How to Improve Your Credit Score by 100 Points

Improving your credit scores can save you money and open new financial doors.

Higher scores can increase your chances of being approved for credit cards and personal loans, in addition to getting lower interest rates on those credit lines.

Your credit can also affect other areas of your life, such as your ability to rent an apartment or get a job.

When you start from a low score, positive changes can have a dramatic effect. So, if you have bad credit, it might be possible to raise your credit scores by 100 points quickly.

Once you establish excellent credit, the same positive activity may only lead to a marginal increase.

Before diving into different ways to raise your credit scores, it can be helpful to understand what factors go into determining your credit scores – and how your score can affect how much you’ll pay for some of your biggest purchases in life.

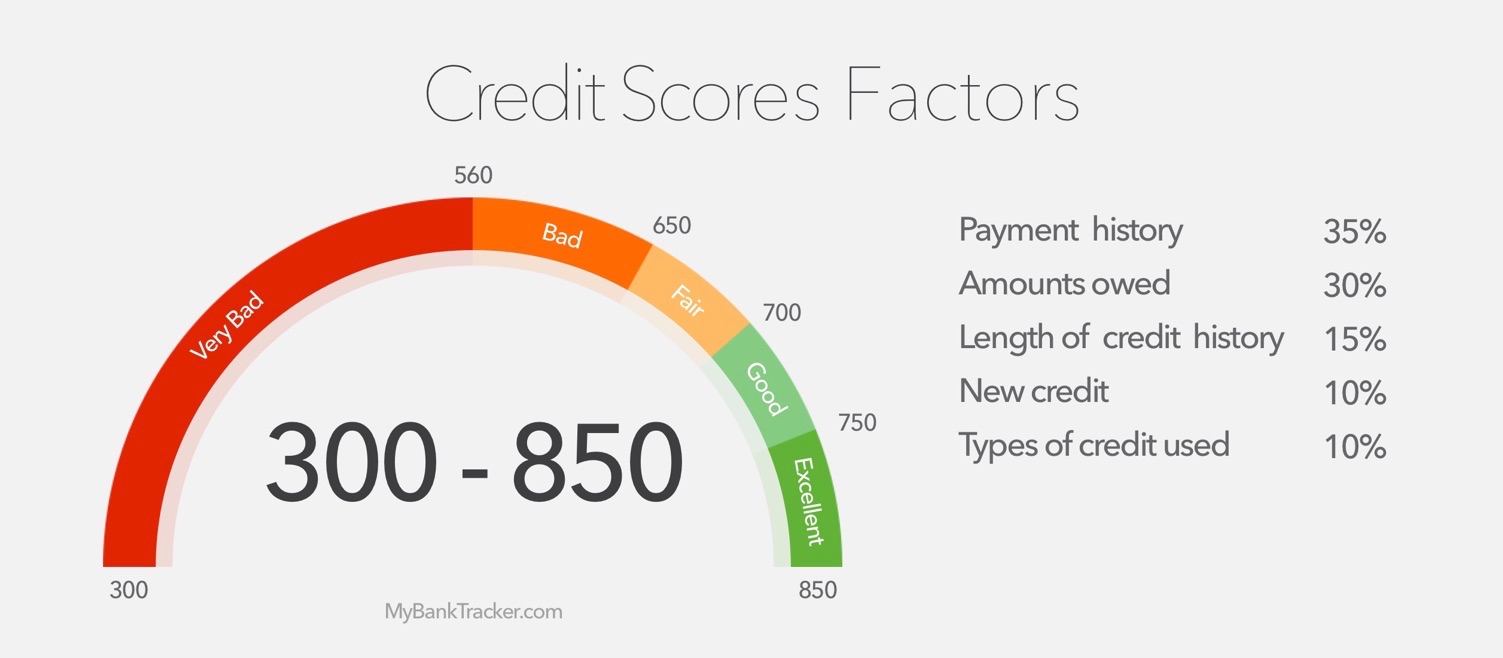

Factors That Influence Your FICO Scores

The Fair Isaac Corporation is most known for selling its FICO credit scores. It uses the information in your credit reports to calculate your credit scores through a top-secret formula.

More than 90% of the major U.S. lenders use FICO credit scores to help determine the risk in offering you credit or lending you money.

There are many different versions of FICO credit scores — each of which have different score ranges.

The standard FICO Score ranges from 300 to 850. The higher your score, the less risk you pose to lenders.

There are also industry-specific scores, such as FICO Auto Score, which range from 250 to 900.

While the exact formula FICO isn’t revealed to the public, FICO shares a big-picture look at the factors that affect your scores:

Payment History (35%)

The most important factor is your payment history.

Paying all your loan or credit bills on time will improve this portion of your score while making a late payment, having debt in collections, judgments, liens, and bankruptcies can hurt your score.

The severity of an incident and the time since it occurred can change the impact.

For example, being 30 days late on a payment isn’t as bad as being 90 days late, and a late-payment mark from six years ago won’t affect your scores as much as one from last month.

Amount Owed (30%)

FICO considers how many accounts have a balance and how much you owe versus your available credit.

On revolving accounts, like credit cards, this is called your utilization rate.

For example, if you have a credit card with a credit limit of $10,000, and you had a $2,000 balance during your last statement period your utilization rate is 20%.

A lower utilization rate is better for your scores. FICO considers your overall utilization rate and the utilization rate of each revolving account. For installment loans, FICO considers the portion of the original loan you’ve paid off.

Length of Credit History (15%)

The average age of your credit accounts, the age of your oldest account, the age of your newest account, and the amount of time since you’ve last used accounts can affect your score.

Credit Mix (10%)

The mix and a total number of different types of accounts, such as credit cards, installment loans, and a mortgage. Having various kinds of accounts can increase your score.

New Credit (10%)

FICO found when someone opens new accounts it may indicate they’re a greater risk to lenders. Opening a new account can hurt your score, but the impact is often minor and fades over time.

How to Improve Your Credit Scores Fast

There are many ways to raise your credit scores, but some take longer than others. For example, there’s no rushing increasing the age of your credit history.

If you want to improve your credit scores quickly, there are several methods to consider.

First off, you may want to start by requesting free copies of your credit reports from AnnualCreditReport.com.

You’ll need to know what’s on your reports before using some of these methods. Some banks and credit cards give you free access to one of your FICO Scores, which can help you track the effectiveness of your actions.

Remove Delinquency Marks

Getting delinquent marks off your credit report can have the greatest impact. Some may be errors, which you can dispute, but you can also try to remove non-erroneous marks.

Dispute Errors

Look over your credit reports carefully for errors, such as an account you didn’t open or an old negative mark that should have dropped off the report. You can contact the credit bureaus and file disputes online.

If the erroneous information was lowering your score, you could see a jump soon after it’s removed.

Ask Nicely

You can directly ask a lender or credit issuer to remove a late payment. You might need to make the request in writing, and there are templates of these goodwill or good-faith letters online.

Explain Why You Were Late

There’s a chance they’ll ask the credit bureaus to take the negative mark off your reports.

Your chances may increase if you’ve had a spotless record since the incident, you were going through a hardship at the time, or it was a legitimate accident – perhaps you used auto-pay and it was accidentally disabled by the issuer.

Pay for Delete

If you have an account in collections, you can ask for a pay-for-delete. With this arrangement, you pay the collector a portion or all of what you owe, and they agree to request the removal of the late-payment and collection marks from your credit report.

This tactic is controversial because even though you aren’t breaking any contracts or laws in asking, the collections agency might be breaching an agreement with the original lender or a credit bureau.

However, primary lenders might agree to the arrangement if there’s a legitimate reason behind the request.

Perhaps you went to the doctor and assumed the insurance covered the entire cost because you never got a bill, but in actuality, it was lost and the account wound up in collections.

Make sure you have a written agreement with the collections agency that they will ask the credit bureaus to remove the mark before sending payment.

1. Vacate a Judgement

Judgments can remain on your credit record for up to seven years. But, if you didn’t get notice of the judgment, perhaps because the creditor tried to serve the notice to an old address, you might be able to get it vacated.

You’ll need to make a Motion to Vacate in a small claims court. If a judge approves your proposal, you could get the judgment dismissed and the delinquent mark off your credit report.

2. Pay Off Old Debts

Paying old accounts that are late or in collections could raise your credit scores even if the delinquent marks aren’t removed from your reports.

It can also keep the creditor from getting a judgment, which would further hurt your credit.

3. Lower Your Utilization Rate

Your utilization rate refreshes each month when the issuers report your balances. You can quickly see an increase in your credit scores if your utilization rate is high and you lower.

Try to pay down balances so they’re equal to just a small portion of your credit limit.

Some say to keep your utilization rate below 30%, and others say below 20. FICO doesn’t share an exact target to aim for, but lower is better.

You may have a high utilization rate even if pay your bill in full because FICO compares the balance reported on your statement to your credit limit.

Consider using your credit card less, or making an early payment before the statement period closes, so a smaller balance gets reported.

4. Increase Your Credit Limits

If you’re having trouble paying down balances, you can also decrease your utilization rate by increasing your credit limit.

However, some card issuers may use a hard inquiry to review your credit when you make a request. This could hurt your credit score, especially if there are several hard inquiries from new accounts and requests.

The impact of a single hard inquiry may be offset by the score increase from your lower utilization rate.

However, because of the potential score drop, it may be better to begin by focusing on lowering your reported balances.

5. Open a Credit Account

If you have low credit scores and don’t have a credit card, getting a secured credit card can be a good place to start.

Using the card for a small purchase each month and making on-time payments can help your payment history and utilization rate. The new card will also add to your mix of credit accounts.

6. Don’t Close Accounts

Don’t close credit accounts while you’re trying to improve your credit scores. Doing so can lower your total available credit, leading to a higher utilization rate.

Many of these methods of improving your credit score can be completed today with immediate effects on your credit score.

You’ll still have to wait for all your lenders to report the changes to the credit bureaus. So, within the next month, your credit scores can jump by 100 points or more.

How Your Credit Score Can Affect Your Future Mortgage Rate

| Credit Score Range | 30-Year Fixed Rate Mortgage | 5-year fixed rate mortgage | 7/1 ARM |

|---|---|---|---|

| 620-639 | 4.684% | 4.016% | 4.506% |

| 640-679 | 4.138% | 3.47826% | 3.96% |

| 660-679 | 3.708% | 3.04% | 3.53% |

| 680-699 | 3.494% | 2.826% | 3.316% |

| 700-759 | 3.317% | 2.649% | 3.139% |

| 760-850 | 3.095% | 2.427% | 2.917% |

How Your Credit Score Can Affect Your Next Car Loan

| Credit Score Range | 60-Month new Car Loan | 40-Month Used Car Loan |

|---|---|---|

| 500-589 | 14.824% | 16.325% |

| 590-619 | 13.74% | 15.086% |

| 620-659 | 9.398% | 10.186% |

| 660-689 | 6.747% | 7.599% |

| 690-719 | 4.656% | 5.322% |

| 720-850 | 3.331% | 3.778% |

How Your Credit Score Can Affect Your Next General Loan

| Credit Score Range | HELOC | Home Equity Loan |

|---|---|---|

| 620-639 | 10.680% | 10.164% |

| 640-669 | 9.180% | 8.914% |

| 670-699 | 7.680% | 7.414% |

| 700-719 | 6.305% | 6.639% |

| 720-739 | 5.055% | 6.139% |

| 740-850 | 4.680% | 5.837% |