The Ultimate Guide to Understanding All Your Financial Options

After spending decades in the mortgage industry and teaching debt-payoff courses, my dad always had money lessons to share and advice to give. But despite having so much useful information at my fingertips, some of the most valuable lessons came from trial and error – a few monumental mistakes.

At age 19 I thought I scored the jackpot when I signed up for a store credit card and never received the bill. The purchase caught up with me, as did the creditors, and my credit score plummeted.

At age 22 I added my then-boyfriend as a co-signer to my credit card and watched helplessly as he racked up debt and stopped paying the bill on time. Those delinquencies reminded me of this terrible relationship for several years afterward.

At age 25 I waited six months after being hired before signing up for a 401k with an awesome employer match. After calculating what dragging my feet had cost me, my stomach churned.

The truth is, taking control of our finances as an adult isn’t always easy. Often times we’re forced to make costly financial decisions that can carry big repercussions before having the knowledge necessary to do so.

It can be a scary world out there.

But, as someone who has made their own fair share of money mistakes, I will say that tapping into the right resources can be the difference between financial stability and financial ruin. So if you’re trying to navigate the financial options of adulthood, you’ve come to the right place. Here are a few tips to get you on the right path to paying for school, building credit, and saving for the future.

Understanding Your Student Loan Options

Selecting a college and major might be one of the biggest career decisions of your life. Selecting the size and type of student loans you will take on is likely one of the biggest financial decisions of your life. Sounds like a lot of pressure, doesn’t it?

When it comes to student loans, it’s not just about the amount you can borrow. It’s about the cost of borrowing and the terms for paying the money back. This can have a huge impact on your finances once you exit school and enter the workforce.

Federal Loans

Federal student loans are backed by the government and often have the most favorable loan terms.

Pros:

- Interest rates are lower than private student loans and are fixed for the duration of your loan.

- Some federal loans don’t require credit history or a co-signer.

- They have income-based repayment plans for those who qualify.

- Loan postponement options are more generous than those offered by private student loans.

Cons:

- The amount you can borrow is established by Congress, which may not be enough for what you need.

- They cannot be discharged in bankruptcy.

- Securing federal loans can be a harder process and you’ll need to reapply each year.

Types of Federal Student Loans

Loans are based on financial need. The government will subsidize loan interest as long as you are enrolled part-time in school, six months after you graduate, and in the case of loan deferment.

Loans don’t require proof of financial need. The amount you borrow will be based on your cost of schooling and other help you will be receiving. You are responsible for paying interest at all times.

Loans are for graduate or professional students enrolled at least part-time, or parents of undergraduate students. Applicants cannot have a poor credit history or a co-signer may be required.

Loans are used to consolidate several federal loans into one loan, offering a simplified repayment process. There are pros and cons to consolidation, so make sure to do your research beforehand.

Types of Private Loans

Private loans don’t have the same rules and regulations as federal loans. This can be good or bad depending on your situation.

Pros:

- They don’t have a pre-determined limit – and funds can be used for whatever education-related need you may have.

- You don’t have to prove financial need to receive private loans.

- The approval process can be much easier and you can receive funds right away.

Cons:

- They require a credit check, which could mean you need a co-signer to qualify.

- Rates are generally higher with private loans and are sometimes variable.

- Without flexible repayment options, you could be strapped to high monthly payments.

The types of private student loans you can receive will vary by lender. Before taking on a private student loan, here are a few things to consider:

- How high the interest rate is and whether interest is tax deductible.

- When you will be required to begin paying the loan back.

- If the loan offers deferment options.

- If there are prepayment penalties.

Building Your Credit

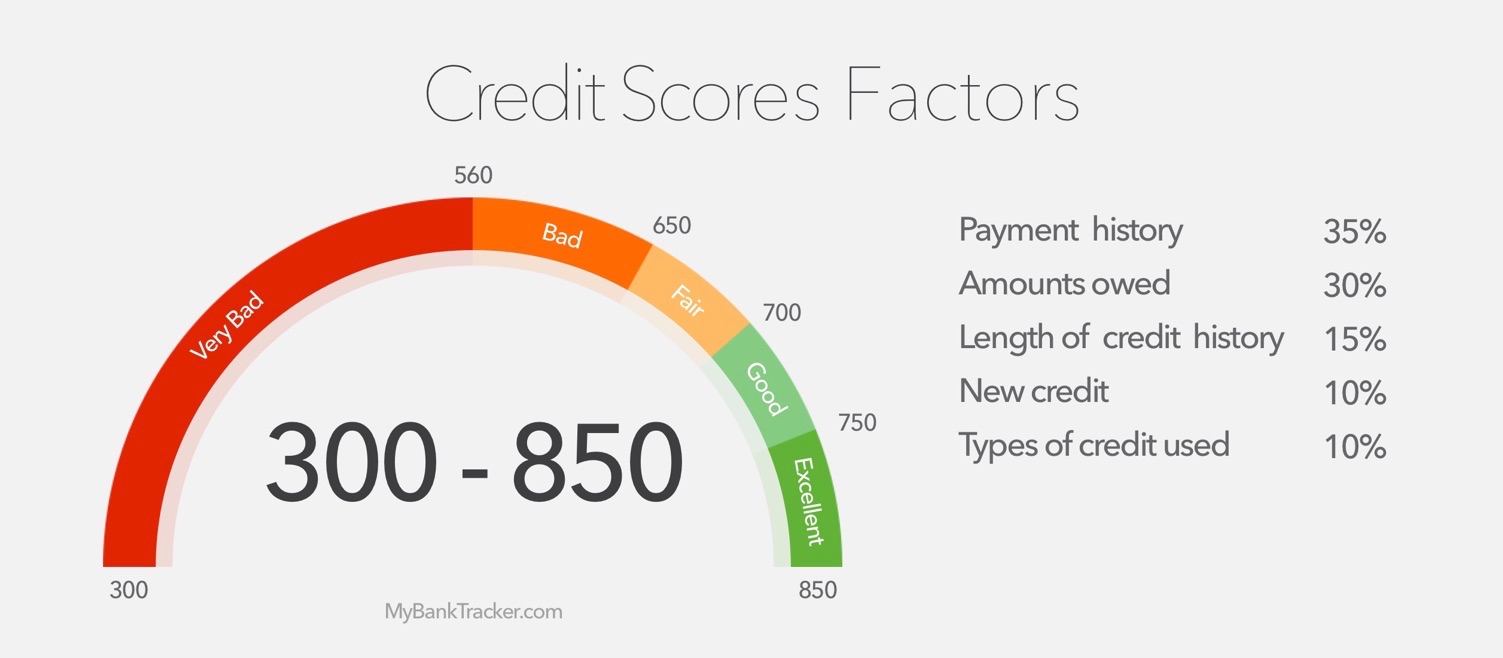

If grades are one of the deciding factors between one college applicant and another, think of your credit score as one of the deciding factors between one loan applicant and another. Your credit score indicates how responsible you are in handling money by taking into account a few key factors.

Factors that Make Up Your Credit Score

Length of credit history (15%)

The longer you have been using credit, the less risk you pose to potential lenders. This takes into consideration both your oldest and newest account, as well as the average age of all of your accounts.

Credit mix (10%)

Credit falls into two camps: revolving (i.e. credit cards) and installment (i.e. auto loans). If you have experience managing both, the better your score will be.

Payment history (35%)

You’ll notice this factor has a much larger impact on your score. This is because your ability to make on-time payments is a huge indication of how risky you seem to be for potential lenders.

Credit utilization (30%)

You might have credit available to you, but if you are constantly spending to the top of your limits, your score will suffer. Credit utilization can be a tricky topic – learn more here.

Number of new accounts (10%)

If you’ve opened multiple accounts in the last two months, it could appear as if you’ve come into some financial trouble – a big red flag for lenders.

Now that you have a better understanding of how you score is calculated, it’s time to start building a solid credit history.

How to Start Building Credit

Start with a Secured Credit Card

Before you’ve managed to establish enough of a credit history to be approved for a regular credit, you can build credit using a secured credit card. Instead of spending money from the card issuer, you are spending your own money in the form of a deposit. The card limit is a percentage of the deposit, depending on the terms. While you are essentially just paying yourself back with every bill, you are showing your ability to manage credit in the future.

Use a Credit Builder Loan

Much like a regular loan, credit builder loans require an application and promise money from the institution you are borrowing from. The difference is, you make the monthly payment on the loan and, only once all payments are made, do you receive the loan amount. Your payment history is then reported on your behalf to credit reporting agencies.

Add Your Rental History

Not having credit doesn’t mean you aren’t already responsible for managing your money. Often times young adults have a stellar history of on-time rent payments and nothing to show for it. Now there are few solutions. Services like ClearNow and RentalKharma allow you to pay rent through their portal. In turn, they report to one or more credit reporting agencies to help bolster your credit score. Just beware: not all credit scoring models will take your rental history into account.

Saving for the Future

It can feel a little strange to turn your sights to retirement when you’re just barely entering the workforce. This is even truer when student loans are knocking and your paycheck just barely covers the necessities.

I know I was less than thrilled when my first job required I start contributing to my 401k. But that thought process completely switched when I learned the huge cost-saving benefit to starting young. Thanks to the magic of compound interest, starting earlier means you will need to save less and will receive more come retirement. Seriously. (Check out

Tip: Check out this calculator to learn more about saving fr retirement.

Not sure where to start? Here are a few options.

Ways to Start Saving for the Future

401k or 403b

If your company offers a retirement plan (and lucky you if they do), it’s likely a 401k. This type of plan uses your pre-tax dollars which will lower your taxable income by the amount you contribute each year. In addition, many companies will offer a match meaning they will contribute a percentage on your behalf – as long as you at least contribute the same amount. (For example, they will give you 3% if you contribute 3% or more).

The other plan you may have through your employer is a 403b. This plan is restricted to certain employers, namely non-profits, churches, and public schools. Structurally they are similar to 401ks, although they have lower administrative fees.

Roth IRA

If your company doesn’t offer a retirement plan, there’s another option: The Roth IRA. While contribution limits are lower for Roth IRAs than for company-sponsored plans, Roth IRAs are a great place to start.

Roth plans use contributions that are post-tax. That means they won’t lower your taxable income now, but they won’t be taxed when the money is withdrawn. This could be preferable if you are currently in a low tax bracket because you would end up paying more in taxes if you are in a higher tax bracket at retirement.

Tip: Check out other retirement plan options that might apply to your specific situation here.

Ready to get started? Here are a few other tips:

Contribute as Much as You Can

If you are offered a company retirement plan with a match, at least contribute up to the match. This will ensure you don’t leave free employer money on the table. But, if you can muster it, shoot for 10-15% of your paycheck. This will really get you on a path to being comfortable at retirement – without having to make huge catch-up contributions along the way.

Make it Automatic

Saving 10-15% of your paycheck might seem like a lot, but if it exits your account on a regular basis without any additional effort on your part, it shouldn’t feel like a struggle. Once you begin thinking about your income as your net pay, minus retirement contributions, you likely won’t even miss it.

Change Your Mindset

Retirement is no longer the antiquated picture of cruising around the world or playing golf with other retirees. Now it really just indicates a new stage of life where work is no longer the main focus.

Retirement can be anything you want, from traveling the world your way to volunteering at an animal sanctuary. If you can dream it – and fund it – you can make it happen.

Instead of thinking of saving as another drain on your finances, why not think of it as a contribution to your dream life? Follow all the steps here to handle your student loans, build credit, and prepare for the future and you will be able to do just that.