Lending Club Personal Loans 2026 Review

- Be a U.S. citizen or permanent resident or be living in the U.S. on a long-term visa

- Be at least 18 years old

- Hold a verifiable bank account

- You can apply for a personal loan through Lending Club if you meet those requirements.

Once you apply for a loan, Lending Club will assign a risk rating from A through G and a sub-rating of 1 – 5. A1 is the best rating you can receive, and G5 is the lowest rating. The better your rating, the better the interest rate on your loan.

Lending Club does charge an origination fee on its loans. The fee ranges from 1% to 6% and is deducted from your loan when issued. There is no application fee, so you won’t need money upfront to get the loan.

Lending Club Personal Loans Pros & Cons

- No prepayment penalties

- Investors in your loan include regular people

- Potential for a high APR

- One-time origination fee applies

Lending Club Personal Loan Calculator

Estimated Interest Personal Loan Calculator

How Long Does It Take to Get the Money?

It takes roughly seven days from applying for a loan until the money arrives in your account.

It can sometimes take longer if the Lending Club requires additional information from you.

It takes so long for the money to arrive in your account because Lending Club isn’t giving you the money directly. Instead, you have to wait for individual investors to fund your loan.

How Lending Club Loans Work

As was mentioned previously, Lending Club is a peer-to-peer lending website, not a bank.

That means Lending Club isn’t putting up the funds for your loan. Instead, other people are investing in your loan.

When you apply for a loan through Lending Club, they post your application’s (anonymous) details for investors to look at.

Information such as the size of the loan, reason for applying, and Lending Club’s rating of your loan (A1-G5) are listed. Investors can then decide if they want to help fund your loan.

The community funds your loan, not a bank.

If an investor wants to fund your loan, they can provide as little as $25 or as much as they want.

That means that your loan is likely to be backed by many investors.

When you send a payment to Lending Club, it automatically gets divided and sent to each investor based on how much they contributed to your loan.

Anyone can become an investor in Lending Club if they live in an approved state and make a $1,000 minimum deposit.

That means your loan payments go to everyday people who want to help others by offering loans.

How to Get Approved for a Personal Loan

When you apply for a personal loan, the lender must look into your financial situation. They want to make sure that you’ll pay back the loan.

When you apply, you’ll need to provide information such as:

- Name

- Address

- Date of birth

- Proof of identity, such as a driver’s license

- Social Security number

- Annual income

- Proof of income, such as bank statements or pay stubs.

- Verification of employment

While giving this information to a lender can be a hassle, it’s worth it.

Companies that don’t request such information tend to charge much higher interest rates because they cannot determine default risk accurately.

They charge higher interest to compensate for the fact that many borrowers may not pay them back.

If a lender has a lot of information about you, the lender can better determine what interest rate to charge you. That usually results in you paying a lower rate.

Improving Your Chances of Qualifying for a Personal Loan

Once you’ve decided to apply for a personal loan, you should work to improve your chances of qualifying.

When getting approved, there are two big things to focus on: your credit score and your debt-to-income ratio.

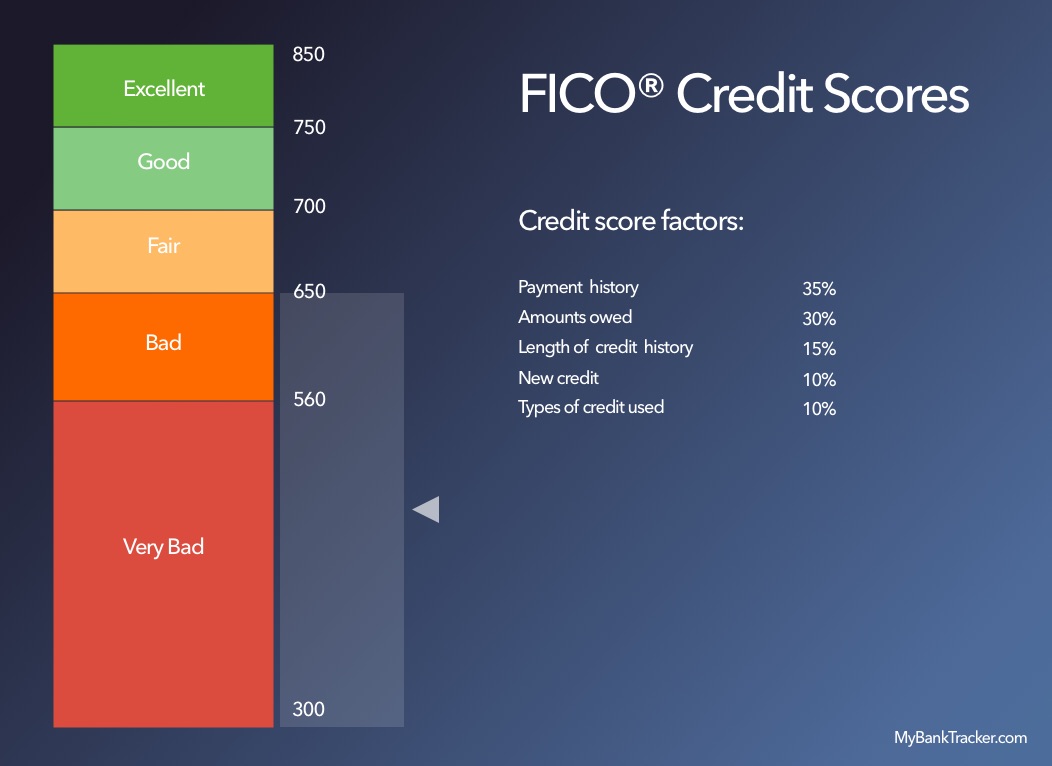

Your credit score is a numeric score determined using a formula that takes five factors into account:

FICO Credit Score Factors and Their Percentages

| FICO credit score factors | Percentage weight on credit score: | What it means: |

|---|---|---|

| Payment history | 35% | Your track record when it comes to making (at least) the minimum payment by the due date. |

| Amounts owed | 30% | How much of your borrowing potential is actually being used. Determined by dividing total debt by total credit limits. |

| Length of credit history | 15% | The average age of your active credit lines. Longer histories tend to show responsibility with credit. |

| Credit mix | 10% | The different types of active credit lines that you handle (e.g., mortgage, credit cards, students loans, etc.) |

| New credit | 10% | The new lines of credit that you’ve requested. New credit applications tend to hurt you score temporarily. Learn more about FICO credit score |

In the short term, you can improve your credit score by lowering your credit utilization ratio. You can avoid using your credit cards or paying down any balance you carry.

Another way to improve your credit score is to remove derogatory marks from your credit report.

These marks, such as a missed payment or an account in collections, can hurt your score.

Try contacting the lender that placed the mark on your credit report. Many will be willing to negotiate a pay-for-delete agreement. Under such an agreement, you pay the loan balance, and the lender removes the mark.

Related to credit utilization is your debt-to-income ratio. The higher this ratio, the less likely you’ll be able to make payments on a new loan.

That’s because your current income will go towards paying your current loans. You can reduce this ratio by increasing your income or paying down your other loans.

Personal Loans from Other Lenders

If you need a personal loan but have decided that Lending Club isn’t for you, consider applying for a loan from one of these providers:

Upstart

Upstart is a personal loan provider that puts a twist on the usual loan approval practices.

Like any lender, Upstart will look at your credit history and debt-to-income ratio when deciding whether to lend money to you.

What makes Upstart unique is that the company takes other factors into account. Upstart looks at your education history, area of study, and job history when making a lending decision.

If you have held a stable job for years or are highly educated in a high-demand field, Upstart’s unique risk assessment protocol may get you a better deal on your loan.

Read Upstart Personal Loans Editor’s Review

Santander Bank

Santander Bank offers personal loans that range from $5,000 to $35,000. You can apply for a loan from Santander to consolidate other debts, fund home improvements, or pay unexpected bills.

All of Santander Bank’s loans have a fixed interest rate.

That means that the interest will stay the same for the life of the loan, even if market interest rates rise.

That way, you’ll know exactly how much you’ll have to pay over the life of the loan, and your monthly payment never changes.

If you already bank with Santander, you can use a loyalty bonus.

By enrolling in autopay from a Santander checking account, you’ll automatically reduce your loan’s interest rate by 0.25%. That can result in significant savings on a large loan when you take the full term to pay it off.

Discover

Discover is best known for its credit cards, but it’s also a bank that offers savings accounts, checking accounts, and personal loans.

You can borrow up to $35,000 from Discover and take seven years to repay the loan.

That allows you to repay the loan on your terms since there’s no early payment penalty.

Discover offers a 30-day return policy, which allows you to return the loan in full with no penalties or interest.

It also employs a 100% U.S.-based customer support staff. That makes it easy to get help when you need it.

Conclusion

Lending Club is an excellent option if you’re having trouble getting a personal loan from more traditional sources.

Or, you might want to avoid regular personal loans altogether because other people fund Lending Club loans and profits don’t go to “fat cat bankers.”