The Best Personal Loans in Nebraska for 2024

If you need to borrow money but don’t have collateral to put up to get a secured loan, an unsecured personal loan could help.

These loans don’t require home equity or a paid-off car. Instead, you simply sign paperwork and get the loan proceeds. That’s why these are sometimes called signature loans.

Funds from personal loans can typically be used for anything you want. You could use the money for a Disney World vacation, a basement remodel, or to pay off debt.

Finding a lender that offers personal loans isn’t hard. Finding one with competitive terms is a bit trickier.

To help you save time, we’ve compiled a list of Nebraska’s best personal loan lenders. Here’s what you should know about each one.

The Best Personal Loans in Nebraska

Our favorite personal loan lenders in Nebraska are below in no particular order:

- Wells Fargo

- U.S. Bank

- Union Bank

Wells Fargo

Wells Fargo offers a wide variety of personal loans. Loan lengths range from 12 to 84 months and amounts can be as small as $3,000 or as high as $100,000. This flexibility and competitive fixed interest rates make these loans appeal to many people.

Additionally, Wells Fargo doesn’t charge prepayment penalties, origination fees, or application fees. You could even qualify for a rate discount in certain instances.

Funds may be disbursed as quickly as the same or the next business day after approval.

U.S. Bank

U.S. Bank offers customers $1,000 to $50,000 personal loans with one to seven-year terms. Non-customers only qualify for up to $25,000 and a term of five years. Rates are competitive and the lender doesn’t charge origination fees or prepayment penalties.

The bank can provide funds as fast as hours after approval if you’re a U.S. Bank customer.

Union Bank

A Union Bank personal loan may be an option if you’ve been invited to apply. These loans have no application or origination fees and terms of three to seven years. Rates are competitive and vary based on the purpose of your loan.

Funds are provided to you one business day after accepting the loan. If you’re using the loan to pay creditors, it may take three to five business days for creditors to receive funds.

How we picked these personal loans

The FDIC’s June 2021 data allowed us to determine Nebraska’s top 50 banks by the deposit market share–serving borrowers in major cities such as Omaha, Lincoln, Bellevue, Grand Island, and Kearney.

After identifying this list, we looked at the personal loans each bank offered. We compared loans using these factors:

- Interest rate range

- Loan terms available

- Potential loan amount range

- Fees charged

Are Online Personal Loans a Better Option?

Online personal loan lenders may seem less personal because you can’t visit them in person. This gives them an advantage, though. They don’t have to pay for physical branches. They can use some of that cost savings to offer better loan terms.

Online lenders must also rely on technology due to their online nature. Their technology can quickly process applications, often in seconds or minutes. Once approved, many online lenders quickly disburse funds to you.

You shouldn’t get a loan at the first digital lender you find. Each lender may offer unique loan options, including different interest rates and fees. Finding the best loan still requires shopping around.

But you shouldn’t just shop at online lenders. Physical lenders have worked to become competitive with online lenders. They know quick application processing and loan funding are important and often have quick timelines.

Physical lenders may offer other benefits. You may have an established relationship with them that could result in loan discounts. You may also be able to talk to a loan officer to share information that could help turn a borderline application into an approval.

For this reason, you should shop around at both physical and online lenders. Only then can you know if you’re getting the best deal on a personal loan.

Pick Your Priorities Before Personal Loan Shopping

Each person may have different priorities when shopping for a loan. Don’t simply take someone’s word that a particular lender has the best personal loan for you.

Instead, examine why you need a personal loan and your priorities. Then, choose a lender that helps you fulfill those needs.

Here are a few loan attributes that may be priorities for you.

Amount you can borrow

If you need a standard-sized personal loan, most banks can help. Expect to see loan amounts in the $5,000 to $30,000 range. If you need a smaller or larger loan, they do exist. Some lenders offer loans as low as $1,000 or as high as $100,000.

Rate charged

The interest rate is often one of the most important factors. It plays a significant factor in how much your loan will cost you. If all other terms and features are equal, the loan with the lowest rate is often your best bet.

Fees you pay

Some lenders have quit charging many fees you used to see on personal loans, but others still charge them.

In general, you shouldn’t have to pay an application fee, origination fee, or prepayment penalties.

The biggest fee most lenders may charge is the origination fee. It may be a percentage of the loan amount. A 1% fee on a $20,000 loan costs $200. The fee amount often reduces the amount you receive from the loan.

Funding speed

Each lender has a process for disbursing loan funds. Some make this happen as soon as the same or the next business day after approval. Others may take days, a week, or longer.

If you need the money by a particular date or time, verify the timeline before applying.

Loan term length

Lenders determine how long to loan you money. Most tend to have loans with lengths of three to five years. Some offer loans as short as a year or as long as ten years.

Discounts

You may find out you qualify for a lower loan interest rate thanks to a discount. You may qualify if you have an established relationship with the bank before applying.

Another common discount lowers your interest rate if you sign up for automatic payments from a linked checking account at the same bank.

Personal Loan Application Checklist

Each lender has different loan applications. In general, expect to provide the following information:

- Identification documents (Driver’s license, passport, etc.)

- Proof of address (Utility bill, mortgage statement, etc.)

- Social Security Number

- Employment and income documentation (W-2, 1099s, tax returns, etc.)

- Highest level of education achieved

- Requested loan purpose, loan amount, and loan length

Concepts to Help Prepare You to Apply

If you apply for a loan, you want to get approved. You can’t guarantee you’ll get approved, but you can do some things to give yourself the best chance of approval.

Knowing what lenders look at in an application can help you put yourself in the best position possible. Two factors lenders consider that you may have the ability to influence include your credit score and debt-to-income ratio.

Boost your credit

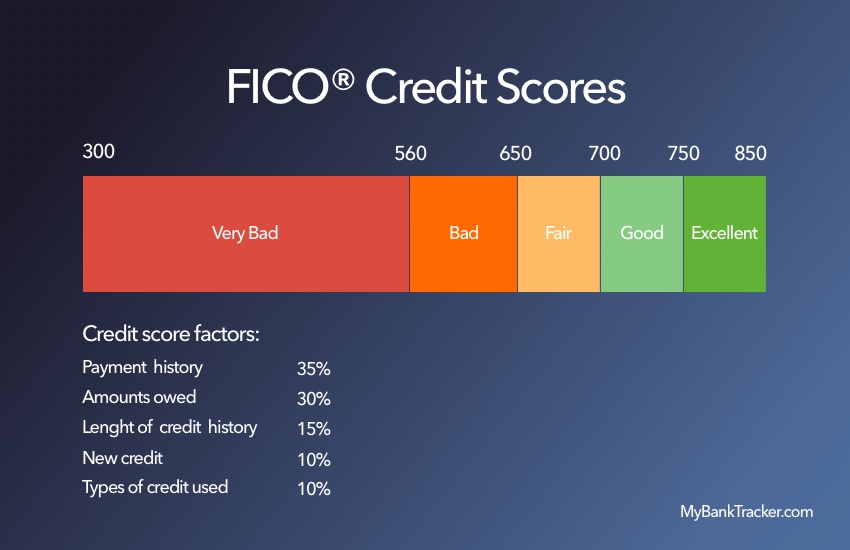

Your credit score is calculated using the information on your credit reports.

Get a free copy of your credit report from the three major credit bureaus at AnnualCreditReport.com. Check the reports for errors and dispute any inconsistencies to get them resolved.

Each credit scoring formula is different, but most use your credit utilization ratio as part of your score. This measures the amount of debt you use against your credit limits.

An example of how you may be able to improve this is by paying down a maxed-out credit card to a more reasonable ratio, such as 30%.

Debt-to-income ratio

Your debt-to-income ratio is also important. Your income isn’t on your credit report, but you provide it as part of your application. The ratio measures your monthly debt payments against your monthly income.

You can influence this ratio in two ways. You can lower your debt payments or increase your income. Paying down debt will only help if you pay off a fixed payment, such as a car loan, in full or if you pay down a variable payment, such as a credit card, enough to change your payments.

Increasing income should always help as long as you don’t incur more debt. The income must be documented, so a part-time job or a side gig that reports your income may be required.

Find Your Ideal Personal Loan Lender

While many lenders offer personal loans, not all lenders provide outstanding personal loans. You can start looking for your next loan using our list of the top personal loans in Nebraska.

Once you find your favorite option, compare it to online lenders. Shopping around can help you get the best loan for your situation.

Frequently Asked Questions

How long does it take to get approved for a personal loan?

Some lenders process applications in seconds or minutes if more information isn’t needed. Some applications may require more documentation or a human review. This may slow down approval to hours, days, a week, or more.

Other lenders don’t use technology to process applications. These often take days, a week, or longer to process.

How long does it take to receive funds from a personal loan?

The fastest lenders often get you funds the same or the next business day after your loan is approved. Other lenders may take days, a week, or longer.

Can I use a personal loan for any reason?

Personal loans rarely require you to use the funds for a specific purpose. That said, certain loans may. In particular, debt consolidation personal loans normally require you to send payments directly to old lenders as part of disbursement.

Will applying for a personal loan affect my credit score?

Pre-approval applications for personal loans may use a soft inquiry. In this case, your credit score will not be impacted.

You must submit a final application to get formally approved for a loan. These require a hard inquiry. This will negatively impact your credit score for a short time in most instances.