What Is a Credit Utilization Ratio?

Do you know what your credit score is? And more importantly, do you know how credit bureaus calculate that number?

Think of your credit score as your financial report card. It gives you an idea of your financial health.

And institutions like banks and lenders use the score when evaluating you for a loan. They use your score to determine how likely you are to responsibly manage the money you borrow.

Quick answer: The credit utilization ratio reveals how much of your borrowing potential is being used. It is calculated by dividing your current debt by your total credit limit.

Needless to say, this is an important number to maintain. And part of getting and keeping a great credit score is understanding what goes into it.

When it comes to your credit score, the credit utilization ratio is one of the most important factors to understand. It has a huge impact on your score, and knowing how it works can help you improve it.

Understanding Credit Utilization Ratios

So what is a credit utilization ratio, anyway? Why does it affect your credit score so much?

A credit utilization ratio is a relationship between how much credit you have and how much credit you use.

This number is expressed as a percent. Let’s look at a real-life example to better understand this ratio:

Say you have a credit card with a $1,000 limit. That’s the amount of credit you have available to use. If you charge $500 on your credit card, you use half of that available credit.

In other words, your credit utilization ratio on that card is 50%.

Here’s how you can calculate your credit utilization ratio:

- Add up all your credit limits

- Add up all of your total unpaid balances as of this date

- Divide your total unpaid balances by your total credit limits

And that’s your total credit utilization ratio.

Here’s another example: Say you have three cards with limits of $1,000, $1,500, and $2,000.

The balance on the $1,000 limit card is $300. You carry a $500 balance on the other two.

You have a total of $4,500 worth of credit you can use. And with those balances, you use $1,300 of your limit. Your credit utilization ratio is 29%.

What Counts as Outstanding Debt?

If you calculate your credit utilization ratio by dividing your outstanding debt by the total amount of credit you can use, you need to know what “outstanding debt” includes.

Outstanding debt is more than just your credit card balances. (But they certainly make up some of the outstanding debt included in the calculation.) You also need to take into account the following:

- Amount of debt you owe to lenders

- Amount of debt you carry on each credit account

- The type of debt you carry, and whether it’s an installment loan or on a revolving account

This is where things can get tricky. Credit bureaus mark revolving balances as carrying more weight than installment loans.

That means the specific ratio on your credit cards impacts your score more than the ratio between your total installment loan balance and the amount you already repaid.

This isn’t necessarily a bad thing. Big installment loans like mortgages and student debt take a lot of time to repay.

Credit card balances theoretically should take less time to repay, since they have smaller balances. (Although, it’s important to remember the impact high interest rates have on credit cards – and how those interest rates can keep you in debt longer if you don’t create a targeted credit card debt payoff plan.)

What does this all mean? It means that credit card balances create a bigger impact on your credit score than other lines of credit.

In other words, the financial world does actually consider some debt worse than others. Specifically, financial institutions judge revolving debt more harshly than installment loans.

How Credit Scores Are Calculated

FICO Credit Score Factors and Their Percentages

| FICO credit score factors | Percentage weight on credit score: | What it means: |

|---|---|---|

| Payment history | 35% | Your track record when it comes to making (at least) the minimum payment by the due date. |

| Amounts owed | 30% | How much of your borrowing potential is actually being used. Determined by dividing total debt by total credit limits. |

| Length of credit history | 15% | The average age of your active credit lines. Longer histories tend to show responsibility with credit. |

| Credit mix | 10% | The different types of active credit lines that you handle (e.g., mortgage, credit cards, students loans, etc.) |

| New credit | 10% | The new lines of credit that you’ve requested. New credit applications tend to hurt you score temporarily. Learn more about FICO credit score |

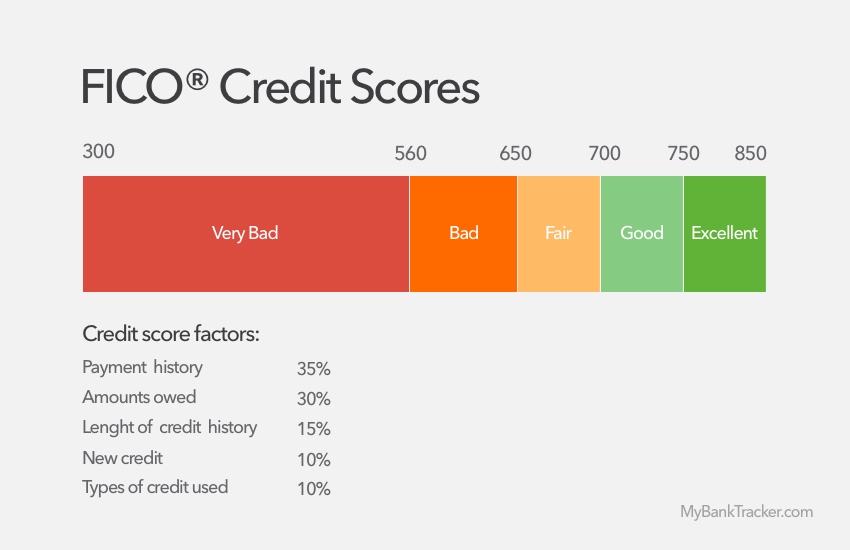

Credit bureaus look at five main factors when calculating your credit score. Each factor is weighted, meaning some impact your score more than others.

Here’s how financial institutions generate credit scores:

- Payment history (35%)

- Amounts owed (30%)

- Length of credit history (15%)

- Credit mix (10%)

- New credit (10%)

“Amounts owed” is the one that refers to your credit utilization ratio. That makes up 30% of your score!

This is why understanding your ratio is so important. The higher that ratio is, the more it negatively impacts your credit score.

Also note that your credit score is calculated based on the type of credit you’re using (like credit cards, mortgage, student loan, and so on). A variety of accounts can be good, and a lack of certain types of credit can hold you back from a better score.

Your score is also calculated based on how many accounts you have. Too many accounts can hurt, which means you should find the sweet spot between varied types of credit and too many accounts and not go overboard in either direction (by having too many or too few).

Why You Need to Know Your Ratio

As you can see, your credit utilization ratio makes up a big percentage of your overall score. That’s why you need to know this number, and how to manage it.

Credit utilization comes into play whether you have debt or not. Here’s where the ratio and its relationship to your credit score gets a little tricky:

When your credit utilization ratio is used to determine your overall credit score, credit bureaus just look at the number.

They look at what the ratio is and that’s it. They don’t take a deep dive into your situation to see that you may have a great credit history, pay off all balances on time and in full, and keep a good mix of different types of accounts.

They just look at what the ratio says. That means the way you use your credit, even if you don’t have debt, impacts your score.

So, for example, say you have a credit card with a $1,000 limit. You can charge up to $1,000 worth of purchases to the card each month. Perhaps you tend to charge $800 to the card between groceries, bills, and transportation.

These are perfectly reasonable living expenses that you budget for and can afford.

If you pay the balance off on time and in full each month, you don’t accumulate debt. You don’t pay interest charges on the balance, either. And most people would say you use your credit responsibly.

But your credit utilization ratio will be 80%! When it comes to determining your credit score, that’s bad news. Your score can suffer and drop.

As a result, you may have a hard time getting a loan when you need one.

You certainly won’t get the best available interest rate.

Lenders don’t like to see people using the maximum amount of credit available to them.

When you’re using a large portion of your credit line, it may appear as if you’re borrowing to stay afloat. It’s a potential sign of financial distress.

Ideally, your credit utilization ratio should be 30% or less.

That means on the card with a $1,000 limit, you only charge up to $300 at a time before paying the balance.

This isn’t a hard and fast rule, but it’s a good guideline to go by. Watch how much you charge to each credit card and aim to keep balances under 30% of the total amount of credit you can use.

You can set up balance alerts if you struggle to keep track of your charges throughout the month. These will alert you when your balance gets too high so you know when to switch to cash or debit for purchases.

Taking this action on each individual card means your total ratio will take care of itself.

Can (and Should) You Change Your Credit Utilization Ratio?

That brings us to the question of how can you manage your credit utilization ratio.

If your ratio is too high, you can try to increase the amount of credit available to you.

Go back to our example of the $1,000 line of credit that you charge up to $800 each month. If you could increase that line of credit to $2,000 and reduce the amount you charge to $600, your credit ratio would drop from 80% to 30%.

Taking this action could give your credit score a boost. To do it, you can call your credit card companies and request a credit limit increase. You could also open a new credit card account to generate more available credit.

But be careful how much you use new lines of credit. If you open new accounts and carry balances on those, too, you increase the amount of available credit and the amount of credit you use.

Opening new credit just to increase your overall credit limits and then putting a balance on that credit is basically defeating the purpose.

(Plus, opening lots of new accounts at once can damage your credit score.)

If you use the new lines of credit you open, your ratio won’t improve. Changing your credit utilization ratio for the better means increasing what’s available in combination with decreasing the amount of credit you use.

Before trying to increase your credit limit, see if you can lower your ratio by simply charging less to your credit cards. It’s the safest way to go to lower your ratio and hopefully start improving your credit score.