The Best Personal Loans in Wyoming for 2024

If you need to borrow money but don’t have home equity to put up for collateral, an unsecured loan is likely your best bet.

One of the more popular secured loans is a personal loan. These flexible loans can generally be used for any purpose.

Each lender sets its loan program rules. Some focus on maximizing profit on each loan. Others focus on being competitive and closing more loans to earn more money.

To help you save time weeding out the bad lenders, we’ve evaluated personal loan lenders in Wyoming and come up with our top picks. These lenders may be able to save you both time and money.

Here’s what you should know.

The Best Personal Loans in Wyoming

Below are our favorite personal loan lenders in Wyoming, in no particular order:

- Wells Fargo

- U.S. Bank

- First Interstate Bank

Wells Fargo

Wells Fargo’s extremely flexible personal loans offer loan amounts from $3,000 to $100,000 for one to seven years, if you qualify. They offer fixed rates that appear competitive.

The lender doesn’t charge origination fees, closing fees, or prepayment penalties. In most cases, a same-day credit decision can be made on your application.

U.S. Bank

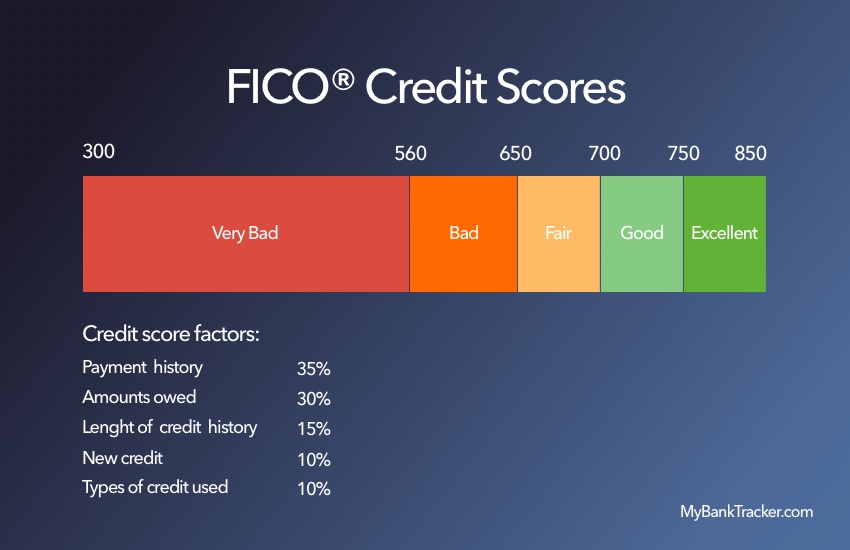

Personal loans at U.S. Bank are available for customers with a FICO Score of 660 or above. If they qualify, bank customers can borrow $1,000 to $50,000 for one to seven years. Non-customers are limited to $25,000 and five-year loans.

U.S. Bank doesn’t charge origination fees or prepayment penalties. Funds can be disbursed as fast as hours after approval. Their interest rates look competitive, as well.

First Interstate Bank

First Interstate Bank offers personal loans for many potential reasons. Sometimes, a debt consolidation personal loan may be the only option.

Personal loan lengths range from one to five years. The rates charged seem to be competitive with other lenders. However, you do have to pay a $200 origination fee with these loans.

How we picked these personal loans

We first found the top 50 banks (by deposit market share) in Wyoming according to the FDIC’s data from June 2021–serving consumers in major cities including Milwaukee, Madison, Green Bay, Kenosha, and Racine.

We looked at each of these bank’s personal loan options and made our choices based on these criteria:

- Interest rate ranges

- Loan length options

- Potential amount lenders loan out

- Loan fees

Are Online Personal Loans Better?

Online lenders also offer personal loans. But are online personal loans a lower-cost option like most other online products and services? Or are loans from physical lenders better? It depends.

Online lenders have several advantages. They’ve built their companies to use technology to complete the application and funding process digitally. Additionally, they don’t have to pay for branches like brick-and-mortar banks do.

Quicker loan process

These advantages allow digital lenders to have fast timelines and sometimes offer lower costs than some physical lenders.

Physical lenders aren’t eliminated from contention, though. They have also improved processes to offer fast loan processing and funding timelines. Many can even provide competitive rates and terms.

The best online lenders may offer better terms and processes in some cases, but each lender evaluates a loan application in their own way. For this reason, you must shop around at both online and physical lenders to find the best loan for you.

Set Your Loan Priorities Before You Shop

Personal loan lenders each appeal to different customers. Some banks focus on low-cost loans, while others focus on fast funding. The best options offer the best of both worlds.

The best loan for you may not be the loan you’d expect. While a neighbor may swear by a particular lender, they may not meet your specific needs.

Here are some loan characteristics you may want to consider when setting your priorities for your next personal loan.

Amount you can borrow

Each bank has a set range of loan amounts a customer could potentially borrow if qualified. Most banks tend to fall in the range of roughly $5,000 to $30,000.

Some lenders may offer smaller loan amounts or larger loan amounts. These lenders aren’t as common, so you may have to look harder to find them.

Interest rates

The interest rate on your loan is often the most significant factor in your loan’s cost. Most people will shop for the lowest overall cost loan, but it isn’t always the top priority.

Even if the interest rate isn’t your top priority, you should still shop around for a good rate after meeting your other goals.

Fees you must pay

The best personal loans don’t have as many fees as they used to. Application fees, origination fees, and prepayment penalties no longer exist on the best loans.

You should still watch out for these fees, though.

In particular, an origination fee can add a hefty cost. If you have to pay a 1.5% origination fee on a $30,000 loan, that’s an additional $450.

Speed of funding

Funding speed can be vital if you need to make a loan payment quickly. The fastest lenders can get you funds the same business day your loan is approved. Others may take longer, such as days, a week, or longer.

Loan length options

Most lenders offer loans around three to five years long. You may find shorter and longer loan terms, but they aren’t as widely available.

Discounts

Always ask a lender if they offer any interest rate discounts and if you qualify. Your lender may offer an interest rate discount if you sign up for automatic payments. A lender you had a relationship with before applying for a loan may offer another interest rate discount.

What to Expect to Provide When Applying for a Personal Loan

Personal loan applications ask for a relatively standardized set of information. This includes:

- Identification proof (Driver’s license, passport, etc.)

- Address verification documents (Utility bill, mortgage statement, etc.)

- Social Security Number

- Income and employment proof (W-2, 1099s, tax returns, etc.)

- Highest level of education you achieved

- Reason for borrowing money

- Amount you want to borrow

- Length of time you want the loan to last

Improve Your Application’s Chances Before Applying

Lenders evaluate your application to determine whether to approve or deny your loan. It makes sense to put forward the best application possible to have the best chance of getting approved. Even so, nothing can guarantee your loan will get approved.

Lenders look at two key numbers you have a chance to influence before applying. These are your debt-to-income ratio and your credit score.

Lower debt-to-income ratio

Your debt-to-income ratio divides your monthly debt payments by your monthly income. It’s an indicator that lenders use to see if you can afford to pay back the loan you are requesting. The lower this ratio is, the better.

You can lower the ratio by lowering your debt payments or increasing your income. Lowering debt payments only works if your debt payment is eliminated or reduced.

Paying down a car loan won’t help unless you pay it off in full. Paying down a credit card could help if it lowers your payment amount.

Increasing your income also lowers your ratio. The income must be documented, so not all extra income helps. Working more at work, getting a raise, or a higher-paying job could be ways to increase your income.

Higher credit score

Your credit score is another major factor lenders use. This helps them determine the likelihood you’ll repay the loan as agreed.

Your credit score is calculated based on the information in your credit reports. You can get a free copy of these reports from AnnualCreditReport.com to verify no incorrect negative information is included. If it is, dispute it.

Credit scoring formulas often consider your credit utilization ratio, which you can influence. It measures your credit used against your credit limits.

In general, a lower ratio is better. You may be able to improve your score if you can pay a maxed-out credit card down to a lower utilization ratio, such as 30%.

Decide on Your Ideal Lender

Once you know what you’re looking for in a personal loan, consider our list of the top personal loan lenders in Wyoming. Then, compare your top pick to online lenders and other lenders from which you may want to get quotes.

Shopping around for the best terms may require multiple preapproval checks or applications. The effort may be worth it, as each lender may offer you different terms.

Frequently Asked Questions

How long does it take to get approved for a personal loan?

Technology has sped up the application process. Many lenders offer decisions in seconds or minutes if additional information or a human review isn’t required.

Other lenders may use manual processes. This could take days, a week, or longer.

How long does it take to receive funds from a personal loan?

The time for funding may vary from institution to institution. The fastest lenders can often get you funding the same business day you’re approved. Slower lenders may take days, a week, or longer.

Can I use a personal loan for any reason?

Most personal loans don’t require using the money for a particular purpose. Exceptions, such as many debt consolidation personal loans, exist. In this instance, a lender may require you to have loan proceeds sent directly to the old loan you’re paying off.

Will applying for a personal loan affect my credit score?

A personal loan application results in a hard inquiry on your credit report. In most cases, this will likely temporarily lower your credit score by a small amount.

A preapproval rate check may not impact your score if the lender uses a soft inquiry. These inquiries do not affect your credit score.