What is the Average Interest Rate on Savings Accounts?

There are many ways to save and invest your money. If you’re looking for a solution that’s simple and safe, you can’t go wrong with a savings account. Money in a savings account will earn interest.

But many factors determine the amount of interest you earn. These include the bank, the type of savings account, and even the U.S. economy.

Whether you’re saving for a vacation, a new home, or building an emergency fund, savings accounts are a fundamental part of financial planning. And, you’d want to earn as much interest as you can on your money.

What is the National Average for Savings Rates?

To give you an idea of what savings rates are like in the U.S., the Federal Reserve publishes a national average of the interest rates earned in savings accounts:

Historical National Savings Rate Averages (<$100,000)

| Date | National average (APY) |

|---|---|

| March 19, 2018 | 0.07% |

| January 3, 2017 | 0.06% |

| January 4, 2016 | 0.06% |

| January 5, 2015 | 0.06% |

| January 6, 2014 | 0.06% |

| January 7, 2013 | 0.07% |

| January 2, 2012 | 0.11% |

| January 2, 2011 | 0.17% |

| January 4, 2010 | 0.21% |

What Factors Affect Savings Rates?

Savings rates aren’t written in stone, so they can fluctuate from day-to-day.

To understand these rate fluctuations, you must first understand the role of the Federal Reserve. And you need to understand how the federal funds rate works. Both factors influence savings rates.

The Federal Reserve is the central bank of the United States. It was created with the purpose of keeping the financial system safe and stable.

How the Fed controls rates

Basically, the Fed lowers interest rates when the economy suffers. This makes it easier for people to get credit or borrow money. This encourages spending and contributes to growth.

When the economy is booming, the Fed responds by raising interest rates. This puts the brakes on borrowing and controls inflation (rising of prices over time).

The Fed uses the federal funds rate to control inflation and economic growth. This is the interest rate that banks charge each other on loans to meet reserve requirements.

The Fed requires banks to maintain a minimum cash reserve at the end of each day. Sometimes, a bank doesn’t have enough in reserves. If not, they can borrow the needed funds from other banks at the federal funds rate.

The Fed doesn’t determine the federal funds rate per se, but it does establish a target range for this rate. When the Fed increases this target rate, it becomes more expensive for banks to borrow funds. And unfortunately, financial institutions pass this cost onto consumers.

A decrease in the federal funds rate triggers lower interest rates across the board, which is a good thing. But an increase triggers higher rates. As a result, interest on short-term loans like auto loans and credit cards increase.

Because banks base their consumer rates on this benchmark, the federal funds rate also determines your rate on savings accounts. Thus, a higher target rate can also result in higher yields on savings rates, but not by very much.

Unfortunately, savings rates don’t move up as much as loan rates.

Bank-to-bank competition

Although economic conditions play a role in interest rates, banks ultimately decide their savings account rates. Banks know that you have plenty of options. And if their savings rates are too low, you’ll go elsewhere.

Therefore, some banks offer slightly higher savings rates to gain a competitive edge. This encourages customers to open savings accounts with their institutions.

So in a lot of ways, savings rates are also based on what other banks offer.

If one bank increases its interest rates on savings accounts, other banks may follow. But even when a bank increases its rate, the bump tends to be small.

Find the best rates

Unlock exclusive savings rates and gain access to top-tier banking benefits.

Where Can You Find the Highest Savings Rates?

The fact that savings rates haven’t increased much in recent years doesn’t mean you have to settle for earning pennies. You can get a higher return on your deposits, but this entails putting your money in the right place.

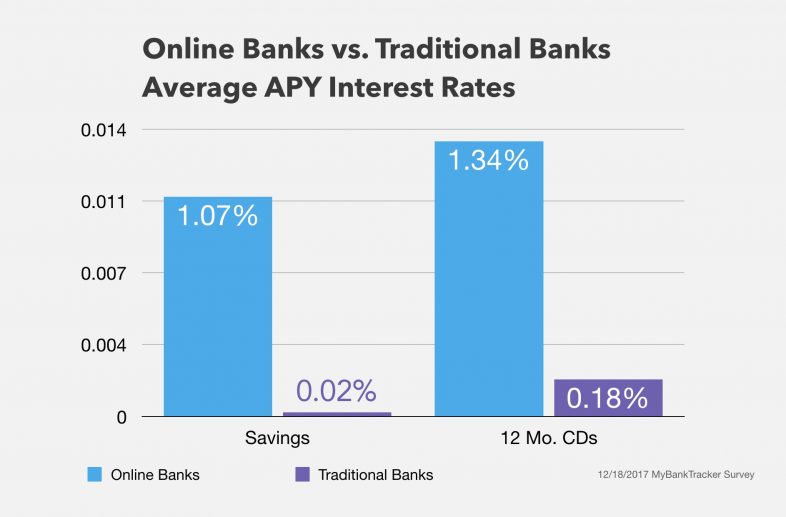

A big name brick-and-mortar bank may be conveniently located near your house. If so, you’re free to open an account with this institution. Just know that these banks don’t usually offer the same return on savings accounts as online banks.

Bigger doesn’t always mean better, especially with regard to banking. Sure, a local big bank may be reputable and offer a wide assortment of financial products.

But the bigger a bank, the more it likely spends on overhead and operating costs. And unfortunately, many of these expenses trickle down to consumers.

Low costs mean higher rates

An online bank, however, may have lower operating costs. Therefore, opening an account with these banks can translate into savings for you.

Likewise, you might save money by depositing your money in a credit union or a small community bank. These institutions may also have cheaper operating expenses.

But while a credit union or community bank may have lower costs, these financial institutions may not advertise the best rates. If you’re looking for a higher savings rate “and” lower costs, an online bank is your best bet. You can grow your savings and reach your financial goals sooner.

Another upside is that you might receive better customer service through an online bank. Fewer expenses allow some online banks to invest more resources in training customer service representative.

Or they may have more resources to invest in newer technologies. As a result, they can offer online and mobile banking systems that are as sophisticated as those set up by big banks.

How to Find a Better Savings Account

Questions to consider when choosing an online bank for savings:

What are my savings options?

High-yield savings accounts are popular products offered by online banks. But these aren’t the only savings tools available to you.

Other options might include high-yield money market accounts. They can have a larger minimum balance to earn the advertised APY. Also, it may come with checks and a debit card.

What are the monthly fees?

Some online savings accounts have monthly maintenance fees, whereas others don’t. Keep in mind that some banks will waive the monthly fee if you maintain a minimum average daily balance.

Another plus is that many online savings accounts have no or low minimum opening deposit requirements. This lets you open an account with little funds.

Will I have access to ATMs?

One downside of an online savings account is that you may have no access to an ATM, depending on the bank.

On one hand, your money isn’t as accessible, so you’re less likely to make unnecessary withdrawals. But on the other hand, this reduces the liquidity of your funds.

Does the bank offer mobile banking?

Mobile banking is an essential feature of any savings account.

Make sure the bank offers mobile banking before opening an online savings account or a money market account. This way, you don’t have to mail in checks.

Instead, you can deposit checks from your smartphone. Mobile banking also lets you check your balance and transfer funds between accounts from a mobile device.

What is the excess transaction fee?

Online savings accounts and money market accounts let you tap your funds whenever. You’ll receive an ATM card with your savings account. Likewise, a money market account comes with a debit card and check writing privileges.

Just know that these accounts limit the number of withdrawals or checks you can write per month. If you exceed this limit, the bank will charge an excess transaction fee.

Conclusion

Some people immediately choose a regular savings account from a bank in their neighborhood — probably the one with the biggest sign. This is a safe, simple place for funds.

But, a regular savings account won’t earn much interest. Other types of savings accounts can offer higher returns.

The recommended option for a better return is a high-yield savings account through online banks.

Of course, it isn’t enough to know the different types of savings. You should also be familiar with average rates for these accounts. When you know what to expect, you can then determine the best place to store your money for the greatest return.