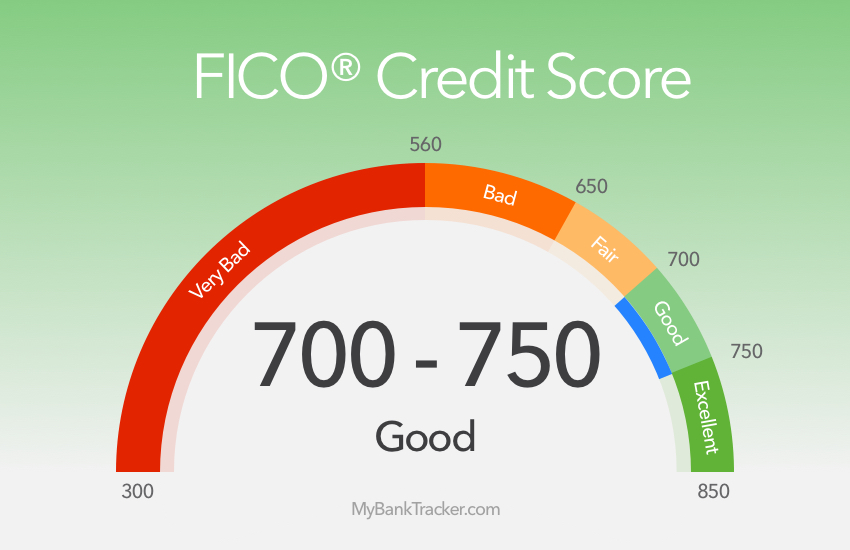

What Are the Benefits of Having a Credit Score Between 700 and 750?

Have you recently worked your way to achieve a credit score between 700 and 750?

If so, congratulations on your hard work and dedication.

You may be aware that it is financially beneficial to have a credit score above 700, but what does that exactly mean, and how can you maximize your financial options?

A credit score of 700 and above is an indicator that a person has established productive habits with their finances for an extended period of time.

You pay your bills on time, you have had different lines of credit for at least a few years, and your debt-to-credit limit ratio is relatively on the lower side.

The average credit score in America is 689, according to the most recent data collected by MyFICO.com.

A credit score between 700 and 750 indicates you are doing better than the average person, and you’re rewarded for your efforts.

You may not realize it, but you’ve set yourself up for financial success in both the immediate and distant future.

As long as you take advantage of your credit score, you can enjoy the perks associated with good credit.

Investing is easier and worth your time and effort

A superior credit score opens up your loan options, which means you will have an easier time acquiring money for investments.

Qualifying for no interest and low interest rates for an extended period of time is a luxury people in good credit standings can expect.

If you have an interest in pursuing endeavors in business, real estate, or any other venture, look into investing.

Take advantage of your credit score and work towards building a foundation for your future.

You most likely won’t need to find a cosigner to help you finance a vehicle or home loan either.

Lenders view you as reliable and trustworthy enough to accept your signature alone on documents.

Unlike those who need co-signers to apply for a line of credit, a credit score of 700 to 750 allows you to be the sole person responsible for loans, credit cards, or other lines of credit.

How Your Credit Score Can Affect Your Future Mortgage Rate

| Credit Score Range | 30-Year Fixed Rate Mortgage | 5-year fixed rate mortgage | 7/1 ARM |

|---|---|---|---|

| 620-639 | 4.684% | 4.016% | 4.506% |

| 640-679 | 4.138% | 3.47826% | 3.96% |

| 660-679 | 3.708% | 3.04% | 3.53% |

| 680-699 | 3.494% | 2.826% | 3.316% |

| 700-759 | 3.317% | 2.649% | 3.139% |

| 760-850 | 3.095% | 2.427% | 2.917% |

How Your Credit Score Can Affect Your Next Car Loan

| Credit Score Range | 60-Month new Car Loan | 40-Month Used Car Loan |

|---|---|---|

| 500-589 | 14.824% | 16.325% |

| 590-619 | 13.74% | 15.086% |

| 620-659 | 9.398% | 10.186% |

| 660-689 | 6.747% | 7.599% |

| 690-719 | 4.656% | 5.322% |

| 720-850 | 3.331% | 3.778% |

What about credit cards?

Your credit score is a direct factor of the type of credit cards you can open. The way credit cards typically work is the higher the credit score, the better credit card perks available.

You should be able to open cash back credit cards like and , or a card that accumulates valuable points such as the without a problem.

Read Chase Freedom Credit Card Editor’s Review

Read Capital One Quicksilver Cash Rewards Card Editor’s Review

Read Chase Sapphire Preferred Card Editor’s Review

Higher credit limits are a luxury. Your income ultimately determines your credit limit, but the better your score, the higher credit card limits you will be offered by credit card companies.

You may also be able to negotiate a higher credit limit with credit cards you already have open, just know that your score will be dinged, as your credit will be pulled.

You should overlook most offers in the mail

With good credit comes a good reputation. Everyone likes to do business with someone who has a good reputation, it almost guarantees a return on investment.

You probably receive a slew of offers in the mail for new credit cards, personal loans, home loans, and other types of lines of credit.

A few offers you receive can have great value, but do some research before you commit to anything.

Hackers and scams

Your good credit is appealing to hackers and scam artists looking for people who are financially stable.

Scammers will try and open a credit card or loan with a high line of credit under your name, while hackers will also try and steal your credit or debit card information to use your income and available credit.

This is why it is important to monitor your credit history and bank account information regularly.

Monitor your bank account activity at least once a week, and your credit history quarterly.

Also, stay up-to-date with the latest scams and hacks people will try to use to steal your credit card, bank, or personal information.

Personal relationships

Believe it or not, people are really looking into credit scores when vetting potential love interests.

People want to be in a constructive relationship where both parties can save to buy a home, invest, travel, start a family, and live financially stable.

A low credit score is usually an accurate indicator on how responsible a person is with money management.

When a serious discussion about your future begins with a love interest, you’ll feel confident in knowing that your credit score is top-notch.