Credit Counseling vs. Debt Settlement: What is Better for You?

With debt such a common problem, you might be searching for a way to get out of the financial hole you’ve found yourself in.

Credit counseling and debt settlement are two approaches that you may have seen offered by various companies and organizations.

They often claim to help you save thousands of dollars.

Learn about these options to see how they work and which one you might consider to help you get out of debt.

What is Credit Counseling?

Credit counseling agencies help people get out of various types of consumer debt, such as credit card or auto debt.

The goal of credit counseling is to form a plan for handling your debt and to get the tools you need to follow through on that plan.

When you visit a credit counselor, you should bring a copy of the latest statements for all your financial accounts.

This includes your bank accounts, investment accounts, and loans. You should also bring a copy of your most recent paycheck.

You can work with the credit counselor to develop a budget that includes a plan for paying off your debts.

Setting you on the right course

Credit counselors might also offer personal finance courses.

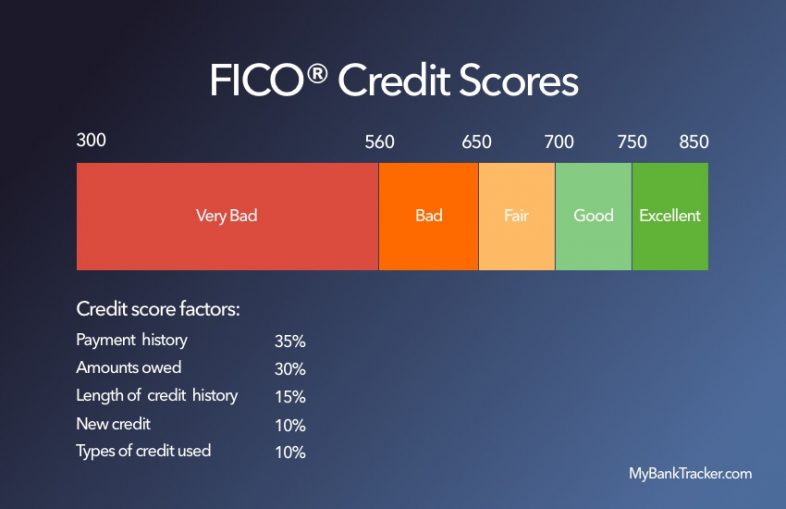

You can learn about managing spending, how to avoid debt, how credit scores work, and more.

All these services are designed to help get your financial life back under control and to manage it effectively going forward.

Some counselors also offer debt-management plans.

Under these plans, the credit counselor will consolidate all your debts into a single loan. You make a single payment to the credit counseling organization each month or pay period.

Typically, credit counseling organizations are non-profits that are focused on educating consumers.

What is Debt Settlement?

Debt settlement is a process by which you convince your creditors to accept less than full payment for your debts.

For example, if you owe $10,000 to a credit card company, you might be able to settle the debt for just $8,000.

If you can convince the lender that you cannot pay the debt in full, they might accept the amount that you offer just so that they get some return on the loan.

Debt settlement programs are usually offered by for-profit companies.

When you contract one of these companies’ services, they agree to negotiate on your behalf.

In exchange, you pay a fee to the company in hopes that it will negotiate a significant reduction in your debt.

There are a couple dangers to signing up for a debt settlement plan.

Stop making payments

The first is that debt settlement programs often require you to stop paying any of your loan bills.

Instead, they instruct you to deposit that money into an escrow account. You may be required to do this for years.

At the end of the program, the debt settlement company will use the funds in this account to settle the debt with the creditors.

The danger is that if you fail to make deposits to the escrow account, you could be forced to drop out of the program.

If that happens, the debt settlement company can keep all the money you’ve deposited, and you’re left with the accrued interest and fees on your debts.

More importantly, this will cause your credit score to drop significantly because your missed payment will be reported to the U.S. credit bureaus.

No guarantees

Another risk is that there’s no guarantee that your creditors will agree to settle your debt.

Some creditors may demand you pay the full amount no matter what, and no amount of negotiating from the debt settlement company will help.

What is the Difference?

The primary difference between credit counseling and debt settlement is how they aim to help you get out debt.

Credit counseling is focused on consumer education.

The credit counselor usually won’t do any negotiating on your behalf.

Instead, the counselor will help you come up with a plan to handle the debt on your own.

If you follow the counselor’s program, you’ll come out with a better handle on your finances, and likely won’t get back into debt again.

Debt settlement is not focused on education.

Its sole goal is to reduce your debts by as much as possible to make them easier to pay off. While this can help you save some money, you won’t learn any new financial skills and may have trouble avoiding going back into debt.

What Do They Cost?

Credit counseling tends to be offered by non-profits. Debt settlement is usually offered by for-profit companies.

For that reason, credit counseling is usually the cheaper option. In fact, many non-profit credit counselors don’t charge any fees for their educational services.

You may pay a small fee to enter a debt management program with a credit counselor.

Debt settlement companies tend to charge percentage-based fees.

The fee is either a percentage of the amount of debt you enroll or the amount of debt that the company negotiates away. You might wind up paying 10%, 20%, or more on the amount you enroll or the amount you save.

If you save a lot of money, this can be worth it, but if the company can’t negotiate away much of your debt, the fees can be a lot to handle.

What to Look For?

The precarious financial position of people in debt often means they’re also in a precarious emotional position.

That makes it easy for less than legitimate companies to scam people with fake debt settlement programs.

Watch out for companies that advertise government programs to bail out people in debt. These companies might also offer guarantees to erase your debts, or charge fees up front.

These are signs that the company is a scam.

When looking for credit counseling services, look for non-profits that don’t charge any fees for their services. With so many out there, why pay when you can find a free credit counseling service?

Tips

You can DIY debt settlement to avoid fees

One thing to consider is that you don’t have to contract a debt settlement company to settle your debts.

It might feel strange to try, but don’t be afraid to reach out to your creditors and ask to settle your debt.

Explain your financial position and that you’ll have trouble paying your debts in full.

You might be able to convince your creditors to settle the debt without paying the fees charged by debt settlement companies.

Consider consolidation and refinancing

If you have a lot of debt, especially high-interest debt, you can pursue consolidation or refinancing.

When you refinance, you take out a new loan and use the money from that loan to pay off your existing debts.

This can turn multiple different loans into one, easy-to-handle loan.

Instead of having multiple payments to make every month, you’ll be left with just one payment to make. This can make it easier to get by month-to-month.

Refinancing also means you’ll get a new interest rate, and have the option of extending the amount of time it will take to pay the loan off.

If rates have fallen since you took out the original loan, this can save you money. It will also reduce your monthly payment, making your loans easier to handle.

Try ton combine refinancing with the education you receive from a credit counseling program.

That will help you get your finances under control as quickly as possible.

Use financial hardship programs

If your problem is significant student loan debt, look into the hardship programs available to you.

Federal student loans offer income-based repayment plans.

Under these plans, your monthly payment is limited to a percentage of your monthly income, making it easier to handle.

You might also be eligible to apply for loan deferment and forbearance.

When you defer your loan, you won’t be required to continue making payments on it. Just remember that the loan will continue to accrue interest during this time.

Forbearance also lets you postpone repayment for several months.

Which is Better for You?

Choosing between credit counseling and debt settlement can be difficult.

We recommend that you pursue credit counseling before looking into debt settlement.

Credit counseling will give you a chance to handle your debt yourself without paying fees to another company to handle it for you.

It will also equip you with the tools that you need to manage your money after you get out of debt.

If, after credit counseling, you are still having trouble handling your debts, then you should consider debt settlement.

If you’re up for it, try to settle your debts on your own before paying a company to do it for you. The savings can be significant.

Just be aware that settling for less than the full amount you owe can negatively impact your credit and make getting loans in the future difficult.

Conclusion

Credit counseling and debt settlement are two different ways to accomplish the same goal: getting you out of debt.

Counseling provides you with the tools you need to manage your money, while debt settlement can help you save money on your debts.