How to Get Approved for Personal Loans With Bad Credit

With bad credit, getting a personal loan can prove to be quite difficult because banks don’t want to take on too much risk when lending to someone who has a bad history with borrowing.

Despite the tough circumstances, you might be in need of a personal loan. It can help with goals such as consolidating high-interest credit card debt.

Learn what you can do to increase your chances of getting approved for a personal loan even when you have bad credit.

What If You Have Bad Credit?

Having bad credit is often confused with having no credit. In many instances, they’re nearly alike. Neither one is a good thing to have, yet both are only as temporary as you allow them to be.

Unfortunately, bad credit gets a bad rap because it makes a slightly worse impression than no credit to lenders if you’re on the market looking for a new loan.

The good news is that just like having zero credit, you can turn bad credit around in a better direction.

One way to start is by applying for a personal loan, but before you begin, keep in mind some special steps to take if your struggle is one with bad credit.

What Does It Mean to Have Bad Credit?

No credit means you have no credit history whatsoever.

You’ve never had a credit card, taken out a car loan, mortgage or borrowed money for college, or repaid a balance on any type of credit-based account.

Your financial life has consisted of cash, debit or checking transactions only, but they do nothing to your credit.

Zero-credit tells lenders that you have no experience with credit, but it doesn’t tell them how you’d manage your credit if you had a credit card or loan in your name.

If you pursued a personal loan from a credit union or alternative lender, they may analyze other criteria, like your character, your income, or you are the balance between your checking and savings account to determine how financially responsible you might be in the absence of a credit history.

Thus, while no credit doesn’t make a positive impression, it can make a promising impression on a prospective lender.

Bad credit, on the other hand, means that you have an established history of credit usage, but through a series of financial mistakes, such as errant or delinquent repayment activity, defaulted loans or other factors, your credit score’s taken a major hit.

So, while bad credit indicates that you have more than enough credit activity than the person with no credit, there are too many significant blemishes on your credit report that may discourage lenders from wanting to work with you.

The key is to identify where the problem lies, and how to effectively fix it.

Bad, Good, or Just Okay Credit? How to Find Out

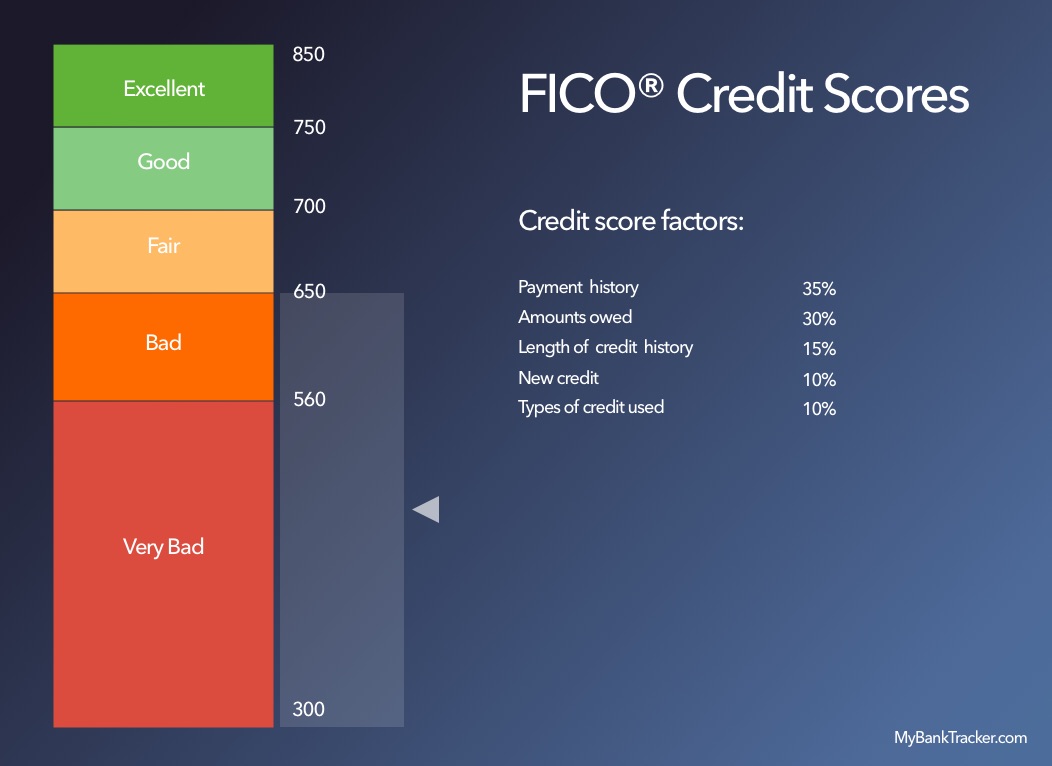

Credit scores range from excellent to very bad on the FICO score scale, and look something like this:

A bad credit score would essentially be anything below 650. Fall too far below that number, and you might be hundreds of points below where you need to be if excellent credit is a goal.

How do you know if you have bad credit, or if you’re just imagining it? If you’ve been rejected for credit recently or offered an interest rate that’s through the roof, there’s a sign that your credit isn’t reaching its full potential.

Check your credit report. It’s free through AnnualCreditReport.com, a government-sanctioned website. Your credit report should contain a detailed list of every single credit account you’ve ever had in your name: active credit card accounts, loans that are both existing or fully paid off, plus your monthly repayment history for each.

Demonstrate too many months where you were late with a loan payment, made a partial payment, or didn’t pay at all, and it’ll show with a red check mark for the particular month you were delinquent. Too many of those and your credit is negatively impacted.

The worst thing you can do to an otherwise superb credit score is to have accounts that have been in default or sent to collections.

It sends the message that you’re a lending risk; that you can’t be trusted to repay someone else’s money without defaulting, and that’s a chance most lenders aren’t willing to take.

Fix in credit report errors now

However, the very reason why your credit is less than stellar may or may not be any fault of your own.

Go over your credit report again — carefully — to see if there any errors.

Inconsistencies can negatively affect your score. It could be a wrong digit in your Social Security number or a past loan that’s listed as default when it was actually paid off years ago.

Or, you may share the same name as someone else with awful credit, and both of your reports have been inadvertently crossed. (Indeed, even the credit bureaus are guilty of committing errors from time to time!)

Contact one or all of the reporting agencies (here, TransUnion, Experian, and Equifax) to dispute discrepancies you believe may be affecting your credit.

If no errors are found (or they’ve been dismissed), then it’s time to take responsibility for your own bad credit.

That doesn’t necessarily mean sitting around moping with a 475 FICO score staring you in the face. There are plenty of steps to take to rebuild your credit, and thankfully, you don’t need to delay seeking a loan.

Finding a Personal Loan When You’ve Got Bad Credit

Personal loans are personal in nature, literally. They’re granted to borrowers with few restrictions or conditions, so you can use them for a slew of reasons, like paying down existing debt (such as a student loan).

In a pinch, when money is tight, a personal loan can help finance a big purchase, a vacation, or cover the bill for holiday shopping.

And you can borrow anywhere from $1,000 to $50,000, a wide range ensuring you don’t borrow too much money, or too little.

Personal loans tend to come with high interest rates, partially because of the flexibility they offer borrowers. And for the person with bad credit, that means personal loan interest rates can venture into the double digits (think 20% to 30% APR).

Tread into delinquent territory with a personal loan, and a bad credit score can worsen.

But let’s stay positive here. OK, you have bad credit, but you’re willing to turn over a new leaf.

The problem is that most conventional lenders aren’t budging, doors are closing in your face, and nobody’s willing to lend you money, at least not without loan terms that you can’t manage.

Try some of these alternative lending outlets who may be willing to work with subprime borrowers:

Online lenders are faster and cheaper

Because online lenders are free of a lot of the operating and overhead expenses of a brick and mortar bank (due to having no physical branch locations), they’re not as pressured to profit from lending money only to borrowers with excellent credit.

Their ultimate goal is to satisfy customers with attractive services and fair terms and conditions.

Online lenders may also be more willing to work with someone with poor credit, offering them a personal loan with lower interest rates and a manageable repayment schedule.

Seek out a peer-to-peer or P2P loan

There are numerous online platforms where borrowers are also lenders and may loan you funds without having to deal with a bank as a middleman.

Bad Credit Getting Approved for a Personal Loan

Bad to very bad credit presents a major challenge getting approved for any loan, and personal loans are no exception to that (sometimes) rule.

Sometimes, increasing your chances is simply a matter of providing a lender with all the documentation they need — which itself sends a good impression.

Online or in person, don’t forget some of these essential forms:

Personal ID

A lender may need proof of driver’s license, birth certificate, Social Security card, or a passport — usually a combination is needed, though a passport is often all that’s required.

Make sure each one includes your date of birth. (In some cases, you may need to provide your mother’s maiden name.)

Proof of address

Provide a utility or cable bill, rent statement or other recent document or piece of official mail clearly displaying your current mailing/billing address.

Depending on the lender, they may request a history of previous addresses or your current employer’s address listed on your loan application.

Proof of income and debt

It goes without saying that honesty is the best policy on a loan application, so if your credit is bad, don’t lie about it. Include a copy of your credit report (if the lender hasn’t checked themselves), including any instances of debt or negative credit activity.

Don’t worry — by providing proof of income and financial activity, like pay stubs or bank/tax statements, positive money habits can counterbalance the negative on your application.

Improving Those Chances of Getting a Personal Loan

Bad credit makes it difficult to get approval for a loan, and personal loans are no exception. But it’s not impossible.

Just like you might seek out an alternative lender, improve your credit through some alternative methods:

Find a secured credit card

A secured credit card is a basic credit card designed for customers with no credit or poor credit who can’t qualify for a regular credit card.

Simple and no frills, most secured cards come with no rewards, and you’ll be required to make a cash down payment that acts as your credit limit and “secures” your account.

Per usual, spend no more than 30 percent of your credit limit, and pay off your balance in full, on time each billing cycle, and watch your credit score start climbing from bad to good to excellent.

Report your rent

Apartment dwellers see no impact to their credit report when they pay their monthly rent, so if you have bad credit, it can be frustrating to see none of that money count towards your FICO digits.

But that’s not entirely true; you can have your rent reported on your credit history just like a mortgage or home loan would, but you need to request it.

Try one of several agencies that specialize in rent reporting, like Rental Kharma, to get started.

Pay down student loans

Borrowing money for college helps further not only your education, but your credit score.

Timely repayment of your loans counts towards a positive credit history, and that reflects on your FICO score.

Federal student loans through the U.S. Department of Education don’t take credit history into account for borrowers, so college-bound students are guaranteed approval at low-interest rates.

You may even consider refinancing your student loans, to help you better manage your monthly payments and pay them down quicker.

These are just a few ways to get your credit into shape if your has taken a hit. Depending on your financial needs, you may choose one of these avenues before taking out a personal loan, or borrowing in tandem for increased credit strength.

Conclusion

In conclusion, it’s fair to say that bad credit isn’t so bad after all, and when it comes to finding a personal loan, poor credit isn’t something to take personally.

Look at your credit score like a variable interest rate; it’s never fixed in one place, and the higher your score, the lower the rates you can obtain.

Bad credit is really just a state of mind, a financial situation that’s easily improved with a positive mindset, new habits, and alternative ways to build your credit profile and borrow money.

Start by setting goals. Don’t expect excellent credit overnight. Consult your FICO score and credit report throughout the year to see where you stand.

Aim to raise your credit score by X amount of points within the next six to 12 months, or further out.

By the time you reach the “good” credit score range, the loans and low interest rates you’ll start qualifying for will improvements to your credit.