What Happens If You Don’t Use Your Credit Card?

Common sense might seem to say that it’s best not to use your credit card, right?

Without using a credit card, you can’t fall into credit card debt and you can avoid potentially high interest rates for your purchases.

But not using your credit card can have negative effects on your finances as well.

It could prevent you from utilizing an easy method to improve your credit score. It can also lead to your card being canceled, rendering it useless to you in an emergency.

When it comes to finances, there’s a lot more to the picture than things like avoiding fees and debt.

While these principles are important, it’s equally important to understand that financial tools like credit cards can have both negative and positive effects on your financial picture.

All you have to do is know how to avoid the negative and maximize the positive.

Here’s the deal:

What Happens If I Don’t Use My Credit Card?

To help you fully understand what happens if you don’t use your credit card here’s some advice.

Learn how your credit cards affect your credit score, what closing your credit card can do to your credit score, and how you can use your credit card to improve your financial situation.

Unused Credit Cards and Your Credit Score

Once you have a credit card, it may seem like it’s yours forever to use if or when you might need it. Unfortunately, that’s not always the case.

If your credit card account goes through a long period of inactivity, your card issuer could close it without warning. There are two immediate effects this can have:

- You no longer have access to your credit card if you need it (and you may not find out until it’s too late if you weren’t notified of the closure)

- Your credit score will take a hit

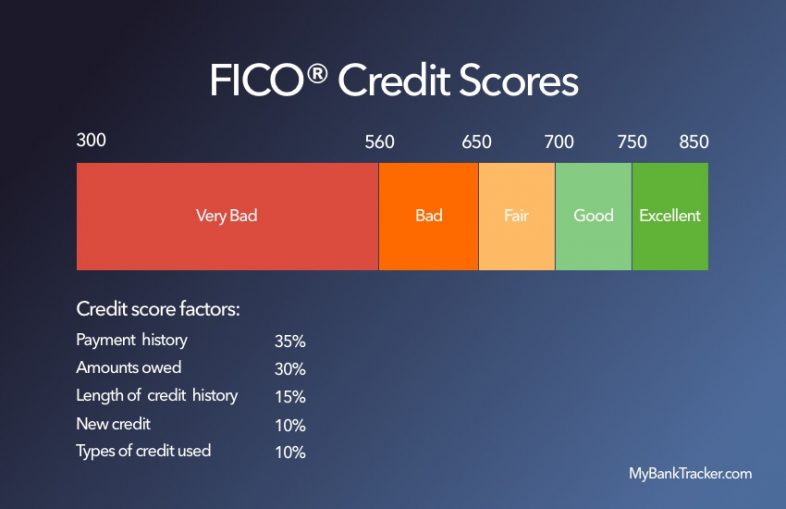

The first effect is pretty clear, but you might be wondering why your credit score will take a hit. There are 5 main factors in calculating a credit score, and one of the most important factors is credit utilization.

Credit Score Ranges and Quality

| Credit Score Ranges | Credit Quality | Effect on Ability to Obtain Loans |

|---|---|---|

| 300-580 | Very Bad | Extremely difficult to obtain traditional loans and line of credit. Advised to use secured credit cards and loans to help rebuild credit. |

| 580-669 | Bad | May be able to qualify for some loans and lines of credit, but the interest rates are likely to be high. |

| 670-739 | Average/Fair | Eligible for many traditional loans, but the interest rates and terms may not be the best. |

| 740-799 | Good | Valuable benefits come in the form of loans and lines of credit with comprehensive perks and low interest rates. |

| 800-850 | Excellent | Qualify easily for most loans and lines of credit with low interest rates and favorable terms. |

It’s important to continuously use your credit cards every month, even if you only use them for small and insignificant purchases. Credit bureaus like to see that you can use your credit card, hold a balance for a short time, and then pay it off in a timely fashion. Making sure that you utilize your revolving credit is a big factor in not only maintaining your credit score but also in raising it.

Length of Credit History

| Credit Age | Rating |

|---|---|

Less than 2 years | Poor - Your credit age is just beginning and needs some time to grow |

2 to 4 years | Bad - You are still in the baby stages of your credit age but it's great you have some years of creditworthiness under your belt |

5 to 6 years | Average - You are on your way to being at the ideal credit age |

7 to 8 years | Good - You are right in the time-frame of what lenders are looking for with credit age |

9+ years | Excellent - You’ve proved your credit stability with credit age |

Additionally, since the length of credit history makes up 15% of your credit score, closing a credit card will shorten your credit history, thus lowering your credit score. Although this will not greatly impact your score, it’s important to be aware that it may affect it slightly.

You might be wondering:

How Not Using Your Cards Affect Credit Utilization

Credit utilization is the amount of money you owe versus the amount of credit available to you.

For example, say you have a $10,000 credit line and you’ve spent $1,000 of that credit line. To figure out your credit utilization, you simply divide the amount you’ve spent on your card by your total credit line; so in this example, your credit utilization would be 10% ($1,000 spent divided by $10,000 credit line).

Now look at what happens if something changes:

Imagine you have two credit cards both with $5,000 limits. You’ve spent $500 on each card, so your credit utilization altogether would be $1,000 divided by $10,000, or simply, 10%. If one of them gets closed, then your credit utilization suddenly jumps to 20%.

Why? Since one of your cards close, you now owe $1,000 for one card, instead of $1,000 for two cards.

This means that your credit utilization ratio is calculated with your now $5,000 available credit line for one card, instead of the $10,000 available credit for two cards, which brings you up to a 20% utilization of your credit.

In this example, it’s not a big deal. Financial experts recommend staying at a 30% or below credit utilization rate.

But if you have multiple cards and any are close to their credit limit, then closing any of those credit cards (regardless of the balance of that particular card) will affect your credit utilization ratio.

In other words, it can be better to keep an unused credit card open rather than to close it, at least when it comes to your credit score.

Why a Credit Card Issuer Would Want to Close Your Unused Credit Card

So why would a credit card issuer suddenly close your account?

You might think they’d rather keep it open in the event that you might use it and rack up interest charges. However, if enough time goes by without activity, the issuer actually loses money on your dormant account.

Most credit card issuers do not charge an inactivity or dormant account fee on unused credit cards. Typically, inactivity fees are only assessed on deposit accounts, like checking accounts or savings accounts.

How long can a card go unused before being closed?

There’s no set time for all credit cards, but typically a year or more is about the maximum your unused card might stay open.

And, for some good news, you’re not allowed to be charged inactivity fees on unused accounts.

Now:

Should You Close a Credit Card Yourself?

If you find that you’re not using one or more of your credit cards, consider the reason why.

Do you prefer not to make purchases with credit cards? Do you not feel you’re getting enough incentive from your credit card to use it? Are you afraid of falling into credit card debt? Do you think an unused credit card is ripe for identity theft?

Credit Cards vs. Debit Cards

| Credit Cards | Debit Cards |

|---|---|

|

|

If you prefer not to make purchases with your credit cards, consider what you are using.

Oftentimes, a credit card is safer to use than a debit card because, in the event that fraud happens, your credit line will be affected but the money in your bank account won’t be.

This isn’t 100% protection from fraud, but understanding which you prefer to risk (your credit line or your bank account) is important to do.

You might be wondering:

Incentives to Using a Credit Card

If you feel you’re not getting enough incentive to use your credit card, it’s probably time to get a credit card that better matches your lifestyle.

There are so many rewards credit cards out there that there’s sure to be one that meets your needs.

You could look at travel rewards, cash back rewards, or rewards for everyday spending. You could see if your favorite stores, brands, or vendors offer a rewards card that you can use on any purchase.

The best way to decide what’s best for you is to evaluate where you do the most spending and what types of rewards would benefit your life and your finances the most.

Travel Rewards Cards vs. Cash Back Cards

| Travel Rewards | Cash Back Rewards |

|---|---|

|

|

How to Use Credit Cards Without Falling Into Debt

If you’re afraid of falling into debt, then there are things you can do to prevent that from happening.

The first thing is to always pay off a credit card balance before the end of a billing cycle. That way you avoid debt and high interest rate charges.

Even better, you could make payments on your credit card from your bank account as soon as you finish making a purchase (or at the end of the day if you’re out when you make the purchase). Then you can rest assured that your balance isn’t going to grow.

How to Protect Yourself from Identity Theft

If you’re worried about identity theft, that’s something to be vigilant of regardless of your credit card usage (or lack thereof). This kind of theft can come in multiple forms: fraudulent purchases and new loans or lines of credit being opened in your name.

To protect yourself from fraudulent purchases, you should review your credit card and bank account statements every month. Make sure every purchase made was yours and dispute anything that was not done by you.

To protect yourself from new loans or lines of credit being opened in your name, review your credit report often. You can get it for free on annualcreditreport.com.

Since you get one report per credit reporting bureau for free each year (there are three), you can space them out and check one every four months.

Like your transactions, make sure all loans and lines of credit are things that you’ve opened.

While you’re at it, keep an eye out for errors and dispute anything that seems incorrect, fraudulent or otherwise.

You Don’t Need to Carry a Credit Card Balance

Finally, understand that you don’t need to carry a balance on your credit card to improve your score.

In fact, the lower your balance, the higher your score (thanks to the focus on credit utilization in calculating your score).

It’s important to keep track of your debt-to-income ratio. Your debt-to-income (DTI) ratio is how much debt you have compared to how much you make in a year. To figure out your DTI ratio, divide your monthly gross income by your monthly debt payments.

What Your DTI Ratio Means

| DTI Ratio | What This Means |

|---|---|

| 35% or less | This is the ideal debt-to-income ratio for most people who have any kind of debt. If you're in this range, you're in good-standing and your best bet is to avoid adding any other debts to your current situation. If do add more debt, make sure to make your monthly payments on time and pay it down as soon as possible. |

| 36% to 42% | Although this is not the ideal DTI ratio, it certainly is not a bad one. Keep paying down your debts in a timely manner and avoid incurring new ones, and you'll see your DTI go down in no time. |

| 43% to 49% | This ratio is a red flag. A DTI in this range indicates that you might be in some financial hardship. It's important if your DTI is in this range, to start aggressively paying down your debt to get it out of the red zone. Consider consolidating your debt to help reduce your interest rate and manage your monthly payments. |

| 50% or higher | This ratio is an extreme danger zone to be in. If your DTI ratio is 50% or greater, then half of your monthly income is going towards paying your monthly debts. You'll not only have a hard time getting approved for new loans or credit cards, but your credit score will also be taking a hit. In order to decrease your DTI ratio, you should be doing all you can to pay down your debt. If you're seriously struggling to pay down your debt and keep up with payments, consider filing for bankruptcy. |

What’s the bottom line?

Not Going to Use It? Close It

If you read all this and still decide that you’d rather not have a credit card, go ahead and close it yourself.

There’s no need to wait for your issuer to realize that you’re not going to use it. This, like all financial decisions, should be made mindfully.

And then you can take action as you see fit for your finances.

Now:

How You Can Use a Credit Card to Improve Your Financial Picture

If you always pay off your credit card balances and therefore avoid accruing credit card debt, then there are many ways you can use credit cards to improve your financial picture.

Credit Cards Offer Flexibility

If you have one credit card, then you can utilize it for emergencies if you need to. They can also be more useful when making purchases online if you don’t feel comfortable using your debit card.

If you have multiple credit cards, you’ll have more flexibility as sometimes vendors will pick and choose what types of credit cards they’ll accept.

Multiple Credit Cards Offer Multiple Rewards

Choosing one credit card with the best rewards for you can help you earn money off of your everyday purchases.

But if you use multiple cards, you may be able to maximize your rewards. For example, if you’re a frequent traveler who also has a long commute to work, you can use a travel rewards credit card for all purchases but gas.

Then you can use a gas rewards credit card for the gas you use on your long commute. You’ll end up with more rewards for the things you love while doing the things you already had to do.

Multiple Credit Cards (or a Higher Limit) Can Increase Your Credit Score

If you can increase your credit limit, then that’s a great way to automatically boost your credit score (see the information on credit utilization above).

All you have to do is call your credit card issuer and request a credit line increase. They’ll do a quick credit check and you should have an answer right away.

If that doesn’t work, you can instead boost your score by getting another credit card.

That will automatically increase the total amount of credit available to you, which will automatically decrease your credit utilization ratio – as long as you don’t increase your balance on your old card or carry a balance on your new one.

Whatever You Do, Avoid Credit Card Debt

Whether you decide to close your unused card, use it, or get a new one, the absolute best thing you can do for your financial picture is avoid credit card debt.

Credit card debt is costly (think high interest rates and difficulty in paying the debt off), it can compound more quickly than even seems possible, and it can decrease your credit score.

If you use a credit card, pay it off before the interest hits (before the end of your billing cycle).

If you have credit card debt now, make a targeted plan to pay it off. And, finally, create a budget or a spending plan to make sure you’re spending your money the way you want to be, not finding out after the fact what your financial picture looks like.

At the end of the day, every financial tool (credit card and otherwise) is only as useful as you make it. Stay mindful and make a plan and you’ll be sure to create the financial picture you want.