The Best Personal Loans in Oregon for 2024

Each lender creates its personal loan products based on its profit goals and the needs of its customers. One bank’s loans could be vastly different from those provided by another.

Some banks charge higher interest rates and many fees in an effort to maximize the amount of money earned on each loan. Others charge competitive rates and have minimized fees to attempt to get more personal loans and profit a little bit on each one.

Finding the best banks to get a personal loan at can be tiring. You have many options to choose from and investigating them all can be tedious.

To help you save time and hopefully save money, we’ve compiled our list of the best personal loans in Oregon. Here’s what we found.

The Best Personal Loans in Oregon

Here are our top picks for personal loan lenders in Oregon, in no particular order:

- U.S. Bank

- Wells Fargo

- KeyBank

Compare Your Personal Loan Options

Find a personal loan that better fits your borrowing needs:

U.S. Bank

The personal loans at U.S. Bank offer different terms depending on your relationship status with the bank. If you’re a customer before applying, you can borrow between $1,000 and $50,000 for one to seven years, assuming you qualify. Non-customers are limited to $25,000 loans and five-year terms.

Interest rates appear to be competitive. The bank doesn’t charge origination fees or prepayment penalties. U.S. Bank customers can get funding as soon as the same business day.

Wells Fargo

Wells Fargo’s personal loan program is highly flexible. You could borrow between $3,000 and $100,000 for one to seven years if you qualify. Rates are competitive and you can usually get a same-day credit decision.

The bank doesn’t charge origination fees, closing fees, or prepayment penalties. You may even qualify for a relationship interest rate discount if you were a customer before applying.

KeyBank

KeyBank’s personal loans start at a $5,000 minimum balance and offer terms of up to seven years. You don’t have to pay origination fees or prepayment penalties with this lender. Sometimes, loans may be funded as fast as the same business day as the application.

How we picked these personal loans

First, we identified the top 50 banks (by deposit market share) in Oregon based on the FDIC’s data from June 2021–available to borrowing in major cities such as Portland, Salem, Eugene, Gresham, and Hillsboro.

Then, we looked at each bank’s personal loan products and evaluated them using the following criteria.

- Interest rates charged

- Loan lengths available

- Loan amounts

- Fees charged

Do Online Lenders Offer Better Personal Loans?

Online-only lenders also provide personal loans to their customers. These companies don’t have to pay for physical bank branches, so their costs are often lower. Some online lenders use these cost savings to offer more competitive personal loan terms.

Online lenders are forced to use technology in their processes due to their digital nature. This can speed up loan processing and fund disbursement timelines unless more information is requested or a human review is necessary.

This combination of factors may make online lenders seem like the superior choice. Sadly, not all online lenders are equal. Some focus on padding profits by offering higher interest rates or charging fees other lenders don’t.

It’s essential to shop around for the best deals, even with online lenders. At the same time, you shouldn’t ignore physical lenders. They know they must compete with digital lenders and have improved to stay competitive.

Many brick-and-mortar banks have sped up application decision times and funding times. Several also offer low fees and competitive interest rates. You may even find relationship rate discounts at some banks.

Finding the best personal loan will depend on your specific situation. Sometimes, an online lender will prevail. At other times, a physical lender will have the best loan. You must shop at both to determine which option provides the best loan for you.

Deciding on Your Top Personal Loan Characteristics

Personal loans are fairly standard, but each person has unique needs. That’s why lenders offer varying terms for their loans.

Being open to lenders others suggest is good because it could help you find the best loan for you. Don’t blindly accept suggestions, though. You need a loan that fits your priorities.

Here are a few characteristics to consider prioritizing to help you find your best loan.

Amount available to borrow

The amount you can borrow from a lender varies depending on what you qualify for and their guidelines. Most lenders allow people to borrow an amount in a range of around $5,000 to $30,000. You can find lenders with lower and higher loan amounts, but they aren’t as common.

Interest

The interest rate you pay often determines the vast majority of the cost of your loan. For this reason, many people include this as a top priority. Even if it isn’t a top priority, it’s often second or third on the list of considerations.

Fees you pay

Minimizing fees can help you save money on your loan. Thankfully, most top banks don’t charge application fees, origination fees, or prepayment penalties anymore.

Some banks still have these antiquated charges, though.

The largest fee to look out for is usually the origination fee. Some lenders charge this fee as a percentage of your loan amount, which can add up fast. A 2% origination fee on a $20,000 loan results in a $400 fee.

Funding speed

How fast you get funds after applying is a huge factor for some people. If you have a bill that needs to be paid as soon as possible, this could be a top factor for you.

The fastest lenders can usually get your loan funds as soon as the same or the next business day. Other lenders may take days, a week, or longer.

Loan length

Personal loans tend to last about three to five years at most banks. Some allow for terms as short as a year or as long as ten years. These are harder to find, though.

Interest rate discounts

Lenders may give you a lower interest rate if you qualify for a rate discount. These are often offered if you set up automatic payments from a deposit account at the same institution.

You may also be eligible for a discount if you had a relationship with a bank before applying for a loan.

Information You Need to Apply for a Personal Loan

Applying for a personal loan requires information you should easily be able to find, including:

- Identification documents (Driver’s license, passport, etc.)

- Proof of address paperwork (Utility bill, mortgage statement, etc.)

- Social Security Number

- Income and employment verification (W-2, 1099s, tax returns, etc.)

- Highest level of education

- Amount requested

- Reason for borrowing funds

- Loan length preference

Work to Improve Your Approval Odds Before Applying

You want to get approved when you apply for a loan. Nothing can guarantee this will be the outcome. You can work to improve your application before applying to give it your best shot.

Lenders look at two key features you may be able to influence. These are your credit score and your debt-to-income ratio.

Your credit

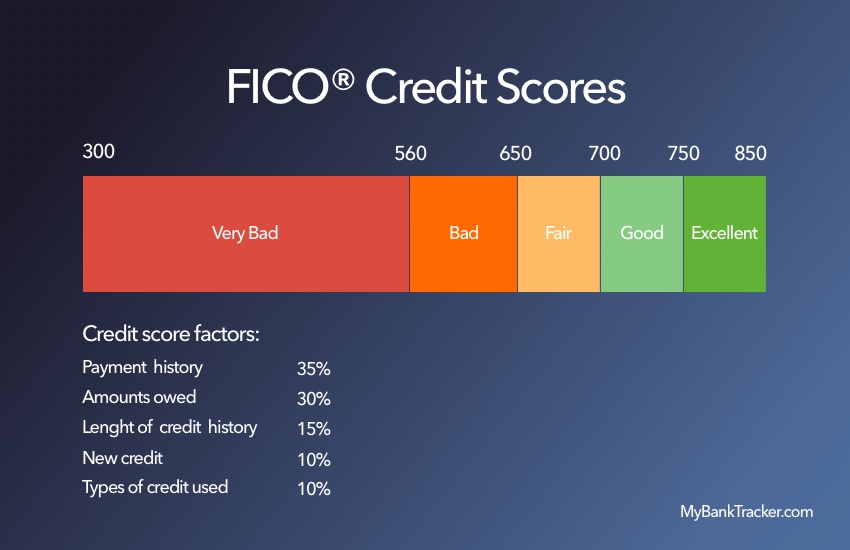

Your credit score is a numerical representation of the risk you pose to a lender. It is calculated using the information in your credit report.

You can verify your report is correct by requesting a copy from the major credit bureaus at AnnualCreditReport.com. If you find an error that may hurt your score, dispute it.

Most credit scores take similar factors into account.

One of these is your credit utilization ratio. In general, a high ratio means you’ve used most of your credit compared to your credit limits.

Lenders view this as risky and it can hurt your score. If you can lower this ratio by paying down a maxed-out credit card to a lower ratio, such as 30%, it could help.

Your existing debt and income

Your debt-to-income ratio calculates your monthly debt payments divided by your monthly income. This shows lenders how much of your income you have available to pay off debt. A lower ratio could help your chances.

To lower this ratio, you need to lower your debt payments or increase your income. You can eliminate debt payments in full, such as paying off a car, or lower your payments on variable payment loans. One way you may be able to do this is by paying down a credit card balance.

Increasing income also lowers your ratio, but the income has to be verifiable. Getting more hours at work, a raise, or a higher-paying job could help. Picking up a part-time job or a side gig that reports your income, such as Uber, could also supplement your income.

Use Your New Knowledge to Find Your Best Personal Loan

Now that you understand what you’re looking for in a personal loan, you can find your best fit lender. You can start by considering our list of the top personal loans in Oregon.

Then, compare your top choice to online lenders. Shopping with multiple lenders can help you find the lowest-cost loan that meets your needs.

Frequently Asked Questions

How long does it take to get approved for a personal loan?

Many lenders use technology to process applications automatically in seconds or minutes. Sometimes, more information is needed or a manual human review is required. These processes can take longer.

Other lenders may take a more manual review process. They may take days, a week, or more to process an application.

How long does it take to receive funds from a personal loan?

The fastest banks disburse funds as soon as the same or the next business day you’re approved for your loan. Others may take days, a week, or longer.

Can I use a personal loan for any reason?

Personal loans generally don’t have requirements for using the funds except in rare cases. Some loans may ask for a specific purpose and require that usage.

The most common example is a debt consolidation loan. Often, you’re required to send loan proceeds directly to old lenders to pay off the debts being consolidated.

Will applying for a personal loan affect my credit score?

Personal loan applications require lenders to make a hard inquiry on your credit report. This action shows up on your credit report and likely will lower your credit score by a few points for a short time.

Preapproval rate checks may be an option without hurting your score, but only if a lender uses a soft inquiry to do this.