If You Hate High Property Taxes, Don’t Live in These Places

Real estate taxes are the second biggest housing expense–after the mortgage–for homeowners. How much of a burden these taxes are, however, all depends on where you live. In some areas, homeowners pay under $500 a year (about the cost of a decent bicycle) in property taxes. In others, median property taxes cost over $10,000 a year (about the cost of a used car). Here are the worst places to live and hold taxable real estate.

The 20 cities with the highest property tax rates

For the US as a whole, the median real estate tax bill is $2,471, according to the US Census Bureau’s American Community Survey. 66 percent of homeowners with a mortgage pay at least $1,500 in property taxes. The average tax rate (net property tax as a percent of the property’s market value) is about 1.5 percent.

In some cities, however, the tax rate is more than double that. The Lincoln Institute of Land Policy’s 50-State Property Tax Comparison Study compared the 50 largest cities’ taxes for a $150,000 property and a $300,000 property to rank their effective tax rates (The data below takes into account if the area has relief programs that limit increases in property taxes). These are the 20 cities with higher-than-average tax rates

$150,000 Valued Property – With Assessment Limits

$150,000 Valued property – With Assessment Limits

| Rank | State | City | Net Tax | ETR |

|---|---|---|---|---|

| 1 | Connecticut | Bridgeport | $6,060 | 4.04% |

| 2 | Michigan | Detroit | $5,218 | 3.48% |

| 3 | Illinois | Aurora | $5,210 | 3.47% |

| 4 | New Jersey | Newark | $4,342 | 2.89% |

| 5 | Wisconsin | Milwaukee | $4,193 | 2.80% |

| 6 | New Hampshire | Manchester | $3,655 | 2.44% |

| 7 | Vermont | Burlington | $3,513 | 2.34% |

| 8 | Iowa | Des Moines | $3,389 | 2.26% |

| 9 | Maryland | Baltimore | $3,181 | 2.12% |

| 10 | Oregon | Portland | $3,064 | 2.04% |

| 11 | Nebraska | Omaha | $3,049 | 2.03% |

| 12 | New York | Buffalo | $2,946 | 1.96% |

| 13 | Tennessee | Memphis | $2,914 | 1.94% |

| 14 | Ohio | Columbus | $2,844 | 1.90% |

| 15 | Texas | Houston | $2,809 | 1.87% |

| 16 | Maine | Portland | $2,800 | 1.87% |

| 17 | Rhode Island | Providence | $2,561 | 1.71% |

| 18 | Illinois | Chicago | $2,453 | 1.64% |

| 19 | Mississippi | Jackson | $2,382 | 1.59% |

| 20 | Missouri | Kansas City | $2,279 | 1.52% |

| Average: | $2,184 | 1.46% |

$300,000 Valued Property – With Assessment Limits

Copy of $150,000 Valued property – With Assessment Limits

| Rank | State | City | Net Tax | ETR |

|---|---|---|---|---|

| 1 | Connecticut | Bridgeport | $12,120 | 4.04% |

| 2 | Illinois | Aurora | $11,106 | 3.70% |

| 3 | Michigan | Detroit | $10,435 | 3.48% |

| 4 | New Jersey | Newark | $8,683 | 2.89% |

| 5 | Wisconsin | Milwaukee | $8,599 | 2.87% |

| 6 | New Hampshire | Manchester | $7,311 | 2.44% |

| 7 | Vermont | Burlington | $7,026 | 2.34% |

| 8 | Iowa | Des Moines | $7,006 | 2.34% |

| 9 | Maryland | Baltimore | $6,361 | 2.12% |

| 10 | Oregon | Portland | $6,128 | 2.04% |

| 11 | Nebraska | Omaha | $6,097 | 2.03% |

| 12 | New York | Buffalo | $6,073 | 2.02% |

| 13 | Tennessee | Memphis | $5,828 | 1.94% |

| 14 | Maine | Portland | $5,800 | 1.93% |

| 15 | Texas | Houston | $5,762 | 1.92% |

| 16 | Ohio | Columbus | $5,687 | 1.90% |

| 17 | Illinois | Chicago | $5,384 | 1.80% |

| 18 | Rhode Island | Providence | $5,122 | 1.71% |

| 19 | Mississippi | Jackson | $5,064 | 1.69% |

| 20 | Minnesota | Minneapolis | $4,704 | 1.57% |

| Average: | $2,184 | 1.46% |

Although many of the cities above are in the Northeast, cities from all regions of the US are represented here.

The dollar numbers and tax rates might not mean much if we don’t look at housing values and typical household income for each area, so let’s take a look at property taxes by county, for which we do have that information.

The top counties with expensive property taxes

Property taxes become a bigger burden when they eat up a significant portion of your household income. For the US as a whole, the median property taxes ($2,403) make up about 3 percent of the median household income for homeowners with a mortgage ($80,403). But in counties with higher than average property tax rates? You could spend three or four times as much of your paycheck. (Look out, New Jersey, New York, and Illinois.) Here are the 31 counties with the highest property taxes as a percentage of household income, from the Tax Foundation:

Property Taxes on Owner-Occupied Housing

| Rank | State | County | Taxes as Percent of Income |

|---|---|---|---|

| 1 | New Jersey | Passaic County | 8.79% |

| 2 | New Jersey | Essex County | 8.55% |

| 3 | New Jersey | Bergen County | 8.29% |

| 4 | New York | Nassau County | 8.26% |

| 5 | New York | Westchester County | 8.10% |

| 6 | New Jersey | Union County | 8.05% |

| 7 | New York | Rockland County | 7.95% |

| 8 | New York | Suffolk County | 7.57% |

| 9 | New Jersey | Hunterdon County | 7.53% |

| 10 | New Jersey | Hudson County | 7.51% |

| 11 | New York | Putnam County | 7.44% |

| 12 | New Jersey | Camden County | 7.23% |

| 13 | New Jersey | Somerset County | 7.02% |

| 14 | New Jersey | Warren County | 6.89% |

| 15 | New Jersey | Monmouth County | 6.89% |

| 16 | New Jersey | Mercer County | 6.84% |

| 17 | New Jersey | Morris County | 6.82% |

| 18 | Illinois | Lake County | 6.76% |

| 19 | New Jersey | Sussex County | 6.70% |

| 20 | New Jersey | Middlesex County | 6.65% |

You’ll notice that many of the counties ranked at the top have high median household incomes and high median home values, so you might think, heck, these people can afford high property taxes. The reality, though, is that a $100,000 household income is middle class in many areas–and it doesn’t go as far as it used to thanks to the rising costs of food, college tuition, and health care. I live in Nassau County (fourth on the list above), where the cost of living in general is higher than most of the rest of the US. Real estate taxes make up 10 percent of my household income and it is definitely a squeeze. (I’m not surprised 56 percent of people in my area say they’re very or somewhat likely to move to an area with lower housing costs and property taxes in the next five years.)

But there are also counties on the list above where the median household incomes and median home values are below or just about the same as the US as a whole. Yet they pay double or triple the property taxes compared to the rest of the country.

Why this matters–and what you can do about it

To be clear, property taxes are important. They help pay for essential services like public schools, community works, and public safety. But they can get so high that they drive people out of their homes–New Jersey, New York, Illinois, and Connecticut top the mass exodus trend–and in extreme cases, people even abandon their property (think Detroit).

These taxes affect not just people who own their own homes, but renters too, since high property taxes usually mean higher rents charged by landlords.

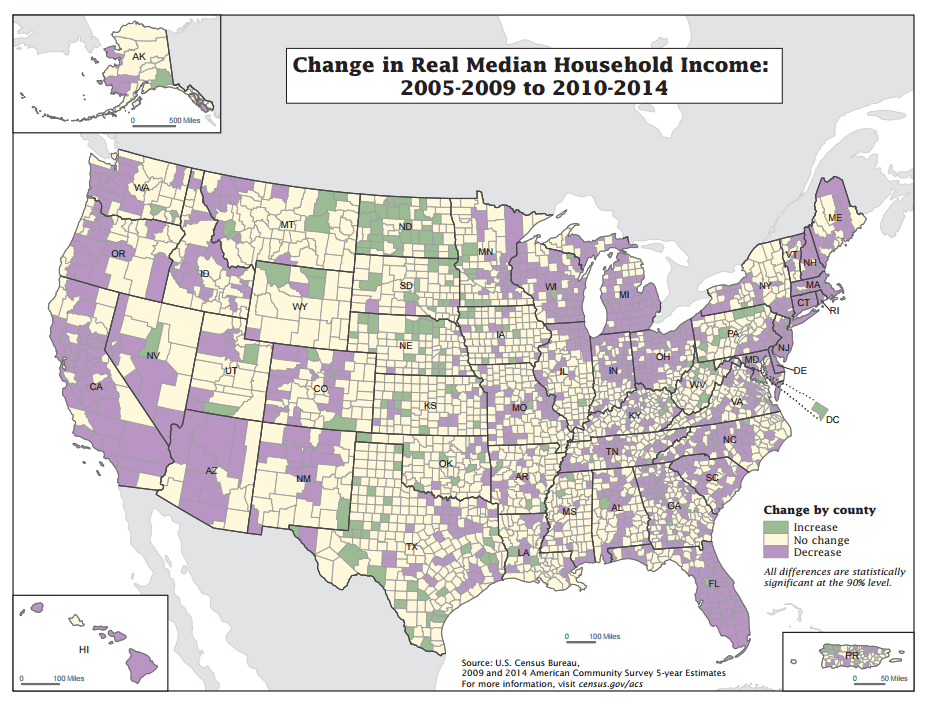

It hurts in particular at this period of time because median property taxes have been rising (up 57 percent from $1,334 in 2000 to $2,090 in 2013, according to PEW), while the median household income in many counties has been declining.

Unlike your fixed-rate mortgage, property taxes can go up every year or every few years, even if your home’s value hasn’t changed or has dropped. It’s estimated that up to 60 percent of taxable properties are over-assessed–in other words, people are paying more on their property taxes than they need to.

If you’re feeling the property tax crunch and believe your home’s market value is lower than your local government’s assessment, consider appealing it. (You’ll find instructions from your state’s and county’s websites.) Some localities have a regulation that says appeals can’t result in higher property taxes, so it couldn’t hurt to appeal every year. If yours could raise your property taxes as the result of an appeal, however, weigh your options more carefully. Or perhaps, like me, consider whether it’s time to move.