What Are Credit Builder Loans and How Do They Work?

Your credit score is a major part of your financial life. The score tracks how trustworthy you are in the eyes of lenders.

If you have a good credit score, lenders see you as trustworthy. If your credit score is poor lenders will see lending to you as risky.

What that means is that your credit score can affect which loans you’re eligible for. It also affects the interest rates you’ll pay.

If you have a poor credit score, it can be difficult to improve it. The best way to improve your credit score is to handle your credit lines properly, but getting a line of credit with poor credit is difficult.

A credit builder loan can help you improve your credit score if you’ve had issues with credit in the past.

What is a Credit Builder Loan?

A credit builder loan is a special type of loan designed to help people with poor credit improve their credit score.

Generally, credit builder loans are easier to get than normal loans.

As you make on-time payments on the loan, the lender will report those payments to the credit bureaus. The idea is to manufacture a credit line that displays responsible credit behavior.

Usually, credit builder loans are for relatively small amounts (usually $2,000 or less) and are repaid over a short period of time (usually 24 months or less). This maintains a low risk for the lender.

Credit builder loans are also effective for people who have no credit score. If you’ve never borrowed money before, the credit bureaus cannot assign a credit score to you.

This can make getting a loan difficult. Credit builder loans give you a way to start building your credit file.

Where Can You Find Them?

Credit builder loans are not as common at the large national banks. Nor are they typically found with the popular online banks.

Your best bet for finding credit builder loans are regional banks, community banks, and credit unions.

These smaller financial institutions tend to be more consumer-friendly when it comes to different options to help people build credit.

How Does It Work?

Because credit builder loans are designed for people with poor credit, lenders want some additional assurance that you’ll pay the loan back.

That’s why most credit builder loans require some form of collateral.

Collateral is an asset that you provide to the lender as an assurance that you’ll pay back your loan.

This can be anything of value, such as the balance of a savings account or CD, the title to your vehicle, or something else.

When you pay the loan back, the collateral is returned to you. If you fail to make payments, the lender can take possession of the collateral to compensate for its loss.

Usually, you can qualify for a credit builder loan, even with very bad credit.

How bad your credit is will determine the rates and the collateral requirements, but you should be able to find a loan for nearly any credit score.

The two common types of credit builder loans are:

Standard secured loan

This type of credit builder loan uses existing funds in a savings account or CD with the same institution as collateral. The money is unavailable for withdrawal, transfer, or other transactions.

The frozen funds are partially made available as you pay off the loan.

The tough part is getting the cash in hand to provide this form of collateral.

Loan-funded secured loan

This type of loan will put the funds that you’ve borrowed into a deposit account. Again, these funds are locked.

Essentially, you’re repaying a loan on borrowed funds that you cannot access.

The key advantage is that you don’t have to come up with the cash to put down as security

How to Use a Credit Builder Loan to Build Good Credit

Credit builder loans are designed to help you build good credit, but building good financial habits is essential to building a good credit score.

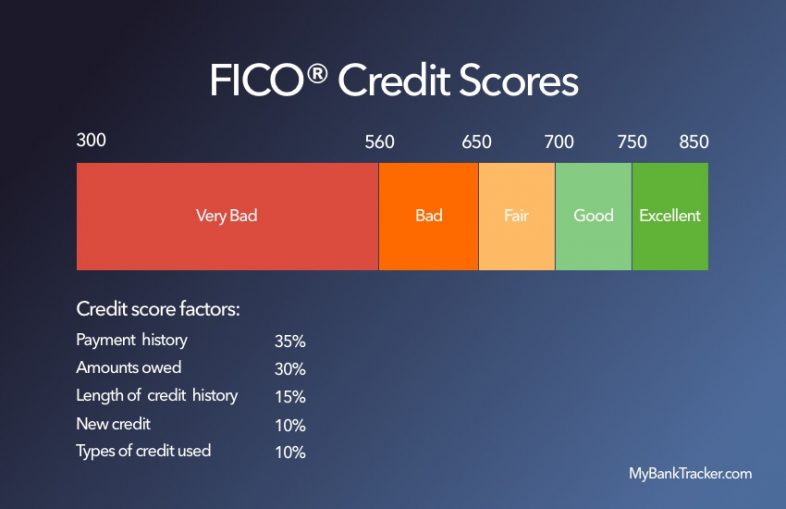

To understand the financial habits you need to build, you need to know how credit scores are calculated.

Payment history

Your payment history is the biggest factor in your credit score, account for roughly one-third of your score. The amount you owe is the second largest factor.

The way to build a good payment history is to make on-time payments on all of your lines of credit, over a long period of time.

Even one missed payment can result in a big hit to your credit score. That’s why making sure you stay on top of your debt payments is essential.

Your credit builder loan can help you build a good payment history, so long as you make your payments on time.

Amounts owed

The amount of money you owe also impacts your score. To keep your credit score high, try to avoid taking on a lot of debt.

Also, avoid maxing out your credit cards because the ratio of your credit card debt to your credit card limits is taken into account.

If you have no prior credit history, a credit builder loan can help you improve your age of credit. The longer you’ve had access to credit, the better it is for your score.

Credit mix

Lenders also like to see that you’ve handled different types of debt, like mortgage debt, credit card debt, or personal loans.

A credit builder loan can improve this factor as well as an installment loan.

Tips

These tips will help you make the most of your credit builder loan.

On-time payments

As mentioned previously, the more important factor of your credit score is your payment history.

Every time you make an on-time payment, your score improves. A single late or missed payment can have a huge effect on your credit score.

If you sign up for a credit builder loan, you must make every single payment on time.

If you don’t your credit builder loan won’t improve your credit at all. In fact, it will make your score worse since it will add a missed payment to your credit history.

Set up automatic payments

The best way to make sure that you make on-time payments is to set up automatic payments.

Almost every lender offers this feature, so you should sign up for automatic payments on all of your loans.

You can link a bank account to your credit builder loan and tell the lender to pull money from your account on your monthly payment’s due date each month.

You can specify how much money should be taken each month, or just pay the minimum each month.

So long as you have money in your checking account, your payments will be made automatically.

Stay on top of other credit lines

If you have other lines of credit, such as a credit card, don’t neglect them while focusing on your credit builder loan.

Building a good credit score involves managing all of your lines of credit.

Forgetting to make payments on one loan while managing another perfectly will still damage your score.

May want to hold off on extra/larger payments

In a perfect world, you shouldn’t pay interest just to build your credit, so you’ll put the money you borrow for your credit builder loan to good use.

If you have money to make extra payments on the loan, you might want to pay the credit builder loan off early to avoid interest charges.

This is a good idea if you want to save money, but will reduce the loan’s ability to improve your credit. If you pay the loan off early, you’ll make fewer payments overall.

This will result in a shorter age of the loan.

Alternatives

If you’re not sure that a credit builder loan is right for you, consider one of these alternatives.

Secured credit cards

A secured credit card functions just like a normal credit card.

You get a plastic card that you can swipe at the store to make payments, rather than paying with cash or a debit card. You have a limit as to how much you can spend on the card, and you need to pay the card off each month.

The big difference is that you have to offer some form of collateral to open a secured credit card.

Usually, you offer cash as a collateral, and your credit limit is equal to the amount of cash you offer.

After 6 to 12 months, you can usually upgrade from a secured card to an unsecured card. That makes secured credit cards a great way to start rebuilding credit and to get back into managing a credit card.

Personal Loans

Personal loans are flexible loans that can be used for nearly any purpose.

Some lenders specialize in low-cost loans for people with great credit, while other lenders can offer loans to people with poor credit.

You can unsecured or secured personal loans, so even if you have poor credit, you may be able to find a loan that you can qualify for.

If you have some financial need that a personal loan can help you meet, a personal loan can be a good way to build credit at the same time.

Conclusion

Credit builder loans are a good way for people with poor or no credit to improve their credit score.

Use the loan to learn good financial habits and carry those forward to your future loans.