Survey Finds That 43% of Americans Have Less Than $500 for a Financial Emergency

Whether it is a natural disaster, unexpected car repair, or job loss, an emergency can throw your finances off track. People are often advised to build a designated emergency fund to handle these surprise expenses that are out of their control.

However, according to a MyBankTracker survey that polled Americans to see how much they had in their emergency funds, we found out that more than 4 out of 10 Americans claim that they don’t even have $500 to pay for an unexpected emergency.

On a more positive note, the study also found that one-third of Americans in their retirement years (65+) have at least $10,000 saved up to tackle an emergency.

The finding may come as no surprise as they have had more time to build up funds to address unplanned expenses.

Read on to find out other interesting discoveries about Americans and their emergency funds, and how to prepare when a sudden emergency expense comes your way.

Key Findings

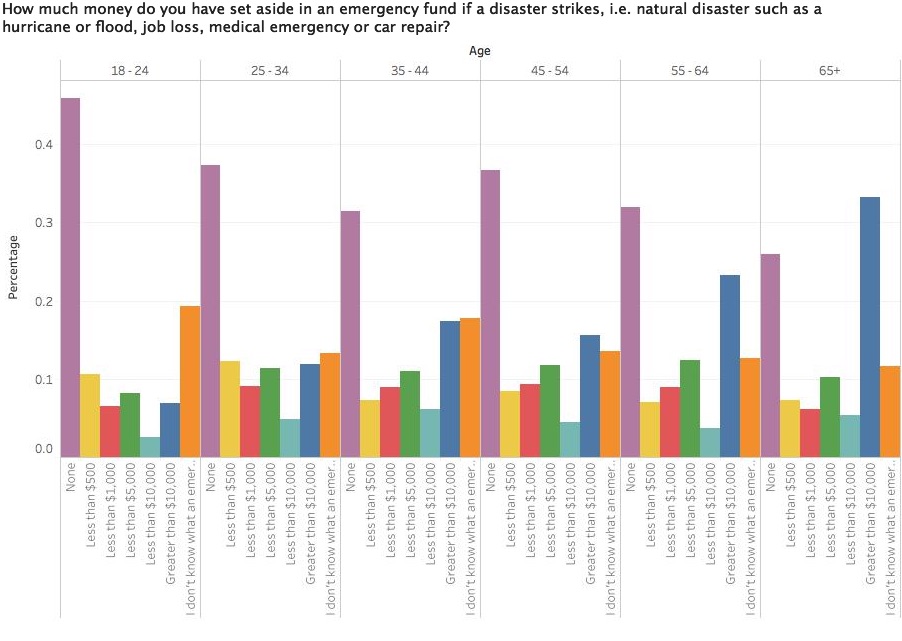

The survey asked more than 2,000 people the question, “How much money do you have set aside in an emergency fund if a disaster strikes, i.e. natural disaster such as a hurricane or flood, job loss, medical emergency or car repair?“

Considering consumer debt has reached about $3.86 trillion dollars, our findings follow that Americans have little of their own funds set aside for emergency situations.

Here’s some of our findings:

- 43.3% of Americans have less than $500 set aside for a financial emergency

- 34.5% of Americans don’t have an emergency fund at all

- 33.3% of Americans of retirement age (65 years or older) have at least $10,000 for an emergency

And, for the kicker:

- 14.5% of Americans don’t even know what an emergency fund is

The Data

How much do you have in an emergency fund?

| Amount | Percentage of respondents | U.S. Population Estimates |

|---|---|---|

| None | 34.5% | 86,962,011 |

| Less than $500 | 8.8% | 22,181,614 |

| Less than $1,000 | 8.3% | 20,921,295 |

| Less than $5,000 | 11.0% | 27,727,018 |

| Less than $10,000 | 4.6% | 11,594,935 |

| More than $10,000 | 18.2% | 45,875,612 |

| I don't know what an emergency fund is | 14.5% | 36,549,251 |

Our survey also found that the highest age demographic that has no emergency savings are 18-24 year olds (45.9%), whereas the lowest age demographic to have no emergency savings are those who are 65+ (26%).

Conversely, the results from our survey showed that people who are 65+ are the highest age demographic to have $10,000 or more saved for emergencies (33.3%), where alternatively, 18-24 year olds are the lowest age demographic to have $10,000 or more in emergency savings (6.9%).

Some other key statistics proved to be:

- 17.8% of 35 to 44 year olds do not know what an emergency fund is

- About 16.9 million 25 to 34 year olds have no emergency savings (37.3%)

- Only about 2% of women aged between 18 and 24 have $10,000 or less in emergency savings

Here’s a chart to summarize the rest of our age demographic findings:

What is an Emergency Fund?

An emergency fund – otherwise known as a rainy day fund, a stockpile, a stash, backup money, etc. – is simply your money that’s specifically set aside for an unexpected, unforeseen, or unplanned emergency.

It’s not a fund that’s meant to be used when you’ve been eying a new pair of shoes.

It’s not a fund that’s put aside to pay for your spring break trip to Panama City Beach.

It is a fund that’s designed to help you cover surprise expenses, so you don’t have to turn to a credit card or loan.

Some of the things it might be appropriate to use your emergency fund for include:

- Tow truck service if your car breaks down

- Paying a plumber to repair a broken pipe

- Paying the dentist for an emergency tooth repair

- Taking care of an emergency visit to the vet because your pet gets sick

- Putting in a new heating and air system because yours conks out

- Meeting the deductible on your homeowner’s policy because you had to file a claim for storm damage

- Covering your day to day living expenses temporarily if you lose your job, or an illness or natural disaster keeps you from going into work

Why do you need one?

Unfortunately, there are certain aspects of your life that are out of your control.

For those events that you cannot predict or prevent, it’s important to set up a separate account so you’re not caught without a dime and a clue.

How Much Should You Have in an Emergency Fund?

The right amount in an emergency fund varies from person to person — there is no universal amount.

General advice suggests that an emergency fund should be the equivalent of 3 to 6 months of essential living expenses.

These expenses include:

Shelter

Shelter includes the costs of putting a roof over one’s head. This means paying for rent or a mortgage.

Food

In a financial emergency, the luxury of eating out would have to be forfeited until the money situation improves. The emergency fund should account for the estimated costs of meals that are to be made at home.

Utilities and other necessary expenses

Electricity, gas, and water are basic necessities. Other essential recurring expenses may include health insurance or medical treatments. Some people may have to include the cost of transportation if it is required to perform work to secure income.

Emergency Fund Calculator

The Average American

According to the Bureau of Labor Statistics, the average American household spent the following on these essential living expenses in 2017:

- Shelter — $11,895

- Food at home — $4,363

- Health insurance — $3,414

Based on this data, the average American household should maintain an emergency fund of $4,918 to $9,836.

With a little planning and saving, you can grow your emergency fund on any income.

Where to Keep Your Emergency Fund

The most important part of an emergency fund:

Being able to access it quickly in case of an emergency.

Online banks offer a tempting combination of higher rates on savings deposits and fewer fees, which makes them the popular choice for storing your emergency fund.

With so many savings accounts to choose from, it’s important to recognize what makes one better than another for you personally.

RELATED: The Best Savings Accounts for Your Emergency Fund

What to look for in a savings account:

- No monthly maintenance fee

- Great online and mobile banking

- High interest rate

- Optional ATM card

They may also feature lower minimum deposits to open an account, or have no minimum opening deposit at all.

Methodology

The survey was conducted by Google on behalf of MyBankTracker within the United States between Sep 20-25, 2018, among a nationwide cross section of 2,014 adults (aged 18+) with a standard deviation of +/- 4.3%. The findings are representative of the U.S. Population, using the U.S. Census National Population Data and Estimates of U.S. Population by Age and Sex Data.