What is Lowest Credit Score Needed to Apply for a Credit Card?

Credit cards offer users a lot of useful benefits. They’re safer to use than cash and, because they are not tied directly to your bank account, they can also offer more security than a debit card.

Credit also allows you to leverage your finances and make purchases now that you don’t need to pay for until your statement hits.

This can help you make the most of your cash flow. Using plastic can also help you rack up credit card rewards, from points to cash back.

And these aren’t one-size-fits-all financial products. There’s a wide range of options depending on your preferences and needs, allowing you to choose one that fits your financial situation.

There’s a credit card out there that will provide you with what you’re looking for, whether you need a secured credit card, plastic that offers lots of rewards, rewards or want to get cash back on your everyday purchases.

But before you get too excited, you should be aware that there may be a catch: the better the card, the harder it is to qualify for it.

A “better” card is one that offers a low-interest rate, lots of benefits and perks, or both.

What Do You Need to Get a Credit Card?

The most important thing you need to get a credit card is a good credit score.

The better your score, the easier it will be for you to qualify for the card you want (especially if that card comes with lots of bells and whistles).

That doesn’t mean you must have a great score to get any credit card.

Regardless of where you fall in the credit score range, you can qualify for a card that suits your needs. But no matter what, the process of getting a card starts with understanding your score.

Credit Scores: Your Financial Report Card

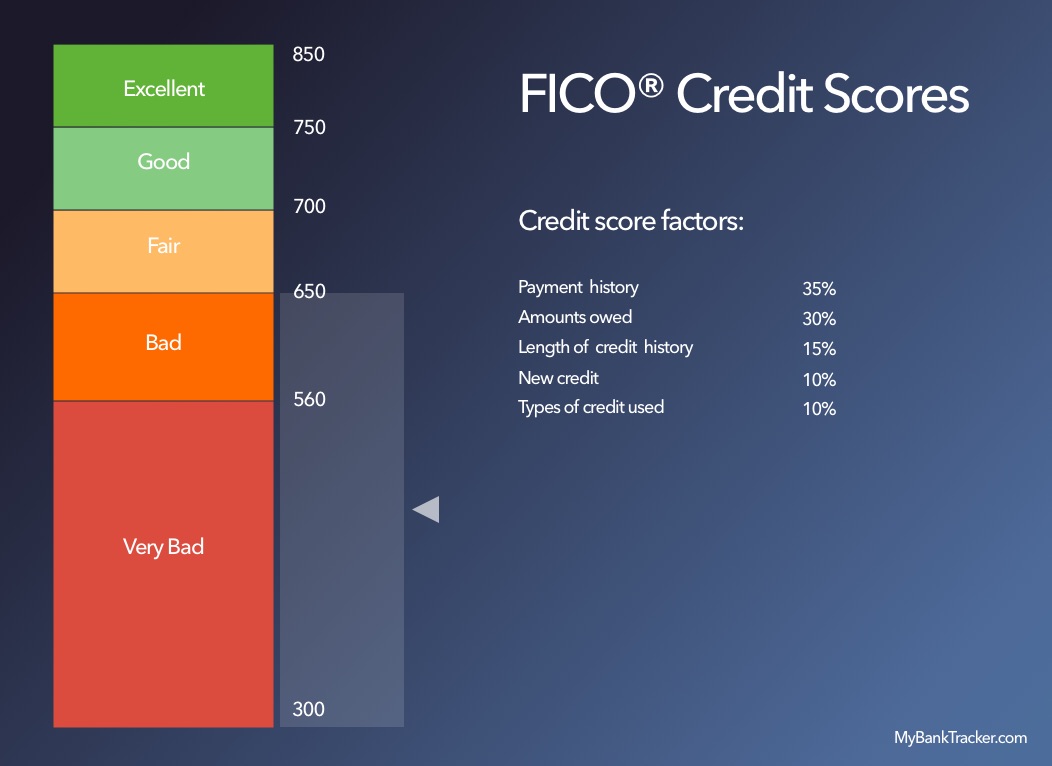

FICO is the score that matters when it comes to creditors and lenders approving you for cards and things like loans.

What is FICO? It stands for the Fair Isaac Corporation, the company which initially did the research to understand how credit history could predict future behavior and created the credit score formula.

Although there are other scoring companies, more than 90% of major lenders use your FICO score to evaluate whether or not you qualify for loans or lines of credit.

Think of your score as a financial report card. It gives financial institutions an idea of how creditworthy you are and whether or not you are a risk.

Scores are based on predictive analytics that indicate what you’re likely to do in the future, based off specific information about your financial situation today.

FICO doesn’t release the exact formula used to calculate credit scores. But we do know the factors that contribute to the formula.

FICO Credit Score Factors and Their Percentages

| FICO credit score factors | Percentage weight on credit score: | What it means: |

|---|---|---|

| Payment history | 35% | Your track record when it comes to making (at least) the minimum payment by the due date. |

| Amounts owed | 30% | How much of your borrowing potential is actually being used. Determined by dividing total debt by total credit limits. |

| Length of credit history | 15% | The average age of your active credit lines. Longer histories tend to show responsibility with credit. |

| Credit mix | 10% | The different types of active credit lines that you handle (e.g., mortgage, credit cards, students loans, etc.) |

| New credit | 10% | The new lines of credit that you've requested. New credit applications tend to hurt you score temporarily. Learn more about FICO credit score |

You can get your free credit score from a few different sources:

- If you have an existing credit card, check what kind of perks it provides. Many cards now provide your FICO credit score on each statement.

- You can get an estimate of your score from credit-monitoring companies.

- Ask your bank if they can provide a free copy of your credit score. Many offer this benefit to customers and allow them to check their FICO score quarterly or annually.

- If you apply for a loan, you should receive a copy of your credit score from the lender.

The next step: understanding what this score actually means to creditors. There’s a credit score range of 300 to 850.

A credit score of 850 is considered perfect. So what is a good credit score? And what kind of score is needed for a credit card?

You don’t need to achieve perfection. Any score above 700 is considered good to excellent and will help you get the best available interest rates on most credit cards.

Credit scores between 650 and 700 are average, while scores below 650 are considered subprime.

What Credit Score Needed for a Credit Card?

Again, credit scores exist on a range. Anything above 650 is likely to get you a credit card you want — although the most exclusive and premium cards may not be accessible if your score is on the low end of this spectrum, and your interest rate will be higher than another cardholder with a better score.

This range is just a general statement and does not guarantee a particular score will be enough to get a specific card. The type of credit card you want ultimately determines the kind of credit score you need to qualify for it.

That being said, we can break this down a bit further and give you an idea of what kind of credit score is needed for certain types of credit cards.

Credit Score Ranges and Quality

| Credit Score Ranges | Credit Quality | Effect on Ability to Obtain Loans |

|---|---|---|

| 300-580 | Very Bad | Extremely difficult to obtain traditional loans and line of credit. Advised to use secured credit cards and loans to help rebuild credit. |

| 580-669 | Bad | May be able to qualify for some loans and lines of credit, but the interest rates are likely to be high. |

| 670-739 | Average/Fair | Eligible for many traditional loans, but the interest rates and terms may not be the best. |

| 740-799 | Good | Valuable benefits come in the form of loans and lines of credit with comprehensive perks and low interest rates. |

| 800-850 | Excellent | Qualify easily for most loans and lines of credit with low interest rates and favorable terms. |

If You Have Excellent Credit (750 to 850)

Credit scores on the highest end of the spectrum allow you to access premium credit cards.

These cards offer high-value rewards on expensive categories like travel. They may also be exclusive, providing great benefits to select cardholders.

You can also get extremely low credit card APRs, which can make using your line of credit much cheaper.

If You Have Good Credit (700-750)

While you may not be able to get the most high-end cards, you can still get good reward and cash back credit cards with a score in this range.

These cards will allow you to build up rewards or earn cash for everyday purchases.

You’ll get a decent interest rate on these cards, but it won’t likely be the best available.

That’s okay, as long as you pay your statements in full and on time. This way, you won’t carry a balance — and you won’t need to pay interest anyway.

If You Have Fair Credit (650-700)

This is where most people fall on the credit score range. You can get basic credit cards, but rewards and cashback cards might be hard for you to access.

Before getting too bummed out, note that it’s not all bad news. Most basic cards also come with $0 annual fees.

This will allow you to get a credit card and use it responsibly, for no cost, to build your credit and improve your score so you can get cards with more features in the future.

You can also check out student credit cards if you are in college and your score falls in this range.

Again, these might provide you with a good way to establish your credit history so you can boost your score and apply for better cards once you graduate.

If You Have Bad (560-650) or Very Bed Credit (Below 560)

With a credit score in this range, it might be a good idea to step away from credit cards for a little bit. You likely have a history of missing payments or defaulting on balances if your score is this low.

That may mean you need to focus on your money management skills first before picking up credit again. But if you’re ready to start rebuilding your credit, the right credit card can help.

While you won’t be able to qualify for the other cards listed here, you can start with secured credit cards or credit-improvement cards. These are designed to help you improve your credit score with responsible use over time.

There’s More to Qualifying for a Credit Card Than Just Your Credit Score

Clearly, your credit score matters! It’s what creditors and banks look at to determine what kind of credit card you can get, what the interest rate on the card will be, and the credit limit they’ll extend to you.

But it’s not the exclusive factor a credit card issuer will evaluate before approving you. They also look at your annual income, your basic household expenses, and any existing debts you carry.

Issuers want to know you have the cash flow available to pay for charges you make to the card. Before they offer you any credit, they want to make sure you can reasonably repay any balances you carry.

How to Improve Your Credit Score?

Now that you’re familiar with the process, you might be eager to check your score and see what kind of credit card you can get with it.

But what happens when you see your score falls into a lower range than what you hoped for?

Don’t despair. Improving your credit score is within your power.

Start with these simple actions:

- Review the table above to understand what factors influence your score. This will help you focus in on the right things to do (and what to avoid).

- Make all your payments on time and in full. If you know you can afford to pay your bills but simply forget, set alerts and reminders, so you pay by the deadline.

- If you’re not making payments because you can’t afford it, it’s time to scale back your spending. Cut out what you don’t need and make frugal choices until you can start making payments again.

- Keep your credit utilization low. You might want to try paying off the charges on your card twice a month, instead of just when the statement is due, to help keep that usage low.

You also want to avoid opening lots of accounts at once.

So if you’re in the market for a new card, choose one to apply for. And don’t go on an account closing spree, either! This can also lower your score.

If you consistently take the right actions, you’ll see your score rise after a few months of working toward your goal of landing in a better range.

Once you make it, you’ll have the credit score you need for the credit card you want.