How to Get Approved for Your First Credit Card

Getting your first credit card is a big deal: this move can set the tone for the next several years of your financial future.

When used responsibly, a credit card can help you build credit history, which can help you save money on everything from car insurance to your cell phone plan.

Credit cards can also help protect purchases against theft and damage, as well as earn rewards like cash back, airline miles and other perks.

But if used irresponsibly, credit cards can land you in a pit of financial trouble that can haunt you for the rest of your life.

So if you’re ready to take the leap, read this to make sure you know how to use your first credit card to help your finances, not hurt them.

The Types of Credit Cards

Secured Credit Cards

There are typically two types of credit cards: Secured and unsecured. Secured credit cards require a security deposit, usually between a few hundred and a few thousand dollars.

In some cases, the security deposit is equal to the credit card limit. So if you make a $500 deposit, your credit limit will also be $500.

If you fail to make a payment, the bank may keep the deposit. Secured credits cards are usually for people who have no credit history or have trouble applying for unsecured credit cards.

Unsecured Credit Cards

Unsecured credit cards are the most common type of credit card on the market. Unsecured cards offer a line of credit that is not secured by a deposit.

This means a lender will extend credit to you based on the quality of your credit history and if you don’t pay it back, the lender is on the hook for the balance. For this reason, unsecured credit cards are typically for consumers will very good credit.

How to Get Approved for Your First Credit Card

1. Check Your Credit History

Instead of applying for the first card you see, it’s important to know where you stand financially and have a clear picture of how your first credit card will fit into your lifestyle.

Also, lenders will use your credit history to see if you qualify for a credit card. So before you even think about how to get your first credit card, you should request a free annual credit report from annualcreditreport.com.

2. Check for Credit Report Errors

Once you get your credit score report, you’ll want to check it over for any errors, missing information or other mistakes.

Also, make sure you recognize any accounts and loans that are listed under your name.

If you think something is wrong, contact the company that issued the credit report right away. Since credit card companies use this information to issue credit cards, it’s important that your credit report is current and correct.

3. Check Your FICO Score

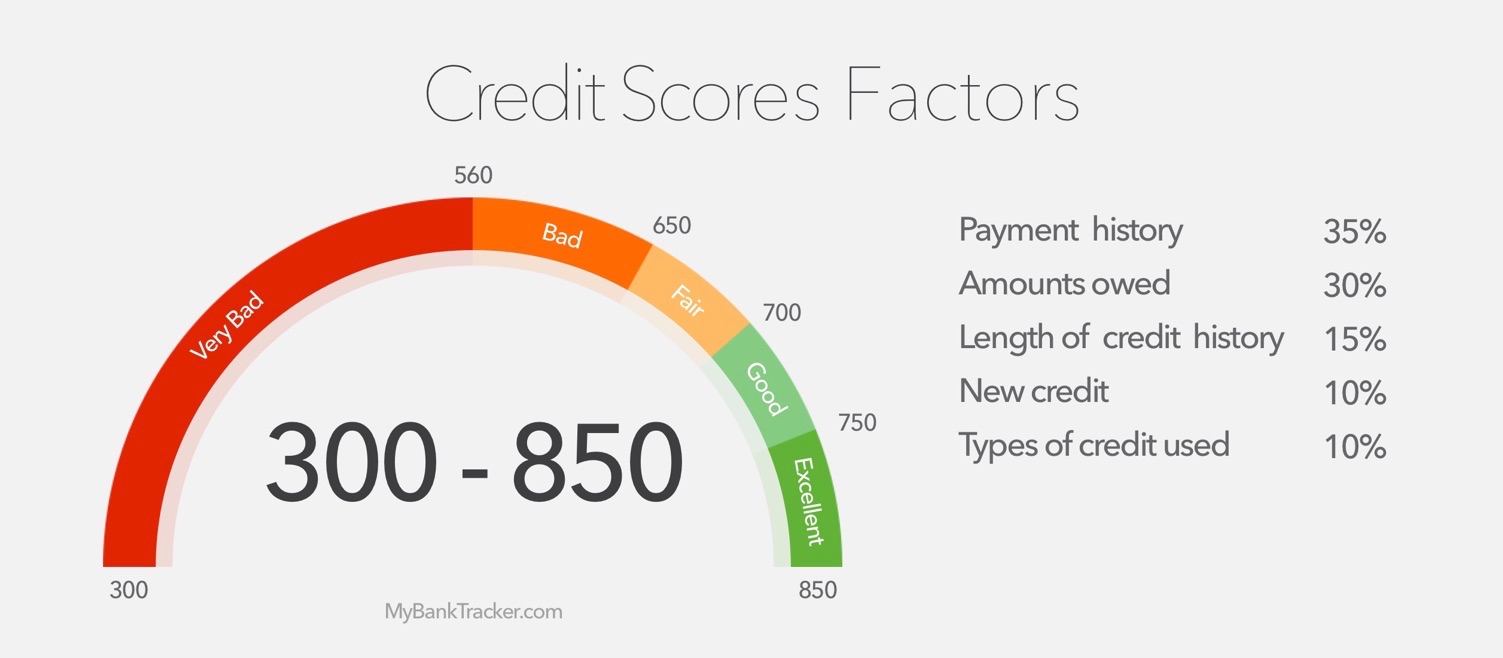

Credit card companies also use your FICO score to determine whether or not to give you a credit card.

Your FICO score is created by using the information on your credit report and the number ranges from 300 to 850 and takes into account the following:

FICO Credit Score Factors and Their Percentages

| FICO credit score factors | Percentage weight on credit score: | What it means: |

|---|---|---|

| Payment history | 35% | Your track record when it comes to making (at least) the minimum payment by the due date. |

| Amounts owed | 30% | How much of your borrowing potential is actually being used. Determined by dividing total debt by total credit limits. |

| Length of credit history | 15% | The average age of your active credit lines. Longer histories tend to show responsibility with credit. |

| Credit mix | 10% | The different types of active credit lines that you handle (e.g., mortgage, credit cards, students loans, etc.) |

| New credit | 10% | The new lines of credit that you’ve requested. New credit applications tend to hurt you score temporarily. Learn more about FICO credit score |

The higher your FICO score, the better and if you have a good credit report, you will probably also have a good FICO score.

If you aren’t sure what your FICO score is, you can request it from the same major credit bureaus that issue credit reports: Experian, Equifax, and TransUnion.

After you’ve checked your FICO score and credit report, you should look over the last three months of bank statements and take note of which categories you spend the most on (this is a great time to create a budget if you haven’t already!) and which stores you frequent.

This will help you understand what you actually spend money on, which may impact what kind of credit card you apply for.

If you spend a lot for gas and groceries, then you may want to consider a card that offers perks for those types of purchases.

If you love to shop, there are credit cards that have store-specific rewards programs or if you need to buy a new computer for school, you might want to think about a card that will give you cash-back rewards for that big purchase.

Finally, read through the fine print of any credit card offers you are considering. You’ll want to know exactly what you are getting into before you apply.

For instance, you may not realize the card has a high annual fee or the low interest rate is only for a certain timeframe. If you have any questions, don’t be afraid to call the credit card company directly and ask for more details.

Best Credit Cards Picks for First-Timers

When you apply for your first credit card, you probably have little to no credit history and your options may be limited.

But that doesn’t mean you are fresh out of luck – there are plenty of credit card programs designed for people just like you. Here are some of our top picks:

Journey Student Rewards from Capital One: Best for Students

Details

With a very simple cash back program, the is a very popular option for students.

The card has no annual fee or foreign transaction fees (great for students studying abroad).

Rewards

Earn 1% cash back on all purchases. If you pay your bill on time, the cash back rate is boosted to 1.25%.

Read the Capital One Journey Student Rewards Credit Card editor’s review.

Capital One Platinum Secured Credit Card: Best for People With No Credit History

Details

The Capital One Platinum Secured is an excellent choice for people who don’t have any credit history or don’t qualify for an unsecured card.

The initial credit line ranges from $200 – $300 and the minimum opening deposit starts at just $49, depending on your creditworthiness. There is also no annual fee.

Rewards

There is no rewards program here, which is typical for secured card programs. Still, the company does offer cardholders a free credit score tool to help users track and build their credit.

Read the Capital One Platinum Secured Credit Card editor’s review.

Citi Double Cash Card: Best for People with Good Credit History

Details

If you already have excellent credit history from paying student loans or a mortgage or auto loan on time, the Citi Double Cash Card

is an excellent choice for your first credit card because it’s one of the best cash back credit cards.

This is the only card that earns you twice the cash back on every purchase with no category restrictions or caps on how much you can earn.

There are also excellent current special offer rates, as well as other features, like no fee on your first late payment.

Rewards

Citi Double Cash gives you 1% back when you make a purchase and 1% back when you make payments – whether it’s in full or over time.

And unlike many other credit card rewards programs, there aren’t restrictions on which categories you can earn points on or limits to how much cash back you can earn.

Read the Citi Double Cash Credit Card editor’s review.

How Your Credit Card APR is Calculated

A credit card is like a temporary loan; it’s a set amount of money you can either choose to borrow from or leave alone.

If you use your credit card, you can avoid paying interest on the balance if you pay it off in full — usually within a specific time period, usually 25-30 days.

Some people use only credit cards instead of cash and choose to pay off the balance each month. This requires a lot of discipline, but it’s a great way to rack up rewards like cash back or airline miles for free.

If you use your credit card and can’t pay it all back within 25 – 30 days, then you will owe interest on the balance, which is money charged in addition to what you already owe.

Interest is typically a percentage of what you owe each month and the amount of interest you get charged is largely dependent on your credit history.

The most common term for the interest on your credit card is Annual Percentage Rate, or APR. This is a little misleading because you don’t get charged interest on your credit card balance once a year — it’s actually charged on your daily balance.

For example, if you have a $1,000 credit card balance with a 15% APR, you’d divide the 15% by either 360 or 365, depending on how many days in a year your bank counts.

In this example, 15% divided by 365 is 0.041% per day. That may not seem like much, but your credit card balance will continue to accrue interest and grow each day, which means you will keep owing more and more until you pay it off.

This is exactly why it’s important to practice good credit card habits – especially when you are just starting out.

How to responsibly manage your first credit card

The better you manage your credit, the better your credit history will be, which will lower your interest rates, which will ultimately save you money over the course of your entire life. Here are three ways to make sure you stay in control of your first credit card:

1. Always make your payments on time

The easiest way to do this is to set up automatic bill pay. Ideally, you’d also pay the entire balance in full each month.

If you always make your credit card payments on time and in full, you’ll avoid paying hefty fees and your credit will stay in tip-top shape.

2. Keep your credit card balance under 30 percent of your credit limit

This is called your “credit utilization rate” (how much credit you have used versus how much you have left).

Running a high balance on your credit card damages your credit because it looks irresponsible in the eyes of the lender.

If you keep the balance low on your credit card, your credit will stay strong and it will be easier to pay off.

3. Carefully read your credit card statements

Since identity theft is one of the fastest growing crimes in the country, you need to keep a careful eye on all your credit accounts.

Each month you will receive a credit card statement from your lender. Make sure all the charges and payments listed on the statement are correct.

If there are unexplainable purchases listed, call your credit card company right away to make sure no one used your card to make fraudulent purchases.