How to Use a Credit Card to Fund a New Bank Account

- Using a credit card to fund a new bank account can earn increase the rewards depending on how the transaction is classified by the bank.

- Depositing funds via credit card may be treated as a cash advance, which incurs high fees, unlike a purchase which may offer rewards.

- Before funding a new bank account with a credit card, it is crucial to review the fine print for terms such as qualifying direct deposits, fee structures, and minimum balance requirements.

Opening a new checking or savings account can come with sign-on bonuses offered by many banks in the market. With intense competition among banks, promotional offers for new account holders are becoming a common sight. Banks nowadays leverage on the attraction of free money to incentivize people to switch over to their services, instead of the traditional free toaster giveaways.

If you have a credit card, you may be able to use it to deposit money into your new bank account. However, it is important to be aware of the process and precautions you need to take along the way. Let us walk you through how it works and what you need to watch out for.

Funding that New Account

There are a few different ways you can use your credit card to transfer money into a new account, depending on which bank is involved and how you open the account.

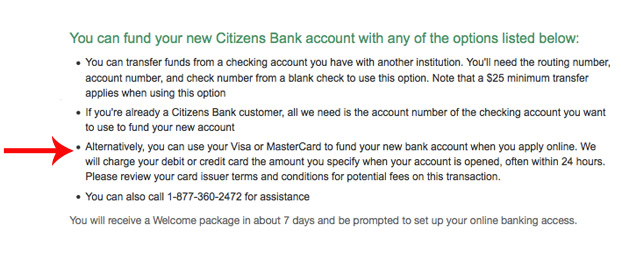

At Citizens Bank, for instance, you can have your initial deposit charged directly to your Visa or MasterCard when you open a new account online.

Bank of America allows credit card transfers to a checking or savings account to be set up as a direct deposit.

A third option is to use a balance transfer check to add money to your account.

You simply write it out for the amount you want and deposit it in your account the same as you would any other type of check.

Finally, you can take the card to the bank and have the teller process a cash transfer manually.

Tip: Make sure that you’re using a balance transfer check, not a cash advance check to make your deposit. Taking a cash advance usually means paying higher interest and fees on the money.

Purchase vs. Cash Advance

Every bank is different when it comes to how credit card transfers to a checking or savings account are processed.

If your future bank codes these transactions as a purchase, you’re good to go and you shouldn’t have to worry about getting hit with extra fees for using your card.

On the other hand, if the bank treats the transfer as a cash advance, moving the money from your card to your account is going to cost anywhere from 3 to 5 percent of the total transaction, not worth it.

Be sure to read the fine print before you decide to fund a new bank account with your credit card.

If the bank decided to code the transaction as a cash advance instead, you wouldn’t be eligible to earn any regular or bonus miles and you’d be charged a cash advance fee of 5 percent, which comes out to $250.

In that scenario, using the card to fund the new account would actually cost you $50 in the long run. Not only that, but you’d also pay an APR of 25 percent on the money, which makes it even more expensive.

It wouldn’t hurt to ask your credit card company to reduce your cash advance limit to $0 if possible before attempting to fund a new account with the card.

To help you identify which of the major banks allow new account funding with a credit card and how these transactions are processed, we’ve compiled the information into an easy-to-digest table.

Credit Card Transfers Counted as Cash Advance

| Bank Name | Credit Card Funding Allowed for New Accounts | Maximum Deposit for Credit Card Funding | Treated as a Cash Advance |

|---|---|---|---|

| Bank of America | Yes | $250 | Yes |

| BB&T | Yes | Varies based on your card limit | Results may vary based on the card |

| Capital One 360 | No | NA | NA |

| Chase | Yes | $500 | Results may vary based on the card |

| Citibank | Yes | Varies based on your card limit | Results may vary based on the card |

| PNC Bank | Yes | Varies based on your card limit | Results may vary based on the card |

| SunTrust | Yes | $100 | Results may vary based on the card |

| TD Bank | Yes | $5,000 | Yes |

| US Bank | Yes | $500 | Deposits from US Bank credit cards are treated as a purchase, results may vary when using other cards |

| Wells Fargo | Yes | Varies based on your card limit | Yes |

The Fine Print is Key

If you’ve found a bank that offers a nice bonus and allows credit card funding for new accounts, don’t rush to add money until you’re read over all the details.

For instance, it’s becoming increasingly common for banks to require a qualifying direct deposit as a condition of getting a bonus so you’ll need to make sure you’re able to set one up once you’ve opened on account.

The other thing to look out for is the minimum balance requirements.

Unless you’re going with an online bank, you’ll typically be required to keep a certain amount of money in your account, either on a daily or monthly basis, in order to avoid a triggering a minimum balance fee.

If you’re only opening the account to get the bonus and you’re not planning to use it, you could end up in trouble if the bank piles on monthly maintenance fees.

These can push your account into the red, which means you’re also looking at additional overdraft charges.