Best Buy Credit Card 2026 Review

Best Buy store fans can choose from two different credit cards: the My Best Buy Credit Card and My Best Buy Visa Card.

Each Best Buy credit card offers benefits while using your card for shopping in-store.

Here’s how the two compare against each other and among other credit cards availa/0

Best Buy Credit Card vs. Best Buy Store Card

Both the store card and the credit card allow you to make purchase products from Best Buy and pay them off later, either monthly or all at once.

You can also apply for either through the Best Buy online application process.

Once you are approved, you can choose between the two. You cannot use the store card outside of Best Buy.

You will, however, earn 5% rewards for Best Buy products.

If you happen to be an Elite Plus member (which is based on your annual spending — see below for more information), you’ll earn 6%.

My Best Buy Visa cardholders also earn 2% back on dining out, groceries, and gasoline, and 1% back on everything else.

Both cards allow you to choose the 5% option for Best Buy purchases or special financing. For example, on purchases totaling $199 or more, you get six months to pay off your balance without any interest.

On purchases totaling $399 or more, you get 12 months at no interest. On purchases of more than $599 get 18 months, and those totaling more than $799 get 24 months.

Elite vs. Elite Plus Status at Best Buy

Best Buy operates the My Best Buy Rewards program that is free for anyone to join.

The program’s benefits include rewards on every Best Buy purchase, free shipping, and special offers.

However, there are two other program tiers that can provide even more perks for the frequent Best Buy shopper: Elite and Elite Plus.

The rewards earned under all Best Buy cards will be saved under the My Best Buy Rewards program.

Elite and Elite Plus statuses in this program require $1,500 and $3,500 in purchases per calendar year, respectively. Each of these levels provides additional perks and benefits. They include:

- Points bonuses

- Free standard and expedited shipping without minimums

- Extended periods of time for returns and exchanges

If you happen to shop frequently at Best Buy, these elite status levels can result in more points and more savings on each purchase.

Redeeming your best buy rewards

You can earn 2.5 points for each dollar spent with Best Buy, which is equal to 5%. Every 250 points is worth a $5 Best Buy certificate that you can use toward your next purchase.

However, this limits your rewards to only those made at Best Buy stores. Other credit cards allow you to redeem as a statement credit toward any purchase, or even for cash and gift cards with other retailers.

Because of this, your rewards certificates are only useful if you continuously shop at Best Buy.

This program also offers free standard shipping on orders $35 or more as well as access to special sales and promotions.

My BestBuy Programs

| My Best Buy programs | Core members | Elite members | Elite Plus members |

|---|---|---|---|

| Shipping fees | Free 2-Day shipping (with no annual fee) on thousands of items available on BestBuy.com | Free 2-Day shipping (with no annual fee) on thousands of items available on BestBuy.com | Free 2-Day shipping (with no annual fee) on all items availble on BestBuy.com |

| Rewards Points if you are My Best Buy credit card user | 5% back or 2.5 points for every $1 spent on eligible purchases | 5% back or 2.5 points for every $1 spent on eligible purchases | 6% back or 3 points for every $1 spent on eligible purchases |

| Rewards points when using another qualifying form of payment | 1% back or 1 point for every $2 spent | 2% back or 1 point for every $1 spent | 5% back or 1.25 points for every $1 spent |

| Returns/Exchanges | 15 day return/exchange period | Extended 30 day return/exchange period | Extended 45 day return/exchange period |

| Specials | Member-Only Access to special offers and pre-sale exclusives, such as Black Friday Early Access event | Member-Only Access to special offers and pre-sale exclusives, such as Black Friday Early Access event |

>

Best Buy Credit Card Fees

The store card carries a high APR, for purchases that are eligible for the 48-month reduced rate plan. This card has no fees except for a late payment fee and returned payment fee, each $39. It can only be used when shopping in Best Buy.

Best Buy Credit Card Preferred & Best Buy Credit Card Compared

| Fees | My Best Buy Credit Card | My Best Buy Visa® Credit Card |

|---|---|---|

| Annual Fee | $0 | $0-$59 (depending on creditworthiness) |

| Where can you use? | In-store purchases only | Anywhere |

| Annual Percentage Rate (APR) for Purchases | 26.74% This APR will vary with the market based on the Prime Rate. 11.90% for select purchases eligible for the 48 month reduced rate credit plan (The store sales associate or store website will identify which purchases are eligible for the reduced rate credit plan) | 26.74% This APR will vary with the market based on the Prime Rate. 11.90% for select purchases eligible for the 48 month reduced rate credit plan (The store sales associate or store website will identify which purchases are eligible for the reduced rate credit plan) |

| How to Avoid Paying Interest on Purchases | Your due date is at least 25 days after the close of each billing cycle. | Your due date is at least 25 days after the close of each billing cycle. |

| Minimum Interest Charge | If you are charged interest, the charge will be no less than $2. | If you are charged interest, the charge will be no less than $2. |

| Late Payment Fee | Up to $38 | Up to $38 |

| Returned Payment Fee | Up to $38 | Up to $38 |

The card’s interest rate is high for purchases and balance transfers. Purchases that are eligible for the 48-month reduced rate plan charge a lower APR.

Based on your credit score, there will either be an annual fee of $59 or no annual fee.

Both cards include higher terms than you’ll find with other rewards credit cards, especially if you happen to qualify for the one with the $59 annual fee.

If this is the case, there are many others available with no annual fee at all and more benefits.

Interest Rates on Credit Cards is High

Both Best Buy cards carry high APRs which can quickly add up if you aren’t diligent in paying your balance in full each month.

If you typically carry a balance, it’s best to choose a card with a lower interest rate. Great options include:

If you can pay your entire balance in full each month and avoid paying interest, the high APR is less of an issue.

Saving on Interest with Special Financing

The Best Buy special financing offers are dependent on how much you spend at Best Buy. Although you can avoid paying interest for as long as 24 months, this is only if you spend more than $799.

If you plan on making a smaller purchase or purchasing with different retailers, you may be better off with a card that offers a 0% introductory APR.

It is nearly as long as Best Buy’s longest financing offer. Plus, you don’t have to spend a certain amount to take advantage of it.

Credit Score Needed for Best Buy Cards

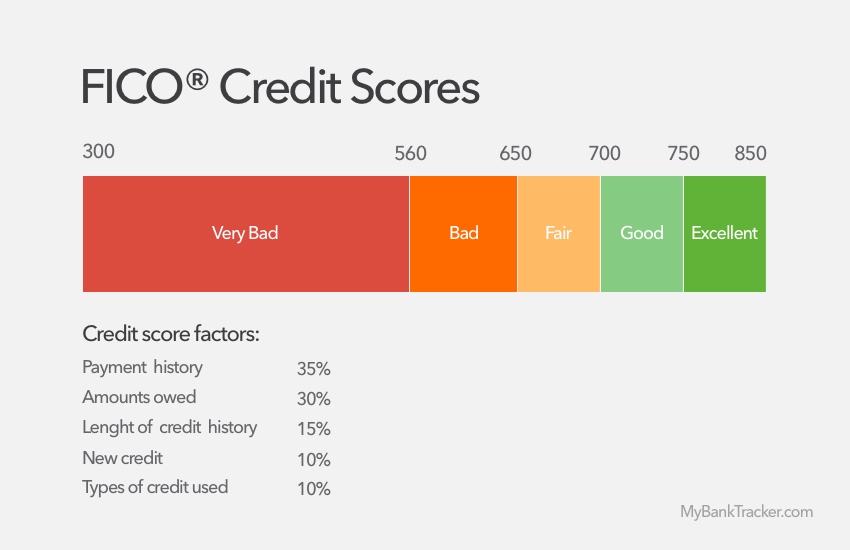

Store cards are generally easier to qualify for if you have had minor credit score problems in the past. Your credit score rating is considered bad if it is in the lower 600s. You may have a better chance of approval for the Best Buy cards than you would with other cards.

Be prepared, however, to receive a relatively low initial credit line — around $500 or less. With a low credit limit, you may not be able to charge an electronic purchase to the My Best Buy cards.

After 6 months of responsible usage, you can request a credit line increase so that you can purchase larger items with the Best Buy on the card.

Fortunately, the higher credit line can also help you improve your credit scores.

Best Buy Credit Card Promotions and Sign-Up Offers

The Best Buy Credit Cards currently offer an additional bonus of 5% rewards on your first purchase made within the first 14 days.

That’s a total of 10% rewards for your initial Best Buy purchases. The value of this sign-up offer is dependent on how much your purchase costs.

For example, if you buy a new television from Best Buy that costs $1,500, you earn 7,500 points, which is worth a $150 certificate. This can result in significant savings on your next purchase.

However, credit cards often provide valuable sign-up bonuses in order to attract new cardholders. It may be worth more to you especially if you don’t plan on making a large purchase at Best Buy right away.

In comparison, the Blue Cash Preferred® Card from American Express typically offers welcome bonuses worth hundreds of dollars. The cash back can be used for anything you want, not just Best Buy spending.

Best Store Credit Cards

| Best Store Credit Cards | Rewards | APR | Annual Fee |

|---|---|---|---|

| Best Buy® Store Card | 5% back or 2.5 points for every $1 spent on eligible purchases | 0% (for 6 months on purchases $199 and up; 12 months for $399 and up) | $0 |

| Home Depot® Credit Card | No rewards program | 0% (for 6-12 months) | $0 |

| Walmart® Store Card | 5-cent per gallon savings on Walmart gas stations | 0% (for 6-24 months) | $0 |

| GAP Store Card | 5 points per $1 spent | 24.99% | $0 |

| Staples® Credit Card | 5% cash back | 0% (for 6-18 months) | $0 |

| Amazon Store Credit Card | 5% cash back with Amazon Prime | 0% (for 6-24 months) | $0 |

| Apple Store Credit Card | 3 points per $1 at Apple & iTunes | 0% (for 6-18 months) | $0 |

| Overstock™ Store Credit Card | 1% on non-Overstock purchases, 8% Overstock purchases | 0% (for 6 months) | $0 |

How to Earn More with Other Credit Cards

Although you have an opportunity to earn 5% rewards at Best Buy stores, there are other rewards credit cards that can provide better benefits.

Blue Cash Preferred® from American Express

See Rates & Fees. Terms apply.

Blue Cash Preferred Card from American Express Pros & Cons

| Pros | Cons |

|---|---|

|

|

The American Express Blue Cash Preferred Card lets you earn 6% cash back at U.S. supermarkets, up to the first $6,000 spent in the category during the calendar year (1% thereafter).

You can purchase Best Buy gift cards at supermarkets and you’re earning 6% cash back at Best Buy.

Read the American Express Blue Cash Preferred editor’s review.

Chase Freedom Flex

Chase Freedom Flex Card Pros & Cons

| Pros | Cons |

|---|---|

|

|

Chase Freedom Flex

offers 5% cash back in select categories (when you activate) that change every quarter. Usually, electronics stores is one category that could allow cardholders to earn big cash back at Best Buy.

The card has no annual fee.

Read the editor’ review of Chase Freedom Flex.

Verdict: Best Buy Credit Cards or Other Cards?

Because you may have a better chance of qualifying for a Best Buy card, it’s best for those with bad to fair credit score ratings.

However, if you’re simply looking for the best program for purchasing at Best Buy, there are a number of other credit cards that award as much or more. As a bonus, they don’t limit your options on spending or redeeming.

However, if you frequently shop at Best Buy stores or can take advantage of the special financing and sign-up offer, the Best Buy Credit Card benefits may be suitable.

Just make sure that you’re making the payments every month. You will also get the most out of these cards if you qualify for Elite or Elite Plus status in the My Best Buy Rewards program.

It should be noted that if you do end up getting the card with the annual fee, it’s important to consider how much you will actually use the card and if it’s worth paying $59 every year.

FAQs

What credit score is needed for a Best Buy card?

Best Buy nor Citi does not disclose the minimum credit score needed to get approved for a Best Buy store card or a My Best Buy Visa Card, respectively.

For the store card, due to it being limited to store purchases only, you’ll likely need a lower credit score (compared to the Visa card).

For the Visa card, be prepared to apply when you have good credit, which is typically 700 or higher.

Can I use my Best Buy Visa credit card anywhere?

You can use the Best Buy Visa credit card wherever Visa credit cards are accepted.

The Best Buy store credit card, which does not display the Visa logo on the card, can only be used for Best Buy store purchases.

What is the highest credit limit for Best Buy?

Based on unconfirmed online reports, the highest credit limit for Best Buy could be $12,000 or higher (with excellent credit). However, individual credit limits will vary depending on your credit score, income and other factors.