The Best Personal Loans in Utah for 2024

Borrowing money can feel overwhelming. You want to ensure you get the best deal, but you have many options to choose from.

First, you must figure out what type of loan will best fit your needs. An unsecured personal loan may work well if you don’t have any collateral to get a secured loan with a lower interest rate.

Some personal loan lenders offer low rates and low fees to try to close as many loans as possible. Others charge higher rates and fees to make more money off each loan they close.

Finding the best lenders takes time. To help you save time, we’ve come up with a list of the top personal loan lenders in Utah worth considering. Here’s what you should know.

The Best Personal Loans in Utah

Our favorite personal loan lenders in Utah are in no particular order:

- Wells Fargo

- U.S. Bank

- Zions Bank

Wells Fargo

The personal loans at Wells Fargo are highly customizable depending on your needs and what you qualify for. Loan amounts can range from $3,000 to $100,000. Loan lengths range from one year to seven years.

The bank doesn’t charge origination fees, closing fees, or prepayment penalties. In many cases, you can get a same-day credit decision. Their rates are also competitive for the industry and you may qualify for a relationship rate discount.

U.S. Bank

U.S. Bank’s personal loans offer different options for customers and non-customers. Customers can borrow from $1,000 to $50,000 for one to seven years. Non-customers are limited to $25,000 and five-year loans.

You don’t have to worry about origination fees or prepayment penalties at this lender. Funds can be provided as soon as the same business day for U.S. Bank customers.

Zions Bank

Zions Bank offers personal loans with competitive interest rates. Loan amounts start as low as $2,500 and have flexible short-term options.

You may qualify for a rate discount if you set up automatic payments through a Zions Bank checking account. Unfortunately, the lender charges a $75 origination fee.

How we picked these personal loans

Using data from the FDIC for June of 2021, we identified the top 50 Utah banks based on deposit market share–available to consumers in major cities including Salt Lake City, West Valley City, Provo, West Jordan, and Orem.

Then, we use the following criteria to identify the top personal loan offers in the state.

- Interest rates

- Loan terms

- Loan amounts

- Fees

Are Online Personal Loans Better?

Most shoppers expect to find better deals online than with brick-and-mortar establishments. It would make sense to expect the same in the personal loan space, but is this the case?

Lower rates and fees

Online lenders don’t have to pay for physical branches. These cost savings may be passed on to borrowers in the form of lower rates or lower fees at competitive lenders.

Not all online lenders are competitive, though. Some try to increase profitability by offering higher rates and fees while hoping you don’t shop around.

Easier applications

The online loan process is streamlined. After applying, most lenders use technology to process your application.

This means:

Approval decisions can be provided in seconds or minutes, assuming additional information or human reviews aren’t required.

Processes to disburse funds often happen quickly with online lenders, too. This streamlined process makes the experience of applying for online personal loans seem attractive.

Brick-and-mortar lenders know this and have worked to improve processes to compete. Many now offer quick approval and disbursement processes, as well.

Physical lenders have some advantages over online lenders, too. They may offer relationship discounts for working with the bank in the past.

They may allow you to meet with a loan officer when applying. You can use this opportunity to provide additional information that could sway approval odds in your favor if they don’t use automated loan processing.

Each lender, both online and physical, offers loans based on their assessment of your risk. This can result in different rates at each lender.

In today’s competitive landscape, you need to rate shop at both online and physical lenders to find the best loan for your situation.

Identifying Your Most Important Personal Loan Characteristics

Usually, the lowest-cost loan is what people are looking for. In certain situations, someone may have other priorities.

Don’t listen to what others say is the best loan blindly. They don’t know your situation. Instead, create a list of what’s most important to you. Here are some major personal loan characteristics you may want to prioritize.

Loan amount

Lenders have a set range they allow people to borrow. Most lenders have a minimum loan amount of around $5,000 and a maximum loan amount of about $30,000. Smaller and larger loans can be found but aren’t as common.

Interest rate

Interest is likely the largest cost of your personal loan. Finding the lowest interest rate loan can help you save the most money if you aren’t sensitive to other factors.

Some situations require other characteristics to take priority, though. Even in these cases, you should still shop for the best rate you can find after meeting those characteristics.

Fees charged

Fees are another factor that can add costs to your loan.

Thankfully, many online lenders do not charge outdated fees like application fees, origination fees, or prepayment penalties.

You should still watch out for these fees.

An origination fee can add a significant cost as it is often a percentage of your loan amount. A 1.5% origination fee can add a $300 cost to a $20,000 loan.

Funding speed

In some cases, how fast you get your proceeds from your loan can make a huge difference. The fastest lenders can get you funds the same business day as approval. Slower lenders may take days, a week, or longer.

Length of the loan

Expect to see most loans last between three and five years. Shorter and longer lengths exist but may be harder to find.

Rate discounts

You may qualify to get a lower interest rate with certain activities. Setting up automatic payments may lower your rate.

If you had a relationship with a bank before applying for a personal loan, you might be eligible for another rate discount.

Documents to Prepare Before Applying for a Personal Loan

To speed up the loan application process, have the following information ready before applying:

- Identification (Driver’s license, passport, etc.)

- Proof of address documentation (Utility bill, mortgage statement, etc.)

- Social Security Number

- Proof of employment and income (W-2, 1099s, tax returns, etc.)

- Highest level of education

- Ideal loan amount

- Ideal loan length

- Reason for the loan

Ways to Try to Help Your Chances of Getting Approved

You apply for a personal loan because you want to get approved. Before you apply, you can work on a few key factors to help your application hopefully have a better shot at approval.

While nothing can guarantee approval, focusing on your credit score and debt-to-income ratio could help.

Most lenders look at these factors that help them decide if you will pay back and can afford the loan you’re requesting.

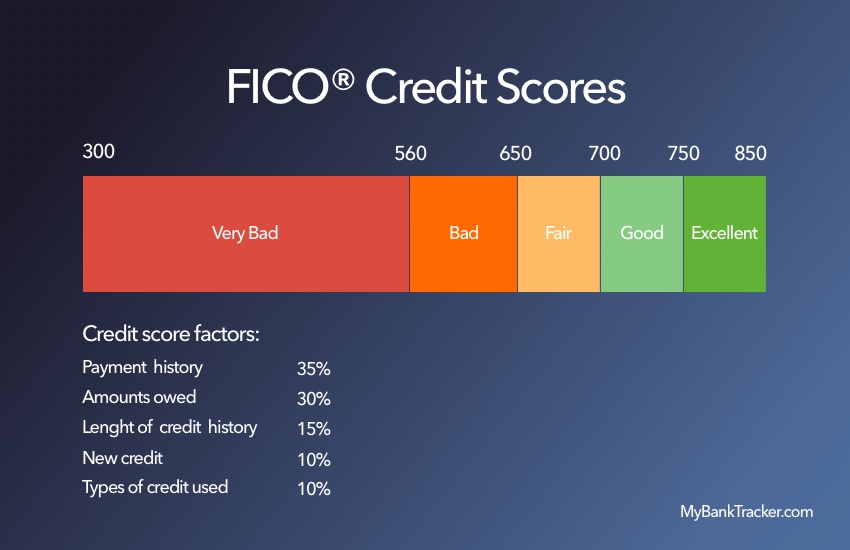

Your credit score

Your credit score is calculated using the information in your credit reports. Make sure that information is correct before applying.

You can request a free copy of your credit report from the three major bureaus at AnnualCreditReport.com. If there are errors on your reports that could negatively impact your score, dispute them before applying.

Most credit scores use your credit utilization ratio as part of their credit scoring formulas. This measures the amount of debt you’ve used compared to your credit limits on that debt.

A smaller ratio generally shows more responsible use. Decreasing your ratio on a maxed-out credit card to a more reasonable 30% ratio could help your score before you apply.

Your income vs. total debt

Your debt-to-income ratio helps indicate how much income you have available to repay the loan you’re requesting. It measures your monthly debt payments against your monthly income.

You can improve this ratio by lowering your debt payments. You could pay off fixed payment loans in full, such as a mortgage or car loan. Alternatively, you can decrease payments on variable payment debt, such as a credit card, by paying down part of the debt.

Your ratio can also decrease if you increase your income. Lenders will want proof of the additional income.

To satisfy this, you may want to focus on adding more hours at work, getting a raise, getting a part-time job, or working a side gig where your income is reported, such as Uber.

Decide on Your Best Loan Option

Your best personal loan may be different than someone else’s. Consider your list of essential loan characteristics when looking at our top personal loan lenders in Utah.

Once you’ve identified your top option, compare them to online lenders and any other lenders you’re considering. Remember, shopping around at multiple lenders could help you save money by securing the lowest possible costs.

Frequently Asked Questions

How long does it take to get approved for a personal loan?

Today, technology and algorithms often process personal loan applications in seconds or minutes. Sometimes, loan applications may need a human review or additional information, which may delay this timeline.

Other lenders may use more manual review processes that could take days, a week, or longer.

How long does it take to receive funds from a personal loan?

Personal loan funding can happen as fast as the same business day as approval at many lenders. Others may take days, a week, or longer to get your funds to you.

Can I use a personal loan for any reason?

Personal loans can generally be used for any purpose unless otherwise specified. One of the more standard exceptions is using a personal loan to consolidate debt. In these cases, lenders will likely want you to have funds disbursed directly to the old lenders to pay off the debt you’re consolidating.

Will applying for a personal loan affect my credit score?

A formal personal loan application results in a hard inquiry on your credit report. This will impact your credit score by a small amount for a short time in most cases.

You may be able to check your rate on a potential loan without impacting your credit if a lender uses a soft inquiry with a preapproval application. Soft inquiries do not affect your score.