Addicted to Your Smartphone? Stop Making These Dangerous Mobile Banking Mistakes

Mobile banking is the latest thing consumers are becoming addicted to, with more than half of users logging in at least 2 to 3 times a week. If you’re hooked on using your smartphone to make transfers, check your balances or schedule bill payments, you could be putting your banking information at risk without even realizing it. Here are the worst mobile banking mistakes hardcore users should avoid.

Mobile banking over public Wi-Fi

Using public Wi-Fi to log in to your bank’s mobile app or another financial services app is a bad idea. In most cases, information sent through a public hotspot isn’t encrypted, so other network users can access your activity. If you’re using an unsecured Wi-Fi network, anything you send into cyberspace is there for the taking for hackers.

Your best bet is to steer clear of using public Wi-Fi altogether, but if there’s no way around it, there are a couple of things you can do to keep your information safe. Instead of using your bank’s app, you can access the site over the Internet as long as it’s encrypted.

[Related: 7 Effortless Ways to Protect Your Money Against Online Bank Hacking]

The “https” at the beginning of the web address should clue you in on whether it is or not. The other option is to spend a few bucks on Virtual Private Network access, which automatically encrypts your information, even when you’re using an unsecured network.

Storing your payment or login information

Having to enter your username and password every time you log in to your mobile banking app or a shopping app that you use regularly can be annoying, especially if you’re doing it multiple times a week.

An easier way to access your apps is just store your information, but that’s a good way to invite someone to steal your password or hack your debit and credit card numbers. Just ask Starbucks customers, who are among the latest consumers to fall victim to a security breach.

If you use multiple cards to pay when you shop online or in-person, a smarter option is to use a mobile wallet like Apple Pay or Android Pay. These apps allow you to link up your debit and credit cards so you can pay without having to actually enter your card number. The idea is that since your information is always encrypted, it’s virtually impossible for hackers to target your accounts.

[Related: Android Pay Is Finally Here: Will It Make Up For Google Wallet’s Failure?]

If you’re not comfortable using one of these apps or you just don’t have a compatible device, you want to make sure you’re logging in manually every time and logging out when you’re done. Even if the app logs you out automatically after a certain amount of time has lapsed, you don’t want to leave yourself vulnerable since thieves can get their hands on your information in no time at all.

Not using the security alert feature

Security alerts are designed to let you know when critical changes are made to your bank account and every smartphone addict needs to be using them. The kinds of things you can be alerted to include:

- changes to your username or password

- unusual login activity

- large transactions

- changes to your email address and phone number

If you haven’t opted in to receive security alerts from your bank, you may not realize that your mobile banking activity has been hacked until a thief has already drained your account.

Signing up for these alerts only takes a minute and this service is typically included as one of the perks of having a bank account.

If you use an app like Mint to monitor multiple bank or credit card accounts in one place, you want to make sure you’re turning on the security alerts here as well, so there’s no chance of anything slipping through the cracks.

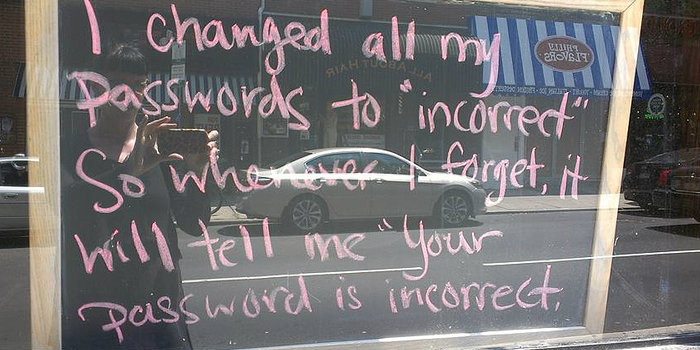

Being lazy with your passwords

A strong password is a good defense against hackers, so if it’s been awhile since you’ve updated the ones you use for mobile banking, now’s the time to do it. Including a mix of upper and lowercase letters, numbers and symbols is the best way to create something unique that an identity thief wouldn’t be able to guess. Things like your email address, physical address, birth date, children’s names or pet’s names should all be avoided.

Aside from making your password unique, you don’t want to make the mistake of using it on all of your banking or financial apps. If you’re using the same information to log in to multiple accounts throughout the day, you’re making it that much easier for an identity thief to wreak havoc on your finances.