4 Steps To Avoid Credit Card Debt

Credit cards can be a valuable part of your financial life: They offer more convenience than cash does and more payment flexibility than debit cards do.

But credit cards do come with a potential downside: They are more risky and potentially more expensive.

Because your costs are deferred when you use a credit card, keeping up with the bills is inherently more difficult than it is when you’re paying instantly with cash or debit.

And when you don’t stay current on payments, you incur fees and damage your credit score.

Avoiding overwhelming debt and fees is not necessarily difficult, but it does take some planning and oversight.

If you’re new to having a card or just nervous about accumulating debt, take the following tips to heart:

1. Keep Track of Account Changes

Thanks to the government’s CARD Act, this is now much easier than it had been previously.

While card issuers are still allowed to change the terms and conditions of your contract, they now must send notice at least 45 days before enacting any changes.

Paying attention to these notices is important, because card companies can alter important components of your account, such as fees, interest rates and billing.

If you read all the materials your card issuer sends carefully, you can avoid being caught off guard by potentially costly plan changes.

2. Pay More Than the Minimum Every Month

Making the minimum allowed contribution to your balance each month is better than not paying at all, but you’d be better off paying the entire balance, or at least more than the minimum.

The main reason to make larger payments each month is the fact you’ll pay off your balance more quickly.

Another good reason to pay more than the minimum is that card companies can contribute your minimum monthly payment to whichever of your accounts has the lowest interest rate.

So if you owe on two accounts, make a larger-than-minimum payment and make sure it goes toward the card with the higher interest rate.

3. Always Stay Below Your Credit Limit

One easy way to rack up fees is to go over the credit limit on your card.

If you end up over your card’s pre-set credit limit, your issuer could charge a fee and increase your interest rate, making it harder to repay any debt you might have.

The easy way to ensure you don’t end up over your credit limit is simple: Watch what you spend.

Keep a detailed record of your spending, either by collecting receipts or writing down your purchases, and frequently check your balance online. Or, ask for a credit limit increase.

If you use your card at merchants such as hotels or rental car companies, be careful what you spend in the time before they process your final charge.

These companies sometimes put a hold on your card based on your estimated charge, lowering your credit limit for a few days.

4. Make On-Time Payments

If this seems like a no-brainer, it is. But it’s also one of the easiest and most frequent ways people fall into debt.

If you pay your balance on time, you avoid late fees and the increased interest rates that accompany them.

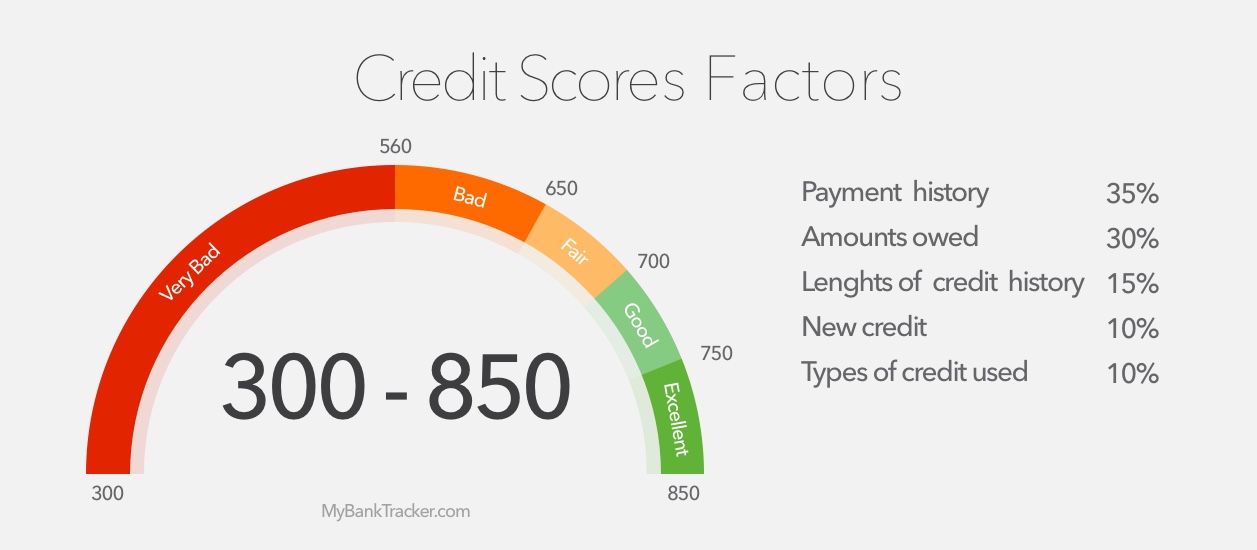

In addition, your good credit record will eventually lead to a better credit score and lower interest rates.

In contrast, if you don’t make on-time payments, you could face late fees and higher interest rates.

Your credit could be damaged, leading to a lower credit score and fewer financial opportunities down the road.

To ensure timely payments, make sure your credit card bill is due at a convenient time of the month — say, a few days after your paycheck arrives. You can always contact your card issuer to have your due dates changed to better fit your schedule.

Compare Your Personal Loan Options

Find a personal loan that better fits your borrowing needs: