How Personal Loans Differ From Payday Loans

When you need money quickly, you may be wondering what the best choice is for borrowing.

Personal loans and payday loans are two ways to get money in a pinch. At first glance, they look similar and payday loans can be viewed as a type of personal loan. But, the financing terms are usually very different between the two.

Understanding what sets personal loans and payday loans apart is a must before you take on either one.

Learn how personal loans and payday loans work to find out which one is the best fit for your borrowing needs.

Personal Loans vs. Payday Loans

| Features | Personal loans | Payday loans |

|---|---|---|

| Borrowing amount | Usually $1,000 to $100,000 | Usually $50 to $1,500 |

| Typical interest rate | 5% – 20% | 200%+ |

| Typical repayment period | 3-5 years | 2 weeks |

What Are Personal Loans?

A personal loan is an unsecured or secured loan that is typically offered by a bank, credit union, or another lender. If you are using a secured loan, the collateral is often in the form of cash in a deposit account.

Pros & Cons of Personal Loans

| Pros | Cons |

|---|---|

|

|

Borrowing Limits

One advantage of getting a personal loan is being able to borrow more. Depending on the lender, you might be able to borrow up to $100,000. You could use that money to:

- Consolidate debt

- Pay outstanding medical bills

- Go on a vacation

- Pay for a wedding

- Make home improvements or repairs

- Cover an emergency expense

Higher loan limits are usually the exception, rather than the rule. Many online and traditional lenders typically offer personal loans that max out at $35,000 to $50,000. The minimum loan amount may be $1,000 to $2,500.

Remember, not everyone qualifies for the max loan amount. How much you can borrow depends on several things, including your credit rating, income and the lender you’re working with.

Compare Your Personal Loan Options

Find a personal loan that better fits your borrowing needs:

Costs

There two types of costs associated with personal loans: the interest rate and the fees.

There’s no standard annual percentage rate (APR) that applies to personal loans. Lenders usually offer a range of rates, based on creditworthiness.

There are personal lenders that cater specifically to people with bad credit, while others are designed for borrowers with strong credit profiles.

In terms of actual numbers, APRs can range from around 6% to 36%. Again, it’s up to the lender to set the rates. The lender also determines whether the rates for personal loans are fixed or variable.

A fixed rate is good if you want predictability when you borrow. The rate — and your payment — stays the same for the life of the loan.

A variable rate, which is tied to an index, can go up or down as the index rises or falls.

Aside from the APR, you also have to consider the fees charged by lenders. That could include:

Common Personal Loan Fees

| Type of fee | Typical cost |

|---|---|

| Application fee | $25 to $50 |

| Origination fee | 1% to 6% of the loan amount |

| Prepayment penalty | 2% to 5% of the loan amount |

| Late payment fee | $25 to $50 or 3% to 5% of monthly payment |

| Returned check fee | $20 to $50 |

| Payment protection insurance | 1% of the loan amount |

The biggest ones to watch out for are the origination fee and the prepayment penalty.

The origination fee is a fee the lender charges to process the loan. It’s usually a percentage of what you borrow and it’s deducted from the loan proceeds.

If you take out a $10,000 loan with a 2% origination fee, you’d receive $9,800 once the fee is taken out.

It’s important to account for the fee so you’re taking a large enough loan to cover it and still leave you with the amount of money you need.

Origination fees are charged up front but a prepayment penalty kicks in on the back of the loan. This fee applies if you pay your loan off early.

Not every lender charges this fee, however. It pays to read the fine print on prepayment penalties as you compare lenders. This fee is in addition to the loan amount, and is therefore subtracted from the loan proceeds.

Personal Loan Calculator

Curious how much a personal loan might cost you? Use our personal loan calculator to figure out how much your possible monthly payments and accrued interest could be if you take out a personal loan:

Estimated Interest Personal Loan Calculator

How Quickly Can You Get a Personal Loan?

Once upon a time, getting a personal loan from a bank was a time-consuming process. These days, it’s much quicker.

Many online banks, and some traditional banks, now offer personal loan approval and funding in as little as 1 to 2 business days.

You can apply for the loan online, upload your documents and link your bank account for direct deposit in a matter of minutes.

Who is a Personal Loan Right For?

There are lots of ways you can use a personal loan. And compared to a credit card cash advance, it’s possible to get a lower APR with a loan.

Fixed rate personal loans are also easier to budget for than a credit card with a variable rate. The payments are the same from month to month and you know ahead of time how many payments you’ll need to make to pay it off.

Those factors, combined with fast funding, make personal loans a good choice for someone who needs to borrow a specific amount of money quickly.

There are personal loan options for people with both good and bad credit. Keep in mind that bad credit personal loans may have higher interest rates than those available to borrowers with good credit.

What Are Payday Loans?

A payday loan is a type of short-term personal loan. You borrow a small amount, say $500 to $1,500.

When you get your next paycheck, you repay the loan, plus any fees the lender charges. You give the lender a post-dated check for the repayment amount or authorize them to take the amount out of your bank account automatically.

Essentially, these loans are designed to help you cover a temporary cash shortfall until you get paid again. Payday loans should only be used for covering short-term, day-to-day expenses and not for more significant expenses like home repairs or medical bills.

Payday loans aren’t offered by banks. There are payday lenders who offer these kinds of loans exclusively. You can get payday loans from local lenders, or online.

In terms of approval, payday loans tend to be easier to get than personal loans. In many cases, all you need to get a loan is your pay stub and a bank account. No credit check is required.

Pros & Cons of Payday Loans

| Pros | Cons |

|---|---|

|

|

Cost

The big draw for payday loans is their convenience. It’s easy to get one and you can get the money you need the same day. But, payday loans often come with a high price tag.

Payday lenders charge loan fees, instead of a flat APR. These fees vary from lender to lender.

According to the Consumer Financial Protection Bureau, a two-week payday loan that charges you $15 for every $100 you borrow has an effective APR of almost 400%.

That doesn’t mean payday lenders can charge you anything they want, however. They’re regulated by law in 37 states. Eleven other states and U.S. jurisdictions have laws requiring payday lenders to observe interest rate caps on consumer loans.

These laws are intended to keep payday lenders from charging unfair fees. Compared to personal loans or even credit cards, however, payday loans can be one of the most expensive ways to borrow money.

Who Are Payday Loans For?

Personal loans are often marketed towards people who find themselves in a cash crunch. According to one study, 58 percent of payday loan borrowers struggle to make ends meet. The average borrower earns about $30,000 a year and 7 in 10 borrowers get a payday loan to pay their rent or utility bills.

Payday loans also cater to people who may not understand that there are better borrowing options, or have the credit score to qualify for a personal loan. What can often happen with these loans is that borrowers end up taking out a new payday loan as soon as the old one is paid off.

This creates a vicious cycle, with the borrower relying on the loans to cover their expenses from paycheck to paycheck. In the meantime, they’re just paying more and more fees to the lender.

As a result, many payday lenders have gotten a reputation for being predatory. The CFPB has attempted to cut down on abusive practices by instituting a new rule requiring payday lenders to make sure that a borrower could reasonably repay a loan.

How Credit and Income Matter for Borrowing

Personal loans and payday loans treat credit and income very differently.

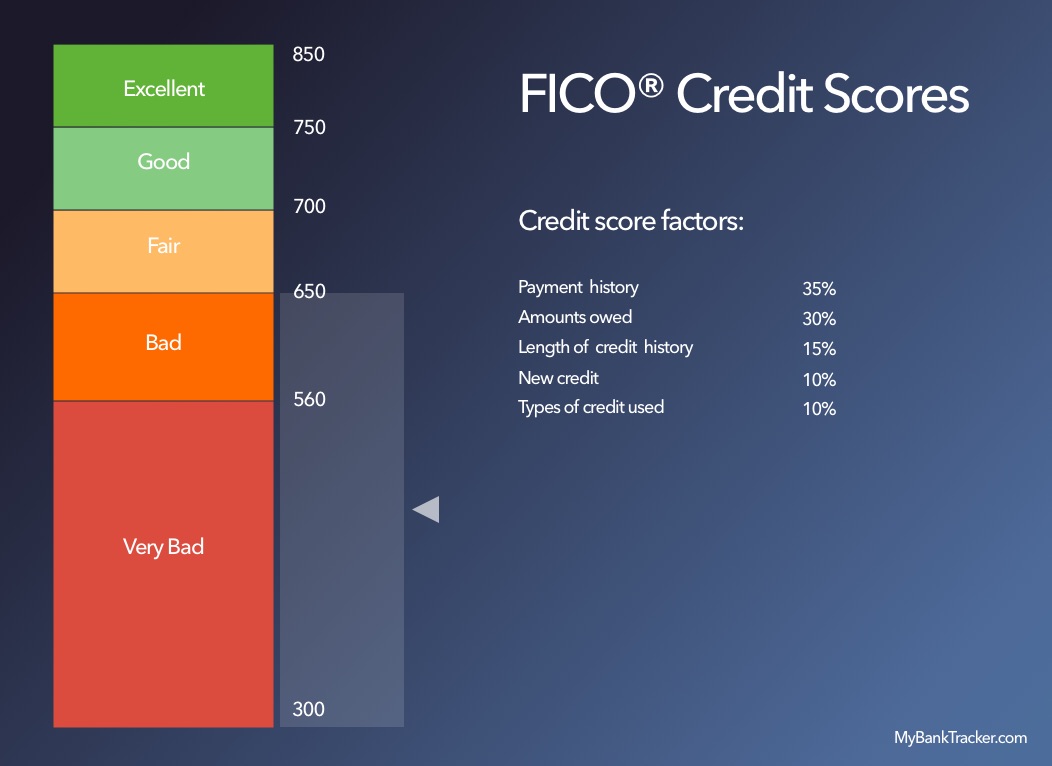

With a personal loan, you’ll generally need a solid income and a strong credit rating to get approved. Paying your bills on time, keeping your credit card balances low and having older credit accounts can all work in your favor. Using different types of credit and applying for new credit sparingly also help your credit score.

In addition to approval, your credit rating also influences what kind of APR you qualify for. The very best rates are reserved for borrowers who have the highest credit scores.

Lenders also look at your income and employment history to gauge how likely you are to repay the loan.

With a payday loan, on the other hand, credit is much less important. You just need to have a bank account and proof of steady income to borrow money. It’s more convenient but the cost isn’t worth it.

Which One Should You Get?

If you need to borrow money quickly, a personal loan should always be your first choice. A payday loan, even a small one, is likely to cost you much more than a personal loan would. Look for short-term personal loan options with no origination fee and no prepayment penalty to keep your borrowing costs as low as possible. It should be noted that laws and regulations regarding personal loans and payday loans can vary depending on the state or country.