Why Is My Credit Score Low?

We hear all the time how credit is important — and how keeping a good credit score is even more so. But understanding the ins and outs of a credit score can get confusing.

There’s a lot of advice out there that says to avoid things that require credit, like credit cards and loans, so you won’t get into debt.

On the other hand, although debt can be a problem, credit remains a useful tool that you should understand how to use.

This is especially true if you check your credit score and see that it’s less than stellar. If you’re wondering why credit matters so much, and what to do about a low credit score, here’s what you need to know.

Why Does Your Credit Score Matter?

It can be easier to tune into the credit conversation if you know why credit scores are important.

Credit itself is useful because it allows you to finance purchases or borrow money to use right now. You can then pay what you borrowed back over time (for a fee).

You may want to finance big purchases you wouldn’t otherwise have the cash to afford to buy all at once, like a home.

You might borrow money from a lender to start a business. Or you may simply want to make the most of your spending and better protect your purchases by using a credit card instead of cash.

You credit score matters here because it’s a big part of what determines the fee you’ll pay for borrowing money or putting purchases on credit.

That fee is the interest rate on your installment loan or revolving line of credit (like a credit card).

The lender determines what interest rate to offer you based in part on your credit score, which indicates how much of a risk you pose to the lender.

A low score indicates you’re higher risk because a low credit score suggests you’re more likely to default on your loan or fail to make payments.

A high credit score indicates less risk, and to lenders, this means you’re less likely to miss payments or fail to make them altogether.

So if you have a low score, expect a higher interest rate. Only good or excellent credit scores get the lowest interest rates available.

And the higher the rate you pay for your interest, the more borrowing or financing costs you.

Obviously, your credit score has an impact on your financial life. It comes at a literal price: more money paid in interest.

The higher your score, the more positive the impact on your finances. You can get approved for more options when it comes to borrowing money or financing, and you get access to the best interest rates available.

But what if you check your score and find that it’s low?

First, don’t despair. Know that you can take action to raise your score — and we’ll talk about that later in this article. Before we do, it helps to know why your score is the way it is.

Learn What Goes into Your Credit Score

Knowing how FICO calculates your credit score can show you why your score may be low.

FICO, or the Fair Isaac Corporation, calculates credit scores based on predictive analytics.

This data suggests a likelihood of what you’ll do in the future, based on your past actions and your present financial situation.

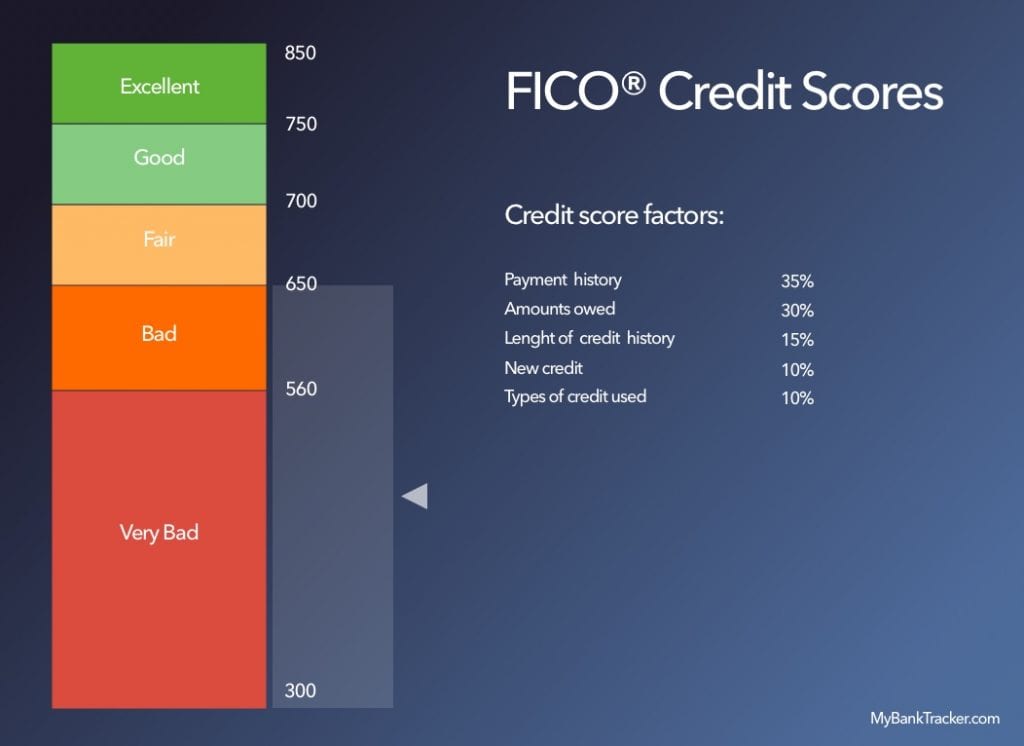

We don’t know the exact formula FICO uses, but we do know the five primary factors that go into calculating your credit score (and how each one is weighted).

FICO looks at the data around your financial life in the above categories and uses it to give you a credit score.

FICO credit scores exist on a spectrum from 300 to 850, with 300 being the very worst, and 850 considered perfect.

Here’s how the rest of the scores break down, and what each range means for your credit rating:

- 300 to 560: Very bad credit

- 560 to 650: Poor credit

- 650 to 700: Fair or average credit

- 700 to 750: Good credit

- 750 or above (to 850): Excellent credit

If your credit score is anything below 650, it’s time to take action. Let’s look at why your score may be low — and how to raise it.

The Causes of Low Credit Scores

There are several reasons your credit score may be average, poor, or bad. Again, those five factors provide some clues that we can start with.

Payment history makes up a huge portion of your score. Missing payments, consistently making late payments, or defaulting entirely on a balance you need to repay all drag down your score significantly.

Amounts owed make up the next heaviest-weighted factor when calculating a credit score. This is where things like credit utilization come into play.

If you use too much of your available credit — even if you pay off the balance — it can drag down your score.

And of course, keeping high balances and a lot of debt means using too much available credit (on top of costing you in interest!).

Likewise, if your available credit drops for some reason, but your spending remains the same, that will negatively impact your score. This can happen when you close a card, which is why there’s a lot of advice out there to avoid this.

The other potential issue with closing a card is that it affects your average account age — yet another factor important to a good credit score.

If you significantly change the average account age by closing very old accounts, your credit score could drop.

And of course, major financial issues that you’ve had in the past could cause a low credit score today.

Accounts sent to collections, filing for bankruptcy in the last seven years, or incurring any financial judgments against you can all cause a low credit score.

When you pull your credit score, you can look through the information and find reason codes. These codes explain exactly why your score wasn’t higher, so you don’t have to speculate so much. These are “negative” reasons, but they’re still helpful.

You won’t know exactly why your score is low because credit reporting agencies don’t provide that detail. But from what they do provide via the reason codes you can determine the most likely reason for your low credit score and can work on raising it over time.

What You Can Do If You Find Your Credit Score Low

Ready to raise your low credit score? Here are some actions you can take:

- Create a budget and stick to it to avoid overspending and charging more than you can afford to repay. And on that note: don’t charge or borrow more than you can afford to repay.

- Make all payments in full and on time.

- Create a debt repayment plan to pay down high balances steadily.

- Keep your credit utilization ratio to 30% or less.

- Don’t open lots of credit card accounts all at once.

- Try to avoid closing accounts if you don’t need to — and definitely avoid closing your oldest credit account. If you need to cancel cards, do so periodically over time (don’t close more than one every six months or so).

- Don’t borrow money that you don’t need, to avoid taking on more debt — budget and save up the cash instead.

- Check your credit report each year at AnnualCreditReport.com and look for errors. If you find any, contact the credit bureau who issued the report and file a dispute. Removing mistakes can help improve your score if the error caused it to drop in the first place.

- Avoid collections accounts at all costs. Paying off the account doesn’t remove it from your credit until seven years later, so do what you can to keep your debt from ending up with collection agencies.

Remember, raising credit scores takes time. Being on your best financial behavior for a month is great — but you need to keep at it for much longer to see results with your score.

It could take up to six months or even years before you can build the score you want to see.

If you struggle to use credit responsibly, you may want to avoid it altogether to stay on the safe side.

However, there are a few good options for you that will help you slowly build better habits while using credit and improving your score.

Or, you might need to rebuild your credit after coming through past financial troubles, but can find it difficult to qualify for credit due to your low score.

In either case, consider applying for a secured credit card. Most credit card issuers will approve you for a secured card even when your credit score is low.

Some banks, like Discover, will even consider transitioning you to an unsecured credit card with better perks and benefits after seven months of managing a secured card successfully.

You can also consider a credit improvement loan to help you raise a low score.

You use the loan to create a positive payment history, and for some people, it helps diversify the types of credit accounts in their name.

But this option isn’t for everyone — it’s better to stick with something like a secured card if you don’t actually need the loan.

With a card, you can charge purchases to it but pay off the balance before it accrues interest. With a loan, you’ll pay a fee for borrowing the money. It becomes a costlier way to improve your credit.

There are many reasons your credit score could be low. Look for what is keeping your score from being higher, and then formulate a plan to improve your credit.

Knowing what’s holding you back from a higher credit score lets you know exactly what you need to do to change your actions and raise it successfully.