What to do When Chase Cancels Your Credit Card

Credit cards, like other bank accounts, can change over time for many reasons.

Card issuers can come out with newer cards and sometimes, they’ll automatically switch existing card customers to the new card.

Or, perhaps the existing card isn’t getting enough applicants. Or, the card issuer is acquired by another company.

Whatever the reason, when it happens to you, you are left with something that you didn’t sign up for originally. It’s not a great feeling.

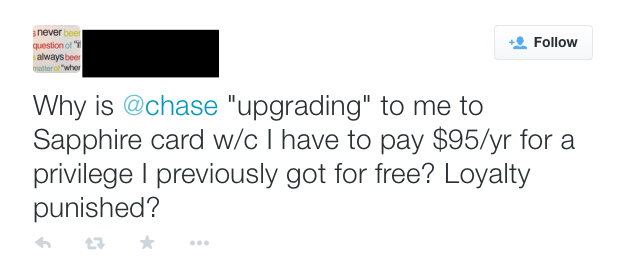

That’s what Chase credit customer (we’ll call him Charlie because he preferred to remain anonymous) experienced when he went on Twitter to express his frustration regarding the conversion of his no-annual-fee credit card to a credit card that had an annual fee.

Glean from his experience so that you know how to avoid being stuck with an unwanted credit card if you are ever put in the same position.

What to do When Your Card is Discontinued

Charlie had a Chase Rewards credit card that was no longer available to new customers, but he was allowed to continue to use it.

However, last month, he received a letter in the mail stating that his card was going to be converted to the Chase Sapphire Preferred card, which has a $95 annual fee.

He probably wasn’t the only one who received a notice about the card program being shut down.

Most likely, other cardholders received the same notice — and plenty of them would have just agreed to convert to the Chase Sapphire Preferred card even though the card program may not fit their spending behavior.

In fact, these credit card conversions happen all the time. It happened to me. It can happen to you.

While you may not have much control over the fact that your current credit card program is shutting down, you can take some action as to what becomes of your credit card account.

Here are a few tips to help you, if you’re ever faced with such a decision:

1. Ask For Other Options

It doesn’t hurt to ask for other options. You don’t have to take the options in the mailed notice as the final word.

Call the number on the back of your card (or the number on the notice) to inquire about other credit card choices.

For all you know, you may discover a credit card that is more compatible with you than the existing one.

According to the mailed notice, Charlie only had two options: switch to the Chase Sapphire Preferred card or close the account.

After speaking with a Chase customer service rep, he discovered that this wasn’t the case.

“I spoke to an agent who said I have the option to switch to a Chase Freedom, no annual fee. Why didn’t [Chase] say that [in the letter]?” he wondered. In the end, he wasn’t pleased with the approach that Chase took to converting his original Chase Rewards card.

It’s one thing when you know the card you’re applying for has an annual fee. It’s another when you weren’t paying for a yearly fee, and now are forced to use a card that has one.

The Chase Freedom card has no annual fee, and it offers 5% cash back in categories that change every quarter (enrollment required) and 1% cash back on everything else.

In other cases, you could get “grandfathered” into the existing account — meaning that you get to keep the account that is no longer offered to new customers (terms can still change in the future).

Remember, look at the terms and perks of the new card before you agree to the new credit card. Annual fees, interest rates, and credit limits can change when you switch to another card.

2. Know What Happens if You Decide to Close the Account

You don’t have to switch to a new card. Maybe the new credit card option was just too expensive.

Maybe you just didn’t want the card account anymore. Whatever the reason is, if you ever find that account closure is the best option, it’s important to understand how it will affect you.

Usually, when you opt to close the account, you can pay off your remaining balance under the existing card terms, but you can no longer use the credit card for purchases, balance transfers, etc.

The bigger concern may be how your credit will be affected. When a credit card is closed, you lose the credit limit of that account.

Since your credit scores account for debt utilization, which is the amount of debt you have divided by the total of how much you can borrow, the loss of that credit line will look bad. It will appear as if you are using more of your available credit.

Finally, credit scores also calculate for the average age of your credit accounts. Having an account for a long time shows responsible credit behavior.

Because the age of this account stops growing, your credit scores will increase slower.

Remember having a bad credit score can affect your future financial decisions. Anything between 700 and 749 is considered good, and anything above 750 is excellent.

Credit Score Ranges and Quality

| Credit Score Ranges | Credit Quality | Effect on Ability to Obtain Loans |

|---|---|---|

| 300-580 | Very Bad | Extremely difficult to obtain traditional loans and line of credit. Advised to use secured credit cards and loans to help rebuild credit. |

| 580-669 | Bad | May be able to qualify for some loans and lines of credit, but the interest rates are likely to be high. |

| 670-739 | Average/Fair | Eligible for many traditional loans, but the interest rates and terms may not be the best. |

| 740-799 | Good | Valuable benefits come in the form of loans and lines of credit with comprehensive perks and low interest rates. |

| 800-850 | Excellent | Qualify easily for most loans and lines of credit with low interest rates and favorable terms. |

Recognizing the potential credit damage posed by closing his card account, Charlie preferred not take that route and continue to hold onto the account, but he also didn’t want to pay an annual fee.

When Charlie converts to the Chase Freedom card, there’s no impact to his credit because the conversion does not require a pull on his credit reports.

3. Care For Your Rewards

Don’t forget about the rewards that you’ve earned — use them while you still can. When you convert the card, your accumulated rewards may disappear. That’s the same case for when you close the account.

In some cases, you may even be able to transfer the rewards from your old card account to the new card account. Once again, I highly suggest that you confirm this with your card issuer before agreeing to a card conversion.

You might even take a swing at negotiating bonus perks and other retention bonuses when switching to another card.

Since many card bonuses are only offered to new applicants, you’d be getting something extra for converting your card — treat the retention bonus as a small token of appreciation for being such a loyal customer.