The Best Credit Unions for Personal Loans

When you need a personal loan, the sheer variety of options can be overwhelming. Banks are an obvious choice but you could go online to get a loan. There’s also a third alternative for personal loans: a credit union.

Credit unions offer many of the same things banks do, including checking accounts, savings accounts, and personal loans, but they work a little differently.

Getting a personal loan from a credit union offers some distinct benefits.

If you’re not sure what those are, or what a credit union even is, we’re here to break it all down for you, starting with the best credit unions for personal loans.

We evaluated the seven largest U.S. credit unions that allow essentially anyone to become a member and apply for a personal loan.

We used these three key factors to rank each credit union and compile our rankings:

- Interest rate

- Borrowing terms

- Borrowing limits

Out of the seven credit unions we reviewed, these three emerged as the best of the best for getting a personal loan.

1. PenFed (Pentagon Federal Credit Union)

PenFed Credit Union specializes in serving members of the U.S. military and certain U.S. government employees but membership is open on a broader scale.

You can also join PenFed if you’re a member or employee of certain organizations, including:

- American Red Cross

- Argon Engineering

- Centech Group

- National Military Family Association

- Voices for America’s Troops

That’s just a shortlist and there are dozens of companies and nonprofits you can be associated with to qualify for membership.

You can also become a member if you’re a relative or family member of someone who’s eligible.

As for the loans themselves, PenFed offers unsecured personal loans and lines of credit of up to $25,000.

PenFed takes the top spot in our rankings for offering the lowest interest rate on personal loans.

Some of the other credit unions we profiled offer a little longer to repay a personal loan but PenFed gives you 60 months, which is still generous.

2. First Tech Federal Credit Union

If you work in tech, you can try First Tech Federal Credit Union for a personal loan.

This credit union opens up membership to:

- Employees of high tech and telecom sponsor companies

- State of Oregon employees

- Lane County, Oregon employees

- Lane County, Oregon residents

- Immediate family members of First Tech members

- Computer History Museum members

- Financial Fitness Association members

The list of sponsor companies is quite lengthy and it features some of the biggest names in tech, including Amazon, IBM, and Google.

But, there are plenty of smaller and mid-sized companies on the list too.

It’s also extremely easy to be eligible because anyone can become a Computer History Museum and Financial Fitness Association members.

First Tech earned the number two spot in our rankings, thanks to its low personal loan interest rates and higher borrowing limit.

You can borrow $500 to $50,000 using a secured or unsecured personal loan or a personal line of credit. First Tech also gives you a bit more time to repay your loan, with terms stretching up to 84 months.

3. Golden 1 Credit Union

Golden 1 is a California-based credit union that opens up membership to people who live in and work in California, their family members, Financial Fitness Association members and members of select employee groups.

To maintain your membership, you just have to open a Golden 1 savings account and maintain a $1 minimum balance.

Golden 1 offers secured and unsecured personal loans from $500 to $50,000. You can also get a “starter” loan of up to $2,500 if you have a cosigner.

Loan terms range from 12 to 60 months, with low-interest rates. Funding is quick, with most loans funding in one to two business days.

What Is a Credit Union Anyway?

A credit union is a non-profit cooperative financial institution.

Unlike a bank, which may be operated by a board of directors or shareholders, a credit union is operated by its members.

The way credit unions are structured generally allows them to offer better interest rates on savings and deposit accounts, charge fewer fees and offer lower interest rates on loans.

Credit unions aren’t as visible as banks but chances are you can find one in your hometown.

If you’re not sure where to look, you can use the National Credit Union Association website to see which credit unions are nearby locally.

Another key difference that distinguishes credit unions from banks is the membership requirement.

You can go to a bank and open an account but at a credit union, you have to be a member first.

Membership Eligibility Requirements

Individual credit unions set their own membership standards. But generally, membership may be based on:

- Where you live

- Your employer

- Where you go to school or church

- Military affiliation

In the case of PenFed, that also includes membership in certain volunteer or nonprofit associations.

Credit unions can also have requirements to maintain your membership year to year. That might mean opening a specific account or keeping a certain balance in your account.

Membership Fees and Branch Access

At a bank, you may be looking at a monthly maintenance fee for a checking or savings account.

With credit unions, those fees are less common, although some (like Arizona Federal Credit Union) do charge a small monthly membership fee.

In terms of accessing your money, credit unions can offer the same in-person branch experience that banks do.

There are often fewer of them, however.

You can handle virtually any banking need at a branch, including making deposits and withdrawals, opening new accounts and applying for personal loans or lines of credit.

Some credit unions also allow you to tackle money management tasks online or through a mobile app.

Credit Unions vs. Banks: How Are They Different?

Credit unions operate on a nonprofit basis; banks are for-profit. They make money by charging you banking fees and interest on loans or credit cards.

With a credit union, any profits are returned back to members as reduced fees, lower loan interest rates and higher rates on savings.

One other thing to note: credit unions aren’t FDIC-insured like banks are.

Instead, member accounts are insured by the National Credit Union Insurance Fund.

The coverage amount is the same: up to $250,000 per depositor.

Which Is Better In General?

Both credit unions and banks have their pros and cons.

Brick-and-mortar banks tend to charge higher fees and offer lower interest rates for savers.

Online banks aren’t as fee-heavy and you can get a better rate on what you save, but you’re trading off the convenience of being able to visit a branch when you need to.

But, you don’t have to worry about meeting a membership requirement the way you would with a credit union.

A credit union can offer some great benefits, but only if you’re eligible to join.

And credit unions may have fewer branches or ATMs, whereas a bank may have a broader branch and ATM network.

Which Is Better for Personal Loans?

Purely from a fee perspective, a credit union may be the better choice for a personal loan.

Since credit unions charge fewer fees in general, you’re less likely to run into origination fees, late fees or prepayment penalties.

Many banks and online lenders don’t charge these fees too, but you’re more likely to encounter these extra costs.

Credit unions may also fare better for interest rates. At some other lenders, rates on personal loans reach the same range as what credit cards charge.

If you’ve got a good credit score and qualify for membership, a credit union personal loan could save you more on interest.

A bank, on the other hand, may offer higher borrowing limits or longer repayment terms. Wells Fargo, for instance, offers personal loans of up to $100,000. If you’ve got a bigger expense to cover, you may have to stick with a bank or online lender instead.

Credit Union Personal Loan Eligibility

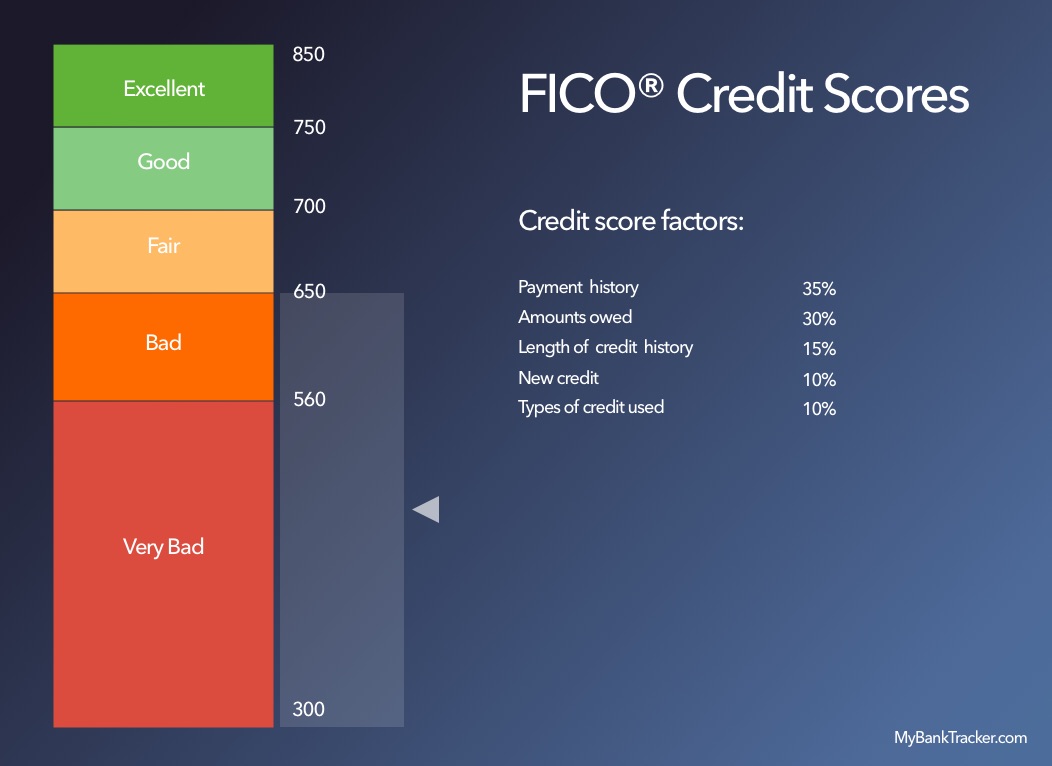

Credit unions use the same factors as banks to approve members for personal loans.

That includes your credit score, income, and financial background.

Each credit union has its own standards for credit approval but generally, the better your score the easier it is to get approved and land a low rate.

What to Consider When Getting Personal Loan

If you’re thinking a credit union is your best bet for a personal loan, here are a few things to keep in mind.

1. Credit score

Credit unions do consider credit scores for loans but they may be more willing to accept borrowers with a lower (or no) credit score.

A bank may only lend to borrowers with good or excellent credit, or reserve their best rates for the most creditworthy borrowers.

2. Borrowing amounts and fund availability

This is something you definitely have to do comparisons on, as some credit unions can have higher loan limits than banks while others don’t.

On the flip side, credit unions can offer smaller personal loans of $1,000 or less, whereas banks typically require you to borrow a couple of thousand at a minimum.

Your odds of getting approved for a bigger loan may also be better at a credit union.

Funding at credit unions can be quick, with some offering same-day funding.

Banks are catching on and offering faster loan funding times but not all of them move as quickly as credit unions.

3. Banking products services

For a variety of banking products and services, big banks may have more to offer.

You may have six checking accounts to choose from at a big bank, versus two or three at a credit union, for example.

Big banks may also be more up-to-date on the tech side, offering more capabilities with their online and mobile banking services than credit unions.

For instance, you might be able to deposit checks on your mobile device and pay bills online at a big bank but a credit union may not offer those services.

Big banks and even smaller regional banks typically have their own mobile apps for convenient access. You can sync those apps to budgeting and personal payment apps so you can do all your money tasks on the go.

Credit union apps, if they exist, may not have that same functionality.

For branch access, banks also tend to be better than credit unions. And they can have much wider ATM networks as well.

For personal loans themselves, a bank may allow you more leeway in how you use a loan compared to a credit union.

4. Interest Rates

Credit unions have the potential for lower interest rates on personal loans.

Those rates can be fixed or variable, depending on the credit union.

Big bank lenders and regional banks can charge higher rates and the rate you pay hinges largely on your credit rating.

5. Customer Service

If you want a more personalized banking experience, a credit union is likely the hands-down winner. Credit unions aren’t out to make money. Instead, they strive to deliver the best banking experience possible to their members. There’s less pressure to push products and services so you may not feel like you’re always being targeted with a sales pitch like you might at a bank.

6. Cosigners

When you’re new to using credit or your score isn’t the best, you may need a cosigner for a personal loan.

At a credit union, that’s usually no problem but big banks tend to be more reluctant to allow cosigners.

Having a cosigner can make it easier to get approved, help you get a better interest rate and potentially allow you to borrow more.

Just remember that your cosigner needs to have an excellent credit score if yours isn’t that great.

7. Fees and other perks

We’ve already mentioned this but it’s worth repeating that credit unions can charge far fewer fees than a bank.

And if there are fees, you may be able to negotiate them with the credit union. Banks may be less willing to budge on fees.

On the perks side, credit unions can offer things like relationship rate discounts on loans, debt protection plans and more options for personal loans.

Many credit unions have the option of getting a secured personal loan, which is less common at big banks.

Secured loans are backed up by collateral, such as your car or a CD you own. Secured loans can be easier to qualify for if you have collateral when your credit score is too low for an unsecured loan.

So How Do You Get a Personal Loan From a Credit Union?

There’s no secret formula for getting a personal loan from a credit union. It’s just a matter of taking the right steps in the right order.

- Decide which credit union you want to borrow from. Reviewing the things mentioned in the previous section can help you narrow the field.

- Talk to a loan officer about the application process and what you’ll need to do to apply for a loan. Ask specifically about the requirements you need to meet and any documentation you need to apply.

- Join the credit union. That just means verifying that you’re eligible, based on membership requirements, and opening a membership account.

- Review your loan options and how they compare to personal loans from a bank. Pick the loan that fits your needs based on term, loan type and what you plan to use it for.

- Apply. If you’ve already scoped out the requirements beforehand, this should be as simple as filling out the application and waiting for a loan officer to review and approve it.

Final Thoughts

If you need a loan but you’re just starting out with building credit or have bad credit, a credit union can be more welcoming than a bank.

Credit unions are also a good choice if you want a more personalized experience, only need to borrow a smaller amount or you want to avoid the higher rates and fees that banks often charge.

Remember, though, that banks can be more convenient and offer more resources.

If you’ve got a solid credit score, you can still get a great rate at a bank and potentially borrow a larger amount.

A bank may also be more appealing to techies who want to do all their banking online, versus visiting a branch.

Bottom line, there are positives to getting a personal loan from a credit union and from a bank. Looking at both sides of the equation can help you decide which one is right for you.