SoFi Personal Loans 2026 Review

When you need money, a personal loan may be just what you want.

Personal loans can offer flexibility and may be cheaper than a credit card if your credit score qualifies you for a low-interest rate.

You can use a personal loan to pay for just about anything, whether it’s a hefty medical bill or consolidating high-interest debt.

SoFi, short for Social Finance, is an online lender offering a new spin on financing.

SoFi personal loans offer meager interest rates with generous borrowing limits.

But:

Applicants should check their credit scores before applying because excellent credit is required for the lowest APRs.

If you need a personal loan and are looking for an alternative to a bank, find out whether SoFi is worth considering in this review in this review.

SoFi Personal Loans

SoFi personal loans can be used for any personal, family, or household purpose. That includes home or car repairs, financing a move, paying medical bills, consolidating debt, or paying for a wedding.

SoFi Personal Loans Pros & Cons

| Pros | Cons |

|---|---|

|

|

If you need a loan for college, SoFi offers a separate lending category for student loans.

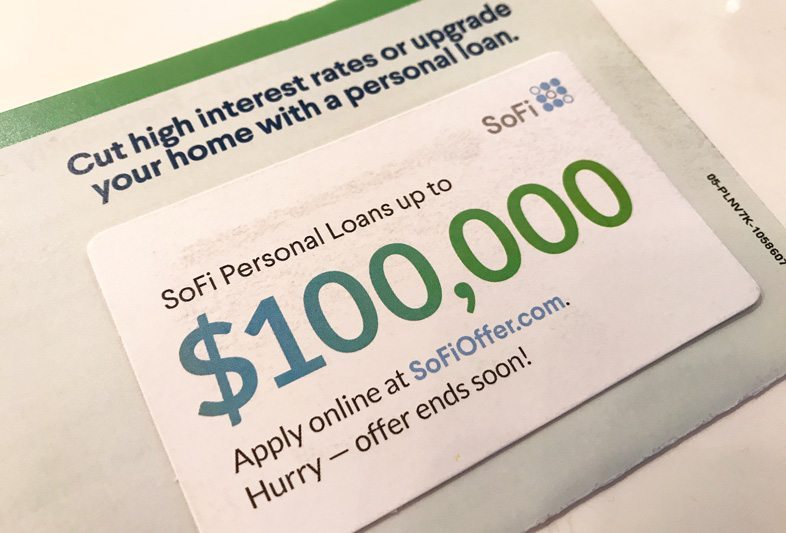

Compared to other online lenders, SoFi has generous borrowing limits. The minimum loan amount is $5,000, with loans totaling $100,000.

Loan terms range from 24 months to 84 months. SoFi personal loans are unsecured, meaning you don’t need collateral.

SoFi offers both fixed and variable-rate loans. With a fixed rate, your interest rate stays the same over the life of the loan.

A variable rate loan, on the other hand, has a rate that’s tied to an underlying index.

The index is the 1-month LIBOR. If the index rate increases or decreases, the rate on your loan will increase or decrease in tandem. SoFi does cap variable rate loans so that it won’t increase indefinitely.

As far as the rates themselves go, SoFi’s rates are competitive compared to what other online lenders charge.

Sometimes, their maximum APR is much lower than you might pay elsewhere. Remember that the best rates go to the most qualified borrowers with excellent credit scores.

One positive associated with SoFi’s loans is the relative lack of fees. There’s no origination fee, closing costs, or prepayment penalty if you decide to pay your loan off early.

Fewer fees mean more savings for you when you borrow. There is no late fee if you’re over 15 days behind on the loan.

SoFi Personal Loan Calculator

Estimated Interest Personal Loan Calculator

Who’s Eligible for a SoFi Personal Loan?

To be eligible for a personal loan from SoFi, you must be a U.S. citizen or permanent resident, be at least 18 years old, and reside in a state where SoFi makes loans.

Currently, SoFi doesn’t make personal loans to residents of Mississippi. If you live in this state, you’ll have to look to another lender for a loan.

You also need to show that you’re financially eligible for a loan.

SoFi requires that you show proof of employment, have an offer of employment to start within the next 90 days, or have income from other sources that would let you keep up with the loan payments.

More than just your credit score

SoFi looks at your financial history, career experience, and monthly income versus expenses to decide if you’re a good candidate for a loan.

Taking a broad view and looking beyond just your credit score is one thing that sets SoFi apart from other lenders.

There is something important to note.

SoFi does allow cosigners or joint applications for personal loans.

So:

If you don’t have a lengthy credit history or you’re looking to apply for a loan with your spouse, SoFi allows you to add a cosigner to increase the chances of approval.

Applying for a SoFi Personal Loan

The application process for a SoFi personal loan can be completed online. The first step is checking the loan rates and terms you qualify for.

You’ll need to give SoFi your Social Security number, but just getting your rates only results in a soft pull on your credit.

Once SoFi presents your loan options. However, you’d need to agree to a hard pull of your credit to continue your application.

You can fill out the application online and upload any supporting documents SoFi asks for, including pay stubs or tax forms. From there, SoFi reviews the details to determine whether to approve you for the loan.

How Soon Is Funding Available?

One advantage of working with an online lender is that it usually takes less time to fund your loan than a regular bank.

Once your application is complete and approved for a loan, SoFi will send you a Loan Agreement to sign electronically.

After you’ve signed off, you should be able to access the loan funds within a few days.

Get a Discount on Your Rate With Automatic Payments

An easy way to save money on your loan’s interest rate is to put your payments on autopilot. When you set up automatic ACH drafts for your loan each month, SoFi will reduce your loan’s rate by 0.25%.

That doesn’t sound like a lot, but that reduction can make a big difference in how much interest you’ll pay over the life of the loan.

Put Your Payments on Pause If You’re Unemployed

Getting laid off or losing your job can put your ability to repay a personal loan in danger.

Missing payments or paying late can also spell trouble for your credit score. Fortunately, SoFi has a program designed to make maneuvering periods of unemployment easier.

If you lose your job through no fault and are eligible for unemployment benefits, you can apply for SoFi’s Unemployment Protection Program.

How it works

If you’re approved, SoFi will put your loan into a 3-month forbearance period, suspending your payments temporarily.

You can reapply for additional forbearance periods for up to 12 months over the life of the loan.

Interest will still accrue during the forbearance period, and it’s added to the principal. You can make interest-only payments to keep the cost from adding up.

If you opt for forbearance, that may extend the repayment term on your loan.

If you get a job while your loan payments are suspended, you can begin making payments before the forbearance period ends or wait until the next scheduled payment date to pick back up.

How Does SoFi Compare to Other Personal Loan Lenders?

Personal loans are not all alike, and it’s to your advantage to check out all the options that are out there. Specifically, it would be best if you considered things like:

- How much you can borrow

- The APR and fees

- The loan’s repayment terms

- What it takes to qualify

With that in mind, take a look at these personal loan contenders:

Upstart

Another online lender, Upstart, offers loans that range from $1,000 to $50,000.

That’s more generous compared to Santander, but it still doesn’t match what SoFi offers, which is something to keep in mind if you’re hoping to finance something big.

Funding with Upstart is fast if you’re approved, and similar to SoFi, Upstart uses a broad list of criteria to make lending decisions.

For example, your credit score and income come into play, but Upstart also looks at where you went to school and what kind of career path you’re on to determine your ability to repay your loan.

OneMain Financial

For borrowers who don’t have the best credit, OneMain Financial could be a better alternative because this is an online lender that caters to those with fair credit.

While the interest rates may not be the lowest, the upside is that you’re more likely to get approved for a personal loan.

Lending Club

If you’re interested in getting loans funded through a peer-to-peer network, Lending Club is the leading marketplace lender in the business.

Personal loan limits extend to $40,000, with loans backed by individual investors rather than a bank.

Lending Club uses its credit grading system to assign borrowers a risk level.

Borrowers with better grades signal to investors that they’re low-risk, meaning they also qualify for better interest rates. Investors comfortable taking on more risk can fund loans for borrowers with lower grades.

Lending Club may be attractive if you need a loan and have poor credit.

Is SoFi the Right Lender for You?

SoFi may hold a lot of appeal for borrowers who are comfortable choosing an online lender over a bank and need to borrow a substantial amount.

The unemployment protection is a nice benefit that you won’t always find at other banks, and the fact that SoFi takes a well-rounded approach when qualifying borrowers could make it easier to get approved versus getting a loan elsewhere.

If you think you’ll need a cosigner, SoFi is a solid option.

In any case, it is always wise to compare your options to find the right personal loan for your needs.