This 7-Year-Old Girl Stole a Necklace. You Won’t Believe What the Store Owner Did. So Sweet!

Educating your children on healthy money habits is important, as the following story proves.

A mother and daughter were on vacation in Miami. They visited a store where the daughter, Violet, spied a necklace she loved. She asked mother if she would purchase it for her, and she refused. Violet already had many necklaces at home, she reasoned, and teaching a child to moderate desires is an important lesson that instills a “save not spend” mentality at a young age.

Fast forward a month. Violet’s father discovers the same necklace in Violet’s room back in New York. He confronts her and she admits she snuck the item into her shirt while mom was speaking with the salesperson and brought it back to New York. Violet’s parents decided she should return the necklace to the store along with a note of apology.

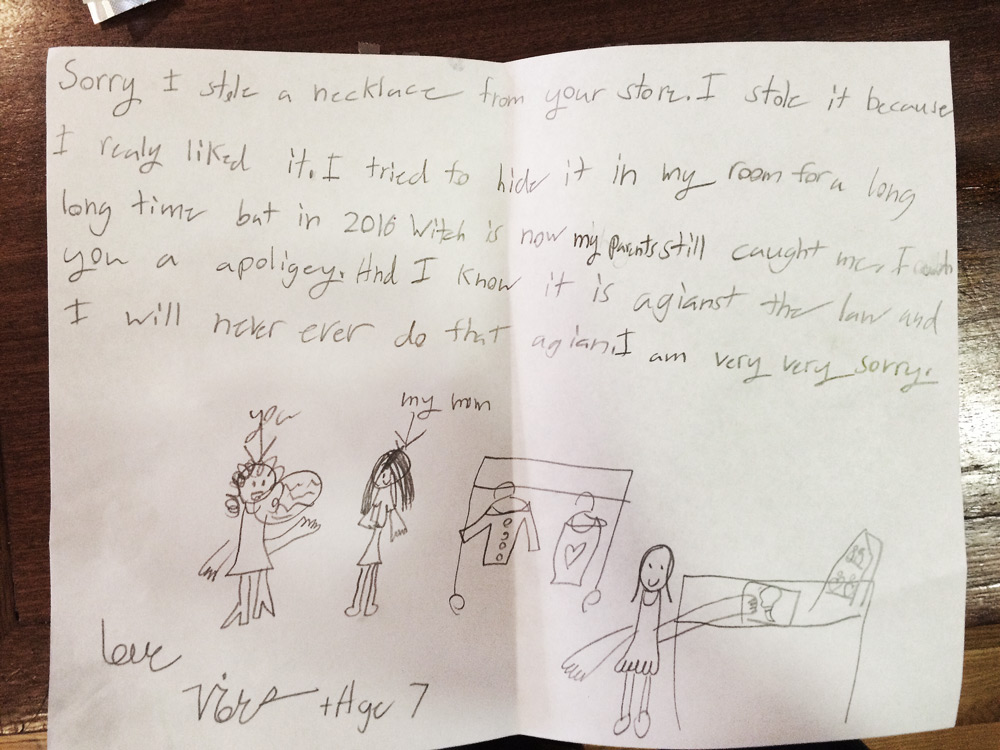

Sorry I stole the necklace from your store. I stole it because I realy liked it. I tried to hide it in my room for a long long time but in 2016 witch is now my parents still caught me. I owe you a apoligey. And I know it is against the law and I will never ever do that again. I am very very sorry.

Love Violet +Age 7

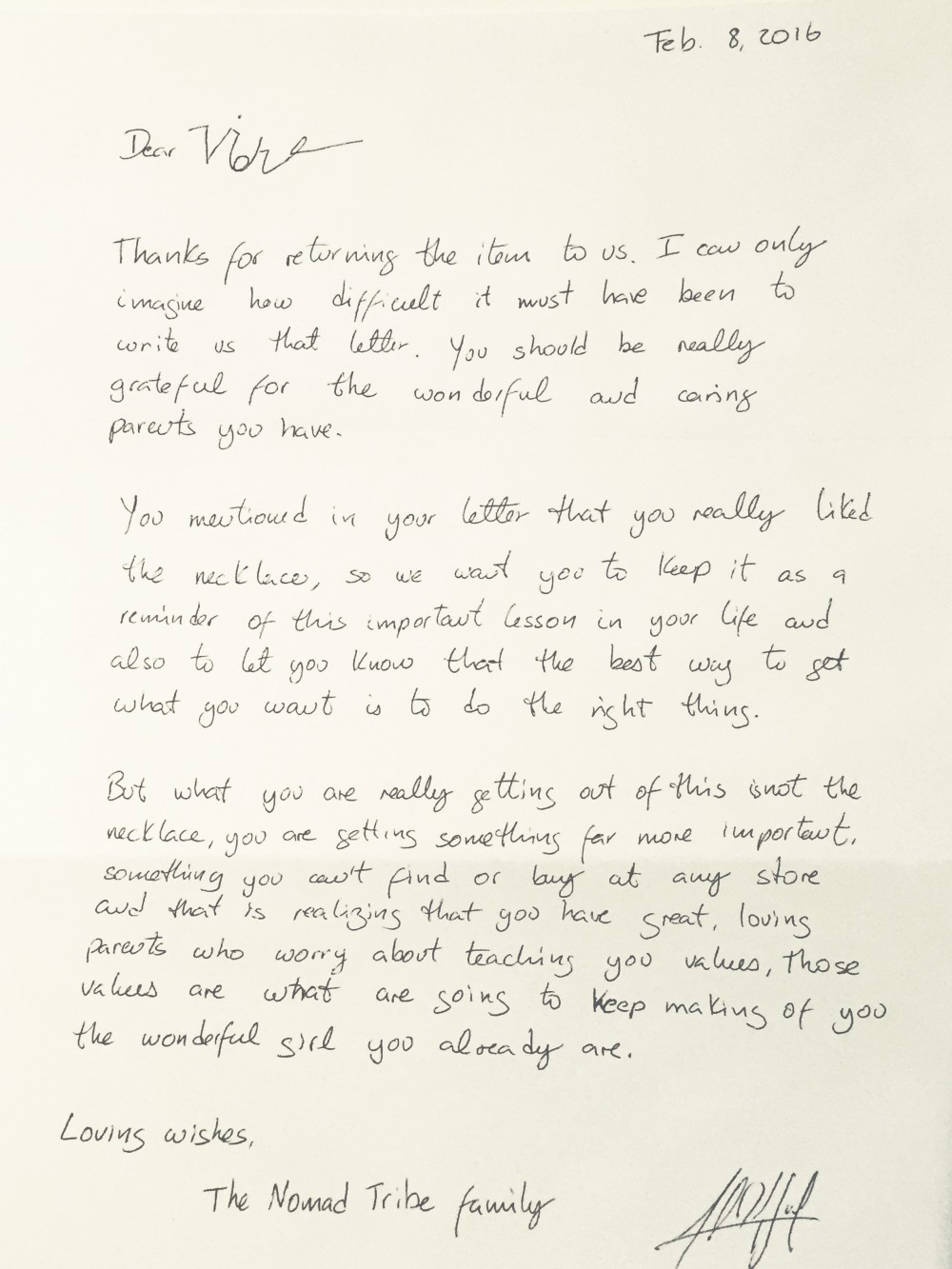

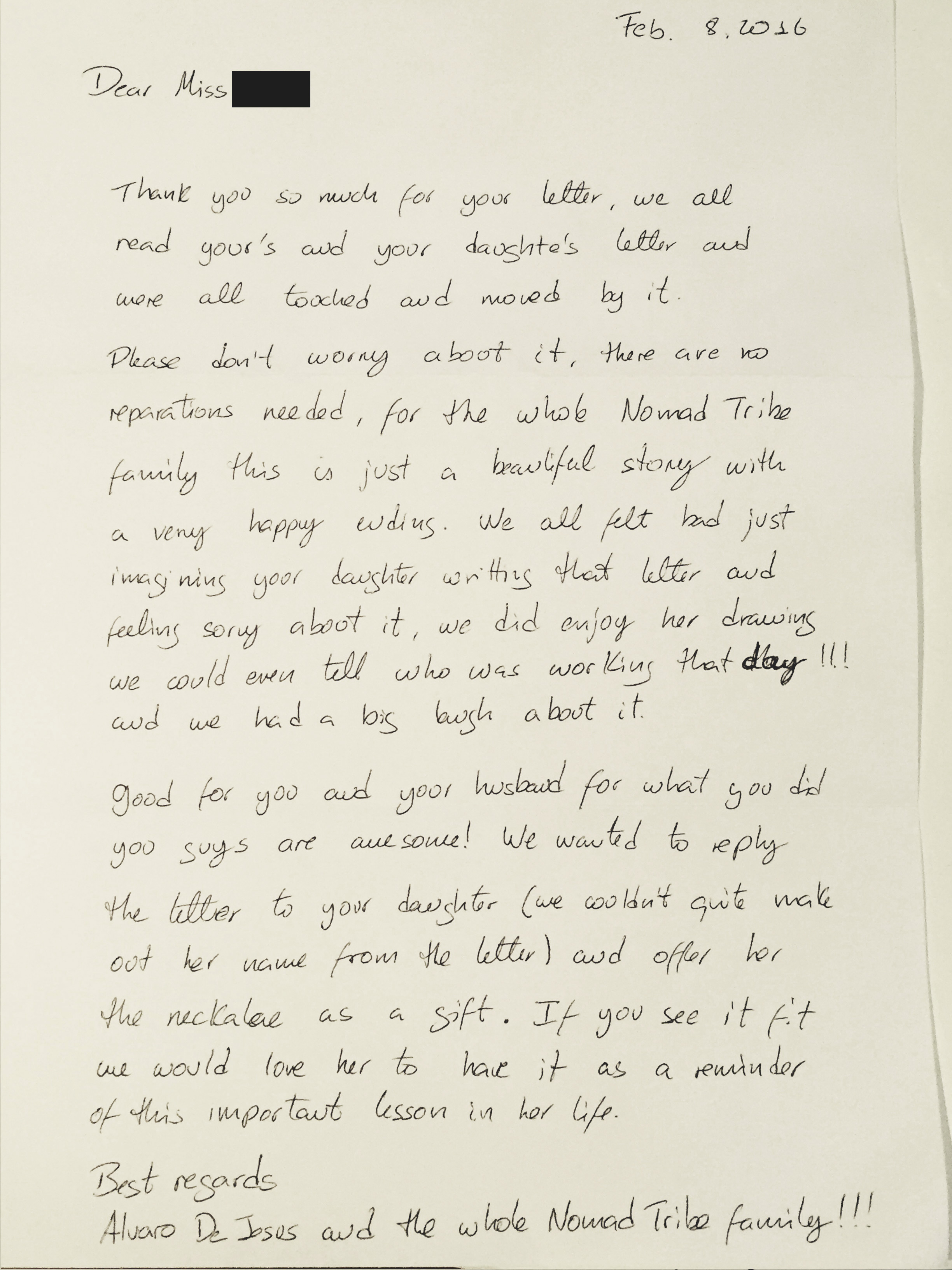

A week later, the family received two letters from the store, Nomad Tribe. The first was addressed to Violet. It included the returned stolen necklace.

The second letter thanked Violet’s parents for teaching her to apologize for her misdeeds. The entire staff was so touched by Violet’s letter that they decided Violet should keep the necklace to remind her of this experience — with her parents permission of course!

This is a sweet story, but it also teaches a few valuable financial lessons.

It’s never too early to teach your children about money matters. Denying your child’s every impulse teaches them that life comes with limits. This is an important lesson we could all stand to remember. And nowhere is this more true than in personal finance. A penny saved is truly a penny earned, but the adage is more poignant when phrased as follows: a dollar you don’t spend on something you want is a dollar you can spend on something you may not realize you need, such as retirement savings or a rainy day fund.

Consider giving your children a modest allowance — perhaps in return for household chores — and opening a kids savings account on their behalf. Many of these accounts offer interest rates on even small balances. An interest bearing savings account will teach children firsthand how small amounts of money saved over time will grow. This fundamental principle of personal finance applies to life’s purchases both large and small — from a new car to a necklace.

Track how much you’re spending on everyday treats and toys for your child and set an allowance that matches. No amount is too small. Once the money becomes their responsibility, your child will learn to choose when their purchase impulse is actually worth their money. You might also consider matching any contributions they put into their savings account. This will teach them the opportunity costs associated with a spend not save mentality. Your child’s $5 weekly allowance could become $7.50 per week if they chose to deposit it all in the bank and collected the full 50 percent match from mom and dad. Over time, these funds could be used to purchase a necklace or start a mowing business in high school.

It’s never too early to lay the foundations of responsible personal finance. Schools don’t teach it so educating your children on the subject falls to you as a parent.