The Best Personal Loans for Debt Consolidation of 2026

Personal loans are flexible financial tools that are becoming more popular. You can apply for a personal loan for nearly any purpose, including consolidating your debts.

If you have a large amount of debt, you might feel like you’re buried under minimum payments.

The stress of managing multiple loans and bills each month can be a lot to handle. You might also have high interest rates on some of your credit cards and loans, which makes them very expensive to pay back over the long term.

Consolidating your existing loans into a single loan leaves you with just one monthly payment. It can also reduce your interest rate, helping you save money.

Best Personal Loans for Debt Consolidation

Though there are a large number of lenders that offer personal loans, some lenders offer better deals than others.

These are the lenders that offer loans that are best for debt consolidation.

SoFi: Best for Low Fees

SoFi is an online lender that offers low-cost, highly flexible personal loans. SoFi will lend as much as $100,000 or as little as $5,000, so you can borrow enough to consolidate your existing debt.

You also don’t have to worry about many of the most common personal loan fees at SoFi. You won’t be charged any origination, early payment, or hidden fees.

As an additional benefit, SoFi offers you some protection against job loss. In most cases, you need to make your monthly payments, no matter your situation. If you lose your job, you still have to make monthly payments.

At SoFi, if you lose your job, you can pause your monthly payments. Interest will continue to accrue, but your credit won’t be hit if you stop making payments. This can reduce some of the stress of borrowing money.

SoFi Personal Loans Pros & Cons

- No origination fees or prepayment penalties

- Potential for a low APR

- Pre-qualification in minutes

- Requires excellent credit for the best APR

Read the SoFi Personal Loans editor’s review.

Earnest: Best for Higher Approval Chances

Earnest is a personal lender that touts its ability to gauge the risk of its borrowers more accurately than other lenders can.

That means that Earnest can approve loans that other lenders won’t. It also means that Earnest can charge less interest and fewer fees.

Earnest analyzes your credit score and other data, such as saving patterns, investments, and career trajectory. If your career is starting and you have a bright future ahead of you, that can help you get a loan from Earnest.

You can borrow as little as $5,000 or as much as $75,000 through Earnest. There’s no origination, early payment, or other hidden fees.

It offers loans to people with a wide range of credit quality. Your loan may not have the lowest rate on the market, but you may have a higher chance of qualifying for a loan if you need one.

Earnest Personal Loans Pros & Cons

- Low borrowing minimum

- No fees or prepayment penalty

- Loans funded within 2 business days

- Requires excellent credit for lowest rates

- Restrictions on how personal loan can be used

Read the full editor’s review on Earnest personal loans.

Lending Club

Lending Club offers loans ranging from $1,000 to $40,000, catering to various financial needs. It is known for its straightforward application process and quick funding, often disbursing funds within a few days of loan approval. Additionally, the company allows for joint loan applications, making it a flexible option for those who may not qualify on their credit standing.

Borrowers can use Lending Club loans for various purposes, including debt consolidation, home improvements, or major purchases. However, it’s important to note that Lending Club charges origination fees ranging from 1% to 6% of the loan amount, which are deducted from the loan proceeds. The platform also provides a unique feature of a co-sign option, enhancing the chances for applicants with lower credit scores to secure a loan.

Lending Club Personal Loans Pros & Cons

- No prepayment penalties

- Investors in your loan include regular people

- Potential for a high APR

- One-time origination fee applies

Read our Lending Club Personal Loans editor’s review.

How to Choose a Personal Loan for Debt Consolidation

You’ll mainly look at three factors when looking for a personal loan to consolidate your debts.

Interest rates

Generally, you want to use a personal loan with a lower interest than the debt being consolidated or refinanced.

If you consolidate to a loan with a higher rate, you’ll pay more in the long run.

Obviously, the lower the rate you can get, the better.

Maximum amount and loan term

There’s no point in borrowing money to consolidate your debts if you cannot borrow enough to consolidate your existing debts.

If you have $125,000 in debt and can only find lenders willing to lend $50,000, you cannot consolidate your debt into a new loan.

It would be best to look at the maximum the lender offers. Longer-term loans cost more but result in lower monthly payments.

If you aim to minimize your monthly payments at a higher cost overall, look for a lender with long-term loans.

A great way to pick the right loan, amount, and term is by using our loan calculator to help you figure out your possible monthly payments and accrued interest:

Estimated Interest Personal Loan Calculator

Fees

Fees add to the cost of your loan. Many personal loans charge origination fees, which are added to the balance at the start of the loan.

Some also charge fees if you pay the loan back ahead of schedule.

Common Personal Loan Fees

| Type of fee | Typical cost |

|---|---|

| Application fee | $25 to $50 |

| Origination fee | 1% to 6% of the loan amount |

| Prepayment penalty | 2% to 5% of the loan amount |

| Late payment fee | $25 to $50 or 3% to 5% of monthly payment |

| Returned check fee | $20 to $50 |

| Payment protection insurance | 1% of the loan amount |

These fees can eat into the savings you get from consolidating your debt.

Look for a personal lender that charges low or no fees.

Why a Personal Loan is Better Than a Balance Transfer Credit Card

There are a few reasons to consolidate your debt with a personal loan rather than a balance transfer credit card.

Higher borrowing limit

One reason to use a personal loan is that personal lenders tend to offer much larger loans than credit card issuers will.

You’ll be hard-pressed to find a card issuer to give you a $100,000 limit like SoFi would.

This is especially true if you’re considering debt consolidation because you likely have less-than-perfect credit.

There’s no point in consolidating your loans unless you can borrow enough to consolidate all, or at least most of them. So, the higher limit offered by personal loans is essential.

Lower interest rate

Many balance transfer credit cards advertise 0% interest rate periods. These can help you save a lot of money, but only if you can pay the loan off in full before the promotional period ends.

If you still have a balance when the 0% interest rate period ends, the credit card’s interest rate will revert to its usual rate.

Credit cards can charge interest over 20% APR. If you have good credit, you can find a personal loan with interest rates that are less than a third of that.

If you plan to take more than a year or so to pay back your debt, you’re better off with a personal loan.

Balance transfer fees

Most credit cards charge a balance transfer fee equal to a percentage of the balance you transfer — usually around 3% to 5% of the transferred amount.

Many personal lenders offer loans with no fees.

How to Improve Your Chances of Approval

There are a few ways to improve your chances of getting approved for a debt consolidation personal loan.

Raise your credit score

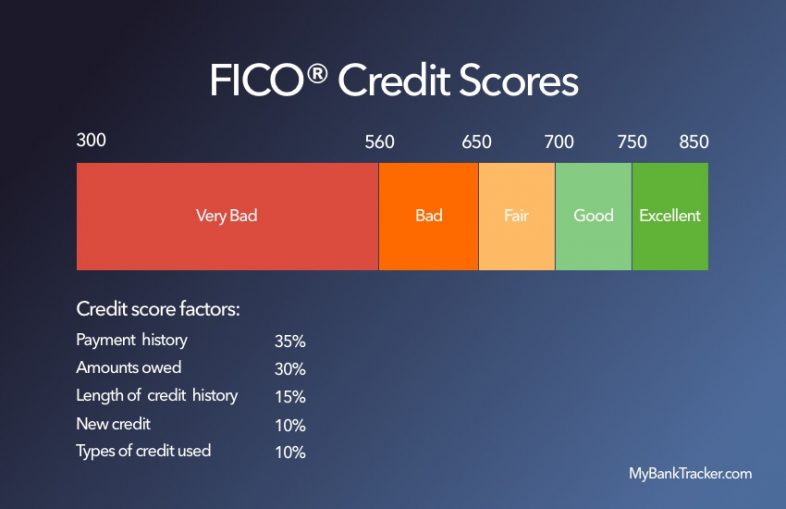

Your credit score is likely the most significant factor in your application’s approval.

Your credit score is a numerical representation of your financial trustworthiness in the eyes of lenders.

The most important of these factors is your payment history. The amount of money that you owe is the second most important.

The bad news is that your payment history takes a long time to improve. The only way to improve it is to pay your bills over time.

In the short term, the best way to boost your credit score is to pay down your existing debts and avoid using your credit cards in the lead-up to your loan application.

Other factors for application

Almost every lender will look at your credit when making a lending decision; some lenders will look at more than your credit score.

One example of this is Earnest. Earnest takes factors such as your savings pattern and investments into account to try to gauge your financial trustworthiness.

If you have poor credit but have recently worked to improve your finances, look for a lender who will consider that.

Rate discounts for automatic payments

The goal of consolidating your debts into a personal loan is to save money and get a more manageable monthly payment.

Remember that you can often get an interest rate discount by signing up for automatic payments.

Most banks that offer both checking services and personal loans will offer this.

Sign up for automatic loan payments from your connected checking account, and you can save as much as 0.50% off the interest rate of your loan. This will reduce both your monthly payment and the total cost of your loan.

Alternatives to Debt Consolidation

Sometimes, as much as you try, you cannot get approved for a debt consolidation loan.

Here are other ways that you can tackle high-interest debt:

Negotiate

When you’re struggling to pay off debt, you can take a chance at negotiating with the creditor to explore different options for your specific case.

The creditor may offer to set up a payment plan that is more manageable for your finances.

Credit counseling

Credit counseling is a service where counselors review your finances to identify ways to improve your debt.

Counselors may also take action to negotiate with creditors on your behalf to establish a debt management plan that is realistic for you.

You can use the National Foundation of Credit Counseling (NFCC) or Debt.com to find trusted credit counselors.

Debt settlement

Debt settlement is when the creditor agrees to discharge your debt if you pay a portion of the amount owed.

This is usually a more drastic step where you’ve missed payments but want to eliminate the debt from your name. The creditor may prefer to collect some of the owed balance instead of selling the debt to a debt collection agency.

Note: Debt settlement usually shows up on your credit report and could significantly drop your credit score (if it has fallen dramatically due to missed/late payments).

Bankruptcy

The extreme method of clearing yourself of a ton of debt is bankruptcy.

Generally, you’d want to avoid bankruptcy if possible because your financial record will be ruined.

Through bankruptcy, you may discharge all of your consumer debts.

Conclusion

If you have a lot of debt, a personal loan can help cut down on interest charges immensely. Furthermore, it’ll help you manage those debts more quickly as you become debt-free.