Installment Loan vs. Revolving Credit: Effect on Your Credit Score

Your credit score has a significant impact on your financial life.

It affects what loans you can qualify for and the terms of the loans that you get approved for.

Once you get access to loans or lines of credit, how you handle those loans determine your credit score.

When people think about loans, they usually don’t consider the many different types of loans out there.

Your credit score differentiates between different types of loans, especially revolving credit and installment loans.

Installment Loan

Installment loans are what people tend to think about when they think about loans. You receive a sum of money at the start of the loan and then pay it back in installments over the loan’s term.

Personal loans, mortgages, and car loans are all types of installment loans.

The benefit of an installment loan is that they are usually much larger than a revolving line of credit is.

Mortgages, in particular, can allow you to borrow hundreds of thousands of dollars because the debt is secured by the value of the home you’ve purchased.

When you take out an installment loan of any type, you’ll determine the amount of the loan and the term of the loan. You’ll also decide whether the interest rate of the loan is fixed or variable, and what the starting rate will be.

Assuming you wind up with a fixed-rate loan, you can calculate the exact cost of the loan before you receive the money. You can also calculate the monthly payments you’ll have to make.

For example, if you borrow $10,000 at 4% interest, with a repayment term of 4 years, you’ll pay $226 each month for the next 48 months.

Over the course of the loan, you’ll pay $10,837.95, of which $837.95 is interest.

Installment loans are great for people who need a large lump sum of money, and who want to know exactly what the loan will cost them up front.

Where installment loans fall short is if you need small amounts of cash at irregular intervals. Each time you need more money you’ll need to apply for a new loan.

Applying for loans can incur fees and each new inquiry on your credit report will drop your credit score. If you need access to credit on a regular basis, you should look into a revolving line of credit.

Revolving Credit

A revolving line of credit is a type of loan where you can borrow money as you need it.

Two common forms of revolving credit are the credit card and the home equity line of credit (HELOC).

With a revolving line of credit, you leave the balance at $0 until you need to use it. When you decide that you need extra cash, you can tap the line of credit.

For example, you access a credit card’s line of revolving credit by using it to make a purchase at a store.

When you use a revolving line of credit, you’ll receive a bill at the end of the month. The bill will tell you how much you owe and list a minimum payment amount.

You must make at least the minimum payment, but can pay off as much or as little as you’d like so long as you meet that requirement.

You’ll continue to receive bills until you pay the balance of the loan down to $0.

Revolving lines of credit usually have a form of credit limit. This is the maximum amount of credit that the lender is willing to give you. Even if you do not pay your balance off in full in a single month, you can continue to borrow more money until you reach this limit.

Once you reach the limit, you must pay the balance down before you can borrow more.

Revolving lines of credit often have some form of maintenance fee to keep them open, so you need to keep that in mind when deciding whether it’s worth keeping one open.

Many credit cards do not carry an annual fee, so they are a good way to keep access to credit for cheap.

Revolving lines of credit also tend to have variable interest rates. The interest rate that you pay is usually pegged to a common market rate, such as the London Interbank Offered Rate (LIBOR).

As that market rate moves, so does the interest rate on your line of credit. The changing rate, combined with the constantly changing balance of your loan can result in different minimum payments from month to month.

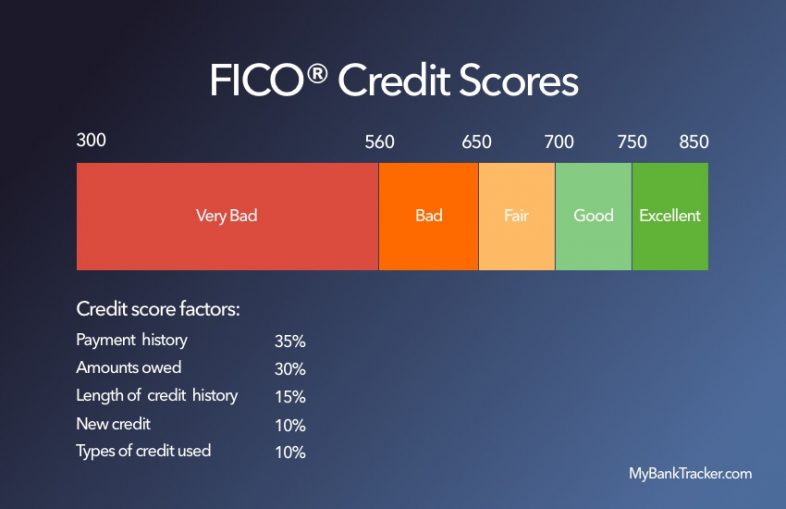

How Your Credit Score is Calculated

Your credit score is a numerical representation of your trustworthiness when it comes to borrowing money.

If you have good credit, lenders will see lending money to you as a low-risk venture.

If you have poor credit, lenders will think it is risky to lend to you.

Your payment history is the biggest factor in calculating your credit score. As you make on-time payments, your score will increase. Having even one late or missed payment can severely impact your score.

The amount you owe has the next largest impact on your score. This includes both the total amount you owe and the ratio of how much you owe to the total credit available to you.

The types of credit used has relatively a small effect on your credit score, but is relevant to the topics discussed in this article.

Lenders want to see that you can handle different types of loans.

This part of your score looks at your experience with credit cards, mortgages, auto loans, student loans, and other types of installment debt.

The more different types of debt you’ve had the better it is for your score.

How Revolving Credit and Installment Loans Impact Your Credit Score

Revolving credit and installment loans both impact your credit, but do so differently.

Credit Utilization

Your credit utilization has a significant effect on your credit score. It makes up a portion of the amount owed piece of your credit score.

Your credit utilization is the ratio of the amount that you owe divided by the full amount of credit available to you.

So, if you have a total credit card balance of $1,000 and a credit limit of $10,000 across all your card, your utilization ratio is 10%.

With installment debt, your credit utilization is calculated by dividing your current balance by the original balance of the loan.

As you pay the loan off, your credit utilization for the installment loan will go down. This will cause your score to go up.

Usually, your revolving credit lines have a larger impact on your credit score. Lenders tend to see installment loan debt as more secure than credit card debt.

Even if you have a large balance of installment debt with a huge utilization ratio, it’s easy to explain away by saying you just got a new loan for a home, car, or another asset. Having a high credit card utilization ratio is harder to justify.

The lower that you can keep your utilization ratio, the better, but 30% tends to be a magic number.

As a rule of thumb, keeping your credit card utilization below 30% will help you avoid significant effects on your credit.

A higher utilization ratio can be a red flag for lenders.

Also, remember that lenders look at the utilization ratio of individual cards. Even if your overall utilization ratio is good, having one card maxed out doesn’t look good to lenders.

Revolving Debt Makes It Easier to Build Up a Balance

One danger of revolving debt is that it is very easy to build up a balance without thinking about it.

Allowing yourself to build up that balance can have a significant effect on your credit score. If you do it with credit cards, it can also be very costly.

Studies have indicated that consumers spend an average of 12-18% more when they use a credit card than when they pay with cash.

If you wind up spending more than you can pay off at the end of the month, you’ll have to start carrying a balance.

This will increase your credit utilization ratio. If you let the ratio get too high, it could drop your credit score.

If you have to apply for a new loan while your score is reduced by your credit card debt, you might wind up with worse terms than you could have gotten.

The seemingly short-term effects of building up a small credit card balance could have long-term implications if it boosts the interest rate of your car or home loan.

Conclusion

Revolving credit and installment loans are very different types of debt, but both impact your credit score.

Knowing how they affect your credit can help you use both effectively.

.