The Best Personal Loans in Vermont for 2024

A personal loan is a flexible unsecured loan option for many people that need to borrow money. You don’t have to put up collateral and most lenders allow a wide range of loan amounts and lengths.

These unsecured loans often come with higher interest rates than secured loans. If you want to save money, you need to shop around for the best lender.

Rather than let you spend hours looking for the best personal loan, we researched personal loan lenders in Vermont to find the top options. Here’s what you should know.

The Best Personal Loans in Vermont

These are our top personal loan lender picks in Vermont, in no particular order:

- TD Bank

- M&T Bank

- Union Bank

TD Bank

TD Bank’s TD Fit Loan allows you to borrow between $2,000 and $50,000 with funding as fast as one business day. Loans are available for three to five years.

Interest rates for these loans are competitive. The bank doesn’t charge origination fees, application fees, or prepayment penalties.

M&T Bank

The personal loans at M&T Bank range from $2,000 to $50,000 for one to seven years. Interest rates are competitive and you may qualify for relationship-focused rate discounts.

Loans may be funded as quickly as 24 hours after applying. You don’t have to pay application fees, origination fees, or prepayment penalties.

Union Bank

Union Bank only allows you to apply for their personal loans if you’ve received an invitation. If you have, the bank offers loans with competitive rates and no application or origination fees. Loan lengths range from three to seven years.

How we picked these personal loans

To find the top 50 Vermont banks, we used the FDIC’s deposit market share data from June 2021–accessible to borrowers in major areas including Burlington, South Burlington, Rutland, Hartford, and Montpelier.

Next, we evaluated each bank’s personal loan offerings based on these criteria.

- Interest rate ranges

- Loan lengths

- Amount you can borrow

- Fees charged

Are Online Personal Loans a Good Idea?

Like many products and services, you can get a personal loan online.

But, is it a good idea to get a personal loan online?

You may be surprised to find out that online personal loans could be even more competitive than loans from brick-and-mortar banks.

Better rates and lower fees

Online banks don’t have to pay for branch locations in the communities they serve.

These cost savings can, in some cases, be passed on to consumers through lower rates and fees.

More tech-forward

Online lenders use technology to aid their processes. This can result in quick application decisions and funding timelines. You may be able to apply and get money from an approved loan on the same business day.

Online lenders aren’t necessarily superior, though.

Brick-and-mortar banks have worked to compete with digital lenders to continue winning business. Many now offer similarly quick application and funding timelines.

Brick-and-mortar lenders may even compete with interest rates and fees in some cases. These lenders may also offer rate discounts to help keep their rates competitive.

Both online and physical lenders compete for the same business, but some charge more than others. If you want to find the best personal loan, you need to shop around at both to find the one willing to offer you the best terms overall.

Evaluating Your Most Important Personal Loan Priorities

It’s easy to believe that one personal loan could be the best for everyone, but that’s rarely the case. Each person has unique needs that can shape what makes the best loan for them.

Here are some personal loan characteristics to consider to help you figure out what’s most important to you.

Amount you can borrow

Each bank has a range of amounts you can borrow based on their programs. You’ll commonly find loan offers in the $5,000 to $30,000 range. Some banks focus on smaller loans, as small as $1,000, while others offer larger loans, sometimes as high as $100,000.

Interest rate charged

The interest rate you pay is likely the highest cost of your personal loan. Optimizing this first makes sense.

However, other aspects of the loan may be a higher priority in your situation. Once those objectives are met, optimizing for the lowest interest rate loan will likely still be a priority.

Fee schedule

Fees can impact the cost of your loan or the amount you receive when loan funds are disbursed. Major fees, such as application fees, origination fees, and prepayment penalties, aren’t standard on the best personal loans today.

Still, you should watch out for these fees.

In particular, origination fees can add up quickly. They may be represented as a percentage of the loan amount. A 2% origination fee on a $50,000 loan would add a $1,000 cost to the loan.

How fast you get funds

If you aren’t in a rush to get the funds, most personal loans disburse loan proceeds within a week, sometimes longer. The fastest lenders can get funds to you as fast as the same business day you’re approved for a loan.

Loan duration options

The length of the loan impacts your monthly payments. Most lenders offer loans in the three to five-year range. You can still find loans as short as one year or as long as ten years. These lenders are harder to find, though.

Interest rate discounts

You may qualify for a lower interest rate if you can secure a rate discount. Some lenders offer these for setting up automatic payments or if you had a relationship with the bank prior to applying.

What You Need to Apply for a Personal Loan

Personal loan applications are straightforward. Here’s what you may need to apply:

- Identification documents (Driver’s license, passport, etc.)

- Documents proving your address (Utility bill, mortgage statement, etc.)

- Social Security Number

- Employment and income documentation (W-2, 1099s, tax returns, etc.)

- Highest level of education accomplished

- Reason for borrowing funds

- Requested loan amount

- Desired loan length

Attempt to Improve Your Approval Odds

Lenders use information from your application to help determine whether to approve you. When you apply, you give the lender permission to check your credit score.

This score plays a big factor in your approval chances. It helps lenders determine the likelihood of default on a proposed loan.

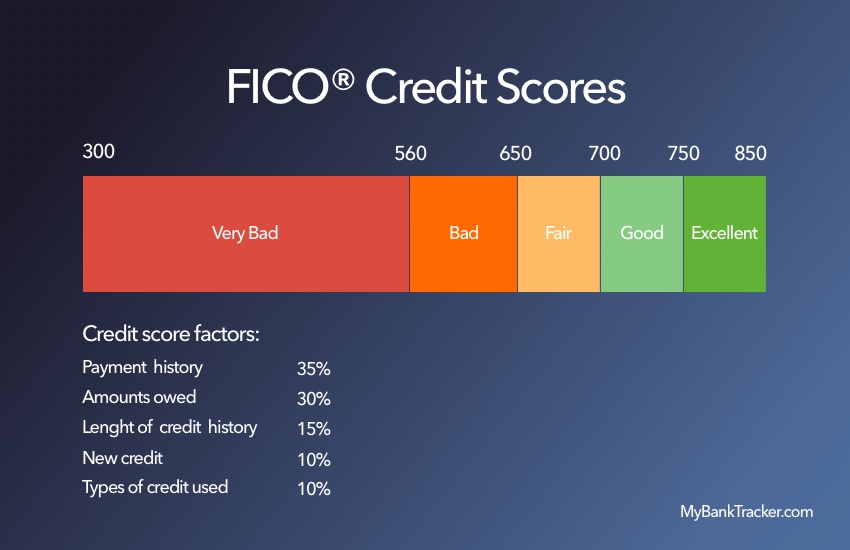

Credit score

Your credit score gets calculated using information from your credit reports. You can check your credit reports to make sure no negative errors could be dragging your score down.

Request your credit reports for free at AnnualCreditReport.com. If you find errors, you should dispute them before applying.

Credit scores generally use the same information to calculate a score, even though each version of your score may use a different formula.

The credit utilization ratio usually plays a somewhat larger role.

This ratio divides your credit used by your credit limits. If you can lower this ratio by paying down a maxed-out credit card, your score may improve.

Debt-to-income ratio

Your debt-to-income ratio helps lenders determine if you can afford to repay the loan.

The ratio measures your monthly debt payments against your monthly income. You can improve this ratio by lowering it. Increasing income or decreasing debt payments helps accomplish this goal.

Increases in income must be documented. You can’t sell stuff around your house to increase income, but you could work more hours, get a part-time job, or secure a raise.

Decreasing debt payments helps, too. Unfortunately, extra payments on some types of debt won’t lower your debt payment unless you pay the loan off in full. Common examples include mortgages or car loans.

Instead, focus on debt that has changing payments based on your balances. Paying down a credit card could accomplish this goal.

Find the Best Personal Loan for You

When shopping for a personal loan, keep your priorities in mind. Start by looking at our list of the top personal loans in Vermont. Once you find your favorite option, compare it to online and other lenders you may want to work with.

Remember, each lender may evaluate your application differently. This could result in different loan offers. Getting quotes from multiple lenders could save you significant money on your loan costs.

Frequently Asked Questions

How long does it take to get approved for a personal loan?

Applications are often processed quickly thanks to technology and algorithms. You may find out if you’re approved in seconds or minutes unless a human review or additional information is needed.

Other lenders may process applications manually. This could take days, a week, or longer.

How long does it take to receive funds from a personal loan?

The fastest banks can get you loan funds the same business day you’re approved. Not all lenders work this fast. Some take days, a week, or longer to disburse funds.

Can I use a personal loan for any reason?

You can typically use funds from a generic personal loan for any reason. Lenders may ask what you plan to use funds for and may sometimes restrict usage.

The most common example occurs when using a personal loan to consolidate debt. Lenders often require you to have funds disbursed directly to the lenders you are paying off.

Will applying for a personal loan affect my credit score?

Personal loan applications result in a hard inquiry on your credit report. This inquiry normally results in a small negative impact on your score for a short time.

You may have heard you can find out what rate you qualify for without damaging your score. Preapproval applications can’t guarantee loan approval, but if they use a soft credit inquiry, they won’t impact your score.