Should You Pay Off Student Loans Early to Save on Interest Charges?

If you have student loans, it can be very tempting to do your best to pay the loans off as quickly as possible.

In general, this is a good thing to do, as getting out of debt is an important step on the path to having a healthy financial life.

Still, there are reasons that you might be better off keeping your student loans and using your extra cash for other purposes.

Why Pay Off Your Loan Early

There are a number of arguments in favor of paying off your loans as quickly as possible.

Reduce interest paid

When you pay off a student loan early, you’re avoiding years of interest charges.

This can result in significant savings, especially if you pay the loan off far ahead of schedule. You’re guaranteed to pay less in interest than if you just paid your balance off as schedule — over many, many years.

Consider this example:

You have $50,000 in student loan debt that you’ll pay off over ten years. The interest rate on the student debt is 5%. Over the course of 10 years, you’ll make 120 $530 payments, for a total of $63,639 paid. If you come into $50,000 and use it to pay off your loan in one fell swoop, you’ll immediately save $13,639 in interest costs.

Remove a psychological burden

Carrying debt involves paying a psychological price. It’s a well-known fact that being encumbered by debt can impact your relationships, self-confidence, and ability to plan the future.

It’s easy to feel helpless when you’re in debt, especially if you can’t picture a way to escape from the amount of debt you have.

Student loans can be even more stressful than other types of debt because they nearly impossible to be discharged in bankruptcy.

That means even if you hit rock-bottom you’ll still be stuck with the burden of student debt. Paying your student loans off can be like taking a weight off your shoulders.

Avoid rate increases

Some student loans have a fixed interest rate while others have a variable interest rate.

Variable interest rate loans have rates that change based on the market conditions.

That means your monthly payment could increase if rates increase.

Paying off your variable rate student loans means you won’t have to worry about unexpected changes to your required monthly payments.

Why Avoid Paying Off Your Loan Early

There are also some arguments that make the case that you’ll be better off by not paying your student loans off early.

Make more through investing

One argument in favor of keeping your student loans is that you can make more money by investing your extra money than you would save by paying your loans.

Over the past century, the United States’ stock market as a whole has averaged an annual return of roughly 10%. That means that for every $100 you put in, you’ll have $110 a year later, on average.

Of course, almost no year in the stock market is average. Some years see huge gains and some years see huge losses.

However, over the course of 20, 30, or 40 years, historical returns show that you are likely to experience similar returns.

What that means is that if your loan has an interest rate below 10%, you will, in the long run, most likely come out ahead by investing rather than paying down your loans.

However, there is significant value in the fact that the savings from paying your loan off are guaranteed. Stock market returns are not.

It’s up to you what interest rate you’re comfortable having on a student loan without paying the loan down as quickly as possible.

I use somewhere between 4% and 5% interest as my rule of thumb. I’ll keep a loan with a rate lower than that because I am confident that the market will offer higher returns. I’ll tend to focus on paying loans with higher rates over investing extra cash.

Tax advantages

There are a number of tax advantages to keeping your student loans.

The most obvious is the student loan interest deduction.

With some restrictions, this deduction lets you subtract some of the interest you paid on your student loans from your income when you file your taxes.

This effectively reduces the interest rate on your student loans, making them cheaper than they may appear.

Another tax benefit that you can take advantage of is investing your money in a 401(k) or IRA.

If you use all your extra cash to pay off your loans, you cannot take advantage of these tax-advantaged accounts.

401(k)s and IRAs are special savings and investment accounts that are designed to help people put money away for retirement.

Any money you contribute to a 401(k) or IRA is locked away until you turn 59½, but you get to deduct the amount you contribute from your income when filing taxes.

You can only contribute so much to each account in a year, and if you don’t make contributions one year, that tax-advantaged space is gone forever.

The savings from using your extra money to contribute to your tax-advantaged accounts can be worth paying some interest on a student loan.

How to Choose Which Loan to Prioritize

If you have more than one student loan, there are two strategies you can use when deciding which to pay off first.

The avalanche method has you focus on the loan with the highest interest rate first. Make the minimum payment on all of your loans, except for the loan with the highest rate. Use all your extra income to pay down your highest-rate loan as quickly as you can.

The result of this strategy is that you will pay the minimum amount of interest possible by eliminating your expensive loans first.

The snowball method has you focus on the loan with the lowest balance first. Make the minimum payment on each of your loans, except the loan with the lowest balance.

Use all your extra income to pay off the lowest balance loan as quickly as possible. Once you’ve paid the lowest balance loan in full, pay the next lowest balance loan, and so on.

The result is that you’ll pay off individual loans very quickly, reducing the total of the minimum payments you have to make each month. The downside is that you might pay more interest using this strategy.

Let’s say these are the four student loans that you have:

Example of multiple student loans

| Loan 1 | Loan 2 | Loan 3 | Loan 4 | |

|---|---|---|---|---|

| Balance | $15,000 | $10,000 | $2,500 | $6,543 |

| Rate | 4% | 6% | 1% | 15% |

| Minimum payment | $250 | $350 | $100 | $250 |

Combined, you the loans have a minimum payment of $950 each month. You can afford to pay $1,000 each month.

Using the snowball method, you’ll pay a total of $37,209 over 38 months to eliminate all your debt. The avalanche method will see you pay $36,720 over 37 months.

You’ll save $489 by using the avalanche method, but the snowball method will free up some your money from required monthly payments more quickly.

Build an Emergency Fund First

No matter what you decide, you should always focus on building an emergency fund first. Though being in debt can feel like an emergency, having some emergency savings can help you avoid going deeper into debt.

Consider this example:

You don’t have an emergency fund. You get hurt and have to visit the hospital and incur a $2,000 bill. Because you don’t have an emergency fund, you have two choices: use a credit card or don’t pay the bill.

Your options are to pay the bill with a credit card or to not pay the bill at all. If you don’t pay, you’ll be hounded by debt collectors and your credit score will be ruined. If you pay with a credit card and then make the $50 monthly minimum credit card payment, the bill cost you $3,300 over the next five and a half years.

Building up an emergency fund of just a few thousand dollars makes unexpected expenses much cheaper.

Ideal size for an emergency fund

The question is, how large should an emergency fund be? You should always aim to keep it in an online savings account for unexpected expenses, but the size of your fully funded emergency fund will vary with your income, family situation, and type of employment.

If you have a secure job that you’re not afraid of losing and have no dependents, and emergency fund of at least 3 months worth of expenses is sufficient.

If you have an insecure job and a lot of dependents, you might want closer to 6 months’ expenses. A common rule of thumb for all situations is to keep six months’ expenses on hand.

That means you should have $12,000 on hand if you spend $2,000 per month. That will help you maintain your lifestyle even if you lose your job.

Can Paying Your Loan Off Early Affect Your Credit?

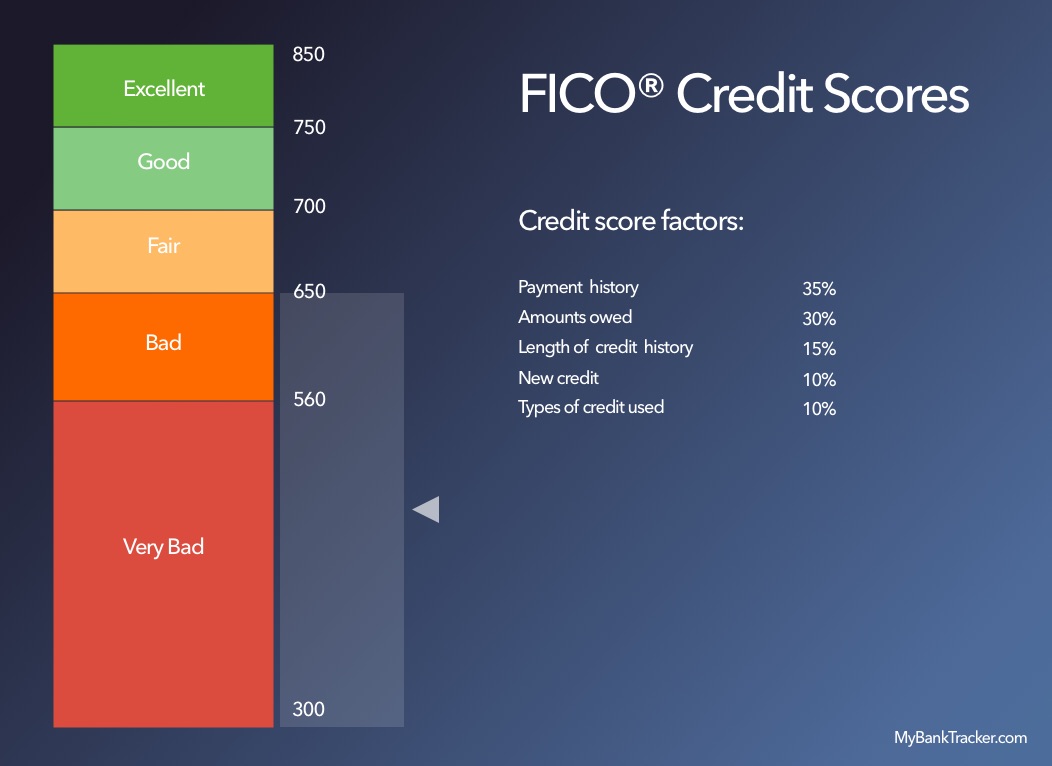

Paying off your loan early can affect your credit, but the effect is more likely to be good or neutral than bad.

While your score will decrease slightly if your student loan is the only installment loan on your report, the reduced debt and credit utilization will more than likely make up for the decrease.

Just make sure you have at least one other credit account, such as a credit card, before paying off the loan. That will let you continue to build credit and recover from any score drop over the course of a few months.

Conclusion

Yes, it is a good idea to pay off your student loans to avoid the many of years of interest charges to come.

But, there are other benefits that come from it. Together, pay off student loans early is generally a great move for your overall finances.