Best Personal Loans to Pay for a Wedding

Personal loans are popular and flexible financial tools. You can apply for a personal loan for nearly any purpose, including to fund a wedding.

It’s no wonder that people want to take out a loan to help pay for their wedding. Weddings can be incredibly expensive and most people don’t want to hold off until they can afford to pay for the wedding.

While taking out a loan means you’ll pay more for the wedding in the end, a personal loan is the best type of loan to use for a wedding.

Best Personal Loans for a Wedding

- Lightstream

- Sofi

- Wells Fargo

- Lending Club

- Bestegg

- Upgrade

Though you can get a personal loan from nearly any lender and use it to fund your wedding, there are a few lenders whose loans are well suited for paying wedding expenses.

SoFi

SoFi is an online lender that offers highly flexible personal loans at a low cost.

You can borrow as little as $5,000 or as much as $100,000, making it easy to borrow the right amount for your needs.

As a bonus, SoFi doesn’t charge any origination fees, early payment fees, or other hidden fees.

SoFi Personal Loans Pros & Cons

| Pros | Cons |

|---|---|

|

|

Wells Fargo

Wells Fargo’s personal loans offer high limits and flexible repayment terms. You can borrow as little as $3,000 or as much as $100,000, and get your money deposited by the next business day. You can choose a term as short as 12 months or as long as 60 months, so it’s easy to customize your monthly payment.

You can borrow as little as $3,000 or as much as $100,000, and get your money deposited by the next business day. You can choose a term as short as 12 months or as long as 60 months, so it’s easy to customize your monthly payment.

If you’re already a Wells Fargo customer, you can get a discount by signing up for automatic payments from your checking account. Wells Fargo also won’t charge you any origination fees or prepayment fees.

Wells Fargo Personal Loans Pros & Cons

| Pros | Cons |

|---|---|

|

|

Lending Club

Lending Club is an online peer-to-peer lending website that offers personal loans.

Because Lending Club is a peer-to-peer site, you aren’t borrowing money directly from Lending Club. Instead, Lending Club will post anonymized details of your loan for other people to view.

These people can invest in your loan, offering to fund a portion of it as small as $25. When you pay the loan back, your payment is split between everyone who helped fund your loan.

One big benefit of a Lending Club loan is that even people with poor credit can get a loan through Lending Club. You’ll have to pay a lot of interest, but if you really need to loan to fund your wedding, you can get one.

Lending Club Personal Loans Pros & Cons

| Pros | Cons |

|---|---|

|

|

What to Look for in a Personal Loan for Wedding Spending

When you’re looking for a personal loan to pay for your wedding, you’ll be looking for the same things that you’re looking for in any loan.

You want to find a loan that is large enough to meet your needs and has a term that results in a monthly payment that you can handle. There’s no point in borrowing money unless it’s sufficient to meet your need.

After that, you need to compare the lenders that offer loans of sufficient size. You’re looking for loans with low interest rates, low fees, and special features that are useful to you. The interest rate and fees on your loan directly impact the cost, and the less you pay, the better.

Many lenders offer special features, like SoFi’s option to pause payments if you lose your job. Once you’ve compared interest rates and fees, these features can help you choose the best loan.

A great way to pick the right loan, amount, and term for your wedding purchase, is by using our personal loan calculator to help you figure out your possible monthly payments and interest:

Estimated Interest Personal Loan Calculator

How is the Interest Rate Determined?

When you are approved for a personal loan, the lender will inform you of the interest rate that you will pay. The interest rate can be seen as the cost you pay for the privilege of borrowing money.

Lenders use the interest rate as a way to offset their risk in lending. If they see you as a high risk, they will charge a higher rate to compensate for the potential that you won’t pay the loan. If you are a low risk, you’ll be charged a lower rate.

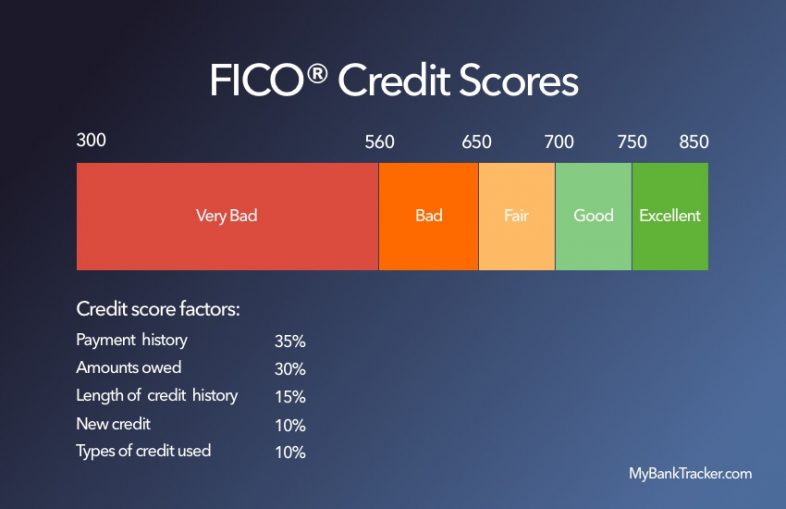

Lenders determine how risky a borrower you are using a number of factors. One of the most common and most important is your credit score. If you have good credit, you’ll be offered a low rate. Poor credit will result in a higher rate.

Personal loans can have fixed interest rates or variable interest rates.

With a fixed rate loan, you’ll know exactly how much you’ll pay each month for the life of the loan and the rate will not change.

With a variable rate loan, the interest rate will fluctuate with the market. This can result in your monthly payments dropping if rates go down. If rates rise, you could wind up paying a lot more each month.

Fixed-Rate vs. Variable-Rate Personal Loans

| Fixed | Variable |

|---|---|

|

|

Fees to Watch Out For

Personal loans can come with their fair share of fees — though most are avoidable.

Common Personal Loan Fees

| Type of fee | Typical cost |

|---|---|

| Application fee | $25 to $50 |

| Origination fee | 1% to 6% of the loan amount |

| Prepayment penalty | 2% to 5% of the loan amount |

| Late payment fee | $25 to $50 or 3% to 5% of monthly payment |

| Returned check fee | $20 to $50 |

| Payment protection insurance | 1% of the loan amount |

There are two very common personal loan fees that you should keep in mind.

Look out for origination fees

Origination fees are charged as a percentage of the amount you borrow. So, if you borrow $10,000 and pay an origination fee of 4%, your first bill will show a balance of $10,400, plus accrued interest. Origination fees are only charged when you first take out your loan as a way to, yet again, pay the bank a little more.

Prepayment penalties may be charged

While paying your loan back early would normally be a good thing, the bank loses money if you pay a loan off ahead of schedule. By paying the loan off early, you’re avoiding interest charges, reducing the lender’s profit on the loan. Prepayment penalties compensate lenders for the lost interest.

Why a Personal Loan is Better Than Using a Credit Card

There are a number of reasons you should consider a personal loan instead of using a credit card to pay for your wedding.

Lower rates

Credit cards can charge often extortionate interest rates. By comparison, personal loans offer much more reasonable interest rates, sometimes less than 7%, while credit cards can charge as much as 25% or more.

Such a huge difference in interest rate can result in big savings over the life of a loan.

Forced to stick to the budget

If you take out a personal loan for your wedding, you receive a specific amount of cash. You can’t spend money you don’t have, so you’re forced to stick to a maximum budget equal to the amount of your loan.

If you use a credit card, your only limit is your credit limit, making it much easier to overspend.

Longer repayment terms

Personal loans can offer longer repayment periods than credit cards can, while costing less overall.

This means that you can borrow more, but pay less each month, paying the loan down at your speed rather than the speed dictated by a credit card issuer.

How to Increase Your Chances of Approval

If you’ve decided to apply for a personal loan to pay for your wedding, these tips can help you get approved.

Improve your credit score

The biggest factor in your application’s approval is likely to be your credit score. Your credit score is a numerical representation of your financial trustworthiness in the eyes of lenders.

Your payment history has the largest effect on your score, followed by the amount you owe. Unfortunately, your payment history takes a long time to build up.

The best thing to do in the short term is to reduce the amount you owe. You can do this by not using your credit cards and by making extra payments on existing debts.

Find a flexible lender

Though all lenders will look at your credit score when making a lending decision, some lenders look at more.

These lenders advertise that they look at more than just your credit, so they shouldn’t be hard to find.

Factors such as your employment history, education, and recent efforts to improve your credit can come into play with these lenders, improving your chances.

Autopay for a rate discount

One feature that is common to many personal loans is that signing up for auto pay can get you an interest rate discount.

This is especially common for loans from banks that also offering checking accounts.

Sign up for automatic payments from your checking account at that bank and you can often get .25% or more off your interest rate.

Conclusion

Weddings are expensive.

Though you should do your best to save for your wedding, or scale it down to fit your budget, if you need to borrow money to pay for it, a personal loan can help you.