The Best Personal Loans in Montana for 2024

Personal loans are unsecured loans that let you borrow money for virtually anything you can think of. You may want to use the funds to remodel your kitchen, pay off a credit card, or go on an Alaskan cruise.

You don’t have to put up collateral, such as home equity or a paid-off car, or be restricted in how you use the funds in most cases.

Plenty of personal loan offers exist, but they aren’t all the same. Some are much better than others.

To help you save time, we found the best personal loan offers in Montana. Here’s what you should know about them and how to pick the best personal loan for you.

The Best Personal Loans in Montana

Our favorite personal loan lenders in Montana are below in no particular order:

- Wells Fargo

- U.S. Bank

- First Interstate Bank

Wells Fargo

Wells Fargo’s personal loans offer a wide range of loan amounts as low as $3,000 or as high as $100,000. Loans can last from one to seven years and have competitive interest rates.

Wells Fargo doesn’t charge origination fees, application fees, or prepayment penalties. If approved, you could receive funds as soon as the same or the next business days.

U.S. Bank

The personal loans at U.S. Bank offer competitive rates, flexible borrowing amounts, and flexible loan lengths. Non-customers can get $1,000 to $25,000 loans for 12 to 60 months. Customers can borrow up to $50,000 for up to 84 months.

You don’t have to pay prepayment penalties or origination fees. Loans can be funded in just hours after approval.

First Interstate Bank

First Interstate Bank offers personal loans, including one that’s only for debt consolidation. Their interest rates appear competitive, but the bank charges a $200 origination fee.

How we picked these personal loans

We used June 2021 data from the FDIC to find the top 50 banks in Montana based on each bank’s deposit market share–accessible to borrowers in major cities including Billings, Missoula, Great Falls, Bozeman, Butte, and Helena.

Then, we evaluated the personal loan offerings at each bank using these factors:

- Interest rates

- Loan lengths

- Amount available to borrow

- Fees

Are Online Personal Loans Superior?

Online personal loan lenders have an advantage brick-and-mortar lenders don’t. Generally, these lenders don’t have physical branches spread throughout a community or the nation.

This allows online lenders to have lower overhead costs. Some offer lower interest rates to pass on part of this cost savings and to offer a more competitive loan option.

Online lenders also rely on technology for their processes since they don’t meet with applicants in person. The technology may also allow for quick approval decisions and fast funding.

Digital lenders aren’t all the same, though. They have to compete with each other to win your business.

Some lenders may not provide the best rates to earn more money on the loans they close. For this reason, you should always shop around, even when dealing with digital lenders.

Shop around

Physical lenders know they must compete with online lenders to win business. They’ve sped up their application and funding processes. Depending on the lender, they may offer competitive rates, too.

Brick-and-mortar lenders may add a human element to the process. If you can meet with a loan officer, you may be able to provide them with additional information that could impact your approval odds.

Each lender will evaluate your application based on their own guidelines. It’s essential to shop around at both online and physical lenders to find the best possible deal for your circumstances.

Figure Out Your Priorities Before Taking Out a Loan

Lenders want to attract a wide variety of customers so they can give out more loans and earn more money in interest payments. Not all lenders offer the same features, though. To find your best loan, you need to focus on the features that matter to you.

While you may focus on the lowest overall cost loan, someone else may want to get their loan funded as quickly as possible. Here are a few loan features to consider when making your list of priorities.

Loan amount

It’s common to find personal loans in the $5,000 to $30,000 range. If you need a smaller or a larger loan, you may need to seek a lender specializing in those areas. Some offer loans as small as $1,000 and as high as $100,000, so they do exist.

Interest rate

A lower interest rate results in lower loan costs if all else is equal. You should always consider the interest rate as a significant factor. That said, you may be willing to pay a slightly higher than ideal rate if other factors are more important to you.

Fees charged

Fees can add up quickly and make a loan more expensive than you otherwise thought. Late fees are common for late payments, but most other types of fees have become rarer.

You shouldn’t expect to pay origination fees, application fees, or prepayment penalties, but some lenders still charge some or all of these fees.

In particular, watch out for origination fees. These may be a percentage of the loan amount, such as 2%. A 2% fee on a $10,000 loan will cost you $200. This is often removed from the loan proceeds, so you’d only receive $9,800 from the loan.

How fast you’ll get funded

Some lenders can get your funds from a loan as fast as the same business day of approval. Others may take a few days, a week, or more.

Timing can be essential depending on your needs for the money. Verify funding timelines before applying if it is important to you.

Loan length

Personal loans generally last from three to five years at most lenders. Some lenders offer much shorter loans, such as one-year loans. Longer loans also exist and can last as long as ten years.

Interest rate discounts

You may be able to secure a lower interest rate through a lender’s discount program. Banks commonly discount the rate if you sign up for automatic payments from a linked checking account at the same bank.

You may also qualify for a discount if you had an established relationship with the bank before applying for a loan.

What You Need to Apply for a Personal Loan

To speed up the process, be ready to provide the following when applying for a personal loan:

- Identification information (Driver’s license, passport, etc.)

- Documents with your address (Utility bill, mortgage statement, etc.)

- Social Security Number

- Income and employment verification documents (W-2, 1099s, tax returns, etc.)

- Your highest level of education

- How much you want to borrow

- Desired loan length

- Reason for borrowing funds

Ways You May Help Your Approval Odds

Lenders look at some key factors when deciding whether to approve you for a personal loan. Knowing those factors can help you prepare yourself to have the best chance of getting approved for a personal loan. Still, nothing can guarantee approval.

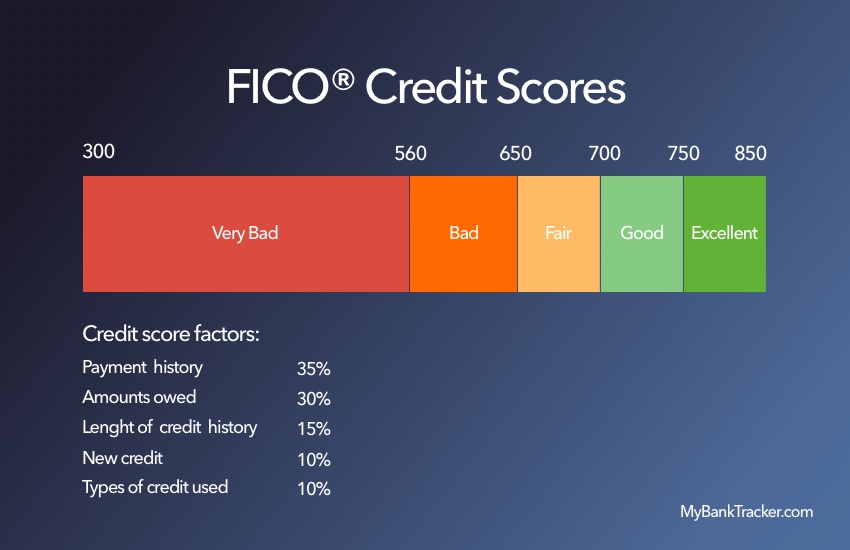

Most lenders consider your credit score and debt-to-income ratio when considering your application.

Improve your credit

Credit scoring formulas use information from your credit report to create your numerical score. Start by verifying information in the report is correct.

You can get a copy of your credit report from each major credit bureau using AnnualCreditReport.com. If you find errors, dispute them.

Credit scoring formulas often heavily factor in your credit utilization ratio as part of your score. This ratio measures the amount of credit you have used against your credit limits.

Paying down a maxed-out credit card to a lower utilization ratio, such as 30%, could help improve your score. In general, the higher your score, the better your chance of being approved.

Lower your debt-to-income ratio

Your debt-to-income ratio is also important. It measures your monthly debt payments against your monthly income. It helps banks decide if you can afford to repay the loan.

You can lower this ratio by increasing income or decreasing debt payments. Increasing income may be the fastest way to improve this, but it must be documented. You may need a part-time job or to work for an app that can report your earnings, such as Lyft.

Lowering debt payments can also help, but your monthly debt payment must decrease. Paying down a mortgage or car loan won’t do this. That said, paying off one of these loans in full or paying down a variable payment debt, such as a credit card, would.

Take Action

Finding a personal loan isn’t hard, but finding your best option takes some time. We’ve helped eliminate some of the searching by providing our list of Montana’s best personal loan options.

Once you find your favorite from our list, compare it to online lenders. Get multiple quotes to ensure you get the best rates before finalizing your lender choice.

Frequently Asked Questions

How long does it take to get approved for a personal loan?

In the fastest cases, you can get approved for a personal loan in seconds or minutes. This can be slowed down if a lender needs more information or a human needs to review your application.

Some lenders have slower processes that take days, a week, or longer.

How long does it take to receive funds from a personal loan?

Funding speed varies by institution and by situation. Funds can often be disbursed as fast as the same business day.

You may find some instances or lenders that have slower funding timelines. In these cases, getting the funds may take a few days, a week, or longer.

Can I use a personal loan for any reason?

Most personal loan lenders don’t restrict the proceeds from a loan you receive.

Some exceptions exist. Most notably, debt consolidation personal loans may require you to send the funds directly to the debt you’re paying off.

Will applying for a personal loan affect my credit score?

A personal loan application requires a hard inquiry into your credit report. This will likely negatively impact your credit score by a small amount for a short time.

Prequalification checks that use soft inquiries won’t impact your score, but they can’t be used for formal approval.