Prosper Personal Loans 2026 Review

Personal loans are a useful financial tool that can be helpful in a variety of situations.

You can take out a personal loan for almost any reason, including home improvement, debt consolidation, or financing another purchase.

With the rise of online banks, online lenders have also appeared. One such online lender is Prosper.

The Prosper lender specializes in providing personal loans to customers over the web.

If you are looking for a personal loan, this article will tell you all you need to know about Prosper’s options.

How Much Can You Borrow?

One of the first things that you should look at when applying for a loan is the amount that the lender is willing to offer.

If you need a small loan, there’s no point in applying for one from a lender that specializes in large loans.

Similarly, you shouldn’t apply for a loan that won’t be big enough to meet your needs.

Prosper Personal Loans Pros & Cons

- Interest paid (partially) goes to investors

- No prepayment penalty

- Check your rate in minutes with no impact to credit score

- Funds disbursed in as little as one day

- Requires excellent credit and high income for lowest rates

- Origination fee applies

Prosper aims to serve as many customers as possible, so it offers a wide range of loan amounts.

You can borrow as little as $2,000 or as much as $35,000. Whatever your needs are, Prosper tries to help you cover the cost.

How Long Do You Have to Pay?

Another important factor of a personal loan is the loan’s term, how long you have to pay.

A longer-term means that you pay less each month, which can make it easier to manage a large expense. This comes with a downside, however.

Longer-term loans tend to charge higher interest rates, increasing the cost of the loan. Plus, you’ll be taking longer to pay the loan, so interest has more time to accrue.

By contrast, shorter-term loans charge lower rates and will result in less interest accruing since the loan will be paid off sooner.

Prosper offers two choices for the loan term, three years, or five years.

You should try to strike a balance between the term you choose and the amount you borrow to get a monthly payment that you can manage.

One option would be to choose the longer term but to pay extra when possible. The lower minimum payment gives you flexibility if money is tight, but paying extra reduces the effect of the higher interest rate.

Is There a Minimum Income or Credit Requirement?

Prosper has a few requirements for people who are looking to borrow money. You must meet all of the following requirements to be eligible:

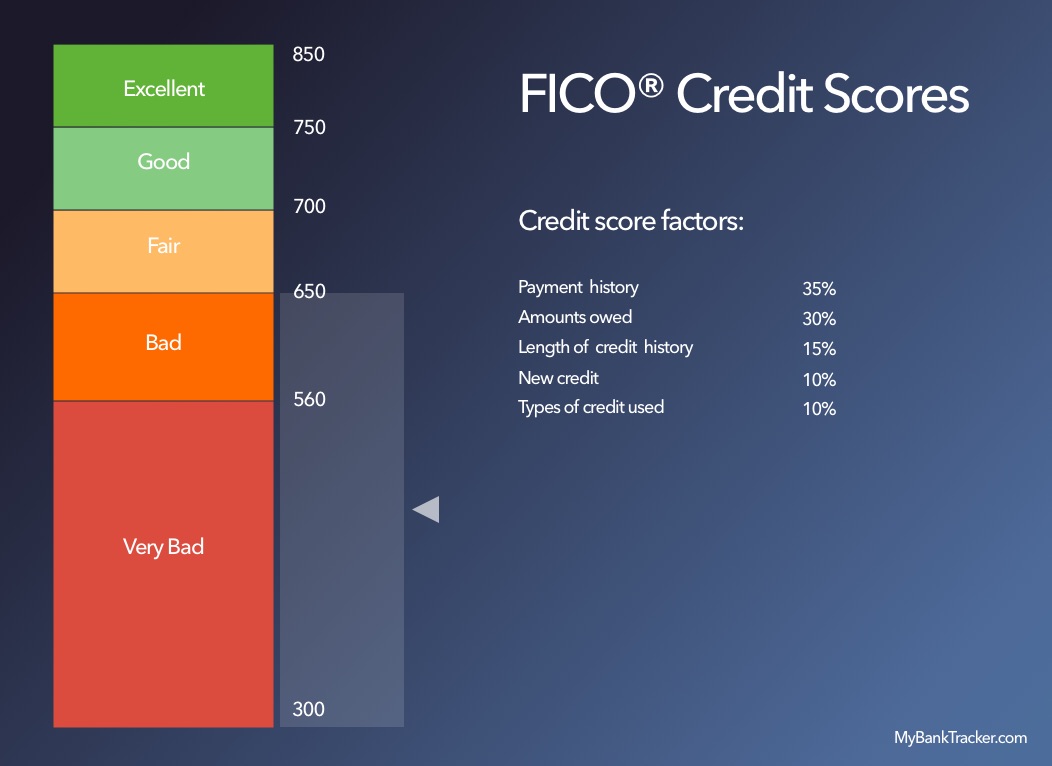

- Have a FICO credit score of 640 or better

- Have a debt-to-income ratio below 50%

- Have a stated annual income greater than $0

- Have not filed bankruptcy in the previous twelve months

- Have fewer than seven credit inquiries on your report in the past six months

- Have at least three open loans on your credit report

If you’ve borrowed money from Prosper before, you must also meet two additional conditions:

- Have not had a Prosper loan charged off

- Have not been declined for a Prosper loan in the last four months due to delinquency or returned payments on a Prosper loan

If you meet all of those requirements, you’ll be able to get a loan from Prosper. Your interest rate will vary depending on a variety of factors, such as your credit score and debt-to-income ratio.

How Long Does It Take to Get the Money?

If you find yourself in a situation where you need a personal loan, you might find that you need the money fast.

If you need to pay for a car repair to make it to a wedding or have some other time-sensitive situation, a loan that takes a week to pay out isn’t much help.

Applying for a loan through Prosper is easy, the process takes about ten minutes assuming you have the required documentation.

Once you’ve applied for the loan, it does take some time to get the money.

Prosper is a peer-to-peer lending site, so investors will need to fund your loan. Depending on how long that takes, it can take a few days to a week to receive the cash.

Are There Any Fees?

Many personal loans charge fees to borrowers, letting the lender earn some return on its investment right away.

Prosper does charge some fees.

One fee that is charged is an origination fee. This fee is a percentage of the amount that you borrow and it is deducted directly from that amount before it is deposited in your account. The fee ranges from 1% to 5% depending on your credit.

This example illustrates the effect of the origination fee. You’ve applied for a $10,000 loan and have to pay a 5% origination fee.

When the money arrives in your account, you’ll receive a total of $9,500. $500 is the origination fee for the loan.

When you receive your first bill, it will be for the full $10,000, plus any accrued interest.

If you pay your monthly bill by check, you’ll also pay a $5 or 5% (whichever is less) check fee per payment.

Finally, late payments incur the greater of $15 or 5% of the unpaid amount.

Get Your Loan from Regular People

One thing that makes Prosper unique is that it isn’t a traditional lender. Instead, Prosper is a peer-to-peer lending site.

When you apply for a loan, Prosper doesn’t make a decision on your application and then send the cash to you.

Instead, Prosper will post the (anonymized) details of your application for other people to look at. These people can then decide whether or not they want to invest in your loan.

If you borrow $10,000, you might actually be borrowing $100 from 100 different people.

Each time you make a payment, Prosper will split that money among the people who helped fund your loan.

Your payments help the people who invested in your loan earn money. Prosper helps connect people who want to help other people by offering loans.

How to Get Approved for a Prosper Personal Loan

Once you’ve decided that you need a personal loan, you’ll have to figure out how to get approved for one.

The first step in getting a personal loan is to apply for one. When you do apply, you’ll have to provide some information to the lender, including:

- Name

- Address

- Date of birth

- Proof of identity, such as a driver’s license

- Social Security number

- Annual income

- Proof of income, such as bank statements or pay stubs

- Verification of employment

Though gathering all of that information may sound difficult, it’s important to do.

Preparing a good application and providing all the requested materials can really help improve your chances of getting the loan.

Once you’ve applied, the lender will analyze your application and decide whether to offer a loan. To make your application more attractive, you should focus on three things:

Credit Score

Your credit score is a numerical representation of how well you’ve handled loans in the past. The better you’ve handled loans, the higher the score. The higher the score, the more likely someone is to lend to you.

Though the best way to improve your score is to make on-time payments over the course of years, there are some short-term methods.

One is to avoid applying for new loans. Lots of credit inquiries will reduce your score.

Another is to reduce your credit utilization, Pay off your credit card balances and reduce the balance of your other outstanding loans.

The less you already owe, the easier it will be for you to make payments on a new loan.

Debt-to-Income Ratio

Your debt-to-income ratio is the ratio of the amount you owe to the amount you make each year. The less you owe and the more you make, the better.

Lenders care about this because they want to feel confident that you’ll be able to handle payments on a new loan. If most of your income is already tied up with making minimum payments on other loans, how can you handle a new one?

Improve this ratio by increasing your income or reducing your debts.

Reason for the Loan

Why you’re applying for a loan is important, especially on a peer-to-peer lending service like Prosper.

Make sure you’re applying for the right reason. Lenders are more likely to fund loans for financially responsible reasons like loan consolidation.

Funding a luxury vacation is harder for lenders to justify.

How Does It Compare?

Prosper isn’t the only personal loan provider out there. You should shop around. When you do, there are a few things to compare.

One is the interest rates. Lower rates are better for you since it means your loan will cost less. It also means lower monthly payments.

Another is the loan terms available. Some lenders have only one term length while others let you choose the one that works best for you. Try to find a term that results in a manageable payment without causing you to pay too much in interest.

Finally, read the fine print and look for fees. Try to choose the loan that charges the fewest fees to make sure you get the best deal possible.

Conclusion

Prosper

is a great choice of personal loan provider for someone who wants to get a loan and doesn’t want the profits to go entirely to banks. One gripe that we have with Prosper loans would be the time that it could take for the funds to get to you.

If you need a personal loan immediately, Prosper won’t be able to help you.

Otherwise, its and peer-to-peer setup and flexible loan amounts all give it a leg-up on the competition.