The Best Personal Loans in New Mexico for 2024

If you need to borrow money but don’t have collateral to use for a loan, you may wonder what your options are.

Thankfully, many lenders offer personal loans. To get these loans, you usually don’t need collateral. Instead, you just have to sign a loan document, which is where these loans get their signature loan nickname.

Each lender’s personal loan program is different. Some are competitive, while others charge high interest rates and fees.

To help you simplify your search, we’ve researched the best personal loans in New Mexico.

The Best Personal Loans in New Mexico

Here are our top choices for New Mexico personal loan lenders, in no particular order:

- Wells Fargo

- U.S. Bank

- New Mexico Bank & Trust

Wells Fargo

Wells Fargo’s personal loans offer many flexible options. Loan amounts range from $3,000 to $100,000 if you qualify. Terms last from one to seven years.

Interest rates are fixed and competitive. Qualified customers may even get relationship discounts on their rates.

The company doesn’t charge origination fees, closing fees, or prepayment penalties. Credit decisions can happen as fast as the same business day.

U.S. Bank

U.S. Bank’s personal loans don’t have origination fees or prepayment penalties. If you’re a customer and qualify, you can get a $1,000 to $50,000 loan for one to seven years. Non-customers who qualify are limited to $25,000 and a length of five years.

Interest rates are competitive and qualifying U.S. Bank customers may receive funds in hours after approval.

New Mexico Bank & Trust

New Mexico Bank & Trust’s Buy Local Loan allows you to borrow up to $5,000 for 36 months, although other terms are available. Rates are competitive and you don’t have to pay an origination fee. To qualify, you must have a New Mexico Bank & Trust checking account.

How we picked these personal loans

Using the FDIC’s June 2021 data, we determined New Mexico’s top 50 banks based on deposit market share–serving major cities including Albuquerque, Las Cruces, Rio Rancho, Santa Fe, and Roswell.

For each bank, we considered the loan options while paying special attention to:

- Interest rates available

- Loan terms

- Amount available to borrow

- Fees incurred for loans

Do Online Lenders Offer Better Personal Loans?

Some people may expect online lenders to offer personal loan options. This could be the case but is highly situation-dependent.

Online lenders don’t have physical branch locations. This means they operate with lower costs and, in theory, could pass part of that cost savings on to you.

Digital lenders are experienced in using technology for applications and loan processing. This can result in application decisions in seconds or minutes and fast funding in many cases. These features make the personal loan process less cumbersome.

Not all online lenders work hard to provide the best deals, though. Some may focus on profits first and may not offer the best rates, lowest fees, and other advantageous terms. As such, you still have to shop around with multiple online lenders to find the best deal.

But are online lenders superior to physical lenders? This statement isn’t always true. Physical lenders still want your personal loan business and know they must compete with digital lenders.

Many brick-and-mortar lenders have sped up their application and funding processes. Several offer the same fast timelines digital lenders provide. The top lenders also compete on rates and fees, too.

You’ll have to investigate both physical and online lenders to find the best deal for your situation. You never know which lender will offer you the best terms based on your unique circumstances.

Finding Your Personal Loan Priorities

What makes a personal loan the best choice for one person may make it a bad choice for you. Don’t believe someone when they say they have the best offer available.

What makes the best offer is dependent on your priorities. But first, you must identify your top needs. Here are a few ideas to help you.

Loan amount

Lenders have different loan amounts they’re comfortable letting people borrow. Most fall in the $5,000 to $30,000 range. Some offer smaller loans, such as $1,000, or higher loans, such as $100,000, but these options are less frequent.

Interest charged

Interest rates, if all else is equal, determine the cost of your loan. As such, it’s normally a top priority.

You may be willing to accept a less optimal interest rate if other factors are more important to you. Even so, you should still price shop for a low-cost loan that meets your other requirements.

Fees you pay

The best lenders don’t charge many fees for personal loans anymore.

You should still expect to pay late fees, but origination fees, application fees, and prepayment penalties are rare.

Origination fees are often the most significant fee to watch out for. Some lenders calculate these as a percentage of the loan amount. A 2% origination fee on a $15,000 loan would cost you $300.

How fast you get funds

Each lender gives out funds from your loan based on a timeline. Some can process funding as fast as the same business day of approval. Others may take days, a week, or longer.

If you need funds as soon as possible, verify how long you should expect to wait for funds before applying.

Loan lengths available

Personal loans usually last from three to five years. Some lenders offer loans as short as a year. Others may allow you to borrow money for up to ten years.

Discount availability

Some lenders give you an interest rate discount if you had a previous relationship with the bank before applying for a loan. Another common interest rate discount may kick in if you set up automatic payments on your loan from a deposit account at the same bank.

What Lenders Ask for When Applying for a Personal Loan

Personal loan applications aren’t hard to fill out. Having the correct information ready can make the process faster. Expect to provide the following:

- Identification documents (Driver’s license, passport, etc.)

- Documents that can verify your address (Utility bill, mortgage statement, etc.)

- Social Security Number

- Employment and income proof (W-2, 1099s, tax returns, etc.)

- Highest level of education

- Desired loan usage

- Preferred amount to borrow

- Requested loan term

Try to Improve Your Odds Before Applying

Most lenders use the same information to determine whether you get approved or denied. They may examine and rate that information differently, resulting in different decisions.

Lenders generally consider your credit score and debt-to-income ratio as significant factors. You can influence both of these numbers to try to boost your odds of approval. Still, no combination of these numbers can guarantee approval.

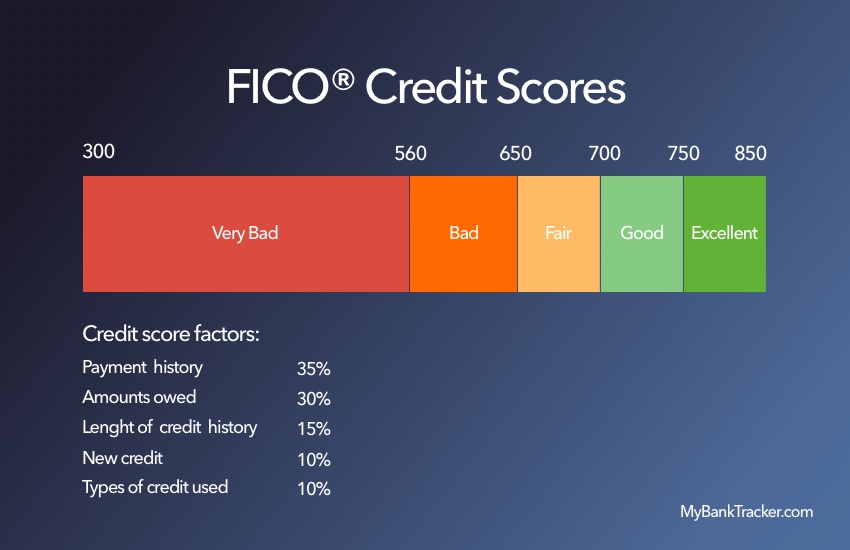

Your credit

Your credit score is based on information in your credit reports.

You can search your credit reports for negative errors and dispute them to work on improving your score.

Request a free copy of your credit report from the three major credit bureaus at AnnualCreditReport.com.

Your credit utilization ratio is a major factor in many credit scoring formulas. You can influence this, as well. It measures the amount of credit you’ve used compared to your credit limits.

Paying down a maxed-out credit card down to a 30% ratio should, in theory, help improve your credit score.

Your debt-to-income ratio

Your debt-to-income ratio is also important to potential lenders as it shows whether you can repay a proposed loan. It measures your monthly debt payments against your monthly income.

You can improve this ratio by lowering your monthly debt payments or increasing your income. Lowering debt payments could work by paying off a car loan in full or paying down the balance on debt with payments that change based on the balance owed.

Increasing your income could be more beneficial, but the income must be documented. This likely means you’ll need to find a higher-paying job, pick up extra hours, or add a part-time job. Side gigs that report income, such as Uber, may help in some cases.

Determine Your Best Personal Loan Lender

People’s circumstances will dictate which personal loan lender is best for them. Start by identifying your priorities and comparing them to our list of top personal loans in New Mexico.

Next, consider how online lenders stack up against your top choice from our list. This should help you see which loan works best for your situation.

Frequently Asked Questions

How long does it take to get approved for a personal loan?

Most personal loan lenders can give you a quick loan approval decision in seconds or minutes. In some cases, more information may be needed or a human may need to review the application. This could take days, a week, or longer. Lenders that manually process applications fall into the longer timeline.

How long does it take to receive funds from a personal loan?

The fastest lenders can get your loan funded the same business day as approval. Others may take a couple of days, a week, or longer. If timing is important, verify funding timelines before applying.

Can I use a personal loan for any reason?

Most lenders allow you to use funds from personal loans for any reason. Exceptions exist in certain circumstances. For example, loans that specify they will be used for debt consolidation may require funds to be disbursed directly to old lenders to pay off the debt.

Will applying for a personal loan affect my credit score?

Applying for a loan results in a hard inquiry on your credit report. Most of the time, this negatively impacts your credit score by a small amount for a short time.

You may be able to rate shop without a formal application. If a lender says you can get pre-approval using a soft credit inquiry, this will not impact your score.