How Your Credit Score is Affected When Rate-Shopping for New Loans

When you’re applying for a large loan, like a car loan or a mortgage, the interest rate you pay matters a lot.

Consider this: on a 30-year, $100,000 loan, a 0.25% increase in the interest rate adds $15 to your monthly payment.

If you’re borrowing $500,000, that same small increase will add $75 to your monthly payment. The increased costs from higher interest rates add up quickly.

Given the effect that the interest rate can have on these large loans, it makes a lot of sense to shop around. You can save thousands by comparing lenders and finding the lender that offers the lowest rate.

Unfortunately, you need to be careful with how you shop around.

If you don’t follow the rules for rate shopping that are put in place by credit bureaus, it can affect your credit and make it harder to get a good deal on a loan.

What is the Rule?

FICO, the company responsible for the most common calculation of your credit score, lists two different rules surrounding rate shopping.

Which rule applies depends on the formula that is used to calculate your credit score.

FICO produces the formulas used to calculate credit scores but does not provide that information to lenders. Instead, when you apply for a loan, lenders contact a credit bureau to get information about your credit score.

Different credit bureaus use different formulas, and different lenders ask for scoring based on different formulas.

That can make it hard to predict which exact score will be given for each loan that you apply for.

30-day rule

The 30-day rate-shopping rule is used for most of the FICO formulas.

This rule states that any “hard” inquiries on your credit for loans such as mortgages or car loans will be counted as one inquiry for calculating your credit score.

Because these types of loans are most prone to rate shopping, penalizing you for each inquiry does not accurately reflect your risk as a borrower.

45-day rule

The 45-day rule is used for the newest FICO formulas.

Like the 30-day rule, it combines all inquiries for loans prone to rate shopping into one when calculating your credit score, so long as those inquiries occurred within a 45-day period.

Applications for credit cards do not benefit from either version.

Most mortgage lenders tend to ask for scores based on older formulas, so the 30-day rule is more commonly used.

What is a Hard Inquiry?

To understand why these rules matter, you need to understand what a hard inquiry is.

Each time you apply for a loan, the lender will request a copy of your credit report from a credit bureau. The credit bureau will take note of this “hard” inquiry on your credit.

These inquiry records stay on your report so that other lenders can see how many loans you’ve applied for recently.

After 24 months, the record of an inquiry will fall off of your report.

Effect on your credit score

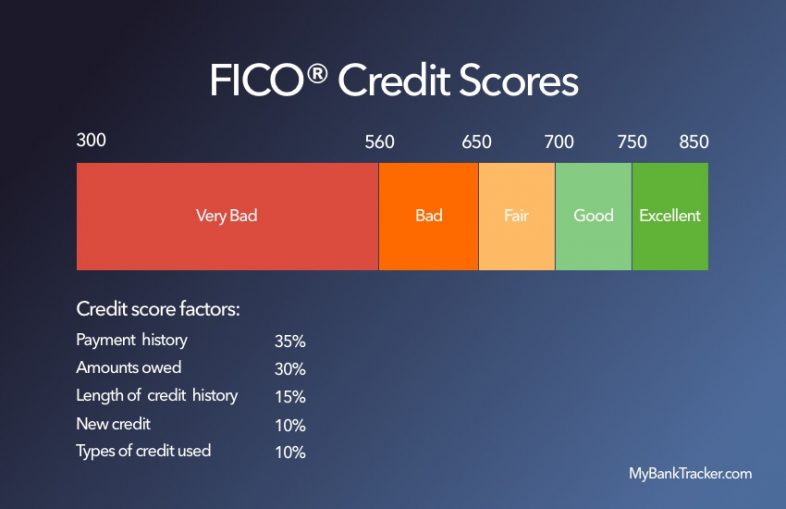

Your credit score is a numerical indicator of your risk as a borrower.

If you have a good credit score, lenders can feel secure lending to you since you will most likely pay them back.

If you have a low credit score, lending to you is riskier for the lender to do.

That results in fewer approvals and higher interest rates on the loans you do qualify for.

Your credit score is calculated from a number of factors, each of which is intended to show a pattern of good or bad borrowing behavior.

One of these factors is the number of recent applications for credit you have made.

Applying for a lot of loans in a short period of time can indicate that you’re in financial trouble.

If you’re borrowing a lot of money from different lenders, there’s a good chance you’ll have trouble paying the loans back.

For that reason, each inquiry that appears on your report will drop your credit score by a few points.

According to FICO, a hard inquiry can cause a 5-point drop.

The effect of having a lot of inquiries on your report can significantly reduce your credit score.

The impact on your credit gets lower over time until the inquiry falls off your report 24 months after you applied for the loan.

Some lenders or companies will do “soft” pull on your credit. This is common for something such as credit limit increase requests or setting up utilities.

These soft inquiries will not affect your credit.

How Does It Affect Your Loan Applications?

When you apply for a loan, the lender will try to assess how risky it is to lend money to you. Lenders are primarily concerned with whether they will get their money back, so they will only lend to you if they think that you will pay the loan back.

Because each hard inquiry will reduce your credit score by a few points, that can impact your ability to get approved for a loan.

Each subsequent loan you apply for will have a lower chance of being approved as your score will have been reduced by all of the inquiries that had occurred.

People with good credit scores will get the lowest interest rates on their loans.

People with lower credit scores will have to pay more interest. That means that even if you get approved for one of the last loans you apply for, you might wind up getting charged more interest.

The rate shopping rules that combine inquiries in a certain time period was created to help avoid these pitfalls of shopping for the best interest rate.

When you apply for a loan like a car loan or mortgage, try to get all of the applications submitted within the rate shopping window to take advantage of the rule.

Tips for Rate Shopping

Here are a few tips to keep in mind when you’re rate shopping.

Check your credit reports first

Before you start the process of looking for any large loan, you should check your credit.

You can check your credit for free using AnnualCreditReport.com. This website is sanctioned by the U.S. government and will never charge you any fees to view your credit report.

This will let you see what your credit score is, giving you an idea of what types of loans you might qualify for.

If you know your credit is on the borderline of getting approved for a mortgage, you might not spend as much time shopping for the lowest rate and getting hit with multiple rejections.

Just as important is the fact that checking your credit report lets you see what exactly is playing into your score.

You might notice a mistake on the report, such as an account you didn’t open. Having a mistake on your credit report is more common than you would think.

Fixing these mistakes is one of the easiest and quickest ways to get a huge boost to your score, making it easier to get a good deal on a loan.

If you notice errors on your report, contact the credit bureau for information on how to dispute the errors. The process can take some time, but it is certainly worth doing.

Avoid applying for other types of loans

When you’re applying for a large loan, it can be difficult to get approved. If you do get approved, the interest rate you will have to pay is incredibly important.

Even a small change in the rate can cost thousands of dollars over the life of the loan.

If you apply for other loans during the rate shopping period, they will not be combined with all of the inquiries for your mortgage or car loan.

This will cause your credit score to drop. That means you might have trouble qualifying for the loans you apply for or may get charged more interest.

Do research before applying

The rate shopping period lasts for either 30 or 45 days, depending on the FICO scoring formula used.

That might sound like a long time, but it’s easy to wind up shopping for the best rates for months at a time.

To make sure you take full advantage of the rate shopping period rules, do your research before submitting your first loan application. That lets you submit all of your applications to different lenders in quick succession.

You’ll easily get your applications in within the 30 or 45-day time limit. That can help you avoid accidentally incurring multiple credit inquiries.

Conclusion

Getting the lowest rate possible when you apply for a large loan can save you a lot of money.

Taking advantage of rate shopping rules will let you avoid impacting your credit by shopping for a deal.