How to Raise Your Credit Score Above 700

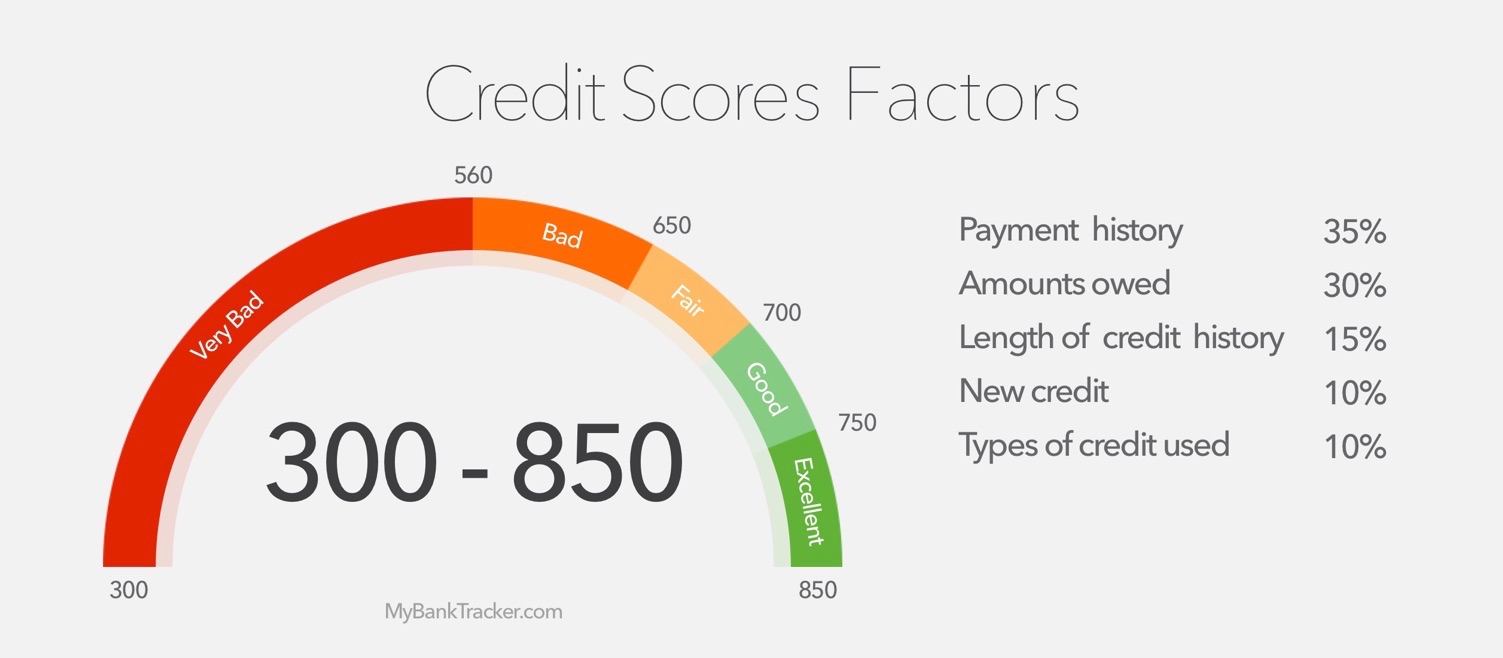

In the world of credit scores, the 700 is an important number. FICO provides score ranges to help consumers and lenders see where their credit score falls.

- Less than 560 – Very Bad

- 560 – 650 – Bad

- 650 – 700 Fair

- 700 – 750 Good

- Above 750 – Excellent

Having a score above 700 will give you access to low rates on loans, the best credit cards, and all but the best deals from even the stingiest of lenders. It also means that your credit score is higher than nearly half of Americans.

People often ask, “How can I raise my credit score?” The reality is that getting your credit score above 700 can be difficult, but if you know the factors that affect your credit score, as well as how to maximize the traits that improve your score, you can raise your credit score fast.

These factors are credit mix, the amount owed, payment history, length of credit history, and recent applications.

Also read: How to Improve Your Credit Score by 100 Points Fast

1. Have a Good Payment History: 35%

Your payment history is the most important aspect of your credit score. It is the easiest to use in your favor, but also the most difficult to repair if it begins dragging your score down.

Lenders are primarily concerned with whether they will get their money back from the people they lend it to.

Having a track record of making payments on time is the best way to boost their confidence in you. It isn’t fast or glamorous, but paying your loans over the course of a couple of years has a massive impact on raising your credit score.

If you miss a payment, how much you miss it by can affect the ding it puts in your credit score. The good news is that many lenders will work with you if you have a history of on-time payments and will forgive the first offense.

If you ever miss a payment or send one in late, contact the lender, explain the situation, and ask if they can work with you to avoid the black mark on your credit report.

2. Reduce the Amount You Owe: 30%

The amount of money you owe is the second largest factor in determining your credit score and changing it is one of the best ways to raise your credit score quickly.

This factor of your score is split into a few subcategories; the main three are your total debt, the number of credit cards with a balance, and your credit utilization.

The total debt category is exactly what it sounds like: how much money you are currently borrowing. The less money you are borrowing, the higher your score, because lenders want to feel confident that you can afford to pay them back.

Similarly, the fewer credit cards you have that have a balance, the better.

Reducing Your Current Credit Utilization

Credit utilization is the ratio of your credit card debt to your total credit limits. The lower this ratio is, the more credit you have available and the better your credit score will be.

The thing that makes your credit utilization a useful way to raise your credit score quickly is that it is reported on a monthly basis and that your utilization from previous months does not factor into your current score.

For example, your total credit limit across all your cards is $8,000 and you put a big $5,000 purchase on a card one month. A lender looking at your utilization will see that you’re using 62.5% of your total available credit, which is a bad sign.

If you pay it off when the bill arrives, and apply for a loan at the end of the next month, the lender will see a credit utilization of 0%, which makes you a much more attractive borrower.

This means that if you put a lot on your credit card one month and that card reports the balance to FICO, your score could drop by a number of points.

If you pay it in full when the bill is due, and don’t use the credit card at all the next month, FICO will see that your utilization is now 0, and your score will get a nice boost.

You can use this if your score is on the cusp of getting you a better deal on a big loan, such as a mortgage.

Avoid putting a balance on your credit cards in the month or two leading up to the application, that way your utilization will be as low as possible when you apply. This will give your score the biggest boost possible.

If you can reduce your credit utilization, keep your balance on one card, and pay down your debt, you can improve your credit score by as much as 100 points, making this one of the fastest ways to improve your credit score.

3. Increase the Length of Your Credit History: 15%

This aspect of your credit score is broken down into two subcategories: the actual length of your credit history, and the average age of your credit accounts and loans.

The longer you have had credit accounts, the more information that FICO has on your credit habits. This gives a small boost to your credit score because it shows that you have a lot of experience with handling debts and bills.

A short credit history will not harm you, but you won’t score many points in this category.

Improving the Average Age of Your Accounts

The part of this category that you can easily use when raising your credit score is the average age of your accounts.

Lenders tend to see people applying for loans or credit cards as a risk factor since it implies that they need financial help. Banks and credit card issuers also like loyal customers because they can make more money out of the relationship.

Put simply, this part of your credit score is simply the length of time each of your loan and credit card accounts has been open, divided by the number of loans and credit cards you have. The higher the average age, the higher your score will be.

You can score the most points in this category by avoiding applying for new loans or credit cards unless you need them, as each new account will reduce your average age of accounts.

This advice also applies to the last factor that influences your credit score.

4. Avoid New Credit Applications: 10 %

As mentioned above, applying for new loans in considered a risk factor because it implies that you need the additional cash.

Every time you apply for a new loan it appears that fact appears on your report and stays there for two years.

The effect that new applications have on your credit score reduces quickly over time and is almost fully eliminated after one year.

If you are planning on taking out a big loan, you can plan on raising your credit score by avoiding applying for other loans in the one or two years leading up to the purchase.

One tip that won’t raise your score, but will reduce the negative effect of applying for loans is to shop around for loans in a short period of time.

FICO understands that car and home buyers may want to work with multiple banks and provide a one month grace period.

No matter how many lenders check your credit for mortgage or car loans, as long as each check occurs in a 30 day period, it will appear as one application on your credit report. This means you can shop around without fear of hurting your score every time you talk to a new bank.

5. Improve Your Credit Mix: 10%

Your credit mix has a small effect on your overall credit score but it is one of the easiest to change to improve your score. Lenders like to see that you are a savvy consumer and capable of handling different types of loans with different terms and requirements.

The different types of credit that the Fair Isaac Corporation (FICO) track are credit cards, retail accounts, installment loans, finance company accounts, and mortgages.

The more different types of credit you have, the better it is for your score. This means that having a car loan, a credit card, and a mortgage is better for your score than simply having three credit cards.

If you have ever asked “how can I raise my credit score fast?” improving your credit mix is one strategy.

You can take advantage of this by financing large purchases at stores, taking out a loan when you buy a car, or consolidating credit debt with a personal loan. Your score will improve with each new type of loan you open.

Avoid Paying Interest to Improve Your Credit Score

One thing that is important to note is that you should never feel the need to pay interest to improve your credit score.

One of the benefits of a high credit score is saving money on interest payments, so paying unnecessary interest to achieve a high score is self-defeating.

The good news is that just opening the account will be enough to get a bump in your score, so long as the lender reports the loan to FICO.

If you have the money to make a purchase in full, you can finance it to get the new type of loan listed in your credit history, then pay it in full once the loan has appeared on your credit report. This lets you avoid interest while reaping the benefits of an improved score.

How a Good Credit Score Can Help You

The impact of a good credit score cannot be overstated.

The cards that become available to consumers with good credit scores are cheaper and have far better rewards.

If you like to carry multiple cards, a good credit score can put a lot of extra cash in your pocket.

How Your Credit Score Can Affect Your Future Mortgage Rate

| Credit Score Range | 30-Year Fixed Rate Mortgage | 5-year fixed rate mortgage | 7/1 ARM |

|---|---|---|---|

| 620-639 | 4.684% | 4.016% | 4.506% |

| 640-679 | 4.138% | 3.47826% | 3.96% |

| 660-679 | 3.708% | 3.04% | 3.53% |

| 680-699 | 3.494% | 2.826% | 3.316% |

| 700-759 | 3.317% | 2.649% | 3.139% |

| 760-850 | 3.095% | 2.427% | 2.917% |

How Your Credit Score Can Affect Your Next Car Loan

| Credit Score Range | 60-Month new Car Loan | 40-Month Used Car Loan |

|---|---|---|

| 500-589 | 14.824% | 16.325% |

| 590-619 | 13.74% | 15.086% |

| 620-659 | 9.398% | 10.186% |

| 660-689 | 6.747% | 7.599% |

| 690-719 | 4.656% | 5.322% |

| 720-850 | 3.331% | 3.778% |

How Your Credit Score Can Affect Your Next General Loan

| Credit Score Range | HELOC | Home Equity Loan |

|---|---|---|

| 620-639 | 10.680% | 10.164% |

| 640-669 | 9.180% | 8.914% |

| 670-699 | 7.680% | 7.414% |

| 700-719 | 6.305% | 6.639% |

| 720-739 | 5.055% | 6.139% |

| 740-850 | 4.680% | 5.837% |