How to Get a Near-Perfect FICO 9 Bankcard Score: One Woman’s Story

There are advantages to maintaining a pristine credit profile. Primarily, having great credit means that you’re more likely to qualify for loans and lower interest rates. There’s also bragging rights.

However, the path to achieving an excellent credit profile is not clear-cut — credit-scoring agencies never reveal their scoring formulas

Fortunately for us, one woman — Nancy, 41 — was kind enough to share her credit report with us to see how she got a stellar FICO 9 Bankcard Score (score range of 250 to 900) of 873.

*Just to be clear: the FICO 9 Bankcard Score is not the standard FICO score that many lenders use for assessing credit risk. It places greater emphasis on one’s behavior with credit cards. Nevertheless, it still tells a large amount of information about creditworthiness. The standard FICO score range is 300 to 850.

Today, Nancy holds 16 active credit accounts. While the large number of credit lines may seem alarming, she’s been managing her accounts diligently with the help of Quicken’s money management software.

Here’s a quick rundown of the key data points from Nancy’s credit report:

- Active accounts: 16 (13 credit cards, 2 student loans, 1 auto loan)

- Delinquencies: 0, never late on any payments

- Total combined credit limit: $143,253 (current total balance: $13,198)

- Debt utilization: 9.21%

- Total combined credit card limit: $110,850 (current total card balance: $446)

- Debt utilization of credit cards: 0.40%

- Average age of accounts: 48.2 months (28 total trade lines)

- Age of oldest account: 74 months

- Age of newest account: 20 months

Nancy’s credit behavior displays many of the marks of a great credit profile, according to the factors that FICO consider in its scoring models.

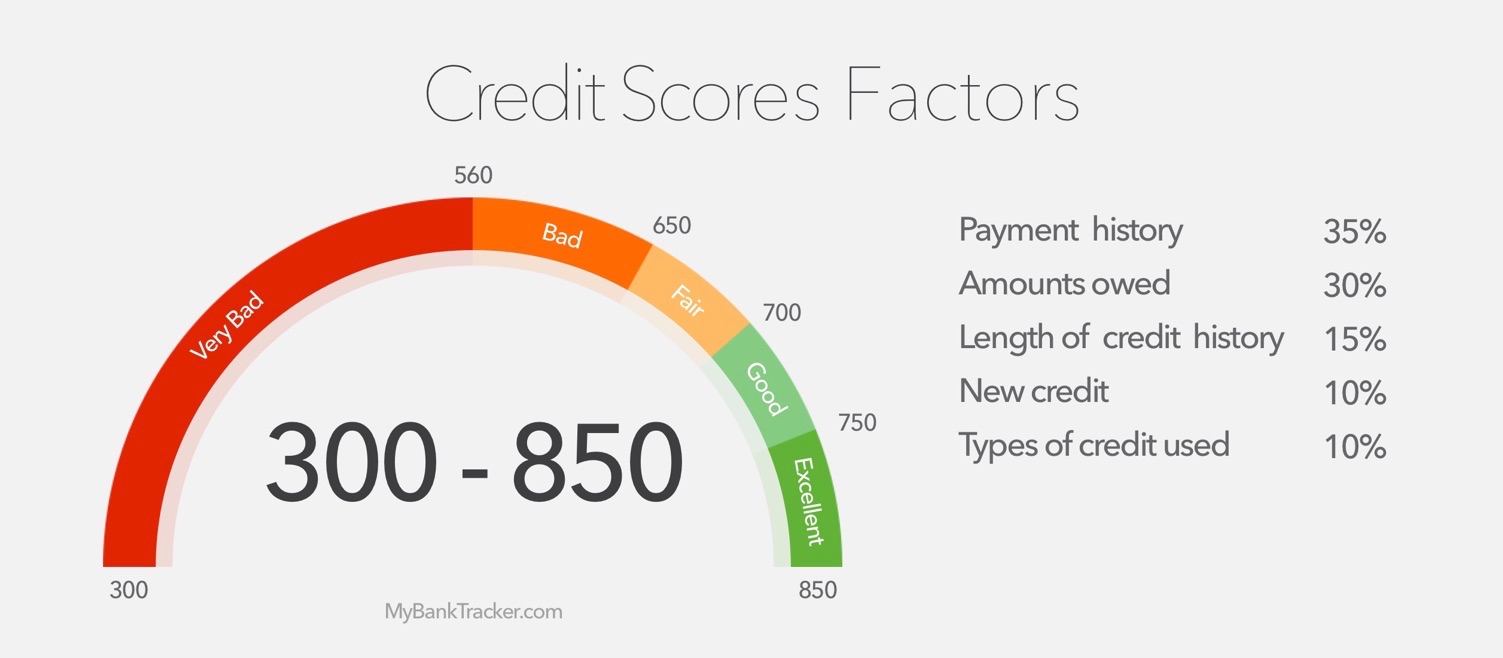

The FICO 9 Bankcard Score is not publicly available but here is the breakdown of the standard FICO credit score:

- Payment history (35%): Looks at on-time payments, late payments and defaults

- Amounts owed (30%): Looks how much you owe and on what accounts

- Length of credit history (15%): Looks at how long you’ve had your credit accounts

- New credit (10%): Looks for new credit accounts in a short period of time

- Types of credit used (10%): Looks for experience with different types of credit

Nancy has never been late with a payment, has a low debt utilization ratio, has a lengthy credit history, carries a mix of loans and doesn’t have any new credit accounts.

How to be like Nancy

Because of the large number of accounts that Nancy has open, she makes it a habit to review her accounts on a daily basis with the help of Quicken.

She still has some student loan debt, which she did not eliminate as soon as possible. It has helped to increase her average age of accounts.

Although having 13 credit cards may appear to be a debt trap, Nancy only carries two credit cards — a Southwest Airlines card and an American Express card.

And, most of them have a $0 balance, and all card balances are paid off every month. She does have seven store-branded credit cards, all of which were opened to take advantage of sign-up discounts and ongoing rewards.

Generally, financial pundits warn against store credit cards, but Nancy shows that it is okay to have them.

In addition, having a large number of credit card accounts contributes to an extremely high combined credit card limit, and Nancy notes that she received automatic credit line increases and actively requested credit line increases over the years.

When it comes to closing card accounts, Nancy said that she always thinks about how this affect her credit. However, if she seldom uses a card, she’ll just close it.