn how to calculate the LTV ratio of a loan and what is considered a good ratio for the best chances of loan approval.

How to Calculate Your LTV Ratio

The loan-to-value ratio of a loan is relatively easy to calculate.

The ratio is the total amount you owe on a loan, divided by the value of the asset.

So, if you take out an $80,000 loan to purchase a house worth $100,000, your LTV ratio will be 80%.

The LTV ratio on a loan is always changing because both the balance on your loan and the value of the asset will change.

The balance of the loan will go down as you make payments, reducing the LTV ratio.

If your asset appreciates, the LTV will go down more. If your asset depreciates, your LTV could increase.

Why Does Your LTV Ratio Matter?

There are a number of reasons that you should keep the LTV ratio of your loans in mind.

Harder to get approved

When you apply for a loan, the one thing that a lender wants to know is whether you’ll pay back the money or not.

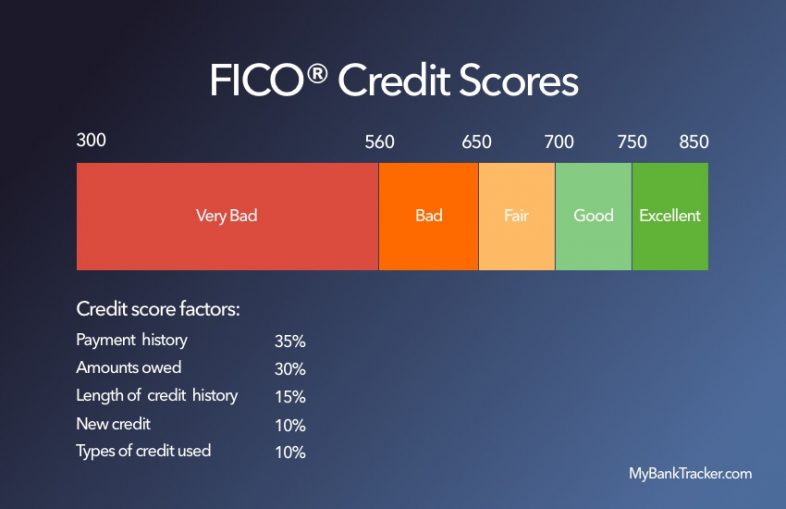

One way lenders try to predict this is your credit score. If you have a good credit score, you’re a lower risk to lend to.

The LTV ratio is another good predictor of a loan’s risk.

The more you’re borrowing compared to the value of the asset you’re buying, the riskier the loan is. If you put in a large down payment, you have more to lose if you default, reducing the risk of the loan.

When you apply for a loan, the lower the LTV ratio will be if it is approved, the better the chance of approval is.

Higher interest rates

When approving loan applications, lenders will judge the approximate risk they take on by making each loan.

To compensate for this risk, lenders will charge different interest rates on different loans.

You can think of the interest rate of a loan as being similar to the price of the loan. Just stores compete to sell products for the lowest price to draw customers, lenders compete to offer the lowest rates to draw customers.

If you are a low-risk borrower, banks will offer very low interest rates to get you in the door.

If you apply for a loan with a high LTV ratio, your loan will be seen as risky for the lender to take on. Lenders want to be compensated for that risk, so they charge a higher interest rate.

One way to reduce your interest rate, and the cost of your loan, is to try to reduce your LTV ratio.

Additional fees

Having a high LTV ratio can result in additional fees being charged on the loan.

One of the best-known fees affected by LTV ratios is Private Mortgage Insurance (PMI).

If you apply for a mortgage with a high LTV ratio (usually higher than 80%), you’ll be required to pay PMI. PMI offers protection to the lender in the event that you stop paying your loan.

Lenders will force you to pay this fee as a requirement for offering you a loan because the LTV of the loan you’ve applied for indicates that the loan is risky.

As you pay down the loan, or your home’s value appreciates, your LTV ratio will drop below 80%. Once it does, you might be able to get the PMI removed from your loan, saving you money.

Ideally, you’ll avoid PMI in the first place by avoiding loans with an LTV ratio above 80%.

Can’t sell the asset to pay the loan

One danger of having a high LTV is that you risk finding yourself in a situation where even the sale of the asset won’t cover the cost of the loan.

This was a situation that many Americans found themselves in during the 2008 financial crisis.

Dropping home values caused their mortgage LTV ratios to exceed 100%. When that happens, you won’t be able to pay off the loan by selling the house unless you pay additional money out of pocket.

Getting approved for a loan with an LTV ratio near 100% is difficult, but not impossible.

If you do get a loan with an LTV ratio near 100%, you put yourself at risk of getting underwater with a small change in the market.

What is a Good LTV Ratio?

In the vast majority of cases, the lower the LTV ratio the better.

For mortgages, 80% is the magic number.

If you apply for a loan with an LTV of 80% or less, you won’t have to pay for PMI. If your LTV exceeds 80%, you’ll pay PMI and other additional fees.

Lower LTV ratios also mean you’ll pay less interest and have more starting equity in your home.

There are some reasons you might opt for a loan with a high LTV ratio.

A high LTV ratio means you can buy a home with a smaller down payment.

That leaves you more cash to purchase home furnishings or to pay for improvements.

You can also use that money for investments, in hopes of earning a return.

Of course, you’ll pay a higher interest rate and may be forced to pay PMI with your loan has a high LTV ratio.

How to Improve Your LTV Ratio?

There are a few ways to reduce your LTV ratio.

1. Make a larger down payment

You can reduce your LTV ratio before you even take on the loan by making a large down payment.

For example, you want a buy a house worth $100,000. Your bank will give you the loan if you put down at least $10,000.

You can choose to put down the $10,000 and have an LTV ratio of 90%.

You can also decide to put down additional money to reduce the LTV ratio.

You could make a down payment of $20,000 to have an 80% LTV, pay $25,000 to have an LTV of 75%, and so on.

How large a down payment you make will be based on the lender’s requirements and what kind of LTV you are aiming for.

2. Make extra payments

Once you’ve received the loan, the best way to reduce the LTV ratio is to make additional loan payments.

Every time you make a payment on a loan, some of your payment is applied to interest charges and the rest is applied to the loan’s principal.

As the principal of the loan decreases, the LTV ratio will also decrease.

If you make additional payments on your loan’s balance, the extra payments will be deducted directly from the principal of the loan.

By making extra payments, you can quickly reduce the size of your loan, improving your LTV ratio.

3. Wait for the asset to appreciate

Another way for your LTV ratio to improve is if the asset you’ve purchased appreciates.

This method is mostly out of your control.

When you buy a house, you can’t know whether it will increase or decrease in value.

If your new home increases in value, over the time the LTV ratio will decrease. This can help you get rid of extra fees, like PMI, more quickly.

However, you shouldn’t be reliant on asset appreciation to reduce your LTV ratio. It’s very difficult to predict how an asset’s value will change over time.

Why the Debt-to-Income Ratio Is Important But Different

With so many acronyms being thrown around during the lending process, it can be easy to confuse LTV and DTI, the other common lending acronym.

Your DTI, or debt-to-income ratio, is also very important in the loan application process.

This is the ratio of your monthly income to the total of all of the minimum payments on your monthly debt bills, including rent. DTI looks only at loan amounts and your income, it does not consider the value of your assets.

The lower your DTI ratio, the better it looks to lenders.

A low DTI ratio means you have a lot of money left over each month to pay down a new loan. A high DTI ratio means you’re struggling to make ends meet.

Conclusion

When you’re applying for a loan, consider what the loan-to-value ratio of the loan will be.

A low LTV ratio can make it easier to get a loan, leading to lower interest rates, and help you avoid fees.