The Best Personal Loans in Delaware for 2026

If you don’t have home equity or other collateral to put up for a loan, you may want to look into an unsecured personal loan.

Most banks and lending institutions offer these loans. Not all lenders are equal, though.

Some offer competitive rates and don’t charge origination or application fees. Others may charge higher interest rates and origination fees to make their loans more profitable to the bank.

To help you find the best personal loan for your situation, we’ve researched loan options in Delaware to find the top lenders. Here’s what you should know.

The Best Personal Loans in Delaware

M&T Bank

M&T Bank offers personal loans with a minimum borrowing amount of $2,000 that could increase to as high as $50,000. Loan terms must be between one and seven years.

These loans do not charge application or origination fees. Prepayment penalties do not exist with these loans either.

After applying, you could get approved and have your funds disbursed in 24 hours or less. Some applications may take longer.

TD Bank

TD Bank’s personal loans have a relatively restrictive three to five-year repayment period but have loan amounts as small as $2,000 and as high as $50,000. You won’t have to pay application fees, origination fees, or prepayment penalties.

Straightforward applications that do not require additional documents can be approved and funded as quickly as one business day.

TD Bank has a preapproval process that allows you to check your rates before formally applying with no credit score impact.

Wells Fargo

Wells Fargo provides a wide range of personal loan options that are fairly flexible. Loan amounts vary between $3,000 and $100,000 and terms can be as short as one year or as long as seven years.

Interest rates from the bank appear competitive. Qualified customers may receive a relationship rate discount, as well. You won’t have to pay an application fee, origination fee, or prepayment penalties on Wells Fargo’s personal loans.

Funding for loans can be as fast as the same or the next business day if you qualify.

Methodology

To find the top personal loans in Delaware, we identified the top 50 banks in Delaware based on deposit market share (according to FDIC June 2023 data).

We then examined each institution’s personal loans based on the following factors:

- Interest rate

- Loan length options

- Loan amount range

- Fees charged

- Prepayment penalties, if they exist

Are Online Personal Loans Better?

If you haven’t considered online personal loan lenders, you definitely should. These lenders often have some of the most competitive rates and terms.

These online institutions compete with other online lenders and brick-and-mortar banks. They often offer fast application decision times and funding times to stand out. Application decisions can often happen in seconds or minutes with funding as soon as the same or the next business day.

If you want to check what rates you may qualify for, many online lenders offer preapprovals that don’t impact your credit score. You still have to formally apply to get a final decision, though.

Physical lenders aren’t obsolete. They know they have to compete with online lenders and many have improved their processes and terms. When shopping for a personal loan, consider online and physical lenders to find the best deal for your situation.

Identifying the Best Personal Loan for You

Getting caught up in what others think is the best loan is easy. Others don’t know your personal circumstances, though.

Instead, focus on what’s most important to you. Here are a few ideas that may help you identify your priorities.

The amount you can borrow

Each lender has different loan amounts they’ll let people borrow. Some banks have narrow ranges, such as $3,000 to $25,000. Others have more comprehensive options that go as high as $100,000.

If you need a small loan, you’ll need to seek a lender offering lower amounts, such as $1,000. They exist, but not all lenders have this as an option.

Interest

If all other loan terms are equal, finding a loan with the lowest interest rate will save you the most money. Each lender may assign you a different interest rate, so it makes sense to shop around.

Interest rates often vary by loan term, too. Longer-term loans tend to have higher rates than shorter-term loans.

Fees you pay

Personal loans at the best lenders don’t come with many fees anymore. You can expect to pay late fees if you miss a payment deadline, though.

Application and origination fees aren’t standard anymore. Neither are prepayment penalties.

Still:

You should watch out for these fees.

In particular, origination fees can be very costly. A 1% origination fee on a $40,000 loan will cost you $400. It’s usually paid out of your loan proceeds. That means you’d only receive $39,600 when your funds are disbursed.

Fund disbursement

Overall, lenders have improved fund disbursement timelines with some offering funds as soon as the same or the next business day. Some may have slower turnaround times that may take a week or longer.

Loan length

When shopping for a loan, look to see what loan lengths are available. Three to five-year loans are most common, but loans as short as one or as long as seven to ten years do exist.

Interest discounts

Some personal loans offer interest rate discounts based on your relationship with a bank or if you sign up for automatic payments. Ask if you qualify for any discounts before applying.

Necessary Information to Apply for a Personal Loan

Applying for a loan is easier if you have the documentation ready before applying. Here’s what you should expect to provide when applying for a personal loan.

- Identity documents (Driver’s license, passport, etc.)

- Proof of address (Utility bill, mortgage statement, etc.)

- Social Security Number

- Income and employment information (Pay stubs, 1099s, tax returns, etc.)

- Your highest level of education

- Loan amount you want to borrow

- The desired length of the loan

- Purpose of borrowing funds

Help Your Approval Odds

Getting approved for any type of loan, including a personal loan, is never guaranteed. Many factors go into the decision process and can vary from lender to lender. However, general guidelines can help you increase your odds of approval.

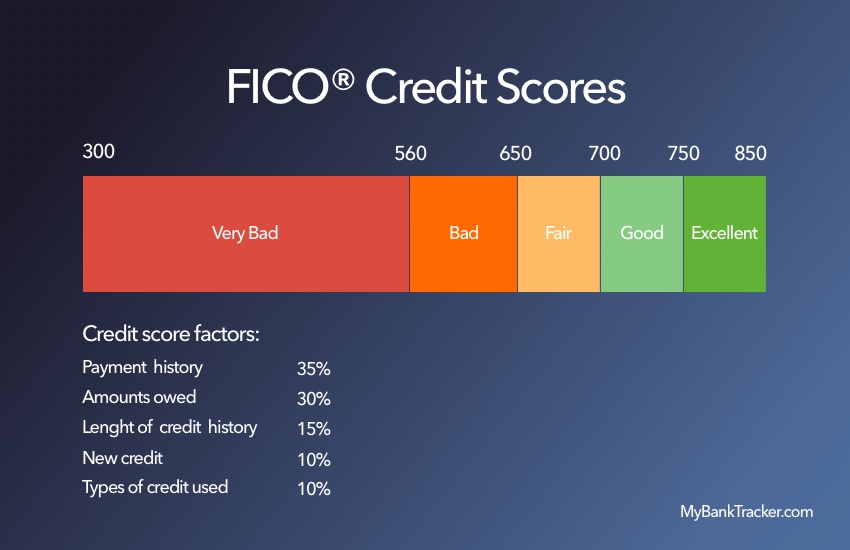

Lending institutions will almost always look at your credit score and debt-to-income ratio when considering your application. Improving these metrics could help your chances.

You can start by visiting AnnualCreditReport.com (a government-sanctioned website) to request a copy of your credit report from each of the three major credit bureaus. Then, review the reports for errors and dispute any mistakes you find.

You can work to improve your credit score based on how the scoring system works.

Credit utilization

One potential opportunity is decreasing your credit utilization ratio.

This factor measures the amount of debt you owe compared to your credit limits. The easiest way to lower this is by paying down credit cards or other revolving balances.

Debt-to-income ratio

Your debt-to-income ratio may also be important. It measures your monthly debt payments compared to your monthly income. You can improve this ratio in two ways.

The first is reducing your monthly debt payments. You can pay off a loan in full or lower the balance on a debt with a payment based on your balance.

The other option is increasing your income. To do this quickly, consider adding a part-time job or a side gig, such as driving for Uber Eats.

Find Your Best Personal Loan

You can start your personal loan search by considering our top picks for Delaware. Then, compare your top choice to online lenders.

When looking for a loan, focus on your needs. While finding the cheapest loan is always a significant benefit, sometimes faster funding or other priorities result in picking another loan.

Frequently Asked Questions

How long does it take to get approved for a personal loan?

Approval times for personal loans are much faster today than in the past. If a lender can use an automated process, your loan could be approved in seconds or minutes.

Lenders may have to review applications for some situations manually. This may take a week or longer, depending on the lender.

A potential lender should be able to provide you with an approval timeline before you apply for a loan.

How long does it take to receive funds from a personal loan?

Some lenders can fund your loan as fast as the same or the next business day after approval. Not all lenders work that fast, though. You may have to wait a week or longer to receive your loan proceeds.

Ask your lender if they can provide a timeline for funding your loan before applying.

Can I use a personal loan for any reason?

Personal loans normally allow you to use the funds for any purpose with a possible exception for debt consolidation purposes. In these cases, the lender may directly pay off your old loans.

Some lenders may offer different rates based on your use of the loan. In these cases, the money may have to be used for that purpose.

Ask your lender to verify before taking out a loan.

Will applying for a personal loan affect my credit score?

When you apply for a loan, a lender makes a hard inquiry on your credit report. This action typically reduces your credit score by a few points for a relatively short time.

Some banks offer a preapproval process if you’re unsure if you will likely be approved. This may use a soft inquiry and these inquiries do not damage your score.

When you apply for the loan after preapproval, you’ll still have a hard inquiry.