Here’s How Paying Off Student Loans Affects Your Credit Score

For many people, a student loan is the first line of credit that they get. That means it is the first thing to show up on their credit report and to start building their credit score.

Many people’s student loans are for significant sums, meaning they’ll be paying the balance for a long time and the loan is likely to play a big role in their credit history.

As with any type of loan, the history of your student loan affects your credit score.

The major concern is that paying off student loans entirely will actually hurt your credit, which may lead some borrowers to consider holding on to their student loan debt for the sake of maintaining good credit.

Learn if this is true and what really happens to your credit when you erase your student loan debt.

How Your Credit Score is Calculated

To understand what really happens to your credit after paying off student loans, you need to know how your credit score is calculated.

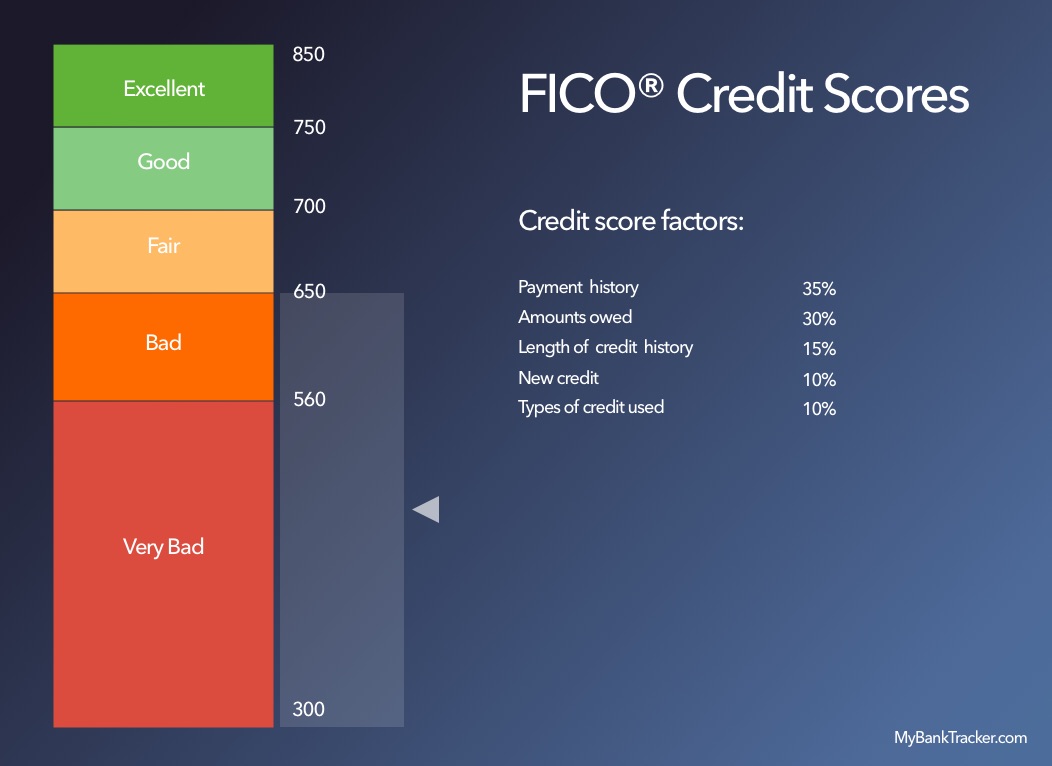

Because more than 90% of the major U.S. lenders use the FICO credit score, it is the one that we’ll use it here.

Your FICO credit score is comprised of five parts:

1. Payment history

The payment history portion of your credit report tracks your history of making on-time payments on your bills.

Every on-time payment looks good and increases your score. Every late or missed payment hurts your score. The later the payment, the larger the impact on your score is.

This factor has the biggest effect on your credit score. Being consistent about making on-time payments is the best way to improve your score.

Want to check your credit report? You can access it here at AnnualCreditReport.com once a year, from all three credit bureaus.

2. Amounts owed

The debt burden portion of your credit score is subdivided into two parts.

The first is simply the total amount of debt you have. The more money you owe, the worse your score will be.

This is because lenders are primarily concerned with whether you can make monthly payments on new loans.

If you owe a lot of money, your income will be tied up in paying existing loans, leaving little to make payments on new loans.

The second portion is the percentage of your credit limits that you are using, otherwise known as your credit utilization ratio.

Combine the total credit limit of your credit cards and the initial amount you were loaned on other loans, such as student loans. Divide your current debts by that number. The lower the result, the better your score will be.

Here’s an example:

Say you have two credit cards, one of them is the Capital One Venture Rewards Credit Card with a credit limit of $9,000 and the other is the Discover it Cash Back card with a credit limit of $10,000.

You’ve spent $2,000 on your Capital One card and $8,000 on your Discover card.

So to figure out your percentage of your credit limits that you’re using, add $2,000 and $8,000 together, which equals $10,000 and divide that by your total credit limit ($9,000 + $10,000 = $19,000), that is $10,000 divided by $19,000 which equals .52 or 52%.

A good rule of thumb is to keep the percentage of your credit limits below 30% – so it looks like, in this case, you would have some work to do.

3. Length of credit history

This is another part of your score that is subdivided into two parts.

One part of this is simply how long you’ve been on record with the credit bureaus.

The longer you’ve had access to credit, the easier it is for lenders to assess your financial habits. That means your score will be better with a long credit history.

The other part is the average age of your credit accounts. The longer you’ve had your loans or credit cards, the better it is for your score.

This is because lenders like to see long-term lending relationships rather than someone who cycles through lenders regularly.

Length of Credit History

| Credit Age | Rating |

|---|---|

Less than 2 years | Poor - Your credit age is just beginning and needs some time to grow |

2 to 4 years | Bad - You are still in the baby stages of your credit age but it's great you have some years of creditworthiness under your belt |

5 to 6 years | Average - You are on your way to being at the ideal credit age |

7 to 8 years | Good - You are right in the time-frame of what lenders are looking for with credit age |

9+ years | Excellent - You’ve proved your credit stability with credit age |

4. Recent applications for credit

Each time you apply for a loan, the lender requests a copy of your credit report from a credit bureau. The credit bureau keeps a record of these requests for two years. Each request will cause a small reduction in your score.

This is because applying for many loans in a short period of time is a risky behavior. It might look like you have a large expense you can’t manage, or want to borrow a lot of money and disappear with it.

Avoid applying for lots of loans if you want to keep your credit score high.

Quick Fact: When a lender checks your credit history (e.g., applying for a student loan, a credit card, a car loan, etc.) it’s called a hard inquiry – and generally speaking – you want to keep the number of hard pulls on your credit report low (about 6 every 2 years).

A soft inquiry, however, is much less harmful to your credit, but still important for you to be aware of. A soft inquiry may be when you want to check your rate that you might get on an auto loan, for example, by putting in basic information about your self (like an estimate of your income or your highest level of education). Although soft pulls do not affect your credit score, reports suggest you should keep soft inquiries to a minimum (about 20 and under every few years).

5. Types of credit

Having different types of loans shows you know how to handle different types of debt.

Having a credit card and handling it properly is very different from handling a student loan properly. If you’ve had multiple different types of loans, it will be good for your score.

If you’re a student who isn’t working, it can be hard to get approved for a credit card. However, it’s important to start building your credit as soon as possible! That’s why MyBankTracker recommends you check out our list of the best secured credit cards to get a jumpstart on your credit and keep it growing.

What Happens When You Pay Off Your Student Loans

Going over each criterion that goes into the credit score calculation, here’s how each one is affected when your student loans are gone:

Effects to credit score when student loans are paid off

| Credit score criteria | Effect |

|---|---|

| Payment history | No significant impact. |

| Amounts owed | Paying off your student debt will decrease your overall debt burden. It will also decrease your credit utilization ratio. This is good for your credit, so your score will see a slight boost from this factor. |

| Length of credit history | Though paying off your loan won’t affect the length of your credit history, it will affect your average age of accounts. If your student loan is your oldest loan, the average age of your accounts will drop. This is bad for your credit and could cause your score to drop. On the other hand, if you only got your student loan later in life, and have an older account, such as a student credit card, your average age of accounts could rise. This will give your score a boost. |

| New credit | No significant impact. |

| Types of credit used | If your only installment type loan is your student loan, you’ll lose installment loans from your credit mix. This will have a small negative impact on your credit score. |

Reasons to Not Pay Off the Loan

There are a few arguments in favor of keeping your student loan a bit longer.

Investing for higher potential returns

One argument is that you can do more with your extra cash by investing it in the stock market.

Student loan rates tend to range from 4-7%. However, the stock market has returned an average of 10% per year over the past century.

Some years see much higher returns, but some years see losses.

If you have loans with low interest rates and are willing to stomach the risk, you could come out ahead by investing your money instead of making extra loan payments.

Tax benefits

Because the government wants to encourage young people to pursue an education, it offers benefits to people who take out student loans.

One of these benefits is the ability to deduct some of the interest that you pay from your income when you file taxes.

This can reduce the effective interest rate on your loans by a significant amount. When looking at the effective rate, you might be more willing to take the risk of investing to try to earn a better return.

Upcoming loan application

If you know you have a good credit score and are about to apply for a major loan, like a mortgage, don’t try to fix something that isn’t broken.

It’s alright to leave your student loan alone for a few months while you go through the paperwork to apply for the new loan.

Just be aware that having the loan on your report affects your debt-to-income ratio, which could impact your chances.

Reasons to Pay Your Student Loan Off

There are also arguments in favor of paying your loan off as quickly as possible.

Guaranteed savings

If you pay off your student loan early, you get the benefit of a guaranteed return on your investment in the form of reduced interest payments.

Consider this example.

You have $50,000 in student loan debt that you’ll pay off over ten years. The interest rate on the student debt is 5%. Over the course of ten years, you’ll make 120 $530 payments, for a total of $63,639 paid. If you come into $50,000 and use it to pay off your loan in one fell swoop, you’ll immediately save $13,639 in interest costs.

If you decide to invest that money instead, you’ll have to earn at least $13,639 for it to have been worth it.

Psychological win

Carrying debt, especially student debt, can weigh heavily on your mind. It’s well-known debt can affect people’s self-confidence, relationships, and ability to think about the future.

Student loans are worse than most debt because they can’t be discharged in bankruptcy. That can make them even more psychologically difficult to handle. Don’t discount the mental benefits of paying the loan off.

Better debt-to-income ratio

Paying off your student loan will decrease your debt-to-income ratio, which lenders like.

Your debt-to-income ratio is the sum of your debts divided by your annual income.

It measures how much cash flow you have left each month to make payments on new loans. The lower this ratio is, the happier lenders will be.

Reducing the Effects on Your Credit

If you do want to pay off your loans early, you should take steps to reduce the effect it will have on your credit.

The best thing to do is to make sure that your student loan isn’t the only credit line that is recorded on your credit profile.

You might consider opening a credit card account as soon as you can. Even if you never use it, it will appear on your report and help your average age of accounts when you pay your loan off.

In general, if your student loan isn’t the only loan on your credit report, the overall effect on your credit score will be small.

It shouldn’t take more than a few months for your credit score to return to where it was. You should always avoid paying interest just to build your credit score.

It’s easy enough to build the score with loans that you need and credit cards that don’t cost anything, so long as you pay them in full each month.

Conclusion

If you’re wondering whether you should hang on to your student loans or pay them off early, you’re already in a good position.

More likely than not, it is okay to go ahead to pay off your student loans if you’re concerned about your credit score.