The Best Personal Loans in Idaho for 2026

Personal loans generally allow you to fund whatever project you may be working on without putting up collateral.

Each lender has its own rules for personal loans. While many lenders have eliminated unnecessary fees and offer competitive rates, that isn’t always the case.

Sadly, many banks still charge outdated fees or higher than market interest rates as they prioritize profitability.

To help you find an excellent personal loan lender, we’ve researched lenders in Idaho and developed a list of the best options in the state.

The Best Personal Loans in Idaho

Wells Fargo

Wells Fargo’s personal loans are very flexible, which could help many potential borrowers. Loan amounts can be as small as $3,000 or as high as $100,000. Loan terms vary from one to seven years, as well.

The bank offers competitive rates with no origination or closing fees. You don’t have to pay prepayment penalties if you want to pay the loan off early.

If you get approved, funding can come quickly. The bank says funds may be disbursed as soon as the same or the next business day.

Read our review of Wells Fargo personal loans.

U.S. Bank

U.S. Bank’s personal loans have a minimum balance of $1,000. The bank can loan U.S. Bank customers up to $50,000 on loans from one to eight years. Non-customers can borrow up to $25,000 on loans from one to five years.

Rates are competitive and rate discounts may exist if you set up automatic payments. Loan approval often takes less than a minute but sometimes takes longer.

You don’t have to pay origination fees or prepayment penalties with personal loans from this bank.

Read our full review of the unsecured personal loans from U.S. Bank.

Zions Bank

Zions Bank appears to offer competitive rates on their loans that can be reduced by 0.25% if you sign up for automatic payments from a Zions Bank account. Minimum loan amounts start at $2,500.

Unfortunately, Zions Bank charges a $75 origination fee which most other lenders do not.

Compare Your Personal Loan Options

Find a personal loan that better fits your borrowing needs:

Methodology

We used June 2023 data from the FDIC to find the top 50 banks in the state based on the deposit market share metric–serving borrowers in major cities including Boise, Meridian, Nampa, Idaho Falls, and Caldwell.

After identifying the banks, we examined their personal loan products based on these features:

- Interest rates

- Loan terms available

- Loan amount range

- Fees

Do Online Lenders Offer Better Personal Loans?

Online lenders also offer personal loans that you can easily apply for. Online lenders have emerged as some of the most competitive options. They have low overhead costs and the technology necessary to speed the loan process up.

Digital-based lenders may offer fast approval in seconds or minutes. Loans that require further documentation take longer. Disbursement times with online lenders are generally fast, too. These lenders often provide low rates and fees, as well.

These lenders face tough competition. They also have to compete with other internet-based lenders and brick-and-mortar lenders.

This means they must continue to offer the best product at an affordable cost to win business.

Brick-and-mortar banks know they have to compete with online lenders and have improved their loan offerings, too.

Both types of lenders may even allow you to check the rates you qualify for with a preapproval application that doesn’t impact your credit score.

To find the best loan today, you likely need to shop around with both physical and online lenders. Then, take the loan option that best meets your needs at the lowest costs possible.

How to Determine Which Personal Loan Is Best for You

Finding the best personal loan for you could be very different from someone else looking for a loan.

You may want to get a small personal loan with a quick approval and disbursement process. Others may want a larger personal loan with the lowest possible costs.

Here are a few personal loan concepts you may want to consider to find what’s most important to you.

Loan amount range

Each lender has minimum and maximum amounts they’re willing to lend. Most lenders have a fairly standard range, such as $3,000 to $35,000.

Some offer smaller loan amounts as low as $1,000 or less. Others may provide loans that can be as high as $100,000.

Make sure your lender has a personal loan option with the amount you need to borrow before applying.

Rates

The interest rate you qualify for likely has the most significant influence over your loan costs if all other factors are equal. Finding a lender with the lowest rates will likely save you money over the life of a loan.

Rates may be less important if you plan to pay the loan off early.

Fees

The best lenders today generally don’t charge a lot of fees. While almost

every institution will charge you late fees, application, and origination fees are no longer common.

These costs add to your loan. In particular, origination fees can add a hefty cost.

A 1% origination fee on a $25,000 loan results in a $250 fee. This fee is usually taken out of your loan proceeds. As a result, you’d only receive $24,750 from your $25,000 loan.

Watch out for prepayment penalties, too. These can be an issue if you plan to pay the loan off early.

Fund disbursement timeline

Loan proceeds are normally paid out faster today than in the past. Some lenders can get your funds to you as soon as the same or the next business day after loan approval.

Other lenders have slower processes that may take a week or more to get you the funds from your loan.

Loan term options

Most personal loan lenders offer options in the 3-5 year range. Some have shorter loans, such as one year. Others may have loans that last seven or even ten years.

Rate discounts

Your personal loan may have an option for a relationship or auto-pay discount. Ask a lender if they offer any rate discounts before determining whether their rates are competitive or not.

What You Need to Apply for a Personal Loan

To make the application as smooth as possible, you should be prepared to have the following information ready before applying.

- Identification documents (Driver’s license, passport, etc.)

- Documentation of your address (Utility bill, mortgage statement, etc.)

- Social Security Number

- Income and employment information (W-2, 1099s, tax returns, etc.)

- The highest level of education reached or completed

- Desired loan purpose

- Desired loan amount

- Desired loan length

How to Increase Your Odds of Approval

No one can guarantee you that you’ll get approved for a personal loan. Each person has unique circumstances that impact their eligibility.

You can work to increase the odds of getting approved based on how lenders evaluate applications. Lenders generally look at your credit score and debt-to-income ratio.

Check your credit first

Start by getting a free copy of your credit report from Experian, Equifax, and Transunion using AnnualCreditReport.com (a government-sanctioned website).

Review these credit reports for errors that could hurt your score and dispute them.

Improve your credit score

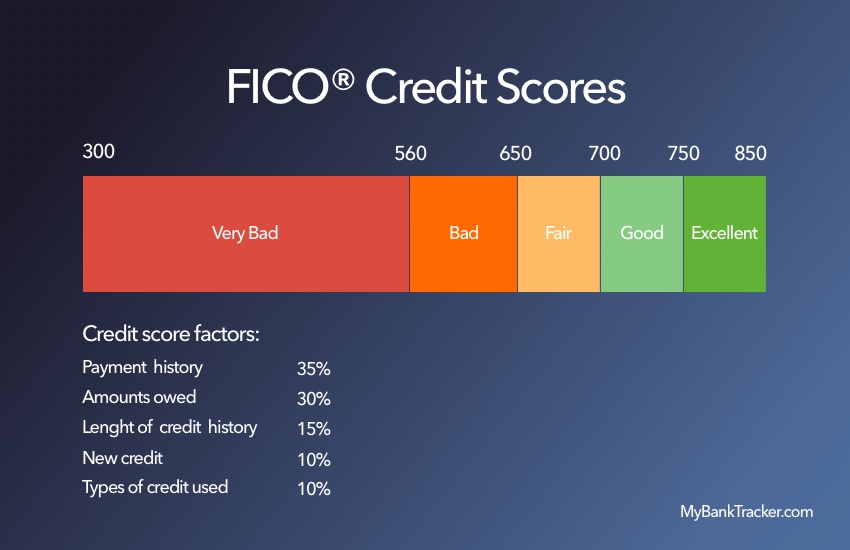

Next, work on your score itself. You can do this by educating yourself about the credit scoring formulas.

Most formulas heavily weigh your credit utilization ratio as a scoring factor. This measures the amount of debt you have against your total credit limits.

You can lower this ratio by paying down debt, such as a credit card.

For example, a credit card with a $10,000 limit and a $6,000 balance has a 60% ratio. If you pay it down to $3,000, you’ve decreased the ratio for that line of credit to 30%.

Lenders also use the debt-to-income ratio, but you won’t find it on your credit report. This is calculated by dividing your monthly debt payments by your monthly income.

Eliminate or lower your monthly debt payments to improve this ratio. You could also increase your income to do this. Getting a part-time job or a side gig may be a quick way to accomplish this.

Moving Forward With Your Best Personal Loan Option

Once knowing what you value in a personal loan, compare your needs to the top Idaho personal loan lenders we’ve identified. You can then compare your top choice from our list to other online and physical lenders to find your favorite option.

Remember, it pays to shop around once you get rate quotes. Each lender evaluates loan applications in their way, which may result in different rates from different lenders.

If all other loan terms are equal, the lender with the lowest rate will likely have the lowest overall cost.

Frequently Asked Questions

How long does it take to get approved for a personal loan?

Personal loan applications often go through automated processes that could approve or deny your loan in seconds or minutes. If a lender needs more information, the process may become a manual process that takes longer.

Other lenders may have slower processes that could take a week or longer to give you an approval decision.

How long does it take to receive funds from a personal loan?

Many lenders offer funds disbursement from approved loans as quickly as the same business day or the next day after approval. Some institutions may take longer, such as a week or more, to disburse funds.

Can I use a personal loan for any reason?

Personal loans generally allow you to use the funds for any purpose. Some loan types may require you to use the funds for a particular reason.

For example, debt consolidation personal loans may require you to pay off old loans directly with the loan proceeds.

Will applying for a personal loan affect my credit score?

A loan application results in a hard pull on your credit report. This will slightly decrease your credit score in the short term.

Preapproval applications at some banks use a soft pull that doesn’t impact your credit score. You still have to make a formal application, though. That means you will end up with a hard inquiry before getting a personal loan.