Survey: Millennials Just as Likely as Gen Xers to Use Personal Loans

Personal loans are installment loans that can typically be used for nearly any purpose. Because of their flexibility, they can be helpful to anyone who may need temporary financial support, regardless of age or gender.

Based on a survey commissioned by MyBankTracker, more than 24 million Americans are considering a personal loan in the next 12 months.

Another survey found that millennials were just as likely to apply for a personal loan as Gen Xers. Baby boomers, however, were just a little less likely to turn to personal loans.

These were our findings:

- 11 percent of 18- to 34-year olds said they were very or somewhat likely to apply for a personal loan in the next 12 months

- 11 percent of 35- to 54-year olds said they were very or somewhat likely to apply for a personal loan in the next 12 months

- Less than 7 percent of those age 55 and above said they would consider a personal loan in the next 12 months

The results of the survey show that age doesn’t rule out the relevance of a personal loan, which many people consider to be an important financial tool.

Common reasons for taking out a personal loan include debt consolidation, home improvement projects, credit improvement, and weddings.

It can play a significant role for someone who is pursuing a major financial goal or lifetime milestone, both of which anyone can have at any stage of his or her life.

When Age Does Matter

While the age of a borrower may not influence the need for a personal loan, age can matter when it comes to the likelihood of getting approved for a personal loan.

More specifically, time is essential to building a better credit score — a key factor that lenders consider on a loan application.

Younger generations didn’t get the chance to develop this financial credential that is crucial for any kind of borrowing.

Credit score

Older generations had time to establish better credit.

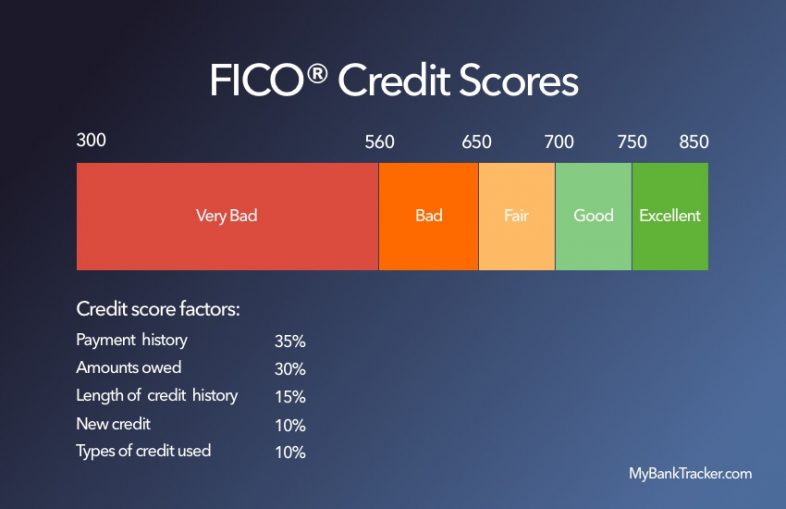

After all, the most commonly-used credit scoring model (the FICO Score) looks at the average age of credit lines, among other factors.

This factor is responsible for 15 percent of someone’s FICO credit score.

Younger generations may only have a credit card or two, in addition to student loans. More importantly, these credit lines will have a short history.

Furthermore, older generations are more likely to have a better mix of credit types that also include mortgages and auto loans.

Most younger adults are not at a point in their lives where they need to buy a home or a new car.

Getting approved for better personal loan terms

With a higher credit score, lenders are more likely to approve a personal loan application. Additionally, it increases the chances of locking in a lower interest rate.

Depending on the size of the loan amount, the total interest paid over the life of the personal loan could be substantial.

For example, compare the total interest paid on a $50,000 personal loan with a 3-year repayment term:

- At a 5.99% interest rate: $4,751 total interest paid

- At a 10.99% interest rate: $8,921 total interest paid

Applicants with higher credit scores tend to qualify for lower interest rates that could mean the difference of thousands of dollars.

How to Choose the Right Personal Loan for You

Regardless of whether you’re a millennial, Gen Xer, or baby boomer, you can find a personal loan that works for you.

Offered by a large number of financial institutions and lenders, the wide availability of personal loans means that you can take advantage of your right as a consumer to shop around for the best deal.

The right personal loan for someone else may not necessarily be the most appropriate for your needs.

Here the main factors to research when you’re thinking about applying for a personal loan:

Borrowing amount

Most lenders have a minimum amount and a maximum amount that they’re willing to lend through a personal loan.

These limits can typically range from $1,000 to $100,000.

If you seek to borrow just a small amount, a high minimum borrowing requirement could result in excess borrowed funds that could tempt you to take on unnecessary debt.

Remember, you’re paying interest on the entire amount borrowed.

On the other hand, if you need to borrow a large amount of money, you’d want to find a personal loan that can provide you with enough funds.

The minimums and maximums can vary by lender and by your application. That is, these limits can change based on the borrower’s financial credentials too.

Repayment period

Like with borrowing amounts, lenders designate a specific amount of time for a borrower to repay a personal loan.

The most common repayment terms are 3 years and 5 years. But, they can be as little as 6 months to 7 years or longer.

The chosen repayment term determines that monthly payment amount and the total interest paid on the loan.

- Longer repayment terms mean lower monthly payments, but more interest paid.

- Shorter repayment terms mean higher monthly payments, but less interest paid

Find a borrowing period that results in a monthly payment that you can afford.

You also want to consider what this means for the total interest paid. Obviously, you’d want to minimize the cost of borrowing as much as possible by opting for a shorter loan term.

Interest rate

Each lender has a range of interest rates, based on your credit score, that may apply to your personal loan.

The actual interest rate isn’t known until you get a rate quote and/or submit your application.

Knowing the interest-rate range of a lender, you can compare the rates and get a better idea of the rate that applies to your loan.

Most lenders will provide a rate quote — within minutes — that won’t result in a temporary ding to your credit score.

Fees

Personal loans may come with a list of fees that will increase the final cost of the personal loan.

Watch out for lenders who advertise an attractively-low interest rate, but charge fees on the loan.

Common Personal Loan Fees

| Type of fee | Typical cost |

|---|---|

| Application fee | $25 to $50 |

| Origination fee | 1% to 6% of the loan amount |

| Prepayment penalty | 2% to 5% of the loan amount |

| Late payment fee | $25 to $50 or 3% to 5% of monthly payment |

| Returned check fee | $20 to $50 |

| Payment protection insurance | 1% of the loan amount |

The most common fee is the origination fee, which is usually deducted from the loan amount. That is, the amount of disbursed funds will be slightly less than the borrowed amount.

Survey Methodology

The MyBankTracker survey was conducted by Google within the United States from:

- May 17-18, 2018, among a nationwide cross section of 1,000 adults (aged 18 and over) with a sample bias of +/- 9.3 percent.

- May 21-23, 2018, among a nationwide cross section of 2,000 adults (aged 18 and over) with a sample bias of +/- 6.9 percent.