The Best Personal Loans in Ohio for 2024

Personal loans allow you to borrow money without putting up collateral. You don’t need a paid-off car or home equity to access the funds. You only need your signature.

Personal loans come in many varieties, depending on which lender you use to take out your loan.

Some lenders offer competitive rates and minimal fees with quick funding. Others have more manual processes and charge more to borrow, including onerous fees and high interest rates.

Finding the best personal loan lenders may not be a quick process. To help, we’ve identified the top personal loan lenders in Ohio. Here’s what you need to know.

The Best Personal Loans in Ohio

These are our top choices for personal loan lenders in Ohio, in no particular order:

- U.S. Bank

- PNC Bank

- Fifth Third Bank

U.S. Bank

U.S. Bank offers different loan options if you’re a customer of the bank or not. Customers can borrow between $1,000 and $50,000 for one to seven years. Non-customers can only borrow up to $25,000 for up to five years.

The bank’s loans have competitive rates and don’t charge origination fees or prepayment penalties. If you’re a bank customer, funding can happen as fast as hours after approval.

PNC Bank

PNC Bank’s personal loans don’t charge origination fees or application fees. They offer some of the shortest possible loan terms, starting at just six months. The longest loan term is 60 months. You can borrow between $1,000 and $35,000 through PNC Bank’s loan program.

Rates displayed on the bank’s site include an automatic interest rate discount. You must set up automatic payments from a PNC checking account to earn this discount.

Fifth Third Bank

Fifth Third Bank’s signature loans allow you to borrow $2,000 to $50,000 for one to five years. Their interest rates are competitive and you don’t have to pay closing costs or prepayment fees. You can even choose your first payment date as long as the first payment is within 45 days from the date of your loan.

How we picked these personal loans

We used June 2021 data from the FDIC to develop a list of the top 50 Ohio banks based on deposit market share–accessible to borrowers in major cities including Columbus, Cleveland, Cincinnati, Toledo, and Akron. Then, we looked at each bank’s personal loan offerings. We identified our favorite lenders using the below criteria:

- Interest rate

- Loan term

- Amount available to borrow

- Fees

Do Online Lenders Have Better Personal Loans?

When you shop online, you expect to find better deals than you can find in person. In one sense, this also makes sense with personal loans.

Online lenders don’t have to pay for several bank branches like physical banks do. Online lenders can use some of these cost savings to offer better rates and terms on loans.

However, you shouldn’t assume that all online lenders offer better loans. Each lender has its own financial goals that result in different rates and terms being offered.

Some charge higher rates to make more money on fewer loans, while others focus on lower profit on a larger volume of loans. Getting a single online loan quote could result in choosing a bad lender. You have to get quotes from multiple lenders to find the best deal.

Online lenders typically have the technology to approve or deny applications quickly. If approved, they can often disperse funds fast, as well.

You shouldn’t ignore physical lenders, though. These lenders know they must compete with online lenders. Many brick-and-mortar lenders have sped up application timelines, funding timelines, and may even offer competitive terms.

Each lender assesses your application differently. There’s a good chance an online lender may offer you the best terms. Even so, a physical lender could have a better loan for your situation thanks to rate discounts or other factors.

To find the best loan, you must shop at both physical and online lenders before making a final decision.

Setting Priorities for Your Ideal Loan

Most people have similar priorities for their personal loans. They want to make sure they can borrow enough money at a manageable payment amount with the lowest cost possible.

Some people have other priorities that may be more important. If you have a bill due in a week, you want to make sure the funding comes through in time.

Don’t assume what one person says is an ideal loan is the right one for you. Figure out your priorities before shopping for a loan. Here are a few ideas to help.

Amount you can borrow

Many lenders offer a predictable range of loan amounts, such as $5,000 to $30,000. This works for most people, but others may need a smaller or larger loan.

You can find lenders that offer small loans of around $1,000 or large loans of about $100,000. They’re rarer, but they do exist.

Rates

The interest rate you pay is often the most critical factor. If all other elements are equal across multiple loans, the lower rate means less money spent on interest.

You may decide a slightly higher interest rate is acceptable if other priorities are more important. Still, a low-cost loan should still be a priority in most instances.

Fees you must pay

Today’s personal loans from top lenders have very few fees. Late fees and returned payment fees are standard, but prepayment penalties, origination fees, and application fees shouldn’t be expected.

Make sure to watch out for origination fees. These fees are often represented as a percentage of the loan balance. A 2% fee may not seem expensive, but it adds up to $500 on a $25,000 loan.

Funding time

Getting access to money from a loan quickly can be very important if you have a deadline for needing the funds.

The fastest lenders can get your funds the same or the next business day after approval. Other lenders may take days, a week, or longer.

Term lengths

Personal loans generally last anywhere between three and five years at most institutions. Some offer a wider variety of loan lengths as short as one year or as long as ten years.

Interest rate discounts

Some banks offer ways to lower your interest rate by meeting specific criteria. Customers that have an established relationship at a bank before applying may qualify for a discount. Another typical discount may kick in if you set up automatic payments from a linked deposit account at the same bank.

Documents You Should Gather for a Personal Loan Application

Personal loan applications almost always ask for the same information. Here’s a list that should cover the most requested information:

- Identification (Driver’s license, passport, etc.)

- Documents proving your address (Utility bill, mortgage statement, etc.)

- Social Security Number

- Employment and income verification documents (W-2, 1099s, tax returns, etc.)

- Highest level of education

- Requested loan use, amount, and term

Boost Your Odds By Preparing Before You Apply

For the most part, personal loan applications are similar across most lenders. Two pieces of information many lenders use to make loan decisions have the possibility of being influenced before you apply. Using this to your advantage could potentially help your approval odds.

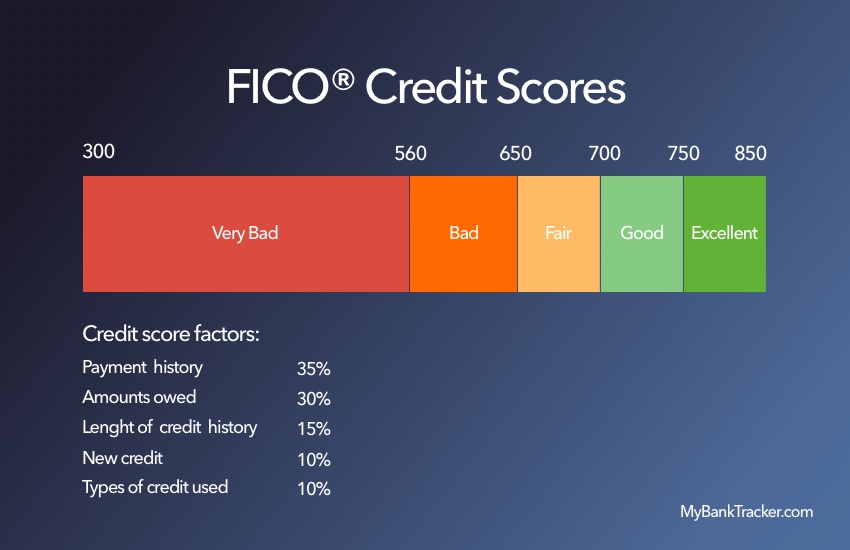

Lenders look at credit scores and debt-to-income ratios to help them calculate the risk of a person defaulting on a loan. Improving your score and ratio could result in a different result than if you did nothing before applying.

Raise your credit score

Your credit score is based on information in your credit report.

Start by requesting your credit reports (for free) from the three major credit bureaus at AnnualCreditReport.com. Check them for errors that could hurt your score. If you find any, dispute them.

Most credit scores use your credit utilization ratio as a significant part of the scoring calculation. This measures the amount of debt you use compared to your credit limits.

Paying down a line of credit that has been maxed out to a lower utilization ratio could possibly improve your score.

Reduce your debt-to-income ratio

Your debt-to-income ratio is a good indicator of whether you can afford to repay a loan. It is calculated by dividing your monthly debt payments by your monthly income.

A better ratio could help you get approved. You can improve the ratio by increasing your income or decreasing your debt.

Increases in income need to be documented, so you can’t sell stuff around yourself and have it count. Instead, you likely need to pick up more hours at work, get a raise, or add a part-time job.

Decreasing your debt payments can help, too. Focus on variable payment loans, such as your credit card, that can result in lower payments if you pay off part of the debt. Unfortunately, paying down a fixed payment loan, such as a mortgage, won’t help unless you pay off the loan in full to eliminate a payment.

Research and Pick Your Top Lender

Picking a personal loan will depend on your preferences. Once you’ve identified them, look to see if any of our top personal loan lenders in Ohio meet your needs.

To make sure you’re getting the best deal, compare your top choice to online lenders. Remember, each lender will rate your risk differently. This could easily result in one lender offering better terms than the others.

Frequently Asked Questions

How long does it take to get approved for a personal loan?

Most personal loan applications are processed using technology. This can result in approval or denial decisions in seconds or minutes, assuming no further information or human review is required.

If your application falls into an exception, the process could take hours, days, a week, or longer. Lenders that process applications manually may also fall into this longer timeline.

How long does it take to receive funds from a personal loan?

Many lenders can provide funds from a loan the same or the next business day after approval. Others may take days, a week, or longer.

Funding timing can be essential if you’re on a tight timeline. If this is the case, ask about funding timing before applying.

Can I use a personal loan for any reason?

Personal loans usually allow you to use loan funds for any reason. Some lenders ask what you’re using the funds for and may limit the use of money to that purpose.

One common restriction requires people taking out a personal loan for debt consolidation to have the proceeds directly distributed to the old debt being paid off.

Will applying for a personal loan affect my credit score?

Yes, applying for a personal loan results in a hard inquiry on your credit report. This will likely slightly damage your score for a short period.

It may be possible to get rate quotes without applying if a lender offers a preapproval process that uses soft inquiries. These do not impact your score.