Which Credit Report Does American Express Pull?

- American Express primarily pulls credit reports from Experian when evaluating applications, making it the most important report to monitor and improve.

- You are entitled to a free credit report from each bureau annually, and potentially more under certain circumstances, allowing you to check for errors and track progress.

- Beyond your credit score, American Express also considers your income and expenses to determine your ability to repay, so accurate reporting is crucial.

American Express has long been known as a premium credit card provider that gives cardholders a wide variety of perks. Given its reputation, wanting to apply for a card from American Express is not unusual.

When you apply for an American Express credit card, the company will almost always check your credit report with Experian. In some very rare cases, American Express will check with a different credit bureau. Remember that all three credit bureaus get their information from the same place: your financial life. That means there isn’t a big difference between them, so which report is pulled doesn’t usually matter. However, there are some cases where knowing which bureau is pulled.

We found out that American Express primarily works with Experian by reviewing 337 consumer-reported credit inquiries from January 2016 through December 2017. That information showed that American Express works nearly exclusively with Experian.

Where We Got the Data

Applying for a credit card can be stressful. The process isn’t very transparent and there’s no way to know what the result will be. All you can do is fill out the application form and wait for the result to pop out.

Given the lack of transparency, it’s probably not surprising to hear that lenders don’t just tell us which credit bureaus they work with. That means we had to gather this information from people who applied for American Express cards.

Every time you apply for a loan, whether it be a credit card or another type of loan, the lender will pull a copy of your credit report from a credit bureau. Each time a lender requests a copy of your report, the credit bureau keeps that on record for two years. These “hard pulls” on your credit cause a small decrease in your credit score and show up on your credit report. That means you can see which credit bureau was used by which lender.

We used the CreditBoards.com database to collect most of this data. People use the website to see how likely they are to qualify for a certain card. After applying for a card, they can provide info like their income, credit score, and which bureau was used, so future users can better gauge their chances.

We used just the last two years’ results so we can give you the most up-to-date info possible.

What Our Research Means for You

The goal of this article is to help you identify the credit report that is most likely to affect your chances of getting a credit card from American Express. Given that Experian is used for almost every American Express application, that is the report you should focus on.

Ideally, anything you do to improve your score with one bureau will improve it at all three. However, focusing on one, especially if there are errors, can make things easier.

How to Check Your Own Credit Reports

It is possible to check your own credit report for free. In fact, it’s a good thing to do regularly just to make sure everything on your report is correct.

We recommend that you use AnnualCreditReport.com to check your credit. The U.S. government has sanctioned the site and the site does not require that you sign up for any kind of subscription service. Through the website, you can get a copy of your credit report from each bureau, for free, once each year.

If you want to look at your credit report more often than once per year, you can space out your requests for your report. Ask Experian for your report, then four months lather ask for your report from TransUnion. Four months later, request a copy from Equifax. This strategy lets you look at your credit report three times a year.

Many card issuers also let you look at your credit reports as a cardholder benefit.

While these services don’t give you the true copy of your credit report that the credit bureaus will provide, they’re good enough to keep track of changes.

When you do want to pull a copy of your report from AnnualCreditReport.com, use these tips.

- Enter your information accurately and double check it. Mistakes might lock you out temporarily.

- You’ll be asked verification questions. Some of these are trick questions, so don’t be afraid to answer “none of the above.”

- Save or print a copy of your report as soon as you get it, otherwise, you’ll lose it if you close the browser window.

You can also request a report by phone by calling 1-877-322-8228 or by mail, by sending a form to:

- Annual Credit Report Request Service

P.O. Box 105281 Atlanta, GA

30348-5281

Requests made by phone and mail will be mailed to you within 15 days.

How to Get Additional Reports from Experian

The Federal Fair Credit Reporting Act is the law responsible for guaranteeing your access to your credit report each year. It also specifies other situations in which you can receive a free copy of your credit report.

You can get a free credit report in the following situations:

- You were denied or notified of an adverse action related to credit, employment, insurance, government license or other government-granted benefits, or another transaction initiated by you within the last 60 days and your credit report was the basis for the credit decision.

- You were denied a house or apartment rental or were required to pay a higher deposit than normally required within the last 60 days and your credit report was the basis for the credit decision.

- You are unemployed and intend to apply for employment within the next 60 days. (One credit report every 12 months.)

- You are a recipient of public welfare assistance. (One credit report every 12 months.)

- You have reason to believe that your credit report contains inaccurate information due to fraud.

Some lenders automatically provide your score when you are denied for a card, but some do not. If you know that you have a right to get a copy of your report you can request a copy of the report used to deny you and the lender must provide it.

Under certain state laws, residents in some states may be eligible for additional Experian credit report requests at a discounted price. Here’s the list of such states:

Experian: Free or Reduced Fee Credit Reports

| State | 1st request | Additional requests | Time frame |

|---|---|---|---|

| California | $8 | $8 | Calendar year |

| Colorado | Free | $8 | Calendar year |

| Connecticut | $5 | $7.50 | 12-month |

| Georgia | Free | $12 | Any time |

| Maine | Free | $5 | 12-month |

| Maryland | Free | $5 | Calendar year |

| Massachusetts | Free | $8 | Calendar year |

| Minnesota | $3 | $3 | 12-month |

| Montana | $8.50 | $8.50 | Calendar year |

| New Jersey | Free | $8 | Calendar year |

| Puerto Rico | Free | $11.50 | Calendar year |

| Vermont | Free | $7.50 | 12-month |

| Virgin Islands | $1 | $1 | Calendar year |

How to Make Your Credit Report Look Better

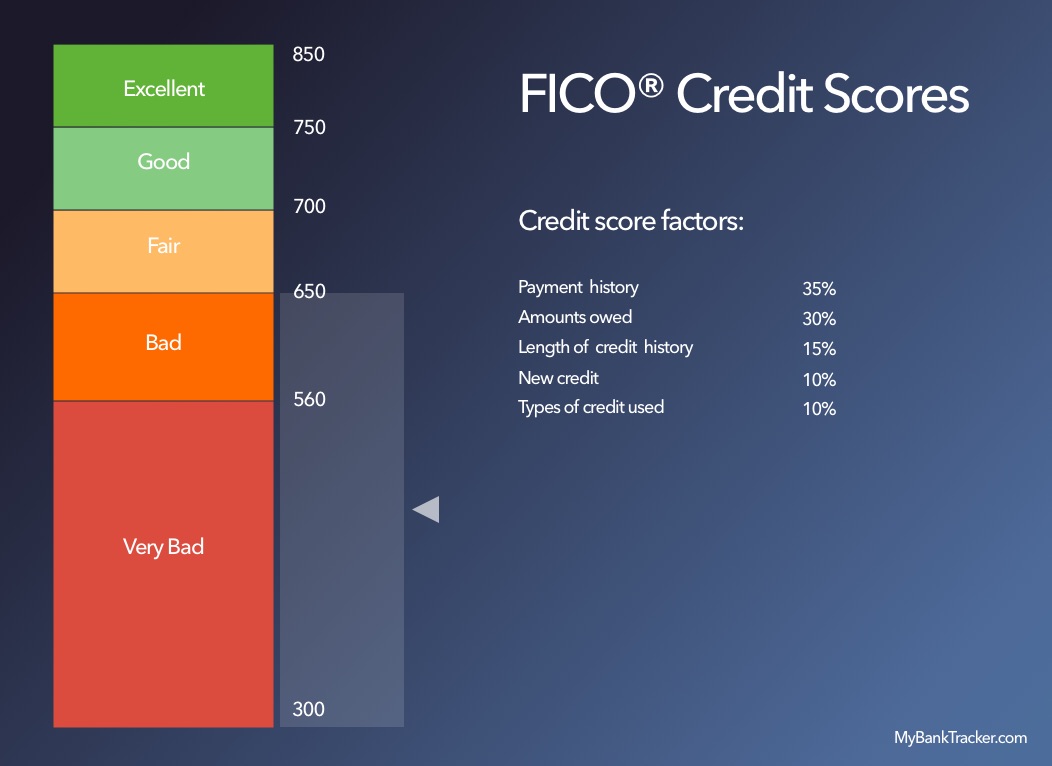

Once you’ve looked at your credit report, you can take steps to improve it, which will lead to increases in your credit score. Your credit score is based on data in your credit report and it is relied on heavily by lenders such as American Express.

Fix any errors

Having errors on your credit report is more common than you’d think. If you have an error that’s hurting your score, removing it is the easiest way to get a big boost to your score. Each bureau has different instructions for disputing errors, so make sure to follow the process carefully.

Remove delinquent accounts

If you have defaulted in the past or have unpaid debts on your report, it can be a drag on your credit score. Negotiate with those lenders to get on a payment plan and have the account removed from your file.

Pay down existing debt

Lenders want to know that you can afford to make payments on a new loan. If you have a lot of debt already, it’ll be hard to make payments on any new loan you receive. Pay down your debt to improve your score.

Increase credit limits

Lenders also look at how much of your credit you’re using. If you’re maxing out your credit lines, that is a bad sign and lenders might be wary of lending to you. Request credit limit increases so that you’re using a lower percentage of your credit limits.

When is Your Credit Report Updated?

Your credit report isn’t updated daily by every lender you have an account with.

Usually, lenders send one update each month to the credit bureaus, after the end of each statement. That means any changes might take a month or two to appear on your report. That means it’s important to start the process of improving your score as early as you can.

Your Income and Expenses Matter Too

When you apply for a loan, your credit score isn’t the only thing that matters. Your income and expenses will also come into play.

When you apply for a card from American Express, the lender will inquire about your annual income and monthly housing payments.

This is because lenders really only care about getting paid back for loans they make.

If you make $1,000 per month and spend $750 on housing, it’s unlikely you can pay the bills on a new credit card. If you make $10,000 a month and spend $4,000 on housing, there’s a much better chance you can make payments.

Though it might be tempting, do not lie when asked these questions. American Express is known to ask for income verification on occasion. If you cannot prove the income you claimed to earn by providing paystubs or historical tax returns, American Express will deny your application or close your account if it has already been opened.