The Best Personal Loans in Nevada for 2024

Personal loans help people get funds for whatever they want. You normally don’t have to put up collateral to get these loans.

Because you don’t have to use home equity or a paid-off car to back the loan, interest rates are often higher than secured loans.

Still, personal loans fill a real gap for people to pay for unexpected expenses or things they want but can’t pay cash for today.

Not all personal loans are created equal, though. Some offer competitive rates and don’t charge outdated fees, while other lenders have expensive loans.

We researched your options to help you find some of the best personal loans in Nevada. Here’s what you should know.

The Best Personal Loans in Nevada

Our favorite personal loan lenders in Nevada are below in no particular order:

- Wells Fargo

- U.S. Bank

- Nevada State Bank

Wells Fargo

Wells Fargo’s personal loans are highly customizable, depending on your needs. They offer a wide range of loan amounts, starting at $3,000 and going as high as $100,000. Loan lengths begin as short as one year and last as long as seven years.

The loans offer competitive interest rates, which sometimes come with relationship discounts for qualified customers. With these loans, you won’t have to pay origination fees, application fees, or prepayment penalties.

Wells Fargo can also fund loans as fast as the same or the next business day after approval.

U.S. Bank

U.S. Bank’s personal loan options depend on whether you’re a bank customer or a non-customer before applying.

Customers can access loans for $1,000 to $50,000 with one-year to seven-year terms. Non-customers can only borrow up to $25,000 and terms are limited to five years.

The rates U.S. Bank offers appear competitive. Loans can be funded as soon as hours after approval if you’re a customer. The bank doesn’t charge origination fees or prepayment penalties.

Nevada State Bank

Nevada State Bank offers unsecured personal loans of up to 36 months. Rates appear competitive, but you must pay a $75 origination fee. You may qualify for a 1% rate discount if you set up automatic payments from a Nevada State Bank checking account.

How we picked these personal loans

We used FDIC data dated June 2021 to find the top 50 banks by deposit market share within the state of Nevada–with access to borrowers in major cities in Las Vegas, Henderson, Reno, North Las Vegas, and Paradise.

After making the list, we examined the personal loans at each of the 50 banks to find the best options. We used the following criteria to rank each loan:

- Interest rates charged

- Available loan lengths

- How much you can borrow

- Fees

Do Online Lenders Offer Better Personal Loans?

People turn to the internet to find better deals when shopping for most products and services. But are online lenders better than brick-and-mortar lenders for personal loans?

Online lenders generally don’t have the same overhead costs physical lenders do because they don’t have to pay for expensive branch locations. Online lenders may also automate processes with technology, further reducing costs.

These cost reductions allow online lenders to pass some of the savings along to customers through more competitive loan offers. The technology can also speed up the approval and fund disbursement processes, resulting in a faster application to funding timeline.

This doesn’t mean a particular online lender is better than all brick-and-mortar lenders. Some will be better than others, so you must shop for the best deals.

Online lenders aren’t always superior to physical lenders, either. Many physical lenders realize the stiff competition they face and have adjusted their product offerings to compensate.

A physical lender may allow you to make arguments why you should be approved in person, tipping the scales in your favor. Many now offer fast application decisions and funding times, as well.

To find the best deal, you have to shop around at both physical and online lenders.

Identify What’s Important to You Before You Start

Personal loans are generally the same, but each lender offers slightly different terms and features. They aren’t uniform because each person has different needs.

Don’t listen to what someone else says you should shop for in a personal loan. Instead, think about what’s most important to you. Here are a few ideas to help.

Loan amount

Most lenders offer a fairly reasonable loan amount range, such as $5,000 to $30,000. Other lenders may specialize in smaller loans, as low as $1,000, or larger loans, as high as $100,000.

Interest rate

The interest rate is almost always relevant. If all other factors are equal, a higher interest rate results in a more expensive loan.

All other factors aren’t usually equal, though. You may decide to take a slightly higher interest rate if other factors more important to you are better.

Loan fees

Some fees exist at almost every lender, such as fees for making late payments. Thankfully, most other fees have disappeared at the premier personal loan lenders. You shouldn’t have to pay application fees, origination fees, or prepayment penalties.

The most significant fee is often the origination fee, so be sure to look out for these. They’re often represented as a percentage of the loan amount.

A 2% origination fee on a $10,000 loan will cost you $200. This amount is often removed from the loan proceeds, resulting in only $9,800 being disbursed.

How fast you get loan proceeds

Many lenders offer personal loan funds as fast as the same business day or the next business day after approval. Other lenders may take a few days, a week, or longer.

Length of loans

Expect to see most personal loans offer three to five-year terms. Shorter loan terms, such as one year, and longer loan terms, such as ten years, exist if you look hard enough.

Interest rate discounts

Lenders may offer discounts on the interest rates of loans if you qualify. Standard discounts include an automatic payment discount or a relationship discount.

What Is Required to Apply for a Personal Loan?

Most lenders require some or all of the following information on their personal loan applications:

- Identification verification (Driver’s license, passport, etc.)

- Documents proving your address (Utility bill, mortgage statement, etc.)

- Social Security Number

- Employment and income verification documents (W-2, 1099s, tax returns, etc.)

- Highest level of education

- Desired loan purpose

- Requested loan amount

- Loan length preference

Work to Increase Your Approval Odds

Lenders evaluate your application to determine if you qualify for a loan based on their criteria. Nothing guarantees you’ll be approved. That said, you can work to increase your chances of approval.

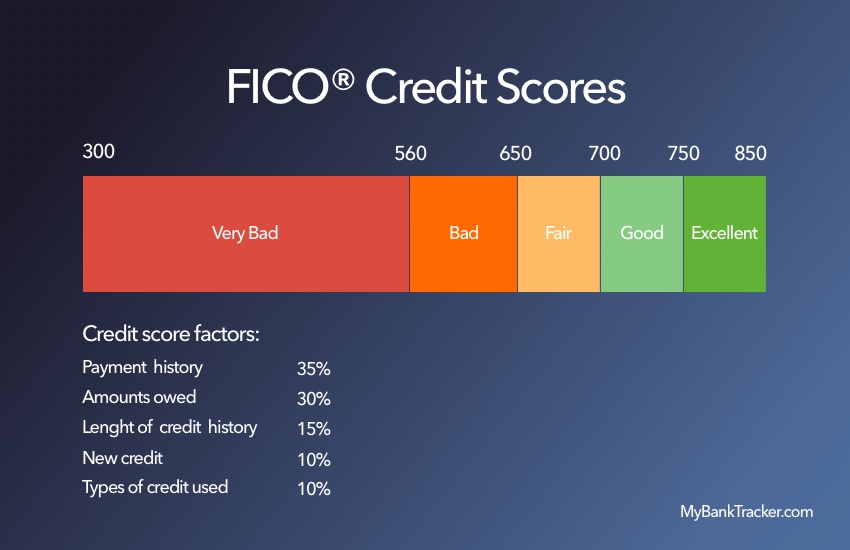

Each institution has unique formulas and qualification criteria. Still, most banks look at your credit score and your debt-to-income ratio. Improving these could, in theory, help your application look stronger.

Check your credit

Your credit score gets calculated based on information contained in your credit reports. You can request a free copy of your credit reports from the three major bureaus at AnnualCreditReport.com.

You should do this to verify all information is correct. Any potentially damaging information that is incorrect should be disputed to fix it before you apply.

Reduce credit utilization

Credit scoring formulas differ depending on the particular model used. Most formulas use your credit utilization ratio as an important factor. This ratio divides the credit you’ve used by your credit limits.

Generally speaking, a lower ratio is better. If you could pay down a maxed-out credit card to a more reasonable percentage, such as 30%, that could possibly improve your score.

Reduce your debt-to-income ratio

Your income isn’t on your credit report but is requested on personal loan applications. Lenders use this to calculate your debt-to-income ratio, which measures monthly debt payments divided by monthly income.

You can improve this ratio by increasing your income or decreasing your debt payments. Increases in income must be documentable, such as picking up a part-time job.

Decreased debt payments should appear on your credit report, but only if your monthly payment changes. This is why paying down part of a car loan with a fixed payment won’t help but paying down a credit card with a variable payment might.

Find Your Top Personal Loan Lender

Finding the best personal loan for you should now be much easier. Start by considering our list of the top personal loans in Nevada. Once you choose your favorite option, compare them to online lenders.

Remember, each lender evaluates applications using their own systems, which may result in different loan terms. Shopping around allows you to find the best deal based on your needs.

Frequently Asked Questions

How long does it take to get approved for a personal loan?

Automated personal loan processing allows many institutions to approve or deny applications in seconds or minutes. Some applications require more information or a human look. This can delay the timeline to days, a week, or longer.

Other lenders may not use automated processes. These applications may take hours, days, a week, or longer.

How long does it take to receive funds from a personal loan?

Many lenders offer funding as quick as the same or the next business day after approval. Other lenders may take days, a week, or longer.

Can I use a personal loan for any reason?

Personal loans don’t typically have fund usage requirements. Some specific loans might, though. In particular, debt consolidation personal loans usually require you to have funds disbursed to the old lenders to pay off the old debt directly.

Will applying for a personal loan affect my credit score?

Yes, applying for a personal loan will impact your credit score. The process includes a hard inquiry, which usually lowers your score by a few points for a relatively short time.

Pre-approval applications may claim not to impact your credit score. This is the case if they use a soft inquiry. Even so, you still have to formally apply to get final approval for the loan.