Tips on How to Improve Your Credit Score

Admit it, your credit score could probably use a little bump.

If you want to purchase a home, car, or any other luxury item, the first thing lenders will look at is your credit score. Getting a handle on establishing good credit can be tough. By having a positive attitude and following these steps you could get on the road to good credit in no time.

Why It’s Important to Know Where You Stand with Your Credit

The first step to a better score is knowing where you stand. Almost everything can be found online, including your credit score.

By visiting AnnualCreditReport.com — a legitimate site backed by the U.S. government — you can obtain a free credit report (look, you’re saving money already!). Keeping up-to-date on your credit report will help you catch any incorrect information.

The three largest credit bureaus in the United States each offer a free annual credit report. A simple way to track your credit standing and financial health is to order one report every four months.

If you find a mistake or are unsure about anything, immediately write a letter to the specific agency and request a formal investigation into the information that could be inaccurate.

How to Understand Your Credit Score

Your credit score is not included in any of your reports. While in most cases consumers pay for the number, there are ways you can access it for free.

For example, larger credit card companies may include your credit score on monthly statements or online. Discover now offers your credit score for free, whether or not you’re a Discover cardholder.

Remember that you have more than one credit score. In total, you can have over 30 credit scores. Some people have hundreds of credit scores. Let’s examine why.

What Exactly Is A Credit Score?

Your credit score is representative of all the information in your credit reports. These scores are calculated by multiple credit bureaus, the largest being Experian, Transunion, and Equifax. This automatically gives you multiple scores.

Each score is specific to the type of lender. For example, free credit scores are typically called “educational scores” – a score assigned by a credit bureau. A lender will typically not use an educational score to measure your creditworthiness. This score is best used for watching your own credit standing.

There are specific scoring models for each type of lender. This is because there are numerous loan products on the market. The most common scoring models lenders use are FICO and VantageScore.

All About the FICO Model

The FICO model, named for the Fair Isaacs Corporation, was originally intended to calculate how likely a borrower would be to default on a mortgage loan. The FICO model has since been updated into a variety of models, including:

- The Standard FICO Score

- The FICO Mortgage Score

- The FICO Auto Score

- The FICO Personal Finance Score

To further multiply the number of models (and scores), FICO provides certain formulas to the various credit bureaus. For example:

- Experian uses the Experian Risk Score (based off a FICO model)

- Equifax uses the Pinnacle Score and the Beacon Score (based off a FICO model)

- Transunion uses the TransUnion Risk Score (you guessed it)

In total, there are almost 50 different FICO scoring models which result in almost 50 different credit scores. And then there’s the VantageScore.

All About the VantageScore

The VantageScore model was created by Experian, Transunion, and Equifax to compete with the FICO model. Still, the big three continue to work with FICO and assign scores based on their models.

The VantageScore model differs from the FICO score in that it gives “reason codes” to help explain to consumers why they score the way they do. Though the model was created in collaboration between the primary bureaus, there can still be discrepancy in your scores between each.

If information from your credit report is mistakenly left out of the scoring model, your score will be different. Therefore it is of the utmost importance to scrutinize your free credit reports, and report any errors based on the reason codes.

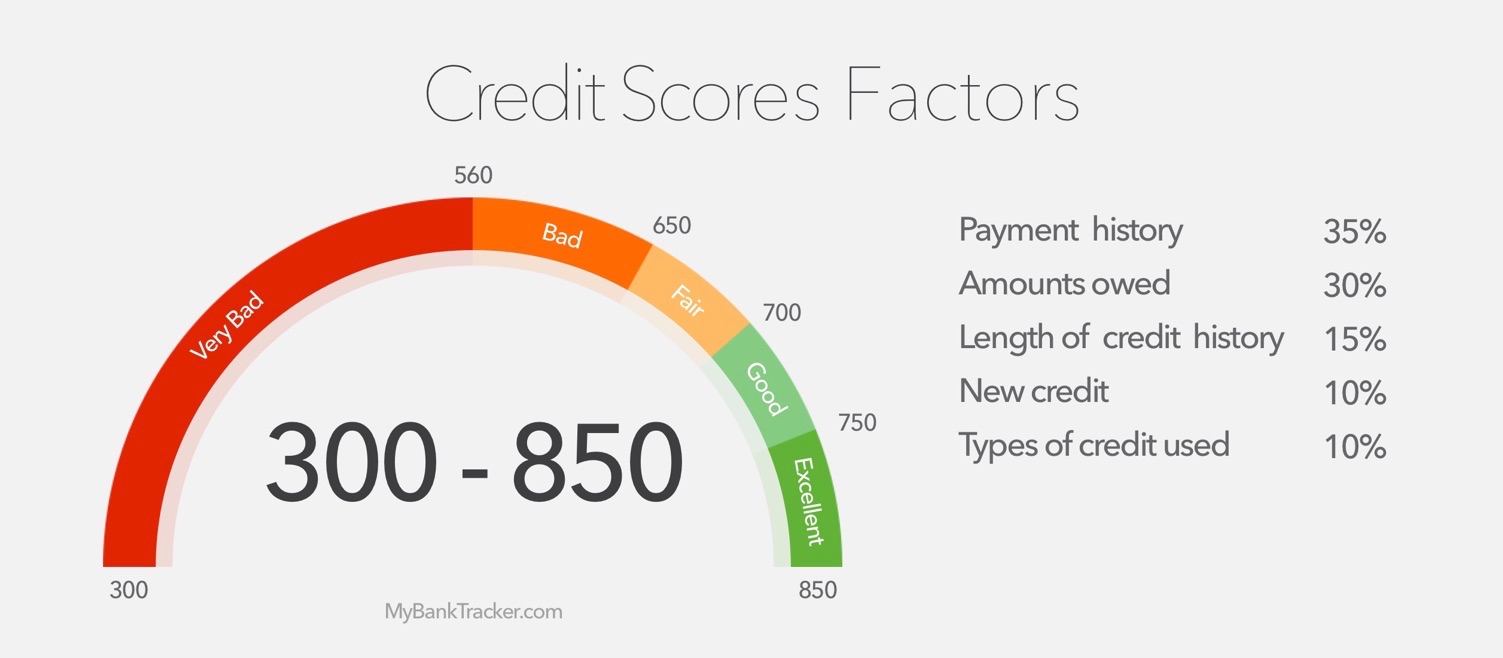

There Are Many Factors That Determine Your Credit Score

It is important to understand how a credit score is calculated. According to the Consumer Federation of America (CFA), there are five factors that go into calculating a credit score:Payment Patterns

Payment Patterns

Companies value prompt payments. Lenders examine your credit score to decide how risky you are to their business. Your score tells potential lenders the likelihood you’ll pay money back based on your history.

If you have a history of late or missed payments, your credit score will take a huge hit. Pay on time, every time. Your score will thank you for it.

IOUs

Since your credit score is meant to predict your risk, the amount of money you already owe makes a big difference. It isn’t only about how much you owe – it’s how much you owe in proportion to what’s available to you.

This is called your credit utilization ratio.

If a company sees a high ratio, that indicates maxed out credit cards, which further indicates a financial situation in which you are stretched to your max. Aim to keep your ratio at 30% or below so new lenders will feel safer lending to you.

Credit History

The longer your credit history, the higher your score. Good credit history is important, but if it’s short, then it doesn’t tell potential lenders much of a story about you.

They want to see that you’ve had good credit history for a long time. This gives lenders a feeling that they can predict your future behavior. In other words, keep paying on time, keep your ratios modest, and keep your accounts open (even after you’ve stopped using them).

New Credit

Your credit score can be lowered if you are constantly opening new credit accounts. For every account you open or attempt to open, you get a “ding” on your credit score. If you’re applying for multiple different loans, those hits will add up.

Shop around for the credit product that you feel is best suited for your lifestyle and only apply for that.

Miscellaneous Other Factors

There are also other factors that go into score calculations, such as the variety of credit you are using (or lack thereof).

Companies look to see if you are using credit for a mortgage or for personal items and other purchases.

Potential lenders want to see a history of multiple types of credit (loans and lines of credit) so they can get a feeling of how you behave in these circumstances. Finally, student loans do something good for you!

Note: Each Factor is Weighted Differently

All of these components factor into your score, but at varying rates. Some things (like payment history) are very important to potential lenders while others (types of credit) help flesh the story out for them, but aren’t as crucial.

Think about all of these factors but understand that you don’t have to them all perfectly to have a good score. Maintain a watchful eye over your bills, but accept that you aren’t always going to be perfect.

How to Increase Your Credit Score

Historically, credit scores have been hidden by smoke and mirrors, but that’s not the case anymore.

You not only have the power to view your credit score on a regular basis, you also have the power to improve it. Here’s how:

Pay on Time

In this case, paying on time is money.

Paying your credit on time accounts for about 35% of your score, according to the Consumer Federation of America.

If you are a naturally forgetful person, set up an automatic payment of credit card bills through your bank.

Be careful about your balance: If you do not have enough money to pay the automatic billing each month, you could be charged with overdraft fees.

Put the Plastic Away

Do you really need that new sweater?

Is it necessary to buy the latest Apple or Google gadget? Hold off on these purchases for now.

If you know your credit score isn’t as strong as you’d like it to be, the most valuable thing you can do is focus on improving your credit.

Another benefit to slowing the use of credit cards is potentially a lower interest rate, which ultimately will result in less debt.

DIY Your Credit Repair

Do-It-Yourself.

It’s okay to admit you need help every now and then, but hiring a credit repair company could put you at risk of being scammed.

You are a strong, smart individual and — in most cases — capable of improving your credit score by yourself.

Use Your Credit Score to Balance Your Habits

The steps seem easy enough, but following through is the difficult part. The key is applying a little bit of determination and smart budgeting.

Having a high credit score is great for multiple reasons. For one, the higher your credit score, the lower your interest rates which equals less money lost.

Higher scores also mean more opportunities to borrow when needed.

It’s impossible to have a perfect credit score considering the many models, bureaus, and lenders charged with examining your credit reports.

What you can do is pay your bills on time, budget your spending, and review your reports when you’re able to.

Credit Score Improvement Doesn’t Happen Overnight

If you’re unhappy with your score or believe it isn’t what it should be, make sure there are no errors on any of your credit reports.

If there are none to be found, don’t lose hope! Instead, write up a plan for yourself to follow.

With patience and consistency, you will be able to get the score you’ve been hoping for.

Stay determined and continue to make active choices with your money.