How to Get Bank of America Personal Loans

Personal loans are a great tool for debt reconsolidation, funding home improvements or paying a surprise bill.

Bank of America is one of the largest banks in the United States but it does not offer personal loans.

It does, however, offer a wide variety of other loans for specific purposes — all of which require some form of collateral (except unsecured credit cards).

Find out which types of loans that Bank of America offers, as well as where you can get a personal loan if you need one.

Types of Loans Offered by Bank of America

As one of the biggest U.S. banks, Bank of America has plenty of money to lend to customers. The company offers the following lending services:

- Credit cards

- Mortgages

- Home equity lines of credit (HELOCs)

- Auto loans

- Business credit lines

- Business term loans

- Secured business lines of credit

- Equipment loans

Credit cards

Credit cards are one of the most common types of lending in the United States. The lender gives you a credit limit, which is the maximum amount they are willing to lend you. You can then use the credit card to make purchases when you shop.

Because there is no asset to back up a credit card, interest rates tend to be very high, often exceeding 20%.

You should only use a credit card when you know you can pay the bill in full, otherwise, you’ll wind up paying huge interest charges.

Bank of America is one of the largest U.S. credit card issuers — part of the reason is that some of its credit cards are very popular, including its travel and cash back credit cards.

It also offers various credit cards for people that are building credit, including student cards and secured credit cards.

If you were looking for a personal loan for debt consolidation or a major purchase, the BankAmericard is a solid choice because it has a great introductory rate that applies to both balance transfers and purchases. (As a useful tip, note that our research found that Bank of America is most likely to pull your Experian credit report when you apply for a new credit card.)

Mortgages

A mortgage is a loan that can be used to purchase land or a house. Mortgages are often the largest loan that a person will ever take out, so the loan can last for up to thirty years. The two main types of mortgage are fixed-rate and adjustable rate (ARM) mortgages.

Fixed-rate mortgages have a single interest rate throughout the life of the loan.

When you sign the contract, you know the interest rate you’ll be charged today, as well as the interest rate you’ll be charged thirty years from now.

Fixed-rate mortgages offer plenty of stability to home-buyers.

Adjustable rate mortgages allow the lender to change the interest rate every so often. For example, a 5/1 ARM has a fixed rate for the first five years.

After that, the rate can change once every year. The benefit of ARMs is that the initial rate is usually much lower than the rate on a fixed-rate mortgage.

Home equity lines of credit (HELOCs)

HELOCs let you turn some of the equity you’ve built into your home into cash. Much like a credit card, your lender will give you a credit limit, which is the most they’re willing to lend to you.

You can go to the lender and request cash from your HELOC, which will be deposited into your checking account.

Each month you’ll be billed for whatever your HELOC’s balance is, plus interest.

If you haven’t taken money from your HELOC, you won’t be billed. It serves as a line of credit that you have the option of using, but are not obligated to.

HELOC interest rates are closer to mortgage rates than credit card rates because your house serves as collateral. That makes them a good way to consolidate other loans or fund home improvements.

Auto loans

Auto loans are loans taken out for the purpose of purchasing a car.

The interest rate varies depending on the cost, make, model year, and whether the car is new or used. If you default on your payments, the bank has the right to repossess your vehicle.

Business credit lines

Bank of America offers business credit lines of $10,000 to $100,000. You qualify if you’ve been in business for at least two years and made at least $100,000 in sales last year.

You can use the business credit line to provide liquidity when you need to pay bills or your employees and are waiting on customers to pay you.

Business term loans

A business term loan gives you a one-time lump sum of cash which you can pay off over the next one to five years.

Qualification requirements are the same as the requirements for a business credit line. These loans are best for making major purchases that will help grow your business.

Secured business lines of credit and term loans

If you need a credit line or term loan larger than the maximums offered by Bank of America’s unsecured loans, you can apply for a secured loan.

Requirements are stricter: you must have made $250,000 in sales in the last year.

These loans are backed by a lien on your company’s assets so Bank of America has a better chance of getting paid if you default on the loan.

These loans are your best bet if your business has significant cash needs.

Equipment loans

Equipment loans are designed to help you purchase expensive equipment that you need to run your business. Whether you need packing machines, conveyor belts, printing presses, or a delivery truck, this loan can help you get your business rolling.

Where to Look for Personal Loans

If none of Bank of America’s loan offerings meet your needs, there are a number of lenders that offer personal loans:

Upstart

Upstart is an online lender that offers loans between $1,000 and $50,000 with 3- or 5-year terms. There’s no pre-payment penalty, so you can pay the loan off sooner if you’d like.

Upstart sets itself apart by taking factors other than your credit score into account.

Your education history, job history, and area of study all factor into your application. If you have a stable job in an in-demand field you could get a better deal from Upstart than elsewhere.

Read a full editorial Upstart personal loans review.

Santander Bank

Santander Bank offers personal loans to its customers — it’s up to you what you want to do with the borrowed funds.

The loans come in amounts between $5,000 and $35,000 and your repayment term could be as much as 5 years.

The money is delivered to you in a single lump sum. That makes them well-suited for paying surprise bills or consolidating existing loans.

No collateral is required. There are no application or prepayment fees. You could get a rate reduction if you set up automatic payments from a Santander checking account to your personal loan.

Read a full editor’s Santander Bank personal loans review.

Lending Club

Lending Club offers people a way to connect with peers for lending. Your loan, which can be as large as $40,000 will be funded by regular people who want to invest money in peer-to-peer loans.

After you apply, people will see the details of your loan and can fund a portion of it. If you take out a $10,000 loan, you could be borrowing $100 from each of 100 different people.

Lending Club offers personal loans for specific purposes, including vacations, credit card refinancing, home improvement, and medical bills.

Read a full editorial Lending Club personal loans review.

Payoff

Payoff is an online lender that focuses on helping borrower consolidate their high-interest credit card debt.

Therefore, these personal loans are available only for that specific purpose, which is also one of the most popular reasons for getting a personal loan. Payoff stands out from most other lenders because it states exactly what is needed to qualify for a loan.

Read a full editor’s Payoff personal loans review.

How to Apply for Personal Loans

When you apply for a personal loan you’ll need to provide information to prove your creditworthiness.

The company offering the loan will research you to determine whether you’ll be able to make the required payments. Some of the information you’ll have to provide includes:

- Name

- Address

- Date of birth

- Proof of identity, such as a driver’s license

- Social Security number

- Annual income

- Proof of income, such as bank statements or pay stubs.

- Verification of employment

Though it may be daunting to gather all of this information, reputable lenders offer better terms than less careful lending operations.

The more information you have to provide, the better the lender will be able to assess its overall risk. That lets the lender charge less interest in the end.

How to Increase Your Chances of Getting Approved for a Personal Loan

If you want to increase your chances of getting approved for a personal loan there are a few things to do.

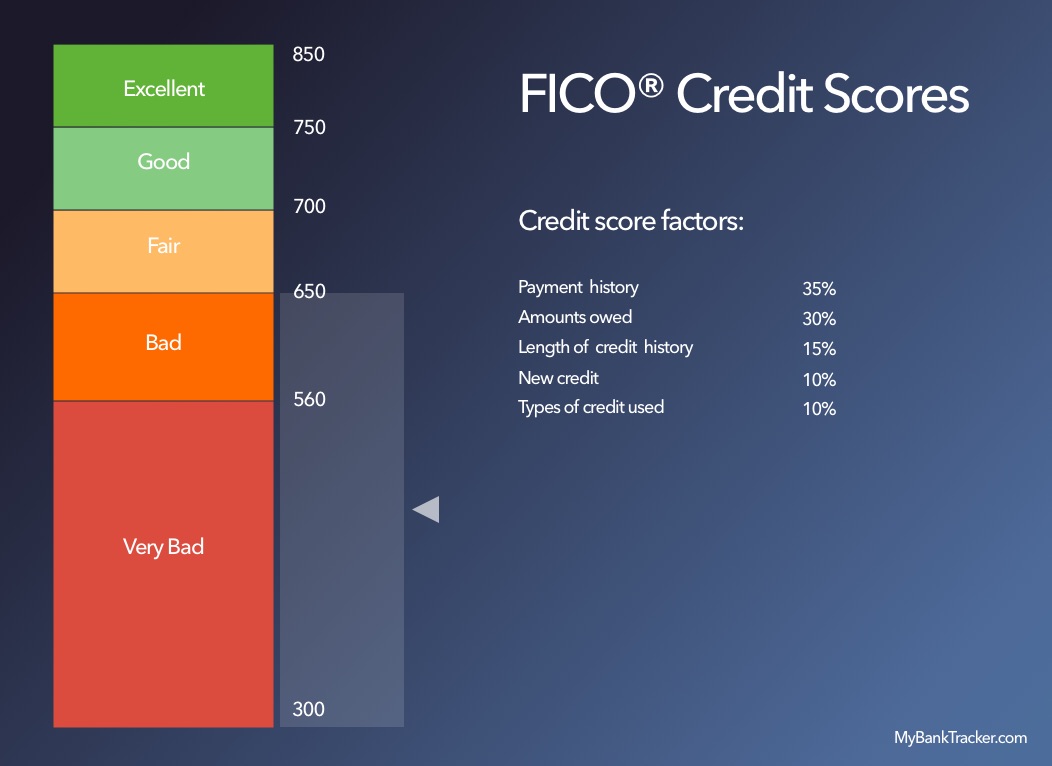

The first is to improve your credit score. This is difficult to do in the short term, but there are a few steps to take. If you pay off some of your credit card balances, it will reduce your credit utilization ratio.

That will give your credit a bump. If you have derogatory marks on your report, you could also try to negotiate a pay-for-delete agreement.

Reducing your debt-to-income ratio also improves your chances. The lower the ratio, the more money you have to make payments on your new loan.

You can do this by increasing your income (perhaps through a side-job), or by paying down existing loans.

Finally, make sure you’re applying for a loan for the right reason. Lenders are more likely to approve a loan for debt consolidation than for a luxury vacation.

Conclusion

Personal loans are useful in a number of situations, especially if you’re trying to get out of debt or pay for an emergency expense.

Though Bank of America does not offer personal loans, there are many other lenders that can provide one.

As always, compare personal loans — interest rates, fees, and terms — before applying. Try out our personal loan calculator to get an idea of what your possible monthly payments and accrued interest could be with a personal loan.