What is a Beacon Credit Score?

Just when you thought you were starting to understand credit scores and how they are calculated, all the names keep changing.

The Beacon Score, now known as Pinnacle, is just one example of an algorithm or formula used by the three major credit rating bureaus to come up with your particular credit score.

You might think that you would have the same score no matter who does the reporting, but that’s rarely the case. Explanations will follow, but first a bit of history:

History of the Beacon credit score

The basic FICO score was first introduced in 1989 by the Fair, Isaac, and Company as a way to standardize how credit scores are calculated.

Before that time lenders would create their own method based on an individual’s credit history, and the results could vary widely from lender to lender.

Three national credit bureaus called Experian, Equifax, and TransUnion were then created and they have since adopted their own credit scoring models.

Every time you pay a bill, buy something with a credit card or take out a loan, this information is reported to the three bureaus.

They all use complex algorithms to come up with your credit score based on the number of late payments, current debts, types of credit used (department store cards vs. Visa or MasterCard) and new applications for credit.

The Beacon/Pinnacle and other credit scores can have a very large effect on the interest you will pay on any type of consumer loan, or you may have a loan application denied all together if you have a low score.

Each of the three credit bureaus used a different name for their scores. For example:

- Experian used – “FICO or FICO II”

- TransUnion used – “Empirica” that later changed to “Precision”

- Equifax used – “Beacon”

In 2001 the FICO company decided to introduce a new scoring model called NextGen, which resulted in the credit bureaus changing the name of how they market their scores. Here are the current names along with their credit score ranges:

- Experian – FICO Advanced Risk Score 330- 830

- TransUnion – FICO Risk Score NextGen 150 – 934

- Equifax – Pinnacle 300 – 850

For all three credit bureaus, lenders usually require a score of at least 650 in order to approve a loan request. If you score is less than 500 you probably won’t be approved for a loan.

How the Beacon/Pinnacle Score is Calculated

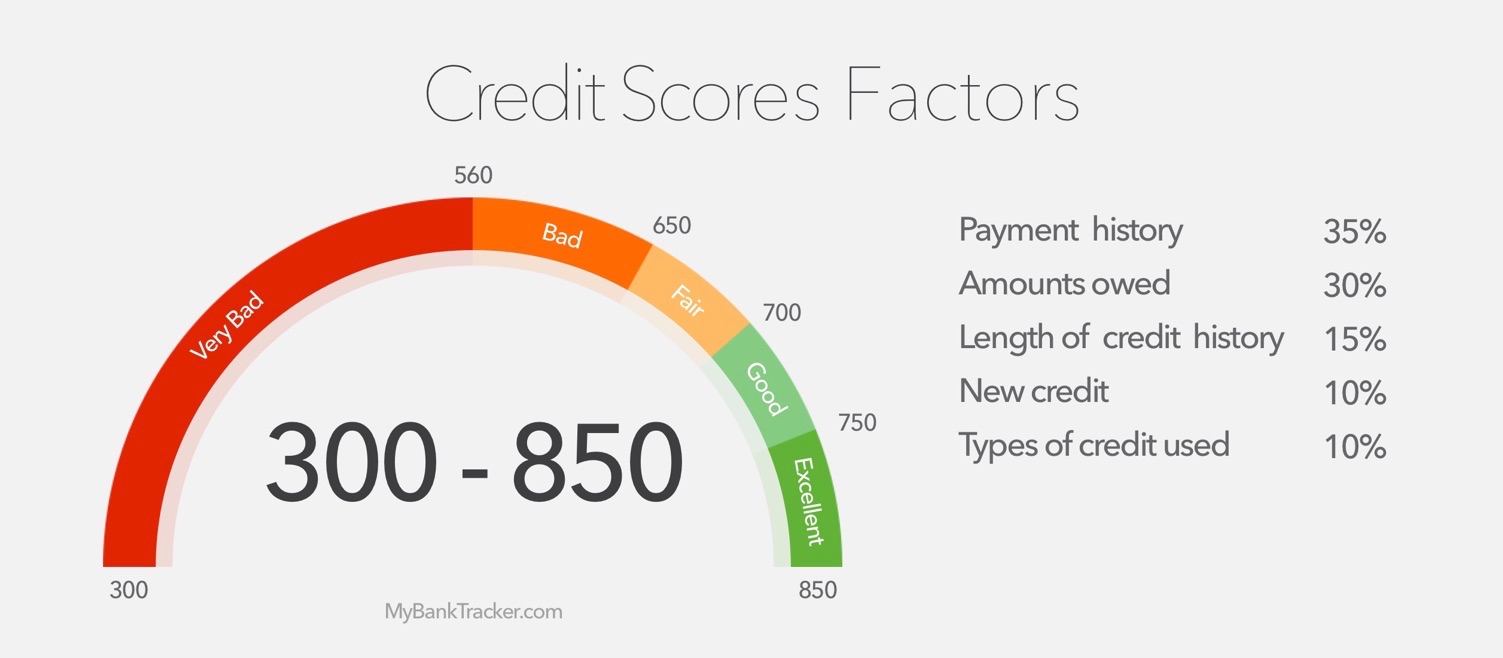

While the exact method remains a closely guarded secret, here is a general guide as to how your Beacon/Pinnacle or other score is calculated:

35%: payment history

This will include any bankruptcy, liens, judgments, settlements, charge-offs, repossessions, foreclosures, and late payments that will cause your score to go down.

30%: debt burden

This includes the amount of debt compared to credit limits ratio, the number of accounts with balances, the amount owed across different types of accounts, and the amount paid down on installment loans.

15%: length of credit history

This is the average age of the accounts on your report and the age of your oldest account.

10%: types of credit used

Installment, revolving, consumer finance and mortgages.

10%: recent searches for credit

Hard vs. soft credit inquiries. A hard inquiry, which can lower your score, occurs when you apply for any type of credit such as a credit card, mortgage or auto loan.

A soft inquiry occurs when you request a credit report for your personal use, when an employer requests a score for employee verification, or when companies initiate pre-screened offers of credit or insurance.

All soft inquiries do not have any impact on your credit score.

How Your Credit Score Can Affect Your Future Mortgage Rate

| Credit Score Range | 30-Year Fixed Rate Mortgage | 5-year fixed rate mortgage | 7/1 ARM |

|---|---|---|---|

| 620-639 | 4.684% | 4.016% | 4.506% |

| 640-679 | 4.138% | 3.47826% | 3.96% |

| 660-679 | 3.708% | 3.04% | 3.53% |

| 680-699 | 3.494% | 2.826% | 3.316% |

| 700-759 | 3.317% | 2.649% | 3.139% |

| 760-850 | 3.095% | 2.427% | 2.917% |

How Your Credit Score Can Affect Your Next Car Loan

| Credit Score Range | 60-Month new Car Loan | 40-Month Used Car Loan |

|---|---|---|

| 500-589 | 14.824% | 16.325% |

| 590-619 | 13.74% | 15.086% |

| 620-659 | 9.398% | 10.186% |

| 660-689 | 6.747% | 7.599% |

| 690-719 | 4.656% | 5.322% |

| 720-850 | 3.331% | 3.778% |

How Your Credit Score Can Affect Your Next General Loan

| Credit Score Range | HELOC | Home Equity Loan |

|---|---|---|

| 620-639 | 10.680% | 10.164% |

| 640-669 | 9.180% | 8.914% |

| 670-699 | 7.680% | 7.414% |

| 700-719 | 6.305% | 6.639% |

| 720-739 | 5.055% | 6.139% |

| 740-850 | 4.680% | 5.837% |

Factors That Don’t Affect Your Beacon/Pinnacle Credit Score

You may be surprised at the number of factors that have no effect on your credit score.

By law, lenders are not allowed to discriminate based on gender, religion, age, ethnic group, or marital status so these are not included in your Beacon/Pinnacle score calculation or any other one.

There will also be no mention of your salary, current employer, occupation, past employment history and where you live.

Certain types of loans that are more “off the grid” such as payday and pawn shop loans, are also not considered.

Child support payments, what you pay for rent and the interest rates you pay on your credit cards are not factored into your credit score.

Generally, medical bills and rent payments are not reported to the credit bureaus, so if you have to choose between paying a medical bill or a credit card, pay the credit card.

You can usually work out a more manageable payment plan with a medical provider. However, you do need a place to live so don’t skip your rent payments.

Why Does Your Score Vary From Bureau to Bureau?

Because a consumer’s credit file may contain different information at each of the bureaus, credit scores can vary depending on which bureau provides the information to generate the score.

This is because the formulas used are dependent on the criteria the bureau believes is most important.

For example, Beacon/Pinnacle might decide that payment history is more important than what percent of your credit card limits you are using.

Even the same credit bureau can use many different credit score models.

For example, in addition to Beacon/Pinnacle, Equifax offers another score called ScorePower.

The reason is a mortgage lender, for example, might want to emphasize different factors than a credit card issuer or a car loan provider.

So while the credit scoring algorithms are measuring most of the same factors, they are weighing each of these factors differently.

Also, some lenders report to all three credit bureaus, but others report to just one or two or none at all.

Each bureau might also update the information in your credit report at different times. Therefore one credit bureau might be missing a payment or other information that could help or hurt your score.

How to Raise Your Beacon/Pinnacle Score

There are many ways to raise your credit score, the most important being to pay your bills on time.

If you have trouble remembering, pay them online through your bank where you can set up the payment date for any time in the future as soon as you receive your bill.

Another quick way is to ask for an increase in your credit card limits. But don’t spend it! If you pay off a credit card, don’t cancel it as that will improve your debt to credit limit ratio.

- Keep all cards to 35-50% of your credit limit.

- Get a copy of your credit report at least once per year and fix any errors. Contact the store or credit card issuer, rather than the credit bureaus. The bureaus will not take your word for it if there are mistakes.

- Never bounce a check. This will stay on your credit report for seven years. Ask your bank for a small amount of reserve credit that will cover any “insufficient funds.”

- Pay at least the minimum amount due on your credit cards plus $10. Make sure payments arrive at least one day before the due date.

- If you are having trouble making your payments on time, contact the lender right away. The worst thing you can do is ignore them. Explain your financial situation and agree on a new payment schedule that you can manage. Get the agreement in writing and ask them to include a note that your payments will not be reported as late.

- Don’t allow people to make hard inquiries for your credit report unless you know you are going to accept a loan if approved.

Which Score is Best to Track?

There is really no particular credit score that is better than another. Your best bet is to choose one such as the Beacon/Pinnacle and track it on a regular basis over time.

All scores are calculated from the same data in your credit history and one is not necessarily more accurate than another.

Remember, you can get one free credit report from each of the three bureaus every year.

However, you won’t get your actual score on the reports unless you pay.

But today many banks and credit card companies are offering to provide your credit score as a benefit. This is a great way to make sure you have your “financial house” in order before applying for any new loan.